Can I Buy Gold Bars At A Bank

For most investors in North America, the answer is no.

If you live in the US, it is a common misconception that you can buy gold at a bank. Many people expect a bank to issue gold, harkening back to days when gold backed the currency, but today most physical gold is purchased from non-bank distributors. Even the US Mint requires retail customers go through an authorized purchaser .

But if youre in Europe or Asia, check with your bank. Some banks may offer gold products to retail customers. I know several people that have done this very thing in Switzerland, for example.

To find out if a bank offers gold bars for sale, just give them a call . One caution: make sure you compare premiums, so that youre not overpaying. Also, inquire if they offer lower rates to their existing bank customers.

The History Of 1 Gram Gold Bars

When purchasing Valcambi 1 gram Gold bars investors are participating in a Gold market that has existed thousands of years. Like this Gold bar, Gold has been used in trade since at least 560 B.C. in Lydia where the first known Gold coins were minted. Prior to using Gold coins and Gold bars for sale and trade, Gold was fashioned by the artisans of many different cultures around the world to make beautiful items. When you buy Gold bars, you contribute to and become part of Golds history that has lasted for more than 6,000 years.

Please call our Purchasing team at 514-6318 to speak to one of our representatives or learn more about How to Sell Gold to APMEX.

Johnson Matthey Gold Bars

Johnson Matthey was founded over 150 years ago and has been producing gold bullion since then. Because of their storied and long history as well as the quality and purity of their bullion, their gold bars are both collected and purchased for investment purposes as well. They offer gold bars in sizes of 1 oz to 400 oz with dozens of other options in between.

Read Also: Do Diamonds Look Better In White Or Yellow Gold

Group This 1 Gram Gold Bar Package With Other Pamp Suisse Gold Bullion

Many who purchase this 1 gram Gold bar package from PAMP Suisse consider expanding their investment portfolios with other Gold bullion from the Swiss manufacturer. In addition to Gold bars featuring the image of Fortuna, PAMP Suisse also manufactures Rosa Gold bars with the beautiful image of a rose. In addition, PAMP Suisse also manufactures hand-poured loaf-style Gold bars like their 50 gram and 100 gram Gold bars, giving a uniqueness to each bar. When you buy Gold bars from PAMP Suisse they guarantee them for weight, quality and content, letting investors rest assured of their purchase.

- Mint Mark: N/A – Not Available

- Metal Content: 0.8038 troy oz

- Purity: .9999

- Outer Pack: 1

How Many Grams In An Ounce Of Gold

It is important to note that 1 troy ounce, used for precious metals measurements, is a little larger than the regular ounce . 1 troy ounce equals 1.09714286 ounces, and exactly 31.1034768 grams, which is usually rounded down to 31.1.

Generally speaking, when the term ounce is used to refer to the amount of a certain precious metal, such as gold or silver, in a bar or coin, it is an abbreviation for troy ounces. For example, 1 oz gold bar actually refers to 1 troy ounce gold bar.

