What Is A Blue Cross Plan

Like the five other Blue Cross® plans in Canada, ABC Benefits Corporation operates the Alberta Blue Cross® Plan in compliance with the licensing requirements of the Canadian Association of Blue Cross® Plans. Each Blue Cross® plan in Canada is an independent organization and has evolved to serve the unique requirements of its regional market.

The Canadian Association of Blue Cross® Plans criteria for using the Blue Cross® name and trademarks in Canada include:

- All licensed Blue Cross® plans must operate on a not-for-profit basis. Any surplus beyond claims and administration expenses is used to improve products or services to customers, as well as maintain adequate reserves.

- Plans must comply with specific financial reporting and auditing procedures established by the Association.

- Plan activities must be directed principally to health care financing and service delivery.

How Much Will It Cost

For any plan, your monthly premium will be based on several factors including:

- Your age

- Whether or not you smoke

- Where you live

- How many people are enrolling with you

- Your insurance company

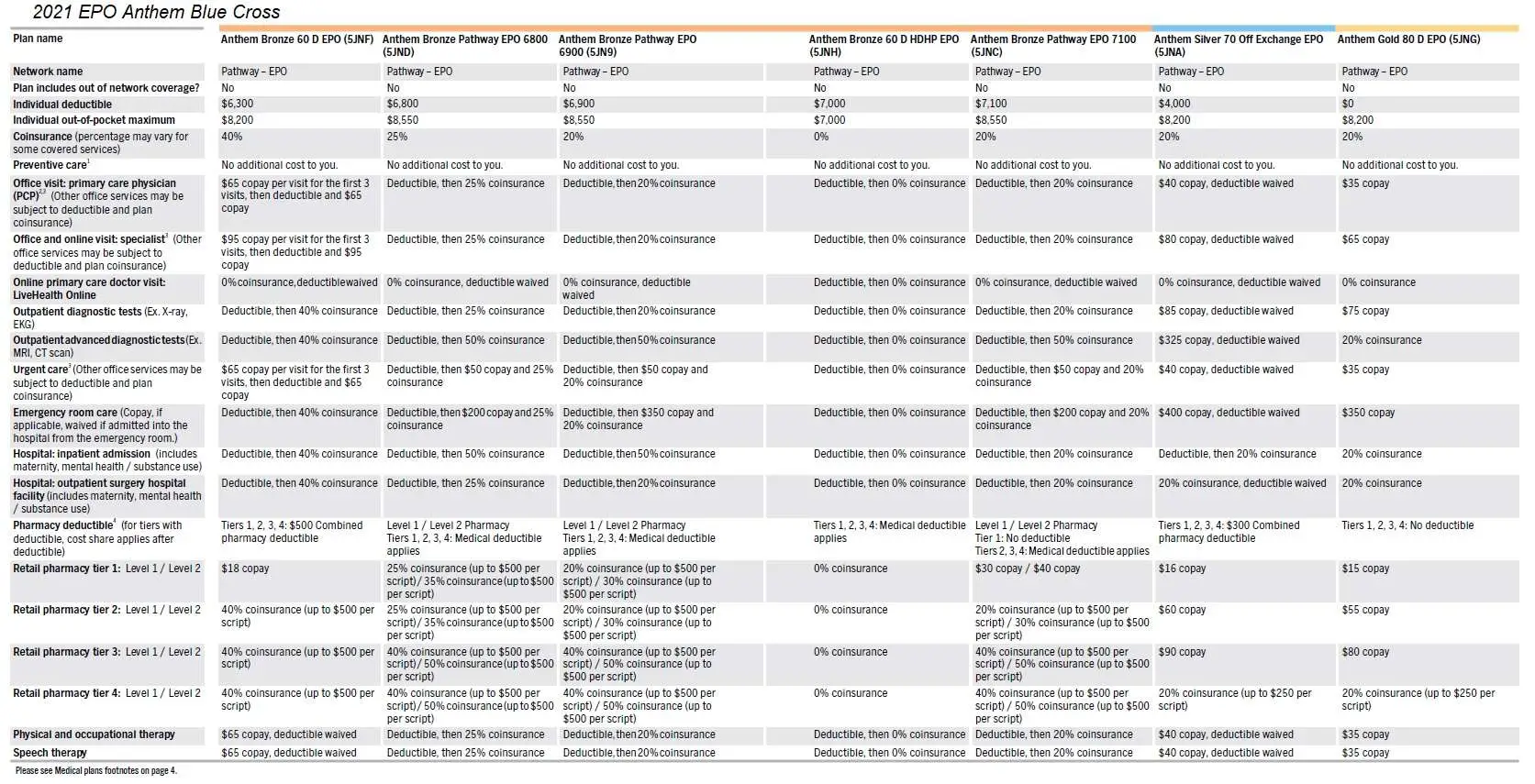

Since your states Marketplace allows various private insurers to offer plans, a Silver plan from one company may cost more or less than the same plan offered by a different insurer. Plans offered by the same company, however, will increase in price as the actuarial value and the amount the plan pays go up.

As discussed above, the federal limit for annual out-of-pocket expenses for individuals is $8,550 the family cap is $17,100. Certain plans may have even lower out-of-pocket caps.

Carrier Specific Notices Disclaimers And Fees

- – EHealthInsurance Services, Inc. is an independent, authorized agent for Blue Cross and Blue Shield of New Mexico. Blue Cross and Blue Shield of New Mexico: A Division of Health Care Service Corporation, a Mutual Legal Reserve Company, an Independent Licensee of the Blue Cross and Blue Shield Association. Effective dates are available on the first of the month only, unless otherwise required by law. Applications must be received by Blue Cross and Blue Shield of New Mexico within the defined enrollment period to be accepted.

