Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

Classification Of Gold As A Precious Metal

Rare metals have higher economic potential than common metals. Of the five precious metals, gold has the largest market. Some investors refer to gold as a monetary metal because of its use throughout the history as a form of currency. Gold as an asset has a high store of value because it maintains its value without degrading. The yellow metal is also used in industrial units because of its desirable properties such as being a good conductor, malleability, and resistance to corrosion.

Read Also: Should I Buy Gold Now Or Wait 2020

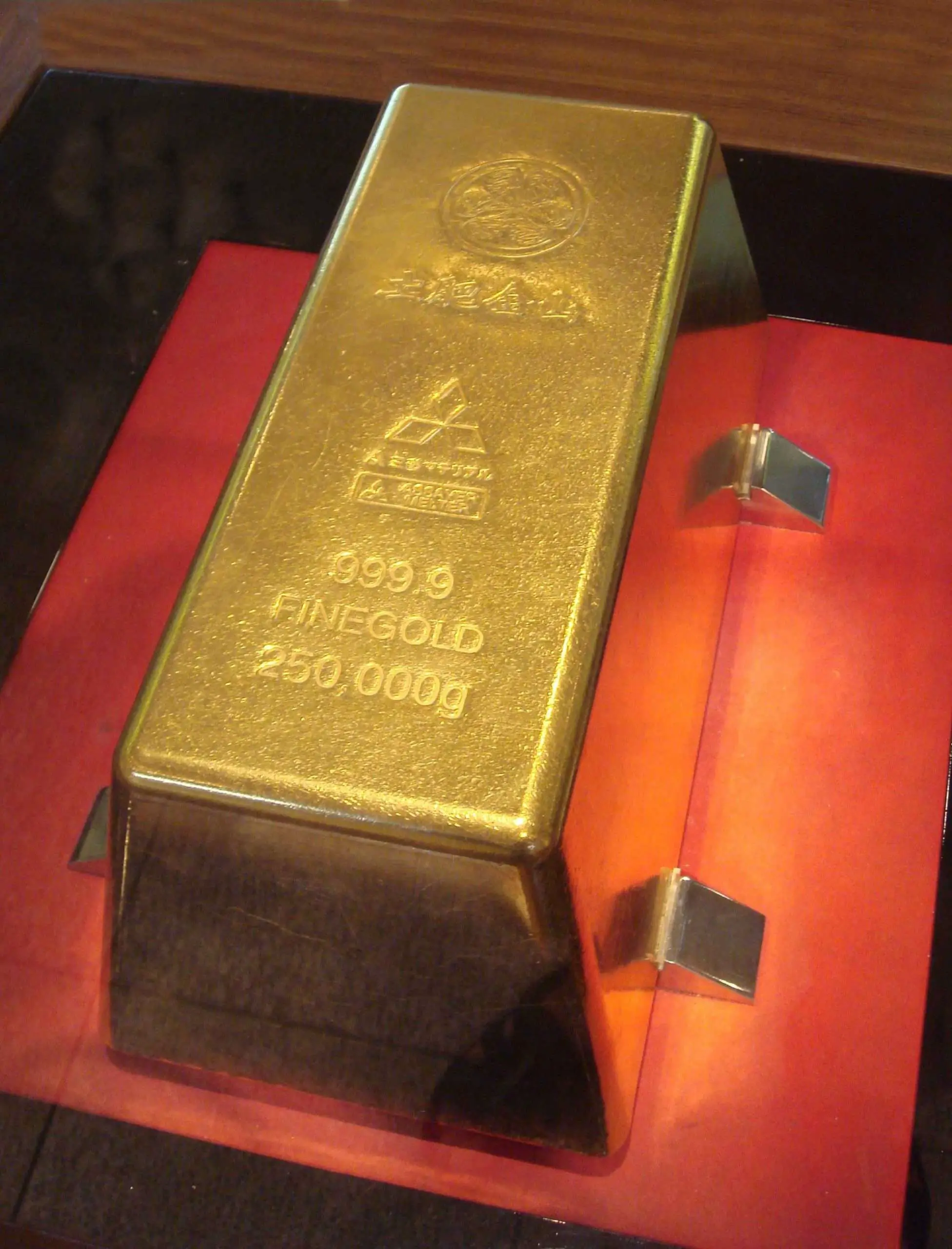

What Are The Main Sizes Of Gold Bars That Are Offered For Sale

The typical sizes of gold bars that are used for personal use come in a variety of metric and imperial sizes. Regardless of how you calculate the weight, the value of the gold within the bar remains the same.

