What Determines The Gold Price

The high demand for gold as a hedge against uncertainty drives a global market that spans every continent and operates on a 24-hr basis. As a result, the gold prices are one of the most quoted metrics in the financial media, along with major currency exchange rates, the price of oil, and stock market indices such as the FTSE and the S& P 500.

The price of gold represents more than just the monetary value of a specific quantity of the precious metal it often reflects general economic outlook and market sentiment. As a hedge against inflation, currency devaluation, and financial crisis, any significant movement is usually an essential sign of investor confidence in global markets and the global economy.

Like other commodities, underlying factors in the gold market such as supply and demand, cost of extraction and refining also determine the price of gold at any one time.

Although the gold price charts are closely tracked by financial news outlets, it is poorly understood outside financial circles or even in mainstream media. Subsequently, most people do not understand the intricacies and complexities of the global gold market.

How Is Gold Priced

When you buy or sell gold, the amount you pay will, of course, be one of the most important considerations. Gold and other precious metals are priced per troy ounce. The benchmark price or current gold price is quoted per troy ounce.

A troy ounce is equivalent to 31.07 grams and is different from the regular or avoirdupois ounce. The regular ounce is smaller than a troy ounce and measures 28.35 grams. Aside from the difference in weight, the regular ounce is used to measure ordinary commodities such as salt and sugar and not precious metals. Although the price per gram is less used in major markets it is popular in continental Europe.

On the other hand, the troy ounce is reserved solely for measuring the weight of precious metals such as gold, silver, platinum, and palladium.

While some investment grade gold coins contain precisely one ounce of gold, coins or bars may be cast or minted in different weights including one kilo. As an investor, you might want to know, what is the price per kilo of gold?

As mentioned earlier, one ounce is equivalent to 31.07 grams. Because one kilo is equal to 1000/31.07 ounces or 32.18 ounces, the price per kilo of gold will, therefore, be $1300 X 32.18 = $41,841

How to Buy Gold and Silver in Ireland – The Complete Guide

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Also Check: Why Are Gold Prices Going Down

Is The Price Of Gold Different In Other Countries

The current price of gold is the same, all things considered, in other countries. The US gold price is converted to the currency in that country based on the current exchange rate. In other words, no matter where in the world you purchase gold, the actual value of that gold in US dollars is the same. The below chart shows the annual gold price performance versus various fiat currencies.

What Can Impact The Price Of Gold

Like most commodities, the price of gold often comes down to supply and demand. And, as it is used today in the manufacturing of electronics and medical devices as well as jewellery and investment, it is a precious metal that is very much in demand. However, the price of gold still fluctuates, and this can be linked to several different factors, including:

Interest rates

Gold does not pay out interest, and so you effectively lose out on interest you couldve earned had you invested in cash instead this is known as opportunity cost. That said, interest rates and the cost of gold are not always in sync, as while they often rise and fall together, they can also move in opposite directions.

The stock market

The price of gold tends to move in the opposite direction to the stock market, and does so just less than 50% of the time. If you compare the 12-month interaction between gold and the S& P 500 Index over the last five decades, it averages at zero. This is why gold can help in building a more stable investment portfolio that doesnt rely upon stocks and share alone, as investors can minimise the risk of all their assets rising and falling simultaneously.

The US dollar

How to invest in gold?

Read Also: War Thunder Golden Eagles Code Generator

What Does Gold Bullion Cost To Buy

The retail price of any gold bullion product is simply the gold spot price plus a small gold premium to cover dealer charges. The gold premium will vary depending on the dealer, but a reputable gold dealer will not charge a high premium for the sale of gold coins or gold bullion. This means if the live gold spot price is listed at $2250.00 per troy ounce, you should always expect to pay more than that to purchase your gold bullion investment.

Is Todays Gold Price The Same In All Nations

Gold price today is ultimately the same in all countries around the world. The gold spot price is converted into other currencies. So, while you might pay more of a particular currency for an ounce of gold in another area of the world, the actual value in US dollars would be the same. If todays gold price were different in various areas, there would be an opportunity for arbitrage, and that is not acceptable in the gold market, unlike other financial markets like the Forex.

You May Like: Does Kay Jewelers Sell Moissanite

How Do Current Gold And Silver Prices Relate To One Another

While silver prices are far lower than gold prices, it can sometimes appreciate substantially. Savvy investors should compare the current gold and silver prices to determine the gold silver ratio at the moment. Depending on the results of that investigation, they may purchase gold bullion, silver bullion, or both.

What Factors Affect The Price

Spend any amount of time studying gold prices and youll notice that it changes quite frequently.

It can change by the minute in some instances. It is important to understand the various factors that affect the gold price so that you can study gold price charts including gold price history for a longer period to determine whether now is the right time to make your move.

This applies whether youre buying, selling or holding gold. Lets consider some of the most important factors that affected the gold price over recent years.