Don’t Miss: How Do I Sell My Gold

Third Party Website Disclaimer

You are about to leave Blue Cross and Blue Shield of Alabama’s website and enter a website operated by HealthEquity. HealthEquity is our business associate and is an independent company that provides account-based plan services to Blue Cross. HealthEquity has agreed to follow Blue Cross’ privacy and security policies regarding the confidentiality and protection of your personal health information.

To continue to the HealthEquity website, click “Accept.” If you want to stay on Blue Cross’ website, click “Cancel.”

Covered California Gold 80 Plan: Gold Is Golden

The Gold plan shines with its $0 deductible, reasonable copayments, and a price tag that is softer than the top of the line Platinum. Typical services will range from a $30-$65 copay. Should you ever need to visit the hospital or have a lot of medical needs, the most you would need to pay for covered services in a year would be $7,800 per individual or $15,600 for a family.

Don’t Miss: Are Golden Retrievers Easy To Train

Blue Cross Select Gold

– Calendar Year Deductible: $850 Individual / $1,700 Family

– Out-of-Pocket Maximum: $6,000 Individual / $12,000 Family

– Convenient Phone & Video Consultations through Teladoc?

– Financial Assistance Available for this Plan

BENEFIT REQUIREMENTSIn Alabama, you must be referred to a specialist by your primary care select physician. If no referral, no benefits are payable under the plan.

Save With Blue Advantage

Blue Cross members can save on medical care, vision care and many other products and services offered by participating providers across Canada.

No receipts to submit save right away when you purchase at a pharmacy or other health provider.

Simply present your Blue Cross identification card to the participating provider and mention the program.

