Consider Larger Silver Bars

Larger silver bars, such as 10 oz or 100 oz sizes, carry less of a manufacturing premium over spot than smaller bars or rounds, so they are often the cheapest way to purchase .999 fine physical silver. Silver bars also excel as an investment choice if you know when the silver price goes up in value.

Top 2 of the Best Silver Bars to Buy

- 10 oz. Silver Bar to Benefit From Silver Price

- 100 oz. Silver Bar For Larger Investments

How To Buy Gold Stocks Mutual Funds And Etfs

Investing in a gold stock, ETF or mutual fund is often the best way to get exposure to gold in your portfolio.

In order to buy a gold stock or fund, youll need a brokerage account, which you can open with an online broker . Once your account is funded, youll be able to pick the gold-related assets youd like to invest in and place an order for them on your brokers website.

Keep in mind that individual stocks and ETFs are purchased for their share price which can range from $10 or less to four figures but mutual funds have a minimum investment requirement, often of $1,000 or more. Learn more about how to invest in stocks and how to invest in mutual funds.

» Need guidance? Check out our full roundup of the best brokerages

Silver Canadian Maple Leaf

First minted in 1988, these beautiful coins contain 1 ounce of .9999 Canadian mined silver, whereas most other silver coins only contain .999. The silver content of the Maple Leaf is purer than that of the American Silver Eagle, and the Canadian government backs its quality. The Silver Maple leaf is available as bullion or proof.

The Silver Maple Leaf is legal tender and has Queen Elizabeth II’s profile on the face of the coin. The reverse side shows Canada’s symbol, the highly recognizable maple leaf, which has been the focus of this coin’s design since the initial release.

With the addition of the world’s best anti-counterfeiting technology, the Silver Canadian Maple Leaf is highly collectible and a sound investment. Radial lines, laser mark micro-engraving, and “Bullion DNA” allow dealers and collectors to verify the authenticity of their coin immediately.

Read Also: Are Gold’s Gym Treadmills Any Good

Oz Gold Philharmonic Coin Austrian Mint

The Philharmonic Coin by the Austrian Mint resonates with the beautiful music produced in the Vienna Concert Hall. It was the first gold bullion coin out of Europe explicitly produced for investors. The Austrian Mint had the idea for the coin in 1986 and was officially released in 1989.

All of the Gold Philharmonic coins for sale today contain .9999 pure gold and have a legal tender value of 100. Any investor who has a taste for elegance and is looking for a coin thats easy to obtain can count on the Austrian Mints beautiful Gold Philharmonic Coin.

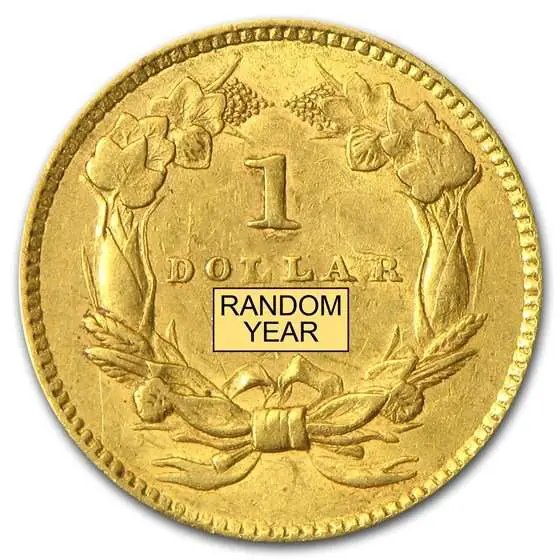

Your Choices Include Gold Coins And Bars

Gold coins weigh about an ounce or less. Those popular among collectors and investors include the American Eagle made by the U.S. Mint, the Canadian Gold Maple Leaf and the Krugerrand. Not interested in coins? Gold bars weighing in at one kilogram or less are often marketed to the average investor, but bars as large as 100 ounces are also available, according to the gold industry group, the World Gold Council.

Institutional buyers such as financial institutions, central banks and exchange-traded funds are in the business of buying even larger bars. The standard for over-the-counter gold bar trades is the London Good Delivery bar, which ranges in size from 350 fine troy ounces to 430 troy ounces , according to the London Bullion Market Association. At current prices, a single such bar would cost roughly $478,000.