You May Like: Where To Sell Gold Rdr2

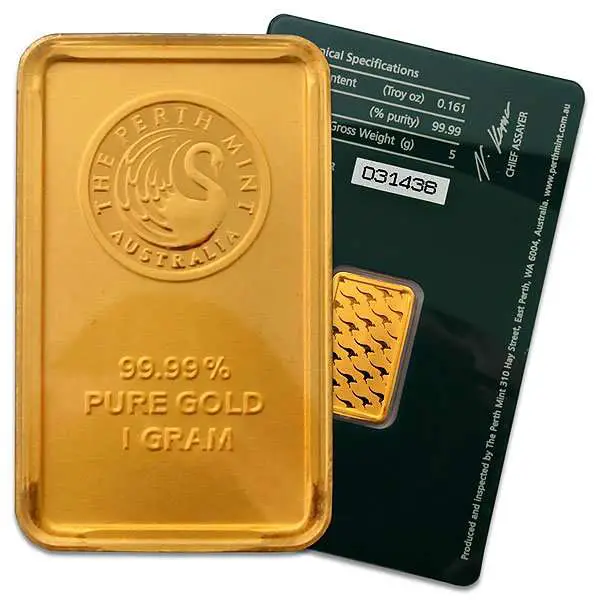

Perth Mint Gold Minted Bars

The world-famous Perth Mint in Australia manufactures gold bars ranging from ½ oz to 1,000 oz in gold weight. For most investors, however, it is simply cost-prohibitive to purchase their branded 400 oz or 1,000 oz bars. Their Gold Minted Bars series offers weight denominations in 5, 10 and 20 grams as well as 1 oz and 10 oz. These bars also include a hopping kangaroo and are packaged in a tamper-proof display card, making them more attractive than many other gold bars. The Perth Mint is a trustworthy and renowned institution that has been producing high-quality gold bars for decades.

Gold Bars: Government Gold Mints Vs Private Gold Mints

One of the most frequently asked questions is, “What gold bar should I buy?”. Gold bars are mostly traded based on their .999 fine gold content. Thus, the most important factor influencing gold bar prices remains the purity and the weight of the gold bar. However, it is also true that the more regarded and renowned the gold bar’s mint is, the higher the price the product will fetch. For instance, a sovereign national mint, such as theRoyal Canadian Mint , is easily recognizable by investors worldwide. Their products are known to contain top-notch quality. Therefore, it’s possible that a gold bar from the RCM, much like a gold coin, will be easier to sell back to a gold bullion dealer and get a better price than less known mints.

The same goes for highly praised private mints, such as PAMP Suisse or Valcambi. Investors will recognize their logo and fame all around the world so they should obtain slightly better prices as well.

Also Check: Where Do I Sell Valuables In Rdr2

Buying Gold Bullion Online

Gold has long been known as the primary means of real money for thousands of years. Gold has been used as a means of paying for goods and services. Gold is a real, tangible asset that has stood the test of time more than any other form of money. Gold is in as much demand today as it was thousands of years ago.

The best way to buy gold today is from online bullion dealers. Buying gold bullion from reputable and trusted online bullion dealers is the ultimate store of wealth.

Gram Gold Bars Smaller Size Is Ideal For New Investors And Limited Budgets

Select Valcambi 1 gram Gold bars to accumulate Gold for your portfolio at your own pace, great for new investors and those with a limited budget. The smaller size of this Gold bar makes it easier for new investors to acquire Gold without needing a large budget. Investors can purchase similarly sized Gold bars for adding to their portfolio over time and as their budget allows. As a result, buying Gold bullion, like 1 gram Gold bars, can be easier for new investors, knowing that Gold can hold its value for the future and the smaller sizes are often easier to liquidate.

- Mint Mark: N/A – Not Available

- Metal Content: 0.0322 troy oz

- Purity: .9999

- Diameter: 15 x 8.5 mm

- Inner Pack: 1

- Outer Pack: 1

Also Check: Where To Sell Gold Rdr2

How Much Is Gold Per Gram

To check the live spot gold price per gram, head over to our dedicated page to this specific topichere. You will also find an interactive chart comparing golds current value to historical prices in order to help you better plan your investments.

Dont hesitate to contact us in case you have any further questions regarding our gold gram bars or any other of our products. An SD Bullion customer service representative is available over the phone at 1294-8732 or through our Live Web Chat feature, from Mondays to Thursdays, from 8 am to 6 pm, and on Fridays from 8 am to 5 pm. You can also reach us via email at [email protected] or on ourContact Us page if we are not available at the office.

Gold Ira With 1 Gram Bullion Bars

World markets and economies are perpetually changing. Geopolitical tensions and crises are a recurring theme, and one that investors should prepare for. One of the most important lessons of the 2008 financial crisis is that Wall Street is peddling diversity, but a bankers idea of a well diversified portfolio contains nothing but securities. These stocks, bonds and mutual funds all carry counter-party risk and can collapse in value especially during times of crisis.

Genuine diversification means owning some tangible assets, and not just securities. Yet most investors are not properly protected, especially in their retirement accounts.

It is time to consider holding 1-gram gold bars and other physical bullion products inside a Gold IRA. Precious metals have a track record of preserving wealth through inflation and crisis which extends back thousands of years. Banks and brokerages come and go. Companies and sometimes even governments go bankrupt and collapse. Valuable gold and silver endure.