Read Also: What Channel Is The Golden Knights Game On

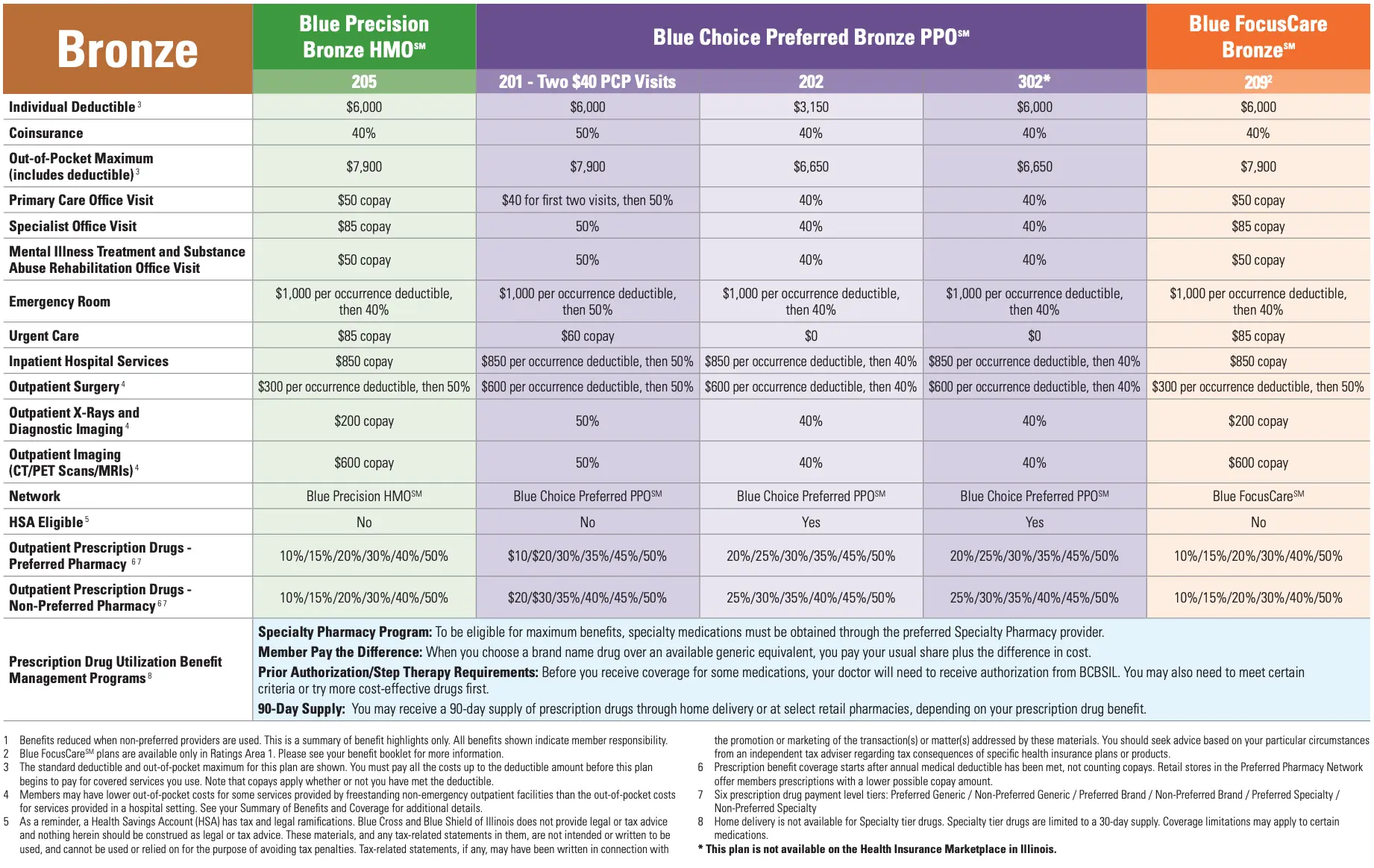

Whats The Difference Between Bronze Silver And Gold Plans

Who is this for?

If youre shopping for your own health coverage, this will help you compare your options by explaining what makes each metal tier unique.

