Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

How Do Central Banks Influence The Price Of Gold

A central bank is a national bank that implements monetary policies and issues currency for its respective country. It also provides financial and banking services for its countrys government and commercial banking system. This means a central bank can affect the amount of money supply in its country to help stimulate the economy if needed. The Federal Reserve is the United States central bank while Europe has the European Central Bank . Other central banks include the Bank of Japan, the Bank of England, Peoples Bank of China, Deutsche Bundesbank in Germany, to name a few. Central banks are also responsible for managing its countrys reserves, including its foreign-exchange reserves, which consists of foreign banknotes, foreign bank deposits, foreign treasury bills, short and long-term foreign government securities, gold reserves, special drawing rights and International Monetary Fund reserve positions.

Gold Futures Vs Spot Gold

There is a difference between the price of gold futures and spot gold. Gold futures represent the due amount to be paid on a date of delivery in the future. The prices for gold futures are higher than spot gold, as is commonly observed in the market. This difference depends on several factors such as the market demand for immediate physical gold, interest rates, and how many days remain before the delivery contract date arrives. The Forward Rate is when the difference between the two is expressed in terms of annual percentage rates.

Spot Gold is normally exchanged by independent dealers while gold futures depend on centralized exchanges which are accessible by investors for almost 24 hours a day. The price for spot gold is completely left to the market and unregulated. In the case of gold futures, the prices are regulated by the Commodity of Futures Trading Commission and the National Futures Association .

Also Check: Is 14k Or 18k Gold Better

Australian 1/20 Oz Gold Coins

Australias Perth Mint produces some of the most thoughtfully designed and well made gold coins on the market. They have produced coins in many different series, so collectors from all over the world adore them.

The Gold Lunar Series is one the most sought-after among Australian coins. Inspired by the Chinese zodiac, these coins celebrate each year with the design of its corresponding animal. The Perth Mint started producing them in 1996 and ran till 2007. Due to the high demand, the production of Series II launched the following year.

2018, for example, is the year of the Dog. Coins in the series depict a Labrador retriever on the reverse side.

Another popular Australian coin series features the Kangaroo. Since 1987, this well-known symbol of Australian wildlife has been depicted on the backside of these coins, with the design being changed annually. The obverse, like all Australian coins, features a portrait of Queen Elizabeth II.

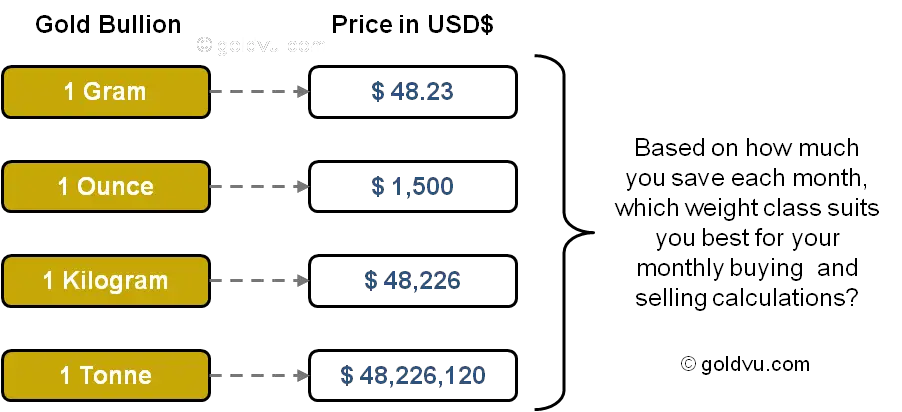

What Is Oz Gram Kilo Tola

Gold and most precious metals prices are quoted in troy ounces however, countries that have adopted the metric system price gold in grams, kilograms and tonnes.

Grams = 0.032151 troy ounces

Tael = 1.203370 troy ounces

Tola = 0.374878 troy ounce

Though not as popular as kilograms and grams, Tael is a weight measurement in China. The tola is a weight measurement in South Asia.

Read Also: Where Is Golden Gate University Located

Do Current Gold Prices Vary By Country

The price for an ounce or gram of gold remains mostly the same regardless of which country you are in. The price is determined by converting the current spot gold price for an ounce or gram of gold into the country”s currency. For example, the current spot gold price for 1 gram of gold would be converted into Indian Rupees according to the current exchange rate.

Value Of Gold Per Ounce: Things To Remember

Do remember that the value of gold per ounce is always a function of supply, demand and many other factors. Just because the price of gold is high right now does not mean it will still be high about a year from now.

Ten years from now, however, this will likely be a different story. Gold is a long-term investment, and if you are not familiar with the ins and outs of purchasing this type of asset for the long haul, its important to consult people who have the knowledge base to help you.

Certain events can also change the current price of gold, so make sure that you keep yourself tuned in to the latest fluctuations to determine the best time to buy.

Also Check: How Much Is Xbox Live Gold For 3 Months

Gold As A Medium Of Exchange

The extraordinary Austrian financial analyst Ludwig von Mises characterized cash as the most marketable good. Most commodity-money advocates select gold as a medium of trade since of its natural properties and knowing how much gold worth today. Gold has non-monetary employments, particularly in gems, hardware and dentistry, so it ought to continuously hold the least level of genuine request. It is impeccably and equitably separable without losing esteem, not at all like precious stones, and does not ruin over time. It is outlandish to flawlessly fake and encompasses a settled stock theres as it were so much gold on Soil, and expansion is constrained to the speed of mining.

Gold Prices |

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Don’t Miss: Where To Do Quantiferon Tb Gold Test

What Are Spdr Gold Shares

SPDR Gold Shares, short for GLD, is the largest gold-backed exchange-traded fund in the world. It is marketed and managed by the State Street Global Advisors. The market cap for GLD is $32.44 billion as of March 2019. The exchange-traded fund was first launched in November 2004. It originally appeared on the New York Stock Exchange under the name streetTRACKS Gold Shares.

