The Price Of Gold In Early Great Britain

In 1257, Great Britain set the price for an ounce of gold at 0.89 pounds. It raised the price by about 1 pound each century, as follows:

- 1351: 1.34 pounds

- 1664: 4.05 pounds

- 1717: 4.25 pounds

In the 1800s, most countries printed paper currencies that were supported by their values in gold. This was known as the “gold standard.” Countries kept enough gold reserves to support this value.

The history of the gold standard in the United States began in 1900. The Gold Standard Act established gold as the only metal for redeeming paper currency. It set the value of gold at $20.67 per ounce.

Great Britain kept gold at 4.25 pounds per ounce until the 1944 Bretton-Woods Agreement. That’s when most developed countries agreed to fix their currencies against the U.S. dollar because the United States owned the majority of the world’s gold.

Gold’s Regulation In The United States

Before the Gold Standard Act, the United States used the British gold standard. In 1791, it set the price of gold at $19.49 per ounce but also used silver to redeem currency. In 1834, it raised the price of gold to $20.69 per ounce.

Defense of the gold standard helped cause the Great Depression. A recession began in August 1929 after the Federal Reserve had raised interest rates in 1928. After the 1929 stock market crash, many investors started redeeming paper currency for its value in gold.

The U.S. Treasury worried that the United States might run out of gold. It asked the Federal Reserve to raise rates again. The rise in rates increased the value of the dollar and made it more valuable than gold. This approach worked in 1931.

Higher interest rates made loans too expensive, which forced many companies out of business. They also caused deflation, since a stronger dollar could buy more with less. Companies cut costs to keep prices low and remain competitive. That further worsened unemployment, which turned the recession into a depression.

Better To Identify The Periods That Favor Gold

Very shrewd is the man who can predict the changes in real interest rates. The relationship between real interest rates and the price of gold can, however, help us to better identify the periods favorable and unfavorable to gold. This allows one to structure one’s thoughts more rigorously.

In deed, all other things being equal, a rise in inflation tends to increase the price of gold, and vice versa. All other things being equal, a hike in nominal interest rates is generally not favorable to the price of gold, and vice versa.

Unfortunately, all other things are only rarely equal, and nominal interest rates tend to be adjusted based on inflation forecasts. Thus, there can be periods where a rise in nominal interest rates have no impact on real interest rates. The crux of the question lies in how quickly nominal rates are adjusted for inflation, which can be counteracted or at least slowed down for many reasons.

Real interest rates generally tend to increase when economic outlooks improve. Thus, the election of Donald Trump, who has been positively perceived by the market players in the U.S. economy has seen real interest rates suddenly rise and gold prices drop in subsequent months.

With the arrival of new “normalization” monetary policies, evaluating their tempo will be essential to determining whether they precede or follow changes in inflation.

To be precise, the original relationship is between the real price of gold and real interest rates.

Also Check: Where To Pan For Gold

Implications On Gold Investing

Unlike with our 10 Year Treasury return calculator or the S& P 500 Total Return Calculator, an investor in gold didn’t have to worry about dividends. Even when gold has a run-up in price, investors in the shiny metal fight a constant battle with inflation. There are some date ranges where a nominal gain in the price of gold was completely overwhelmed by inflation.

The Cost Of Everyday Items In The 1920s Compared To Gold:

People think back on the 1920s as a time of glamour and wild spending an image cemented in our culture by the parties thrown by the fictional Gatsby in F. Scott Fitzgeralds classic book. Yet for all our cultural ideas of excessive spending, most of the costs from that era still look like a pittance to us today. Nonetheless, they show a sharp increase from the prices a decade earlier. Between 1910 and 1920, people had to spend over twice as much for the same amount of steak or a new suit meaning the value of $1 was essentially halved in that time.

For once, the cost of a car actually went down as the technology became more familiar and manufacturers figured out cheaper ways to make them.

