It Depends On Your Investment Strategies

Every investor is ultimately seeking profit what differentiates them is the time horizon and level of risk theyre willing to take. Investing in gold does offer opportunities to profit quickly and handsomely. However, its not as easy as it may seem.

If youre investing in gold for profit, youre trying to buy low and sell high, which means predicting the market. While resources are available, such as indicators and investment books, to improve your knowledge and chances of success, the reality is that even experts still struggle to pick the right time to buy and sell. As Warren Buffet said, The only value of stock forecasters is to make fortune-tellers look good.

Its important to note that investing in gold for security and the long term is recommended by the experts as the best way to make a profit while also protecting your wealth. For example, if youre investing for security and the economy experiences a downturn, you can almost rest assured that gold will retain its value and most likely even increase as a result.

The long-term trend for the price of gold also provides assurances that even if the price of gold falls, it will most likely rebound and continue on its upward trajectory. Therefore, if investors commit to gold as a long-term investment, the best time to buy gold is essentially anytime.

Gold Survival Guide is your NZ gold merchant.

Gold Bullion And Physical Gold

A popular investment product for investors of all types is gold bullion. Gold bullion is the physical metal itself in a refined format suitable for trading and can appear as gold bars, ingots or coins. Investors can usually purchase these from a precious metals dealer, bank or brokerage on the internet or in person.

Additional to gold bullion, investors can choose to purchase gold jewellery or any other physical gold products. However, there is often a price mark-up on gold jewellery due to the labour involved and retail pricing of the product.

Physical gold cannot be stored as easily as other financial assets. It takes up lots of space and comes with the additional risk of loss or theft. When buying and storing physical gold of any sort, you should ensure that you have insurance that covers it in the case of loss or theft. View our gold price chartâ for more information on trading physical gold.

Factors To Consider When Buying Physical Gold

If you decide to buy physical gold, youll want to keep a few things in mind:

- Storage: Physical gold requires a secure storage location. While you can certainly keep your gold at home, many investors prefer a custodian. Make sure you research secure options for storing your gold before you buy it, and keep in mind that safe storage adds costs to your gold investment.

- Insurance: If you decide to store your gold at home, you should insure your gold to protect yourself against theft or natural disaster. This can add to the cost of your homeowners or renters insurance. And even if you dont keep your gold at home, youll want to check in on your storage providers insurance policy to determine how its protecting your investment.

- Manufacturer: Because youre making an investment, youll want to make sure youre buying from reputable sources that will help your purchases value grow over time. When buying gold, look for respected producers like Credit Suisse, the Perth Mint and the Royal Canadian Mint.

- Purity: The gold content in the coin, bar or piece of jewelry has a big impact on its value and worth as an investment tool. Ensure any gold you purchase as an investment has the purity level to help it stand the test of time. That means youre probably targeting gold items that are at least 91%, if not 99%, pure.

Don’t Miss: Get Tinder Gold Free Trial

The Best Time To Buy Gold: Is The Gold Market Seasonal

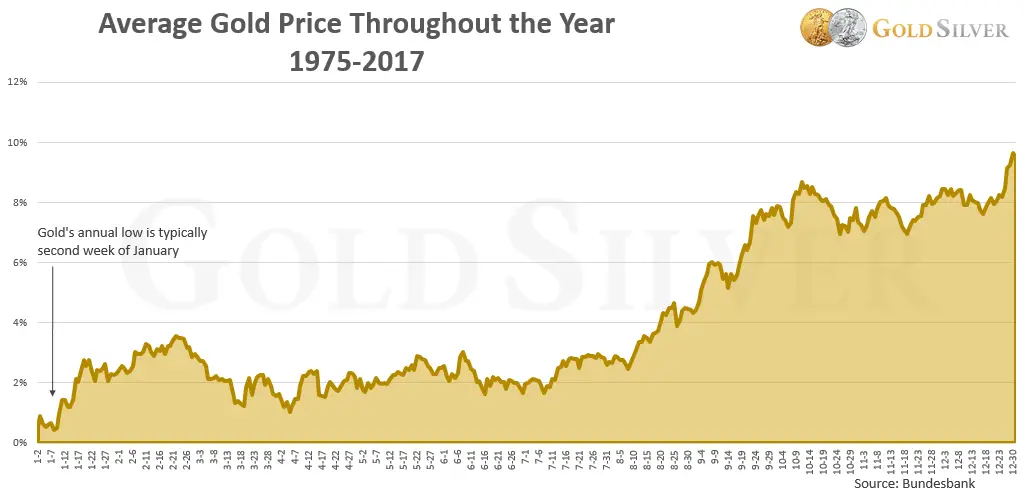

Why should gold bullion have a seasonal pattern? There are several reasons, among the more important being the jewellery market, which accounts for about three quarters of the gold sold each year.

