Why Is Zakat On Money Today Paid Based On Gold

The Prophet, on him be peace, indexed Zakat payment to the value of the silver dirham and gold dinar of Makkah, which was the currency of the time. So those weights must remain the method of measuring gold, silver, and all our currency for Zakat payments.

Muslims, moreover, have long converted to gold as the standard weight measure for the Zakat niâb threshold on currency because its coinage has proven the most constant stable measure of wealth.

To use silver directly as the niâb standard, as some today advocate, arguing that silvers lower threshold will benefit the poor by resulting in more Zakat payments, actually compels many poor themselves to pay Zakat, increasing their financial burden and further impoverishing them.

At noon on January 11, 2021, for example, niâb calculated on silver stands at just $481.95. This means a person with that amount of money, in all its forms combined, at the Zakat Due Date must pay 2.5% of it, or $12.04, in obligatory Zakat a burdensome duty for those struggling to sustain themselves and their families.

The niâb for gold at this same time is $5,074.50, at a Zakat payment of $126.86, a fair and, therefore, moral responsibility for the wealth God has given one.

Calculating Zakat Of Gold

Question:

Assalamualaikum ustadz. Id like to ask about zakat of wealth. I have about 100 grams of gold bullion on July. Then in August, it underwent a cutback to 88 grams . 6 months afterward I bought more gold about 7.5 grams. How to calculate its zakat obligation?

Thank you, may Allah reward you greatly.

From: Taufik Hidayat

Answer:

In the name of Allah. Peace and prayer of Allah be upon His messenger.

Zakat of gold, silver, and money isnt compulsory until some requirements regarding it are fulfilled, namely:

The owner is a muslim.

The owner is a free man, not a slave.

The gold, silver, and money are entirely owned.

Its amount has reached the nishab of zakat.

Its amount isnt diminish for a full one year period.

The Messenger of Allah peace and prayer of Allah be upon him- said,

Theres no zakat for gold which amount is below 20 mitsqal and silver below 200 dirhams.

According to Mujam Lughah Al-Fuqaha, 1 mitsqal equals 4.24 gram thus, 20 mitsqal is 4,24 gram x 20 = 84,8 gram.

Our government has defined the nishab for gold for zakat is about 85 gram of pure gold. This is also the opinion of Sheikh Muhammad Ibn Shalih Al Uthaymeen, and this is our stance. And Allah knows best.

If a person has gold weighing about 85 gram or more, he is not obliged to pay for zakat until he has that 85 gram of gold or more for a year without ever reduced from it.

What Measure Determined The Value Of Gold At That Time

Weight determined the value of the silver dirham and gold dinar as currency in the time of the Prophet, on him be peace. He established the weights of Makkah as the Muslims standard measure for currency based on the weights of the dirham and dinar of the Makkans. This remains in force for calculating Zakats niâb on gold.

Read Also: 18 Carat Gold Value

How To Calculate Zakat On Gold

Yet as for those who hoard up gold and silver and do not spend it in the path of God give them heavy tidings of a most painful torment on a Day Hereafter when gold and silver shall be heated in the Fire of Hell

Yet as for those who hoard up gold and silver and do not spend it in the path of God give them heavy tidings of a most painful torment on a Day Hereafter when gold and silver shall be heated in the Fire of Hell

