Summary: What Is The Future Of The Gold

In the world of investing, there is of course always going to be risk and potential for loss. Gold is no different, but it is also one of the least risky investments that there is. It is an asset that will always be in demand, either for its uses in Jewelry, or electronics, and it is also in demand from central banks as well as investors.

Gold is also a resource that has an uncertain, but scarce, supply. This supply is also always dwindling which means the demand will keep rising along with the price. More so, the factors that impact the future golds price prediction are only going to get more relevant with the Covid-19 crisis and the ongoing need for a safe haven asset.

| Year | |

| 2030 | $8,732 |

Investing in gold has never had a better time to start than right now, the price is primed to explode, but getting involved in trading such a commodity can be difficult due to its physical nature and the exclusivity of many gold brokers who are not so open to new traders.

One alternative option, which makes investing in gold a lot easier, and even possibly more profitable, is to sign up with PrimeXBT. The platform has won awards for its app, as well as been praised for its incredibly low fees. PrimeXBT also allows you to start trading in under 10 minutes, and with a small amount of money.

Please Note For The Investment Process Or Things That Need To Be Considered In Gold Investment

When doing the above before investing, it is very necessary to pay attention to some of the things above to be more sure how profitable we are to invest in gold as a long-term business and other businesses.

What Drives The Price Of Gold

The price of gold changes daily, as do the influencing price factors. Like most other assets, gold prices can shift for many different financial reasons. If youre not tracking gold prices, changes in interest rates, inflation predictions, and stock market movements could all potentially catch you off guard.

A primary price driver is gold supply and demand, and accordingly, global income growth.

As global incomes increase, so can demand for gold jewelry and technology that includes gold, like smartphones, tablets, and computers. Income growth also encourages savings, which helps boost the demand for gold bullion coins and gold bars.

When demand is high and supply is limited, the purchase price of gold coins and bars tend to increase. It’s basic supply and demand.

The strength of the U.S. dollar can also influence gold prices. The two generally have an inverse relationship. A strong dollar can sometimes discourage gold buyers, as gold becomes more expensive to purchase. When the dollar is weak, gold is cheaper to purchase in other currencies.

Another recurring factor is geopolitical turbulence, like changes in European politics, tensions in the Middle East, and recurring risks in the Korean peninsula. Such international pressures can spur safe-haven buying and push gold prices higher.

You May Like: Pandora Rings Rose Gold Crown

Gold Price Forecast For The Next 5 Years

Forecasting the price of gold over the next five years will be a little easier than considering a long-range forecast. Thats because the current economic conditions will give us a clearer idea of where the price of gold will go. Here are three factors to consider when forecasting the price of gold for the next 5 years:

Factors That Are Affecting On Gold Price

Because gold is such a mature and established market, there are a number of factors that come into play when determining its price and how it is affected. Gold is also a rather unique asset compared to things like stocks and bonds, and that also makes it act differently and the fact that it operates as a hedge means one needs to look for factors that impact other assets differently.

A list of the factors to consider include: Consumption demand, Protection against volatility, Gold and inflation, Gold and interest rates, Good monsoon, Correlation with other asset classes, Geo political factors, Weakening dollar, Future gold demand.

Consumption demand has to do with the uses of gold as an asset removed from its market. Demand for gold keeps changing, and in recent times has been boosted as electronics manufacturers have seen the use of gold in their goods for conductivity.

Of course, gold is also consumed as jewelry, and there are big drives in demand even from global governments who seek out gold as a store of value that they keep in central banks.

As mentioned before, Gold is an asset that helps with protection against volatility. There is a demand for gold from people who are looking to protect themselves from volatility and uncertainty. Gold is a physical asset so it is able to be stored and kept by individuals, and its market moves differently from typical volatile markets so it is in demand for people hedging against uncertainty.

Also Check: Gold Bands Rings For Women

Gold Prices Historical Overview

Historically, gold has been around since thousands of years as an important metal, but it wasnt used for money until around 550 B.C. At first, people carried around gold or silver coins. If they found gold, they could get the government to make tradable coins out of it.

It played an important role through the Roman Empire where Emperor Augustus, who reigned in ancient Rome from 31 B.C. to 14 A.D., set the price of gold at 45 coins to the pound. In 1257, Great Britain set the price for an ounce of gold at 0.89 pounds.

But then, in the 1800s most countries printed paper currencies that were supported by their values in gold. This was known as the gold standard, but In 1971, US President Richard Nixon told the Fed to stop honoring the dollars value in gold and ended its primary use as a currency value and helped drive the asset to be more of a store of value.

This saw the price of gold start to take off as an ounce was with $40 dollars when depegged from the dollar, but in less than 10 years it rose to be worth $2,249 in relative with by 1980.