What we see for the fourth quarter of each is the impact of the gift-giving tradition associated with the druid Winter Solstice, now known as Christmas. Layered on top of that is the Indian festival season of Diwali, which kicks off in November and continues through the first leg of the traditional wedding season in December.

You can see noticeable spikes in both January and September, months when Indian manufacturers typically restock inventories to meet the demands of the two Indian wedding seasons. The first, mentioned above, starts in November and ends in December. The second starts in late March and runs through into early May.

Can Indian jewellery buying be a major driver of gold market seasonality? Probably. Don’t forget that gold, viewed as an industrial commodity, has been in a primary supply deficit since 1990 more has been used than produced, and the world has been living out of inventory.

Now Western central banks are slowing their ill-advised selling, and people in China, Russia, the Mideast and India will be buying in size. Further, in 2005, investment in gold ETFs and similar financial products showed a 53% increase, to 203 tonnes. And things are barely starting to warm up.

Time To Buy Gold Stocks But Which One

An intriguing investment for prospective investors to consider is Barrick Gold. Apart from being one of the largest precious metal miners on the planet, Barrick offers several key advantages over many of its peers.

One of the advantages Barrick has over its peers is debt or rather lack thereof. Barrick adopted an aggressive debt-reduction program several years ago when gold prices were in a slump. That discipline resulted in Barrick boasting net debt dropping 71% to just US$471 million in the most recent quarter. In the most recent quarterly update, Barrick also announced that it had no major debt maturities until 2033. This is a significant advantage over its peers that is reflected in Barricks solid earnings cash flow.

By way of example, in the most recent quarter, Barrick saw earnings surge 80% while free-cash-flow surged 150%. That increase was a key factor in Barrick providing a generous 12.5% bump to its dividend last year. While the current 1.63% yield hardly resembles a solid income investment, it does meet or exceed most of its peers.

Don’t Miss: Banned For Buying Gold Osrs

When To Sell Gold And Silver

While gold and silver bullion should be considered long-term holds, there will come a time when you may want to sell. When would that be? Probably one of two occasions

If the time comes and you do want to sell some or even all your bullion, GoldSilver will gladly buy it from you and well make the entire process easy and secure.

You can sell your gold and silver to us whether its stored in your home, IRA, or in our private vault storage program.

Current And Historical Prices Of Gold

Investors should start by looking at the spot price of gold, which is what it can be bought and sold for at that moment. The spot price of gold is quoted per one gold ounce, gram, or kilo. For example, by the end of day on Monday, June 7, 2021, the spot price of gold was $1,903.00 per ounce, $61.18 per gram, and $61,181.45 per kilo.

If you look at historical gold prices, you’ll find that the price of gold shot up dramatically in the 2000s. In 2008, the price of gold varied from around $720 an ounce to over $1,000 an ounce. As the economy sank further into the recession, gold prices soared to around $1,895 in 2011 due to investor sentiment and demand. By April 2020, gold prices declined slightly from where they were almost a decade earlier but continued to perform well in the midst of an economic downturn.

Something similar happened in the late 1970s. After the price increase in the ’70s, gold spent the next 20 years declining in value before going back up around 2000. During the pandemic crisis, demand for gold surged, and the price of gold increased. Investors couldn’t be certain at that time whether the increase would continue or not because it is equally possible that the trend could continue or the price would once again languish for a considerable length of time. While languishing, any gold investment would not produce any interest or dividends.

You May Like: What Is Included In Spectrum Gold Package

Balipratipada 26th October 2022

Balipratipada is also known as Bali Padyami or Bali Padva marks the end of Diwali. It is celebrated on the fourth day of Diwali and is considered one of the auspicious days to buy gold in 2022. As the festivities of Diwali come to an end, buying gold on Balipratipada has much significance. People buy gold to bless their household with abundance and invite prosperity. You may also get the benefit of festive discounts and offers on gold purchases on Balipratipada. The gold bought on this day symbolises progress and good fortune.

Read More on Gold

Should You Buy Gold Stocks Today

If youre wondering whether to buy gold stocks today, the answer will depend greatly on your portfolio.

If you think you need or you want more exposure to gold, then you can certainly find some high-quality stocks trading at attractive valuations. Its always good to have some exposure to gold. In fact, many investors typically allocate around 5-10% of their portfolios to the yellow metal.

You may also want to add defence to your portfolio, and gold stocks are well known to be some of the top safe-haven assets investors look to buy when uncertainty picks up.

If youre underweight gold, you could certainly look to add more exposure today. However, if you already have enough capital allocated to gold stocks, there are plenty of other high-potential investments to make in this environment.

Also Check: Buy Gold In Dubai

Is It A Good Time To Invest In Gold

Gold futures touched Rs 48,000 per 10 grams, according to data on the Multi Commodity Exchange . While global trends led to a rise in domestic prices, another factor that seems to be contributing is rising lockdowns in Asia amid rising Covid-19 cases.