This name was changed to SPDR Gold Shares later in May 2008. It trades on the NYSE Arca. GLD also trades on the Singapore Stock Exchange, Hong Kong Stock Exchange and the Tokyo Stock Exchange.

What’s The Price Of Gold

You may also manipulate the graph by choosing a specific range of time located at the top of the graph. You can switch to silver prices by clicking the button at the top left.

This chart updates every 10 seconds . You may always refer to this page to find the current price of gold at any given time.

Read Also: How Much Is 2 Kilos Of Gold Worth

Gold Prices In Indian Rupees

Gold is a global commodity that can be transacted in any currency. If you are in India, for example, you would likely buy or sell gold using the local currency: the rupee. Gold prices may be quoted by the ounce, gram and kilo. Single ounce gold coins are very popular with investors, and fractional gold coins and bars make investing in gold easier for those on a tight budget.

The Indian Rupee is the official currency of the Republic of India. Like a U.S. Dollar, the rupee can be subdivided into 100 smaller units of currency, known as paise. Per the 1934 Reserve Bank of India Act, the Reserve Bank manages the Indian currency

The rupee is named after is named after a silver coin, the rupiya, that was first issues in the 16th century.

What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

Recommended Reading: How To Buy Gold In Robinhood

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

How Do Current Gold And Silver Prices Relate To One Another

While silver prices are far lower than gold prices, it can sometimes appreciate substantially. Savvy investors should compare the current gold and silver prices to determine the gold silver ratio at the moment. Depending on the results of that investigation, they may purchase gold bullion, silver bullion, or both.

Recommended Reading: Can You Buy Gold On Etrade

Does The Monetary Denomination Of A Gold Coin Affect Its Overall Value

Not particularly. Having a legal tender status, in and of itself, can help increase the total value of a coin. But the actual face value or denomination has little to no bearing on that value. It doesn’t mean the coin contains an amount of gold worth the face value. It’s actually much higher.

Typically, the specific issuing country will have more effect on the total value of the coin. Investors prefer coins minted by major economic powers, such as the U.S., China, Great Britain, or Canada.

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

Don’t Miss: How To Find Out If Gold Is Real

The Price Vs The Value Of Gold What Is The Difference

The value of gold is measured beyond the daily spot price. Right now, as you read this post, the live spot price of gold is $1787.52+7.83 . You may have just calculated your gains or losses based on when you purchased your gold. While the price of gold is important to understanding gold investments, you will find that it is golds long-term intrinsic value that has stood the test of time. While you read this post try to think about the longevity of your financial future. Lets not consider todays price of gold, rather how it has retained its value over time.

Buying gold is considered a safe haven against economic downturns and market uncertainty. Gold has the ability to preserve its purchasing power in ways that other investments do not. Golds worth is in its security and high quality performance over time as a preserver of wealth.

While market forces, inflation and economic trends influence the daily price of gold, gold retains purchasing power regardless of price. In the 1920s, one oz. of gold was worth $20. A $20 gold piece could buy a man a fine suit and night out on the town while today a $20 bill could not cover a fraction of those costs. However, the cost of 1 oz. of gold today could still buy those same goods as it did in the 1920s.

How Are The Premiums Over Spot Calculated Are They The Same For All Gold Products

Premiums vary depending on the product.

Generic gold items usually have lower premiums. A more intricate design on a gold bar or gold coin will raise the premium. Rare or limited edition products will also have high premiums.

The reason for this is twofold. Highly artistic gold products are more costly to manufacture. Buyers are also willing to pay more for such items.

Read Also: Where Can I Buy Carolina Gold Rice

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

Understanding The Dow To Gold Ratio

The Dow to gold ratio is a measure of the stock market in comparison to gold. The Dow gold ratio been observed to move downwards in the wake of panic associated with inflation and deflation. During the Great Depression, the Dow to gold ratio stood at 1:1. In January 1980, both the Dow Jones Industrials and gold prices sported a handle at 850, thus reaching 1:1 ratio.

The Dow to gold ratio has fluctuated from 16 to 20 between 2017 and 2018. Analysts believe that the ratio will fall in favor of gold during the next financial crisis while some believe that the ratio will return back to 1:1.

As an example, a 20,000 Dow and $20,000 gold price may seem impossible to achieve today but when panic spreads in the market, price extremes on either side could be reached, sometimes even simultaneously.

Read Also: Where To Buy Yukon Gold Potatoes

What Gold Worth Today

Few individuals contend that gold has no natural value, that it could be a primitive antique that now not holds the money related qualities of the past. They contend that in an advanced financial environment, paper money is the money of choice that golds as it were worth is as a fabric to create jewelry. At the other conclusion of the range are those that attest that gold is a resource with different natural qualities that make it special and vital for financial specialists to hold in their portfolios. They accept that speculators have as numerous reasons for contributing to gold as they do vehicles to form those investments.

Most would concur that gold has continuously had esteem for all of these reasons a component of enriching gems, a at some point cash, and as a venture. But in expansion to these concrete values, we would include another characteristic of gold, which, in spite of the fact that harder to pinpoint, is as fair as genuine: its riddle. The portion of the exceptionally offer of gold is the puzzle of its appeal. In the world of back and contributing, we regularly like to tiptoe around the word secret. However, as is genuine with most disciplines, theres continuously a put for both science and craftsmanship, and indeed a mystery.

Gold can invigorate a subjective individual involvement, but gold can be generalized in the event that its embraced as a framework of exchange.

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

You May Like: Where To Buy Gold Bars In New York City