Typical metric sizes are 1 gram, 50 grams, 100 grams, 500 grams and 1 kg bars. At current market rates these typically are worth:

|

Indicative Metric Gold Prices for Gold Bullion Bars |

|

|

Unit size |

|

Other gold bullion sizes are measured by the ounce and the tola. Typical sizes for ounce bars include 10 ounce 5 ounce, 1 ounce, ½ ounce sizes, ¼ ounce and 1/10th-ounce sizes.

Tola sizes are usually 5 tolas, 3 tolas, 2 tolas and 1 tola size. A tola weighs 11.664 grams.

What Is The Gold Jewelry Price Calculator

Gold ornaments comprised of various purity level, 24K is the purest form of gold, while 22k gold consist of little impurity used to make the gold ideal for jewelry designs like the bangle, ring, etc. 22k jewelry is comprising of standard quality gold, but some contain low karat , e.g., 20k, 18k, 16k, etc. Detail of gold jewelry price calculator.

Also Check: Who Buys Gold Filled Jewelry

One Pound Of Gold Converted To Kilogram Equals To 045 Kg

How many kilograms of gold are in 1 pound? The answer is: The change of 1 lb unit of a gold amount equals = to 0.45 kg – kilo as the equivalent measure for the same gold type.

In principle with any measuring task, switched on professional people always ensure, and their success depends on, they get the most precise conversion results everywhere and every-time. Not only whenever possible, it’s always so. Often having only a good idea might not be perfect nor good enough solutions. Subjects of high economic value such as stocks, foreign exchange market and various units in precious metals trading, money, financing , are way too important. Different matters seek an accurate financial advice first, with a plan. Especially precise prices-versus-sizes of gold can have a crucial/pivotal role in investments. If there is an exact known measure in lb – pounds for gold amount, the rule is that the pound number gets converted into kg – kilo – kilograms or any other unit of gold absolutely exactly. It’s like an insurance for a trader or investor who is buying. And a saving calculator for having a peace of mind by knowing more about the quantity of e.g. how much industrial commodities is being bought well before it is payed for. It is also a part of savings to my superannuation funds. “Super funds” as we call them in this country.

List with commonly used pound versus kilograms of gold numerical conversion combinations is below:

- Fraction:

What’s The Live Gold Price

The Live Gold Price we use to help you estimate the current Karat Value of Gold is provided by one of Australia’s international market partners. They are a market-leading Gold and Metals Commodity pricing exchange service similar to Kitco. The current live gold price is $2,440.70 .

Our Live Gold Price is sourced from our friends at Gold Price Live Australia who provide up to the minute live gold price information.

Also Check: Will Gold Price Go Down

What Is Gold Karat

Its means purity level of gold, the 24K gold is 99% pure, while 22k gold is jewelry ideal. Its formula for calculation of karat is = Karat/24. e.g., 22k gold can be calculated like = 22/24 = 0.916 = 91% pure gold, which is also called 916 gold. Therefore the 22k gold coins and products stamped with 916 seals.

It’s Nearly Impossible To Put A Modern

…because things don’t have the same relative values in our world as they do in a typical medieval-style adventuring world that is pre-industrial, but has magic.

As you’ve already noted, 1 GP is worth about 1 goat or about 1 whip. It’s also good for 2 nights’ stay in a modest inn, or 5 gallons of ale. On the other hand, it’s only 1/25th of the price of a 1 lb hourglass, 1/50th the cost of a chain shirt, or 1/1000th the price of a spyglass. These aren’t items that are all of equivalent values in modern terms, so it doesn’t make sense to try to assign a modern value to a gold piece. The gold piece has value exactly in relation to what kinds of items one can purchase with it.