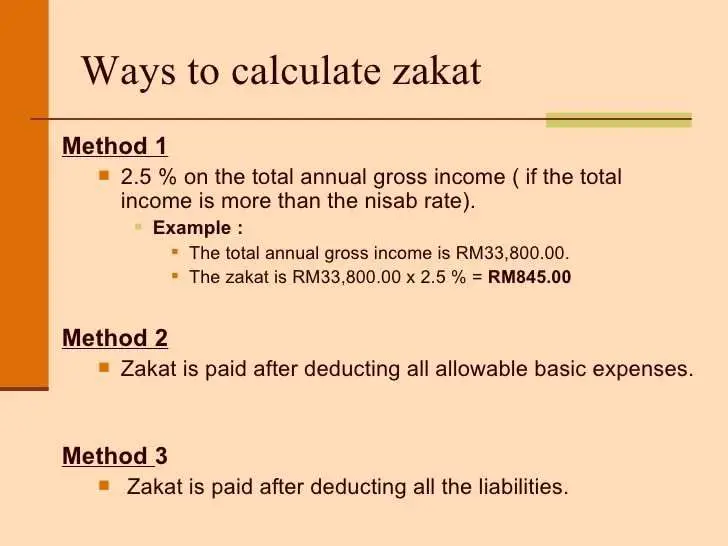

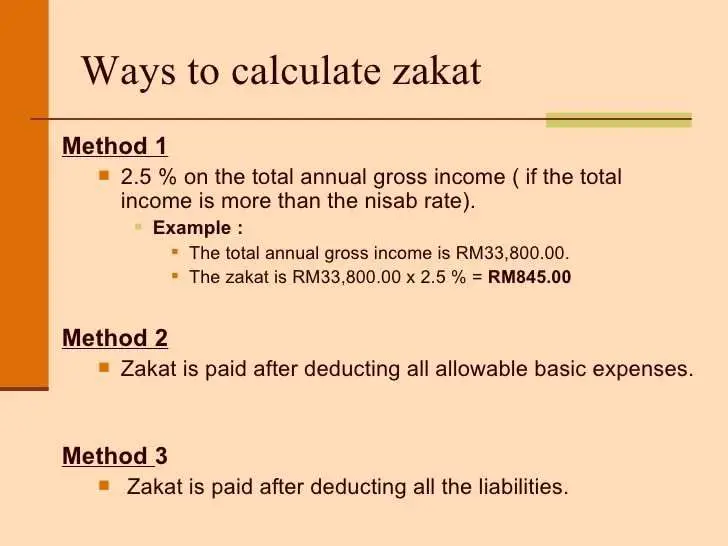

The Rules For Calculating And Paying Your Zakat

Safa Faruqui

Working out how much Zakat to pay and how to pay it can be sometimes difficult and for that reason, we have created this short guide. We’ve broken down some of the most common questions and cleared up the main misconceptions about Zakat.

While you’re here, you can also use our Zakat calculator or read our Zakat policy.

What is Zakat and why is it important to me?

‘You shall observe the Salah and give the obligatory charity , and bow down with those who bow down.’

Zakat is the third pillar of Islam. It is an obligatory act of charity amounting to 2.5% of a Muslim’s annual savings. Zakat is intended to purify our wealth, not only physically, but also spiritually. It purifies our heart against selfishness as well as ensuring that society’s poorest are protected against hunger and destitution.

A common misconception is that Zakat is a form of tax. However, it is a spiritual obligation in which we will be accountable to Allah directly. Zakat plays a key role in supporting the poorest in the community, through providing them with essential aid as well as helping them come out of a life of poverty.

Who has to pay Zakat?

You must pay Zakat if, firstly, you are an adult Muslim of sound mind, and secondly, you have possessed the minimum amount of wealth for one lunar year.

How much Zakat do I need to pay?

What do I need to pay Zakat on?

Zakat is not just paid on the savings in your bank account. You need to pay Zakat on other types of wealth, such as:

Don’t Miss: Golden State Grant Ssi

Why Has Allah Imposed Zakat On Gold

Allah has forbidden hoarding of gold in severe terms in the Quran because of its essential value to the economic life of the community and because that obsession quickly becomes a sickness of the human soul.

Yet as for those who hoard up gold and silver and do not spend it in the path of God give them heavy tidings of a most painful torment on a Day Hereafter when gold and silver shall be heated in the Fire of Hell. Then their foreheads and their sides and their backs will be branded with it : This is what you have hoarded up for yourselves! So taste now what you used to hoard up!

Hence, the Prophet, on him be peace, instructed Muslim guardians to invest the money of the orphans in their care so annual Zakat payments would not consume it before they come of age and assume investment control of it.

The detailed answer:

Gold in all its forms coin, bullion, and handicraft and whether held as personal or business wealth, accrues due Zakat every lunar year that it reaches its established Zakat niâb of 85 grams, excepting jewelry women use to adorn themselves.

There is unanimous agreement among Muslim scholars that any Muslim who owns gold or silver must pay Zakat on it as currency. This means there is Zakat on all money. The Prophet, on him be peace, said: On silver, 2.5% is due.

Calculate Zakat On Gold

When you want to calculate Zakat on gold then the Nisab is the cash equivalent of 3 ounces/87.48 grams of gold

For example, if each ounce of gold is currently worth $43, the Nisab using the gold calculation is . If your personal wealth is above $129, you owe zakat.