A Precious Metal IRA is self-directed, meaning the IRA holder calls the shots. They can hold a wide range of assets in addition to the usual menu of Wall Street approved stocks, bonds and mutual funds. It is possible to own bullion, real estate and shares of privately held companies for example.

If you own gold inside a Precious Metals IRA and decide to sell it, the profits from the sales are tax-deferred. The tax advantages and rules are just like those governing conventional IRAs.

Don’t Miss: How To Get Free Gold Bars In Candy Crush

Best Gold Bars To Buy For Investment: Top 5 Gold Bars For Investors

Are you in the market for the best gold bars to buy as an investment? If so, we’ve got two options to choose from: gold coins or traditional gold bars. Before deciding to buy gold bars or incorporate another type of precious metal into your portfolio, you should be aware that:

Ultimately, you are looking for gold bars for sale because you recognize the myriad financial benefits of owning precious metals. Your next step is to decide which gold product to buy. Bullion bars and bullion coins both share characteristics that make them a superior investment hedge against more volatile assets and are much more reliable than holding national currencies. That isnt going to change regardless of which type of gold you choose to invest in.

The world’s most trusted producers of gold bars in the world today include Credit Suisse/PAMP, the Perth Mint, the Royal Canadian Mint, Johnson Matthey and Engelhard. Others, including Metalor, Umicore, and various government mints are also reputable bullion manufacturers. There are also gold quarters that are worth a pretty penny if you happen to come across one. Read our exclusive article to find out how much a gold quarter is worth.

Where To Buy Gold Bars

Tip: Buy your gold bars from a reputable dealer onlyone with plenty of positive customer ratings, a buyback policy, and no pushy sales people.

Perhaps the most important thing you can do is buy your gold bars from a reputable dealer. A trustworthy dealer can provide sound education, help you avoid pitfalls, and steer you toward the best products for your needs.

How do you know if youre dealing with a reputable bullion seller? Look for these things

If youre new, I suggest you compare three dealers. Be sure to compare total costcommission, credit card or bank wire fees, and shipping and insurance. And consider that cost isnt the only factor when buying gold bars: ease of ordering, delivery promptness, customer service, and buyback policies are all important to consider in where you shop.

One effective method for first-timers is to buy from two different dealers, so you can compare service, delivery, and cost. It also provides you with two vetted sources for future purchases.

Gold bars are one of mankinds most definitive forms of moneytheyre a tangible asset, are highly liquid, and will protect your portfolio from financial crises. Owning gold bullion at this point in history is a wise move.

Recommended Reading: Who Owns Gold Peak Tea

Most Popular Weights Of Gold Bars

The most popular gold bar sizes among investors are usually 1-Troy-ounce and 10-Troy-ounce gold bars. Gold buyers also often purchase 1-kilogram bars. The reason is that the weight, in combination with the singularity of a product – a single 32-troy-ounce bar instead of 32 individual 1-troy-ounce ones – gives them a better gold bar value. Gram bars are especially popular among new investors. They are more affordable and, thus, portray a better way into the bullion market.

Having said that, gold bars come in many more varieties than other precious metals like silver or platinum, for example. You can find gold bars for sale in the following weights:

Gram Bars Vs Ounce Bars

Troy ounces are usually the most common measure when it comes to weighing gold and precious metals in general. It dates back to the Middle Ages and was originally created in Troyes, France . It differs a little from the regular ounce as it is equivalent to 31.1 grams.

However, grams and kilograms have steadily become a popular way to determine gold content as they are more internationally known units of measure.

Besides, grams offer a wider variety of sizes to purchase from that would fit in different investment budgets without having to buy multiple or a fraction of the same ounce gold bar.

Don’t Miss: Where Is Gold Peak Tea Made

Why Buy Gold Bars

Gold has shown throughout time that it is a protection of wealth and a hedge against inflation. Gold bars are an affordable option for investors as they carry a lower premium over gold spot price. Additionally, gold bars come in a variety of different size options. This makes it easy to choose the right size for your budget and investment goals.

The Advantages Of Buying Gold Bars

Tip: Youll get more ounces for your money with bars than coins.