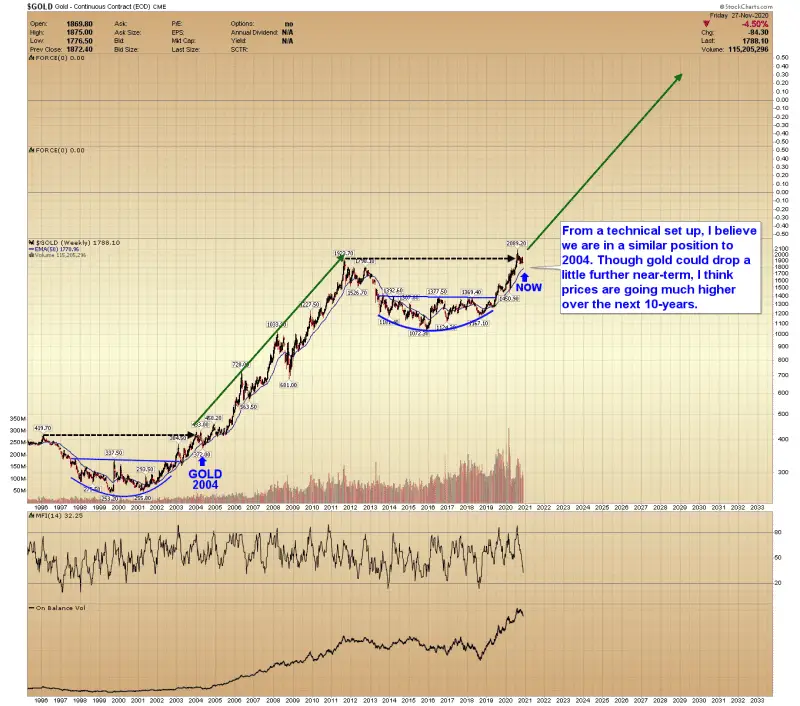

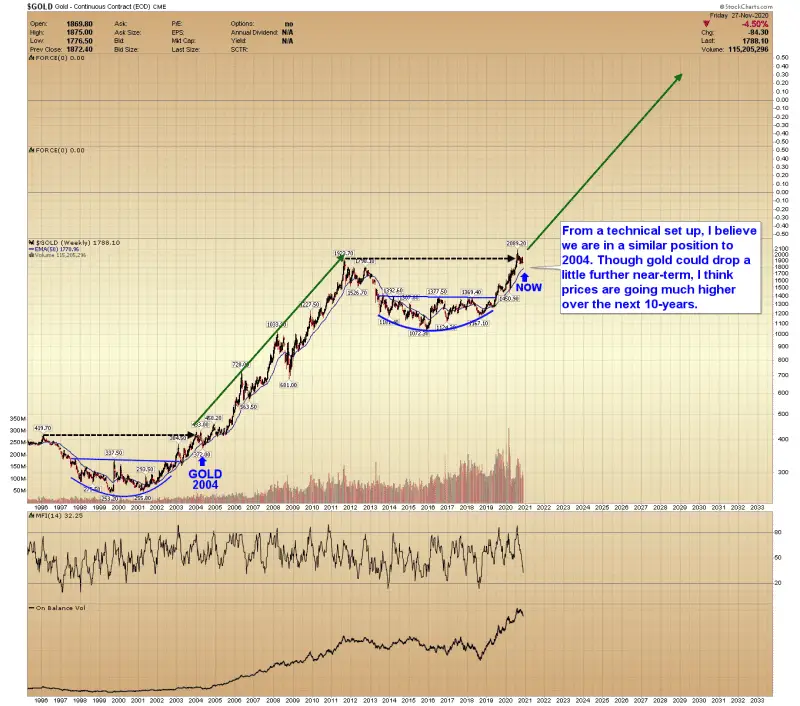

Gold Price Prediction Chart

First, the bear case…

Surveying the landscape, I found several banks that predict lower prices for gold in 2022.

Gold ended 2021 at $1,805 per ounce heres where they see the price going from there.

Various reasons were given as to why theyre bearish, the most common ones were related to rising interest rates and their belief that inflation will fall .

One thing that stuck out about most of these predictions, though, is that most are based on one factor, which ignores a plethora of other catalysts. Ill also note that banks are generally very conservative, and have frequently been incorrect about gold.

Recommended Reading: Mens 14k Gold Rope Chain Necklace

Gold Prices Drop On 2 September 2022

Gold prices witnessed a decline in Bangalore, Visakhapatnam, Hyderabad and Kerala on 2 September 2022. In Bangalore and Hyderabad, 22 karat gold is priced at Rs.46,490 per 10 gram while 22 karat gold costs Rs.50,720 per 10 gram. In Kerala, the price of 10 gram of 22 karat gold and 24 karat gold are Rs.46,490 and Rs.50,720, respectively. Gold prices in Visakhapatnam stand at Rs.46,490 per 10 gram of 22 karat gold while 24 karat gold is priced at Rs.50,720 per 10 gram.