People also face trouble when calculating Zakat on gold jewelry. This confusion mainly occurs due to a lack of clear information on the subject. At first, you need to know that zakat is only due on gold or silver jewelry. There is no Zakat due on platinum or palladium, Diamonds, and gemstones like pearls, sapphires, rubies, corals, etc.

If your gold jewelry is made up of a mixture of metals you are only required to pay Zakat on the gold. You can also give actual gold in Zakat. For example, if someone has gold jewelry that weighs 100 grams, they can give 2.5 grams of gold as Zakat on the jewelry.

If there are diamonds, gemstones, pearls, etc, set within your gold jewelry, take it to a professional jeweler when you need to find out the weight of the gold. A professional jeweler will have the knowledge and experience required to assess the weight of the gems and will be able to give you the best approximate weight of the stones. Now to calculate Zakat on your gold jewelry, you can use this simple method.

The total weight of jewelry the weight of other stones x the price of gold x 2.5%

Read Also: Does Kay Jewelers Sell Fake Jewelry

Do I Need To Pay Zakat On My Gold And Silver

Gold and silver in whichever form they are in are all subject to Zakat.

If you own personal items made from a mixture of metals, then the gold/silver content is liable to Zakat in the mixed metal.

Some scholars are of the opinion that mixed metals are only liable to Zakat if half or more of the metal is gold or silver.

How Do I Know If I Need To Pay Zakat

Like any other obligation in Islam, Zakat is only mandatory if certain conditions are met. As we know, Allah does not burden a soul with more than it can bear.

The majority of scholars agree the basic conditions for Zakat are that it is mandatory for Muslim adults, of sound mind, who own the minimum amount of Zakatable wealth, or Nisab, for at least one lunar year.

You should know there are some schools of thought who put forward that Zakat is also due upon minors who have wealth or inheritance if they meet the other conditions: Muslim, complete ownership of the wealth for one lunar year, and meet the Nisab threshold.

Of course, this doesnt apply to childrens allowances or Eid money, but rather applies to minors with trust funds and inheritances. The details and technicalities are beyond the scope of this blog post, but you can consult with your local scholar for more details. We just wanted to make you aware of this possibility.

Recommended Reading: Buy Gold Now Or Wait

A Beginners Guide On How To Calculate Zakat

It is the month of Ramadan, and at this time many of us are wondering how to calculate Zakat. But lets take a step back and take the time to appreciate, what is Zakat? Why does it hold such importance in Islam?

At a time when many services and businesses are restricted, when borders are closed and many peoples livelihoods are uncertain, charities continue to provide aid and support. All over the world, humanitarian organizations are trying to make sure the most vulnerable people are not overlooked during this pandemic.

But they wouldnt be able to operate without the generosity of people who are willing to give at a time of crisis. As Muslims, giving charity is more than a means of earning Allahs pleasure, its also an obligation and a right we must fulfill, known as Zakat.

Those who put aside from their wealth a known right for the needy and the poor they are honoured in Gardens of Bliss.

Quran 70:24-35

To help you fulfill this important obligation, weve put together this beginners guide to Zakat. In the next sections, well cover everything you need to know to get started. The topics we cover will include:

- What is Zakat?

- What is Nisab? How do I know how much it is?

- How is Zakat used? Who receives your Zakat?

- How do I know if I need to pay Zakat?

- How do I actually calculate Zakat?

- Additional resources on Zakat.

Calculate And Pay/donate Your Zakat Using The Latest Nisab Values

The alms are only for the poor and the needy and those employed to collect and to attract the hearts of those who have been inclined and to free the captives and for those in debt and for Allahs Cause, and for the wayfarer a duty imposed by Allah. And Allah is All-Knower, All-Wise.

Zakat, the giving of alms to the poor and needy, is one of the five pillars of Islam. It is mandatory upon all Muslims who meet the necessary threshold of wealth.

Excluding living costs, expenses etc, an individual must own a specific amount of wealth or savings for over 1 year. This is referred to as Nisab and is the threshold at which Zakat becomes payable. The amount of Zakat to be paid is 2.5% of Nisab .