The primary reason investors choose a gold bar is that its less expensive than a gold coin. Premiums are lower because coins have a more intricate design and thus greater labor and machining costs. Coins may be prettier, but youll pay extra for that appeal. The other advantage of gold bars is that theyre easier to store. A gold bar takes up less space than the same number of ounces of coins. In fact, bars were originally designed specifically for ease of storage.

Buying gold bars doesnt compromise any of the core advantages of gold: theyre portable, private, liquid, and will last forever.

Also Check: What Dentist Does Gold Teeth

Gold Bars Manufacturers: Government Mints Vs Private Mints

Gold Bars are precious metals bullion which have been manufactured for centuries, under government regulation.

Government Mints, such as the Royal Canadian Mint or Perth Mint, represent government institutions which have the absolute right to produce legal tender bullion. Each gold bullion bar produced by a government mint must be obligatorily commissioned and regulated by the National Treasury Department’s, otherwise, they can be subject to criminal charges. On the other hand, private mints have the flexibility of producing a wide range of uniquely designed gold bars.

When you go to buy gold bars available for purchase, they presently are produced by notorious private mints, such as PAMP Suisse, Credit Suisse, Argor-Heraeus, Republic Metals Corporation, Istanbul Gold Refinery, Valcambi, Scotiabank, Ohio Precious Metals and Sunshine Mint. These companies manufacture bars made of gold of with various outstanding designs, like the and PAMP Suisse Gold Bars, and especially popular and newly designed 1 oz. PAMP Suisse Gold Bar. One of the newest, and perhaps most remarkable gold bar pieces is the Gold CombiBar from Valcambi. These bars are made of several bar segments and can be easily separated into smaller gold bars, making them a flexible investment opportunity.

Gold Bullion Bars

Invest In 1 Gram Gold Bars At A Lower Premium Over Golds Spot Price

Choose Valcambi 1 gram Gold bars for an easy and affordable entry into the Gold market because of their low premium over the spot price of Gold. A Gold bar typically has one of the lowest premiums over Golds spot price because investors do not pay for additional numismatic or collector value. This means that these Gold bars include only minimal markups to cover distribution, fabrication and dealer fees. As a result, investors buy Gold bars such as these to balance out their portfolios.

Don’t Miss: Coleman Dental Gold Teeth

Pricing And Volume Discounts*

Save on your order when you purchase in larger quantities.

Quantities ofTD Customer PricingNon-TD Customer Pricing

1-9 C$97.37 / productC$100.29 / product

10-24 C$96.35 / productC$99.24 / product

25+ C$95.33 / productC$98.19 / product

* Pricing shown is based on TD Customer Pricing with payment from a TD bank account. Final pricing will be confirmed at checkout.

1 gram TD Gold Bar+ Drawstring Pouch

TD Customer Pricing as low as C$98.62 when you pay from your TD bank account. Final pricing will be confirmed at checkout.

Valcambi Suisse Gold Bars

Valcambi is another sought after brand when it comes to gold bullion. They are probably most well known for their divisible, 50 gram gold bar which is perforated into 50 1 gram gold pieces which can be broken off as needed. Aside from offering these unique Combi Bars they do also produce some regular 1 oz gold bars which are pretty desirable as well.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

Buy 10 Gram Gold Bar Random Designs Online

Random Design 10 Gram Gold Bars are now available from SD Bullion at the lowest premium over the current gold spot online! Purchasing gram gold bars is a popular way to expand any collection of precious metals, with several different designs available here. Many collectors add secondary market gold bars such as these to expand their investment portfolio.

The secondary market is defined as not purchasing the bars from the original mint but from a secondary source. These bars are sold as generic from the secondary market and have the possibility to show wear and tear. For these 10-gram gold bars, no matter the condition, the purity and quality of the gold remains untouched.

These bars will include a wide range of generic designs derived from a variety of mints, manufacturers, and suppliers. These bars are all sourced from the secondary market, however, 10 grams of pure gold is still guaranteed. The designs on the obverse and reverse side of these gold bars depend on the manufacturer you receive. These designs can show scuffs and scratches but are still a great addition to any collection of pure gold.

Gold bars are seen as a sound investment for people who not only want to boost their investment collection but are also looking for lower premiums than those on the primary market.