To make shopping for health insurance easier, plans you purchase for you and your family are divided into metal tiers: bronze, silver and gold. We all know gold costs more than silver, and silver costs more than bronze. But when it comes to health plans, metal tiers tell you more than just price.

Blue Cross Select Gold Accordion Plan Overview

- Each member must designate a Primary Care Select Physician

- We Pay:

- $300 copay per day

- We Pay:

- 0% after meeting the calendar year deductible

- We Pay:100% after meeting the calendar year deductible

Benefits listed apply to in-network services. In-Network services outside of Alabama may vary.

For complete coverage details see the Prescription Drug List for this plan.

Don’t Miss: Who Owns The Golden Nugget Casino

Blue Ppo Gold Plan Costs

Health insurance costs include monthly premium payments, individual/family deductibles, out-of-pocket expenses, copayments, and coinsurance. Here is what you can expect with Gold® plans:

- Individual in-network deductibles ranging from $1,000 to $3,250

- $10 or $30 office visit copayments

- $0 or $10 copayments for generic prescription drugs

- Coinsurance of 100% to 80% percent of services provided in-network, after deductible and copayments are met

- Annual out-of-pocket maximum of $3,250 and $3,500 for individuals and $9,750 or $10,500 for families, depending on the plan

Blue Cross: Canadas Trusted Insurance

A recognized symbol of health care globally

Being trusted, professional and familiar is what you need in your coverage provider when travelling out of province

Covering over 7 million Canadians each year

One in five Canadians chooses Blue Cross to protect them and those they love with the right coverage for their needs

Over 80 years as a health care provider

Since 1938, Blue Cross continues to provide quality healthcare, including for provincial governments.

#1 for travel insurance for 5 years in a row

With flexible and affordable travel insurance, more Canadians choose Blue Cross than any other provider.

Don’t Miss: Delta Skymiles Gold Vs Platinum

Is The Covered California Gold Plan Right For Me

-

If you dont like deductibles, then lets talk more. Not everyone has extra savings lying around to cover a deductible, but would rather pay a little more per month for a plan with copayments they can afford. If you are the kind of person who doesnt want a plan with a deductible, i.e. the Minimum Coverage, Bronze or Silver plan, and you dont like the price tag of the more expensive Platinum plan, then the Gold may be just right for you.

-

You need specific medical services. Advanced lab work such as an MRI, CT, or PET can be pricey on a plan with a deductible. If you anticipate the need for these services, have a scheduled surgery, or are at high risk for occasional hospital visits then this plan should be up for serious consideration.

-

If you only frequent the doctors office, typically take generic drugs, and are not exposed to risk that takes you to the hospital often, then you may want to look closer at the Silver Plan to see which plan is going to be to your advantage. Remember, if you can pay the deductible on the Silver plan if needed, then the savings in premium per month is extra money in your pocket.

Price: $$$

Important Notices And Disclaimers

- The information shown here is a summary of benefits for informational purposes only. Review the official plan documents for a detailed description of coverage benefits, limitations, and exclusions. Only the terms and conditions of coverage benefits listed in the policy are binding.

- The benefits listed may be contingent on your use of physicians, hospitals, and services within the specific insurance company’s provider network.

- The Copayment, Deductible, and Coinsurance amounts are your share of the costs for covered benefits. These amounts are subject to change.

- Each insurance carrier may have unique Notices, Disclaimers, and Fees. Please check below for information regarding the plans and carriers you selected.

- The quotes or rates shown above are estimates only. Your premium is subject to change based on the optional benefits you selected, if any, and other relevant factors, such as changes in rates that take effect before your coverage start date. The insurance company always determines your actual premium. Insurance companies reserve the right to change the terms of a policy upon proper notification.

- The Summary of Benefits & Coverage can be found at healthcare.gov. A paper copy of this Summary of Benefits & Coverage is available upon request by calling our toll free number. Click here to view the Uniform Glossary of Coverage and Medical Terms.

Also Check: What Do Golden Eagles Eat