Though individual investors may also be eligible to purchase London Good Delivery bars , they might have trouble complying with the strict regulations in place regarding the bars, which must be kept in LGD-accredited vaults or transferred through a chain of custody that meets LGD standards.

Read Also: How Many Grams In 1 Oz Of Gold

Can I Buy Coins From My Bank

Depends where you live. If youre in Europe or Asia, check with your bank. Some banks offer gold products to retail customers. I know several people that have done this very thing in Switzerland, for example.

To find out if a bank offers gold coins for sale, just give them a call . One caution: make sure you compare premiums, so that youre not being overcharged. Also, inquire if they offer lower rates to existing customers.

If you live in the US, it is a common misconception that you can buy gold at a bank. Many people expect a bank to issue gold, harkening back to times of old, but today most physical gold is purchased from non-bank distributors. Even the US Mint requires retail customers go through an authorized purchaser .

Should You Buy Gold Coins Or Gold Bars

The answer requires the potential gold bullion buyer to weigh a few factors aside from the gold bullion itself.

Things like the overall gold price, gold guarantee government or private mint, gold purity, gold-selling privacy, gold unit size, and more.

The best answer require about 10 minutes of research for most gold bullion bar and gold coin, buyers. Many often choose a mix of both.

Recommended Reading: How Much Is 18 Karat Gold Per Ounce

Dhanteras : Gold Coin Vs Jewellery Vs Biscuit

Dhanteras or Dhanatrayodashi is the first day that marks the festival of Diwali. Worshippers of Goddess Lakshmi believe that investing in precious metals like gold on Dhanteras brings good luck, wealth, and prosperity

Dhanteras or Dhanatrayodashi is the first day that marks the festival of Diwali. Worshippers of Goddess Lakshmi believe that investing in precious metals like gold on Dhanteras brings good luck, wealth, and prosperity.

No doubt, many of us are familiar with gold as an investment option, but we rarely evaluate the pros and cons of investing in gold coins, jewellery and biscuits. Here is the complete guide to this.

Investing in gold jewellery

For many, purchasing jewellery is the favourite form of investing in gold. The ornamental use is the major benefit of this investment type, bringing pride and satisfaction to the investor, personal finance experts dont consider it as an efficient form of investment since making charges and wastage charges are involved in the final price of the jewellery.

Other factors like safety and security, and susceptibility to wear and tear are the other major drawbacks of jewellery. Moreover, jewellery designs keep changing with time and whenever one exchanges old jewellery with new jewellery one should cough up an additional amount as new jewellery involves making and wastage charges.

Investing in gold coins

Investing in gold biscuits

How To Buy Physical Gold

If you decide that investing in physical gold is the right move for you, here are some things to keep in mind.

1. Find a reputable dealer. From working with pushy salespeople to falling victim to scams, navigating the world of buying and selling gold can be sketchy. Sellers can inflate their products value, or use persuasion tactics to create a sense of urgency to buy immediately. Doing some homework ahead of time can help you avoid a bad investment.

You can use the National Futures Associations Background Affiliation Status Information Center to check on a firm or individuals background.

2. Watch out for fees. Gold dealers typically charge more than golds spot price, or the price at which gold trades on a commodities exchange. This premium typically consists of a dealers fee and manufacturing and distribution charges.

3. Find secure storage. People joke about burying gold for a reason: Its valuable, and because it’s a physical commodity, people may try to steal it. Its important to anticipate storing your gold somewhere safe, whether that is a literal safe or a safety deposit box at a bank. Storing gold safely can get expensive. Depending on their size, safety deposit boxes at a bank can run from $30 to a couple hundred dollars a year.

4. Consider purchasing insurance. Insurance is an additional cost of owning physical gold. If you purchase insurance, be sure your policy covers the exact type of asset you have.