Don’t Miss: How To Get Free Tinder Plus

Gold Coins Vs Gold Bars: How To Know Which To Invest In

Deciding on the type of gold you invest in depends on your current investment portfolio, and the amount of risk you are willing to accept. Investing in gold bars represents a relatively low-risk option with incremental long-term rewards. The gold price premiums are low and the option to sell is always available if the market continues to rise. If you want to diversify your portfolio with an investment like mutual funds or bonds, investing in gold bars is your best option.

Gold coins represent higher premium costs and a bit more risk, as the price of gold coinage tends to fluctuate more than gold bars. The upside to gold coins is that you can read the market effectively and sell them at a five or ten-year high in price. Additionally, gold coins have an added benefit as they allow selling in smaller batches. This makes it easy to sell smaller portions of your gold bullion as opposed to selling a single 1kg gold bar all at once.

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Don’t Miss: Gold’s Gym How To Cancel Membership

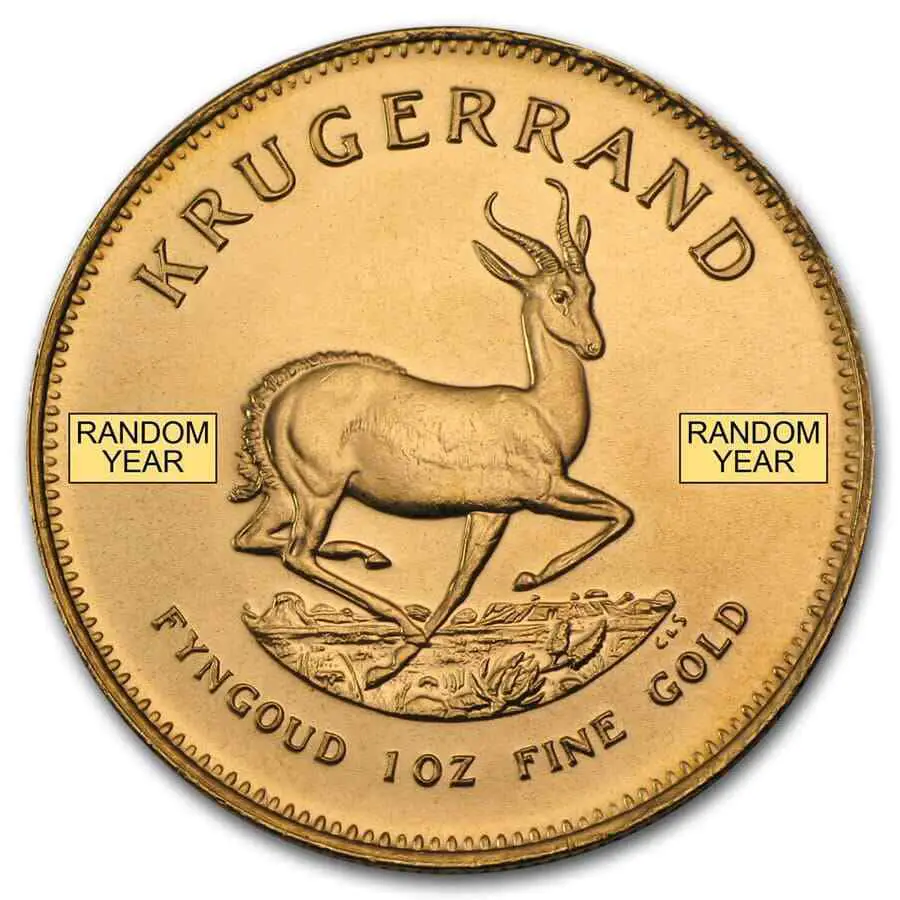

How Are Gold Coins Prices Set

Gold coins are a very unique investment. They are sometimes considered legal tender and are produced and recognized by the issuing government. The coins are always labeled carefully with the correct year of issue, the gold purity, and the weight of the coin. Gold coins prices fluctuate daily, as they move separately from the stock market. Gold coin prices can be affected by several different factors. Factors like rarity, shifts within the money market and the stock market, a recession, or the threat of a recession, elections, political movement, or even geopolitical issues. These are all factors that can influence the price of gold coins.

Should I Invest In Physical Gold

If you are thinking about investing in gold, then you are at the perfect place! Gold is the most valuable and popular commodity available on the market. GOLD AVENUE has a wide and beautiful selection of gold coins, ingots, and bars available for you to start your precious metal journey. You can choose between the most popular gold coins on the market: the classic American Eagle coin from the US Mint or the stunning Canadian gold Maple Leaf from the Canadian Mint. If perhaps coins arent what you are looking for, you can find the products for you in gold cast bars or minted bars from the world-renowned Swiss refinery PAMP. We are also the official online retailer of the most famous minted bar: the classic Lady Fortuna from PAMP. Gold is a timeless and elegant commodity that every investor should consider to diversify their investment portfolio.