Today you could get:

- a goat for about $75 – $300

- a bull whip for about $30

- 2 nights stay in a modest inn for about $100 – $150

- 5 gallons of beer for about $30

- a 1 lb hourglass for about $30

- a combat-grade chain shirt for $500 – $1000

- a spyglass for about $150

So, by using modern item values, we might say that 1 GP is worth somewhere between 15 cents and $200 in $US.

But before you dismiss the prices as being “inconsistent” with modern values, consider your setting. Relative prices are much different now. Many things are much easier to make, and the cost of hand labor is reduced. Other things may be more in demand or uncommonly made now, and cost relatively more. If you want to build a more modern setting for your world, you might as well just use a modern currency.

Don’t Miss: How To Make Gold Jewelry

How Is The Price Of Gold Moved By Interest Rates

Put simply, interest rates are the cost of borrowing money. Lower interest rates imply that it would be cheaper to use the countrys currency in order to borrow money. Interest rates tend to have a strong impact on economic growth. Central banks use it as an important tool to make decisions in regards to monetary policies.

It is common for central banks to decrease interest rates if they lead to better economic prospects. Lower interest rates result in increased consumption and investment by the local population. The disadvantage is the low interest rates decrease currency and bond yields, both of which positively influence gold prices.

Estimates Are Currently 190000 Tons Of Gold Exist Above Ground

Government central banks own only about 1/5th of the above-ground gold bullion supply. Another 1/5th is spread out amongst private investors in various coin and smaller gold bar size formats.

The vast majority, or around half of all physical gold above ground gets held in gold jewelry form, most of which resides in the eastern world .

Total notional gold derivative contract trading volumes around the world every year dwarf the entire physical supply of gold in the world. In other words, ‘bets on the fiat spot price actions of gold,’ are many multiples more than the actual value of physical gold owned by human beings.

This is only one primary reason why when you buy physical gold bullion in any format you will have to typically pay some price premium above the fluctuating gold spot price.

^ If this illustration does not make sense to you, perhaps learn more about how the gold market works ^

Read Also: What Do Golden Retrievers Eat

Why Is There A Difference Between The Prices Of Gold And Silver

The primary reason behind the large discrepancy in the value of gold and silver is due to their rarities. The usual market principles such as supply and demand play a pivotal role in determining the value of gold. Since gold is low in supply, it is also much harder to obtain than other metals.

Silver is much larger in supply and is easier to mine. In fact, silver is often obtained as a by-product of other metals during mining. Silver can be obtained at a rate of 0.07 parts per million. In contrast, the average occurrence rate of gold is 0.004 parts per million.

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

Recommended Reading: Where Is The Best Place To Buy Gold Jewelry

How To Calculate The Gold Price

If you know the purity , weight unit, and your desired currency . Then provide these detail in the dropdown list mentioned above, and you will see the latest real-time gold rate calculation in your provided currency (currency rates are also latest and updated with 60 minutes interval. The complete description of how to use this calculator has mentioned below.

Detail Of Gold Calculator

Following is the description of our gold calculator. Each option is shown in the following image and described in detail.1. Select a unit type of gold from the dropdown list shown in the image above. You can choose different units from the list which are famous around the globe. They are Gram, Ounce, Tola, Kilo, Tael, Masha, Bhori or Vori, Grain, etc. There two types of tola they are slightly different in weight.2. Enter the number of units. You can enter a numerical value of your choice. For example, 1, 1.5., 2, 5, 10, 20, 50, 100 etc. This calculator is also supporting the floating-point values for example, 1.5, 2.5, 3.15, 4.1234, etc.3. Select Karat or Purity from the list, e.g., 24k, 23k, 22k, 20k, 18k, 14k, etc.4. Choose your desired currency from the dropdown list, as shown in the image. You can select any currency for example, Euro, US, Australian, or New Zealand Dollar, Pakistani, Indian, or Nepali Rupee, KSA or Saudi Rial, etc. It contains almost all currencies in the world. Moreover, currency rates are regularly updating with a one-hour interval while gold prices are updating with a one-minute interval.5. Spread: it is a difference between the buying price and selling price. By clicking on this link, you will be forwarded to another page having a spread option. Businesspeople like goldsmiths for buying or selling gold using this option.