You May Like: How Much Is 18 Karat Gold Per Ounce

Q What Percentage Of My Assets Should I Invest In Gold

A. If you were to take a cross-section of advisors who recommend gold as part of an investment portfolio, you would find their preferred level of diversification would range between 5% and 30%. How high you go within that range depends upon how concerned you are about the current economic, financial, and political situation. Analyst Michael Fitzsimmons offered an interesting take on how much gold is enough in a recent Seeking Alpha editorial, Assuming a well-diversified portfolio , he says, my belief is that middle-class investors , should own at least 5-10% in gold. I also believe that as an American investors net worth climbs, the higher that percentage should be because, in my opinion, he or she simply has more to lose by a falling US$. For instance, an investor with a net worth of $2-5 million might have a 15-20% exposure to gold $10 million, perhaps a 30-40% exposure.

What Is A Silver Cast Bar

A cast bar simply means the silver has been melted and then poured into a cast or mould. This cast will have the refiners hallmark stamped into it along with the weight and purity. A cast bar may also be referred to as a moulded bar, poured bar or a silver ingot. The word ingot and bar are often used interchangeably.

Also Check: Kay Jewelers 19.99 Ring

Buy Gold Bars The Most Affordable Gold Option

Unlike other precious metal dealers, SchiffGold works with our customers on a one on one basis to make sure youre getting the service you deserve.

SchiffGold also offers some of the lowest pricing in the entire industry!

If youre ready to buy or simply have questions you can reach out to us via:

1. Is gold a good investment for me?

The classic example: one ounce of gold would buy you a nice suit of clothes 100 years ago. Today, an ounce of gold will still buy you a nice suit of clothes. Dollars, on the other hand We all know that a dollar cant buy the same things it did when we were kids, let alone a century ago.

So if youre socking away funds for retirement, why save in dollars? The US dollar is consistently losing purchasing power. Plus, in todays banking environment it can actually cost money to keep your savings in a bank account. Gold is one of the best ways to ensure the 100 dollars you have today will hold its purchasing power decades into the future.

SchiffGold and Peter Schiff generally recommend keeping 10-15% of your savings portfolio in gold and silver. You dont have to be extravagantly wealthy to buy gold anyone who has started a nest egg can allocate a portion of it towards the yellow metal.

For more information about why people invest in gold:

2. What kind of gold should I purchase?

Gold As A Diversifying Investment

In general, gold is seen as a diversifying investment. It is clear that gold has historically served as an investment that can add a diversifying component to your portfolio, regardless of whether you are worried about inflation, a declining U.S. dollar, or even protecting your wealth. If your focus is simply diversification, gold is not correlated to stocks, bonds, and real estate.

Read Also: What Dentist Does Gold Teeth

How To Buy Your Coins

Gold coins have been traded since at least the Bronze Age and collecting them is a hobby almost as old. The first-century Roman emperor Augustus was an avid collector of ancient Greek gold coins, says Amanda Foreman in The Wall Street Journal. His face was featured on the aureus, later to be replaced with the solidus as the gold coin of the later, Eastern Roman world.

Angels, ryals and guineas would pop up among others as variations of gold coins in England from the Middle Ages onwards, down to the 24-carat Britannias and 22-carat sovereigns that are still legal tender today

BullionByPost sells all of these, including the high-grade gold ryal of King Henry IV pictured above. It is on the market for £2,650. If youre after a specific historic coin, the Royal Mint will track it down for you.

BullionVault , as its name suggests, sells bullion coins. Aside from the Britannia, other common one-troy-ounce gold bullion coins you will come across include the American Buffalo , Krugerrand , Maple Leaf , Gold Panda and Gold Nugget . But only the Britannia is free of capital-gains tax in the UK. For a full list of where to buy physical gold, head to moneyweek.com/where-to-buy-gold-coins-and-bars.

Emerging markets: has the Brics dream survived reality?

How to invest in SMRs the future of green energy

Too embarrassed to ask: what is a tax wrapper?

Funds May Be An Option

Investing directly in physical precious metals such as gold can be difficult and costly, which in turn can make it harder for you to diversify your portfolio.

Mutual funds or exchange traded funds that invest in precious metals companies or a variety of physical precious metals may help you avoid putting too many precious metal “eggs” in one basket. Unlike physical precious metals, mutual funds and ETFs are registered securities that come with legal protections and ongoing disclosure about the investments.