3 September 2022

Gold Prices Fall By Rs485 On 29 April 2022

On 29 April 2022, gold rates fell sharply in India. Gold futures prices on the Multi Commodity Exchange dropped by Rs.485 and were trading at Rs.51,264 for 10 grams. U.S. gold futures were down 0.1% at $1,885.90 and spot gold was down 0.1% at $1,885.06 per ounce. As Ukraine-Russian tensions supported safe-haven demand, the gold prices slipped in the country. However, the cost of yellow metal may remain volatile as the market players react to Ukraine-Russia developments.

30 April 2022

Read Also: Where To Buy Golden Goose On Sale

Understanding The Future Of Gold

Gold, like many assets, moves in cycles driven by events and economic factors. When gold is in a bull market, its moves can be dramatic. Therefore, it is important to consider some allocation in gold to take advantage of any potential upward moves.

REFERENCE:

© 2022 Allegiance Gold. | Gold IRA | Precious Metals IRA |Gold Products | Silver Products | Platinum & Palladium Products | Terms of Use | Privacy Policy | Risk Disclosure| AML Program | Sitemap |

How To Use A Gold Price Chart

Use U.S. Money Reserve’s gold price chart to compare the price of gold over a specific period. The amount of time is up to you. You can review gold prices from 1980 to 2008, or over the last 5 days, 1 month, 1 year, 5 years, or 10 years.

A gold price chart can help you identify gold price trends and figure out when is the right time to buy gold for you. As market analysts are prone to say, A trend is your friend! But how do you identify a trend?

Start by looking for peaks and valleys in gold prices during the selected period. Do you see a pattern? You might notice a spike in gold prices in late November every four years , or a dip when stock prices skyrocket. Identifying historical market trends doesn’t necessarily mean gold prices will perform the exact same way in the future, but trends and patterns could give you insight into what might happen and when you should act.

Recommended Reading: When Is The Best Time To Buy Gold

Gold Prices Witness A Rise Of Rs400

Gold prices reversed their downward trend on Firday. The price of the precious metal edged lower on Friday. Silver prices declined by Rs.1,265 per kg to Rs.54,351 per kg, from Rs.55,616 per kg the previous day. The price of 22 karat gold in Delhi is Rs.46,400 per 10 gram. In Ahmedabad, 10 gram of 22 karat gold is sold at Rs.46,470.

Gold prices in Lucknow and Chandigarh are Rs.46,550 per 10 gram of 22 karat gold. The price of 22 karat gold is Rs.46,400 per 10 gram in Kolkata and Kerala.

23 July 2022

Gold Rates Up In India

The cost of 1 kg gold was up by Rs.1,000 on Monday and trading at Rs.52,760 while 22 karat gold was trading at Rs.48,360 per 10 grams. The gold rates in Chennai are Rs.48,430 per 10 grams of 22 karat gold and Rs.52,830 per 10 gram of 24 karat gold. In Delhi, the price of 10 grams of 22 karat and 24 karat gold are Rs.48,360 and Rs.52,760, respectively. In Mumbai, 22 karat gold is priced at Rs.48,360 per 10 grams and 24 karat gold is priced at Rs.52,760 per 10 grams.

13 June 2022

Don’t Miss: Black And Gold Polo Ralph Lauren

Prices Of Gold In Bangalore Hyderabad Visakhapatnam And Kerala On 16 August 2022

On August 16, 2022, the price of gold stayed the same in Hyderabad, Bangalore, Kerala, and Visakhapatnam. In Bangalore, 10 grams of 22-carat gold cost Rs.48,150 at the current exchange rate, while 10 grams of 24-carat gold cost Rs.52,530. A gram of 22-carat gold currently costs Rs.48,150 in Hyderabad, and a gram of 24-carat gold costs Rs.52,530.

17 August 2022

Is Gold A Good Investment

Whether gold is the right investment for you will be determined by your personal objectives and research. Always draw your own conclusions about the commoditys prospects and the possibility of meeting analysts targets.

Keep in mind that past performance does not guarantee future results. In addition, never trade money that you cannot afford to lose.

Don’t Miss: How Much Does Gold Cost Per Pound

Understanding The Spot Price Of Gold

To use this gold price chart, and many others, it’s important to understand gold spot prices. Note that the chart doesn’t track the price of gold coins or bars. Instead, it reports the spot price of gold, which is the market price at which gold is bought or sold for immediate payment and delivery. It’s the price you’d pay on-the-spot.