Read | Gold, Silver price today: Rate of precious metals on a surge

Analysts maintain a bullish stance on gold as m. Last week, Motilal Oswal Investment Services said it expects gold price to hit Rs 56,500 in a years time. It may be noted that gold price peaked at Rs 56,200 during August 2020.

The company said that on the domestic front, the correction in gold prices offers a good opportunity to market participants to buy the yellow metal again.

On the domestic front, the post-budget prices correction is a good level to enter once again for immediate targets towards R 50,000 and eventually hitting new highs of Rs 56,500 and above over the next 12-15 months,” said the company.

Rising coronavirus cases, continuous liquidity injections, rising inflationary expectations, economies growing on the back of debt, Middle-East tensions, trade war between US and China and few other factors continue to boost the sentiment and build a strong case for higher gold prices, added the company in a note last week.

However, most analysts have advised investors to go for Gold ETFs as they are price-efficient and offer safety.

Let An Expert Find The Best Time To Buy Gold

If you arent interested in tracking gold price influences, get in touch with a financial professional for help. You can work directly with a trained specialist like a financial advisor or a representative at a gold IRA company. Another option is to work indirectly with a group of fund managers who oversee a gold exchange-traded fund.

If youre looking for a tax shelter, consider working with a gold IRA company. These firms employ specialists who work with the precious metals market. The price per ounce you pay for gold includes the service fee or premium. Ask about commissions and compare the brokers offer price to the spot price of gold.

A financial advisor can keep an eye on gold trends for you and teach you about short-term and long-term investments. Many financial advisors can manage your entire investment portfolio, guided by your goals as well.

Fund managers oversee exchange-traded funds to buy gold and gold-related investments at the best times. Management costs are divided among shareholders and included in the per-share price. There are thousands of gold ETF shareholders at one time to keep per-share costs down. ETFs are like mutual funds with fluctuating prices throughout the trading day instead of a daily net asset value.

Recommended Reading: How Much Is An Ounce Of 18k Gold Worth

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Is Investing In Gold A Good Idea

Investing in gold could be a good idea right now, but in our opinion it’s never better than betting in stocks that exist as cousins to gold. Commodities aren’t cash flow producing assets, and you can buy companies that mine gold for great earnings yields. This is the Warren Buffett approach. He traditionally never took positions in gold, always taking market uncertainties as a time to load up on more equities on sale and tolerate the volatility risks, but when he did eventually do it he bought Barrick Gold .

We’d suggest a similar approach, except not investing in Barrick Gold which will naturally have that unwanted Buffett premium from followers bidding up his stocks. By buying companies with clear gold commodity exposure, we can translate our outlook on gold into a thesis for cash producing assets, where horizon risks are limited by owning shares in a business rather than a commodity where we have to rely wholly on a speculative appreciation.

Don’t Miss: Kay Jewelers Sale 19.99

When Should You Buy Gold

As the price of gold can vary significantly, even over a very short period of time, many ask when is the best time to get into gold?. As you can imagine, with all the possible factors which can influence the precious metal, this is actually a fairly complex question. To try and answer it, youll have to decide on four key factors:

1. What do you think will happen to the price of gold in the short term?

2. What do you think will happen to the price of gold in the long term?

3. Are you investing in gold to secure your portfolio against unexpected events?

4. Are you investing in gold to make short term profits?

Is Now The Time To Buy

That bullish outlook suggests high potential returns ahead. Yet with prices already at multi-year highs, the entry costs are significant, too.

That raises the question of when to buy. However, Albert Cheng, CEO of Singapore Bullion Market Association, said the question should be rephrased from “when” to “how much?”

There is no good time to buy gold … every investor should have some.Albert Cheng

“There is no good time to buy gold,” said Cheng, who said he sees the asset hitting $2,000 per ounce by the end of the year. “Every investor should have some gold in their portfolio.”

Typically, financial advisors recommend a gold allocation of 1% to 5% of an individuals’ overall portfolio. Cheng said that could shift higher from 5% to 15%.

“Gold remains a very small proportion of most people’s portfolio. But even an increase of 1 to 2% can have a massive bearing,” said Refinitiv’s Alexander.

Don’t Miss: 18 K Gold Price

Auspicious Days To Buy Gold In 2022

Gold is considered to be one of the most precious metals around the globe. In India, the yellow metal is not only considered to be an asset, it is also one of the most used metals for making jewellery.

In India, gold is no longer just looked at as a status symbol but also considered to be a good investment. There is no denying the fact that gold is one of the safest investment options. It is also a very high-yielding investment option.

India, being a multi-cultural country, people across different states consider different days and occasions to be auspicious for buying the yellow metal. With respect to the different cultural and religious references, people across the country choose to buy the precious metal on different occasions. The auspicious days for buying gold in the year of 2022 have been listed below.

Auspicious Time To Buy Gold In 2021