Furthermore, mutual funds and ETFs can provide a cost-effective way to diversify among different types of physical precious metals and companies involved in mining and other aspects of the precious metals business. Its important to note, however, that the performance of such funds doesnt always track that of the physical commodity.

That said all securities that offer exposure to commodities such as precious metals carry the risk that you could lose some or all of your investment. Commodity futures-linked securities in particular may employ complicated investment strategies for achieving their investment objectives and can be volatile. They may have different tax treatment than your standard stock, as well, so it may be worth discussing your plans with a tax professional.

You May Like: How Much Is 14k Italian Gold Worth

How To Buy Gold Bullion

Though commemorative coins often demand a higher premium, all gold products will have some premium on top of the live spot price. This is to cover the additional costs of storing, testing and minting. It is therefore important to buy gold from the most competitive and trustworthy gold dealers, in order to ensure that you gain the maximum possible return on your investment.

All gold products on our website are automatically updated in line with the gold price, meaning you can be sure that you are always paying the best possible purchase price. Have a look at our range of gold coins or gold bars, if you want to find out more about our range of investment opportunities.

You Can Buy Gold But Should You

Despite its age-old allure, gold isnt always the strong investment that movies and TV shows may have led you to believe.

I advise all of my clients to stay away from investing in gold, says Smith. Gold is a speculative investment and has a very poor long-term performance record. For individuals that still move forward on purchasing gold, buying gold in the form of a tradable security is a much easier and cheaper way of incorporating it into a portfolio.

I advise all of my clients to stay away from investing in gold. Gold is a speculative investment and has a very poor long-term performance record.

But while hes clear that he doesnt think investing in gold is a good idea, Smith does acknowledge the draw the physical metal can have. Theres something comforting about being able to touch what you own. You dont get that if you own a part of Johnson & Johnson.

Greg Young, a CFP and founder of Ahead Full Wealth Management in North Kingstown, Rhode Island, agrees. People like gold because its so easy to understand, he says. But anytime someone insists on a specific asset, there is an underlying emotional rationale.

About the author:Alana Benson is one of NerdWallet’s investing writers. She is the author of “Data Personified,””WTF: Where’s the Fraud?” and several young adult titles. She has spoken at multiple fraud conferences, most notably for the FTC.Read more

Read Also: Dial Gold Bar Soap For Tattoo

Are You Looking For More Great Cryptocurrencies To Buy

You made it to the end of my list! I hope you enjoyed my top 11 cryptocurrencies to buy for 2021, and that you found the information I provided useful.

If youre looking for more great cryptocurrencies to invest in, or to find out which coin is going to be the next big cryptocurrency, here is what you can do:

Austrian Philharmonic Gold Coin

The Vienna or Austrian Philharmonic, first released in 1989, filled the hole that the sanctions imposed on South Africa, and therefore the Kruggerand, left in the gold market. A favorite of investors and music-lovers alike, the Philharmonic was the first European one-ounce gold investment coin on the exchange. Minted by the Münze Österreich AG, the Austrian Mint, it was the best-selling gold coin in Europe by 1990.

All the Philharmonic coins display the same design, with only the mintage year changing. These coins boast 99.99 gold and come in one-tenth-, quarter-, half-, and one-ounce weights with the addition of a 1/25-ounce coin. There are also two larger weightsthe 20-ounce gold coin and a 1,000-ounce coin called “Big Phil.”

Big Phil was created to commemorate the 15th anniversary of the Vienna Philharmonic coin. It contained 31.103 kg of pure gold and had a nominal value of 100,000 or about $111,216.50 U.S. dollars. Only 15 of these coins were minted.

The front of the coin depicts the world-famous pipe organ of the Vienna Musikverein’s Golden Hall, where some of the best musicians in the world perform. The Musikverein is the main stage for the Vienna Mozart Orchestra and is the permanent seat of the world-renowned Vienna Philharmonic.

The reverse side of the coin shows a plethora of instruments, featuring the bassoon, Vienna horn, harp, and four violins, all surrounding a cello.

You May Like: What Is Horizon Gold Card