The spot price refers to the price for one troy ounce of gold and is typically quoted in U.S. dollars. A troy ounce is a standard unit of measurement for precious metals. One troy ounce is exactly 31.1034768 grams , but youll often see gold prices listed as $/oz. without mentioning troy.

The spot price of gold does not account for any other costs associated with the design, manufacture, or sale of a gold coin or bar, including costs like shipping or insurance. Spot prices also do not take into account the demand for certain gold products and their numismatic value.

The Cost Of Everyday Items In The 1940s Compared To Gold:

There wasnt much of a jump in inflation from the 1930s to the 1940s. Suits cost pretty much the same and steak actually dropped a few cents per pound. Cars continued their upward trajectory in price. By this time the price of gold was no longer fixed, so it started going up as well.

The breakdown:

Cost of steak : 36 cents

Cost of a nice suit: $25

Cost of a car: $850

Cost of an oz. of gold: $34.50

You May Like: When Does Gold Rush Start

My Gold Price Forecast Methodology

I use a mix of technical analysis and observing market fundamentals to make my predictions about the gold price. Unlike strict chart technicians, I also include looking at the larger scope when evaluating the gold marketsuch as considering monetary dynamics and macroeconomic fundamentals.

For instance, I watch for fluctuations in the U.S. money supply as a clue to where gold may be going. In Spring 2020, the federal government rapidly grew the money supply with trillions of dollars in stimulus payments early in the covid-19 pandemic. Changes in the supply of money tend to take around 18 months to take effect on the economy. That’s what we’re seeing this year with inflation.

Gold bar from popular Swiss refiner Valcambi

The Cost Of Everyday Items In The 1980s Compared To Gold:

Kind of like the 20s the 80s are remembered as a time of excess. The cost of every day items increased considerably in this time. The price of a steak nearly tripled, a nice suit almost quadrupled, and the average price of a car more than doubled. The relative value of the dollar versus ten years earlier took a pretty serious dive.

The breakdown:

Cost of a steak : $3.89

Cost of a nice suit: $199

Cost of a car: $7200

Cost of an oz. of gold: $594.90

Don’t Miss: Babe Ruth Gold Card Value

Gold Price Prediction 2022

Gold price started in 2022 at $1,830.50. Today, Gold traded at $1,680.50, so the price decreased by -8% from the beginning of the year. The forecasted Gold price at the end of 2022 is $1,777 – and the year to year change -3%. The rise from today to year-end: +6%. In the first half of 2023, the Gold price will climb to $1,861 in the second half, the price would add $87 and close the year at $1,948, which is +16% to the current price.

The short-term forecast:

Gold Rates Rise By Rs260 On 6 June 2022

In India, the price of gold increased by Rs.260 for 22 karat and 24 karat gold. In Delhi, 10 grams of 22 karat gold and 24 karat gold cost Rs.48,100 and Rs.52,470, respectively. The price of 22 karat gold and 24 karat gold are Rs.47,927 and Rs.52,285, respectively, in Chennai. In Bhubaneshwar, 22 karat gold is priced at Rs.47,740 per 10 grams while 24 karat gold costs Rs.52,090 per 10 grams.

07 June 2022

Recommended Reading: How Much Is An Ingot Of Gold

Gold Price Forecast For 2022 2023 2024 2025 And 2026

| Month |

| 30.5% |

Gold Price forecast for .In the beginning price at 1661 Dollars. High price 1779, low 1609. The average for the month 1686. The Gold Price forecast at the end of the month 1694, change for October 2.0%.

Gold Price forecast for .In the beginning price at 1694 Dollars. High price 1793, low 1623. The average for the month 1705. The Gold Price forecast at the end of the month 1708, change for November 0.8%.

Gold Price forecast for .In the beginning price at 1708 Dollars. High price 1743, low 1577. The average for the month 1672. The Gold Price forecast at the end of the month 1660, change for December -2.8%.

Gold Price forecast for .In the beginning price at 1660 Dollars. High price 1664, low 1506. The average for the month 1604. The Gold Price forecast at the end of the month 1585, change for January -4.5%.

Gold Price forecast for .In the beginning price at 1585 Dollars. High price 1649, low 1492. The average for the month 1574. The Gold Price forecast at the end of the month 1570, change for February -0.9%.

Gold Price forecast for .In the beginning price at 1570 Dollars. High price 1614, low 1460. The average for the month 1545. The Gold Price forecast at the end of the month 1537, change for March -2.1%.

Gold Price forecast for .In the beginning price at 1537 Dollars. High price 1570, low 1420. The average for the month 1506. The Gold Price forecast at the end of the month 1495, change for April -2.7%.