Recommended Reading: How To Get Free Eagles In War Thunder

Zakat Scholar: Providing Specialist Advice

We understand that calculating your Zakat can be daunting, and even confusing. Therefore, we work with a dedicated Zakat scholar during Ramadan to provide a specialized advice service. This service allows you to speak directly to a learned scholar via email or telephone.

Please note: the Zakat scholar is available during Ramadan 24/7.

How To Calculate Zakat A Beginners Guide

Those who have saved and have extra money to invest should take the opportunity to think and perform a stock check, both metaphorically and actually, whether they have contributed enough to help those in need. Muslims are required to pay zakat, which is considered a form of devotion. Donating money to the impoverished is considered cleanse annual earnings above and beyond what is needed to meet a persons or familys basic requirements.

Read Also: Classic Wow Banned For Buying Gold

Last Year Alone Your Zakat Enabled Us To Save Lives

Your Zakat has funded some of our crucial work with people and communities living in disaster and war zones: drought and famine-struck countries across East Africa communities affected by conflict in Yemen and families in war-torn Syria struggling to survive one day to the next.

Your Zakat has supported communities to build sustainable livelihoods in the face of climate change and to build better lives for vulnerable orphans and families across the globe.

Alhamdulillah, your Zakat has the power to transform peoples lives. Help make this happen. Give your Zakat for the love of Allah .

What Is Zakat Due On

Zakat is due on any personal expendable wealth owned by a sane adult Muslim, including any wealth that is tied up in business assets and property. In these cases, the value of such assets is included and added to the value of any money in the bank and cash at home.

Here is the complete list of what Zakat is due on:

- Gold and silver

- Cash held at home or in bank accounts

- Pensions

- Property owned for investment purposes

- Stocks and shares owned directly or through investment funds

- Money lent to others

- Business stock in trade and merchandise

- Agricultural produce

Any debt that is owed, however, is to be subtracted from the total wealth. Personal or business loans are not considered to be part of your wealth, thus making them ineligible for Zakat.

You May Like: Free Eagles For War Thunder

When Should Zakat Be Paid

When it comes to paying zakat, then it is safe to say that zakat should be used to eliminate poverty, and ensure that those with wealth above a certain threshold have a duty to donate it to worthy causes. Ramadan is a hugely popular time for the payment of zakat, but zakat can be paid at any time in the year, and many zakat fundraisers run throughout the Islamic calendar.

Zakat is payable once a year, and payment of zakat should not be delayed. Many Muslims like to pay their zakat once the moon has been sighted for Ramadan as the reward is increased.

Calculate How Much Zakat You Have To Pay:

Your Zakatable Wealth x 2.5% = Total Zakat You Owe for the Year

We hope this helps you understand the fundamentals of how Zakat is calculated!

To make the calculation easier, you can use our Online Zakat Calculator, where you can just plug in your numbers. It will even calculate the value of your gold and silver automatically.

Don’t Miss: Banned For Buying Gold Wow Classic 2020

Do We Use The Same Gold Weight As The Prophet On Him Be Peace

Scholars, Muslims, and others have matched the exact equivalent of the gold dinar of the prophetic generation to our weights for Zakat on gold today through preserved samples of coinage called mithqal.

The second Rightly Guided Caliph and Companion Umar ibn Al-Khaâb himself standardized the legal weight of the dirham and the Caliph Abdul-Malik minted all coins of the realm on that legal weight. Many historians have established that 10 silver dirhams equaled a specific weight as measured against a mithqal.

It is unanimously agreed upon since the early ages of Islam, the era of the Companions and the Successors, that the weight of a silver dirham is equal to seven-tenths the weight of a gold dinar .

How To Calculate Your Personal Zakat

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 40 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 545,523 times.Learn more…

Zakat is one of the pillars of the Islamic faith. Zakat literally means “alms”, and there are different kind of Alm’s, e.g. Zakat ul-Fitr or Zakat ul-Maal . The implied Zakat that makes up the pillar of islam is Zakat ul-Maal, which mandates muslim to donate 2.5% of their personal wealth to those in need, annually.Muslims believe that Zakat purifies the spirit and brings them closer to God, and that not paying it makes your wealth “dirty” .Learn how to calculate your personal zakat so you can fulfill your spiritual duties.XResearch source

Recommended Reading: Can I Buy Dubai Gold Online