Also Check: What Is The Price Of 14 Karat Gold Per Gram

Karat Scale To Fineness Scale Approximation

The karat scale purity is rounded to 0.1%. For example, 8K is rounded to 33.3% rather than 33.33% recurring.

We are also using the rounded down fineness, as opposed to the rounded to nearest whole number fineness. See table below for the difference.

| Karat | |

|---|---|

| 250 | 250 |

For 24K gold, we offer 2 nines , 3 nines , 3 nines 5 , 3 nines 7 , 4 nines , 4 nines 5 , and 5 nines . See nine purity for more information.

Some manufacturers may stamp a particular karat but the fineness may vary slightly .

What Is A Loco Swap

A loco swap is between a miner and a refinery and they swap the gold or silver they have without physically shipping it. The two companies agree to swap a precious metal with one another in a different location.

To get a 99.5% pure 400 oz gold bar from a dore bar that is received from the miner, it has to go through a chlorine refining process known as the Miller process. The Miller process bubbles chlorine gas through the melted dore metal. This allows the gold to react with the chlorine to form gold chloride that then forms a slag on top of the molten precious metal. This process produces gold to a purity of 99.5% and is cast into 400 oz bars for the wholesale market.

Read Also: How To Trade Gold Stocks

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

- American Eagle

What Is The Value Of One Gram Of Gold

1. The gold price calculator only provides an estimated value of your gold. 2. The commonly used units are troy ounce, gram, and kilogram. The conversion among those units are as below: 1 troy ounce = 31.1034768 grams, or 0.0311034768 kilograms. 1 gram = 0.03215 troy ounces 1 gram = 0.001 kilograms. 3. The purity of gold.

Recommended Reading: Where To Sell Gold Seattle

How Much Is A Gold Piece Really Worth

I have been wondering what a gold piece is worth, due to the fact there are many things that cost the same, but in reality, are probably worth radically different prices, such as a Goat and a Whip, which both cost 1 gp.

What is a gold piece really supposed to be worth? Like, how would things be priced if they were in familiar modern monetary units instead of “gp”? That would give me something to base my adjustments to abnormal prices on, such as items not listed in the PHB.

- May 11 ’15 at 21:42

- 3May 11 ’15 at 22:18

- 1

Understanding The Dow To Gold Ratio

The Dow to gold ratio is a measure of the stock market in comparison to gold. The Dow gold ratio been observed to move downwards in the wake of panic associated with inflation and deflation. During the Great Depression, the Dow to gold ratio stood at 1:1. In January 1980, both the Dow Jones Industrials and gold prices sported a handle at 850, thus reaching 1:1 ratio.

The Dow to gold ratio has fluctuated from 16 to 20 between 2017 and 2018. Analysts believe that the ratio will fall in favor of gold during the next financial crisis while some believe that the ratio will return back to 1:1.

As an example, a 20,000 Dow and $20,000 gold price may seem impossible to achieve today but when panic spreads in the market, price extremes on either side could be reached, sometimes even simultaneously.

You May Like: How Much Is It To Buy An Ounce Of Gold

Live Prices For Gold Bullion

Gold bullion prices are guided by the gold price, but it is not a direct correlation. There are lots of costs involved in transporting gold and in manufacturing the gold from the raw material to the gold bars that are offered for sale. Whilst these costs are typically lower than in gold coins, for instance, there remains an element of additional manufacturing, transport and marketing costs that are factored into the final selling point and indeed the purchase price when someone is selling gold.

To find out the live market cost of gold we would recommend visiting our constantly updated live gold price page. Not only does this page give you an overview of line and intraday pricing, we are also able to show you the historic prices for gold going back to 1975.