Don’t Miss: How Much Is An Ounce Of 18k Gold Worth

Is Gold A Wise Investment For Retirement

Like any investment, gold comes with some risk. The price of gold per ounce might drop faster than you had anticipated and could take years to pull back to parity. However, history shows us that gold has been a resilient investment in the face of economic uncertainty. A conservative way to invest in gold is to take the total cost of gold per ounce you are looking to purchase, convert that amount into USD, and then break this down into equal gold investments over a few years. This way you can track the success of your gold investment and make informed gold purchase decisions along the way.

How Much Is An Ounce Of Gold

The price of gold per ounce is perhaps the most common way investors monitor the gold market. The image below shows a 1 ounce gold nugget and a 1 ounce gold coin – in this case a gold eagle coin. The Gold Price Now chart at the top of the page shows the current value of gold in US dollars. You can also get the price of gold in other world currencies by selecting a different currency from the drop down menu below the chart.

Don’t Miss: What Does Bacardi Gold Mix Well With

Does The Gold Market Operate 24 Hours Per Day Around The World

Yes, gold is bought and sold at all hours of the day and night, all around the world. You can get the current gold price per ounce at midnight or sunrise, lunchtime or any other time you need it.

Gold is traded 24 hours per day to ensure that all comers have access to this investment market, including banks, governments, other financial institutions, and investors just like you. The market is active around the clock to guarantee that you can always get an accurate gold price per ounce.

What Are The Factors That Affect The Gold Price

- 1. Demand and supply of Gold

- 2. Speculations

- Technology: 11%

- Unaccounted: 2%

They are available in markets. Bullion bars and coins are mostly used for investment of money, and jewelry is used to be worn, and it was used as an investment in the old-time, still, in some countries, it is used for investment.

You May Like: War Thunder Golden Eagle Codes

What Is Gold Jewelry

Jewelry made of gold can be combined with other precious elements and gems to enhance its appearance and value. The value of jewelry depends on gold purity and mass, worth of gem used, and artistic work used to build it. Jewelry is used to be worn, and as an investment, e.g., 22k gold is the famous and 91% pure gold.

Why Wont My Dollars Hold Their Value

Scenario: the market has crashed, investors are selling stocks in an irreversible panic frenzy. In the months ahead, economic uncertainty conditions the populace to save their money as much as possible and not to spend. Like an economic time-bomb, these dollars sit quietly, waiting to have purpose. When this frugality mindset breaks and confidence is restored in the market, a large-scale sudden wave of spending can cause a rapid influx of dollars to over-flood the economy.

When there are more dollars to spend on goods than there are goods to sell, increased levels of inflation or even the rare economic killer known as hyper-inflation have historically occurred soon after. When this phenomena begins, inflation spirals out of control and collapses the economy into a devastating state, similar to the hyper-inflation of German currency leading up to WWII.

Dollars simply do not store value through turbulent economic periods, they can actually become quite useless – the germans used to burn them for warmth because it was more expensive to buy firewood with their currency!

Without a safe place to store the value locked inside our hard-earned currency, most of us stand to suffer a preventable loss – unless of course the value within our currency is translated into the form of gold bullion.

Also Check: How Much Is Brick Of Gold

Investing In Gold With 1 Oz Bars

The 1 oz gold bars that are offered here by the United States Gold Bureau come within an air-tight assay card that guarantees the quality and purity. Buying gold 1 Troy oz bars , are a perfect starting point or addition to a precious metals portfolio since they are easy to store and liquidate as-needed. Our 1 oz gold bars come from a variety of highly recognized and widely traded manufacturers including Credit Suisse, International Trade Bullion, PAMP Suisse, and Royal Canadian Mint to ensure the highest quality gold content and purity. Each gold bar comes in a durable assay card for long-term storage and safe-keeping. Many bars are stamped with the exact weight, fineness, and an individual serial number. The 1 oz bars are about the same size as a military dog tag which makes them an ideal size for storing in quantity.

The 1 Troy oz gold bar is the most common size of gold bars and they are traded around the world, even in countries using the metric system. A Troy ounce contains 31.1 grams and is the unit of measure used for precious metals, as opposed to the avoirdupois ounce more commonly used in grocery stores that contain only 28.35 grams.

Gold bars often have a lower price premium over market spot price than gold bullion coins and are valued based on the spot price derived from the gold-trading markets around the world. Precious metals like gold are often used to diversify investment portfolios and hedge against inflation and economic downturn.

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

Don’t Miss: How Much Is 14k Italian Gold Worth

Understanding The Cycles Of Economic Ups & Downs

Investors across the globe agree that all bubbles burst, which is a phrase used in economics to express all market up-trends will eventually become down-trends.

What is critical to understand about this recurring phenomena is that these up and down cycles are necessary balancers for the fair valuation of global markets.

When the stock market becomes too over-valued and warning signs of an impending crash start flashing, nervous investors looking to earn the maximum ROI from their stock portfolio begin pulling out their assets in vast numbers, sensing their patiently-earned gains may soon vanish. This panic-frenzy of sell-off behaviour across the market pushes towards an irreversible tipping point. At this time, much of the stock market becomes bearish and succumbs to buyer fears and economic turbulence.

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Don’t Miss: Is The Delta Platinum Card Metal