The breakdown:

Cost of steak : 40 cents

Cost of a nice suit: $60

Cost of a car: $260 for a Model T

Cost of an oz. of gold: $20.67

Read Also: How To Get Free Gold Bars In Candy Crush

Nominal & Inflation Adjusted Gold Price

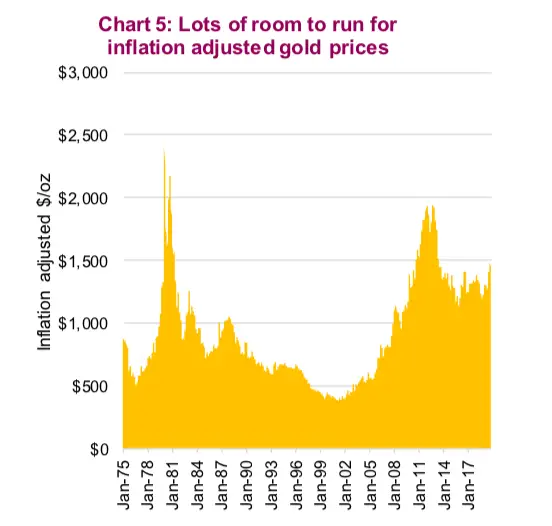

To understand the current and future gold price, I looked at the historical gold price first. The gold price before 1971 is of limited value. It was not set in the free market and thus relatively stable. On August 15th 1971, Richard Nixon suspended convertibility of Dollars into Gold at a fixed rate of $35, with a gold price of $43.30 at that time. In the inflationary 1970s, gold was in a bull market that lead to a speculative spike in 1980. What followed was the collapse of the bull market and a long bear market in the 1980s and 1990s. Ever since the peaks of the dot com bubble, the gold price has steadily risen from the bottom of $253, set in July 1999

Since a Dollar now has not the same value as a Dollar in 1971, a time when an average car was sold for $2700 , a house for $42,000 . Inflation ran high in the seventies, causing the price of all goods to increase rapidly. The inflation adjusted, or deflated gold price is calculated by multiplying the historical nominal gold price by . By deflating the gold price, real growth in the gold price can be discovered.

Gold Price Chart And Analysis

- US interest rate expectations continue to fall.

- Gold looks like it is consolidating ahead of the next move higher.

The latest University of Michigan Consumer Sentiment report, released last Friday, showed inflation expectations in the US continuing to fall. The one-year ahead inflation reading fell for the fourth consecutive month to 4%, the lowest level seen since April 2021. The five-year reading rose to 3% from 2.9% in November but remained within its recent range.

A 25 basis point interest rate hike at the February 1 FOMC is looking nailed on according to a closely watched market indicator. The latest CME FedWatch Tool is showing a 93% probability of a twenty-five basis point rate hike, compared to recent Fed talk and prior expectations of a half-point increase. With the market now pricing in a total of just 50bps of hikes this year, US bond yields have turned lower again over the last week, dragging the US dollar down.

Also Check: What Is 10 Karat Gold Worth

Can Bitcoin Also Provide Hedge Against Inflation

Bitcoin, like gold, has a finite supply. This is the primary reason they are thought to be unaffected by inflation. Governments are unable to print gold or Bitcoin. Only by mining can you increase their supply, which happens at a constant rate.

Gold and Bitcoin are high-risk investments. People who invest in them frequently do so not for their intrinsic value but rather to protect their capital during adversity.

Both gold and Bitcoin are unforgeable. Bitcoin transactions are recorded on a public ledger, and more currency cannot be added to the ledger. Gold is easily identified, and its purity can be determined.

Finally, both gold and Bitcoin are nearly indestructible. Gold is prone to wear and tear if not handled with care. It will, however, never disappear. The only way for a cryptocurrency to disappear is for the entire world to lose internet access for an extended period.

Video You May Like

Gold Price And Its Relationship With Inflation

Published on July 10, 2019 by Tim McMahon

Inflation is the increase in the price you pay for goods and services, which affects the purchasing power of your money. This is more accurately called price inflation as compared to monetary inflation. As inflation increases, the value of your money decreases.

There are many different causes of inflation, but the most important cause is an increase in a countrys money supply. When the government decides to print money or implement a quantitative easing program, the money supply is increased , thus affecting the general level of prices.

As we can see in the following chart, the Federal Reserve engaged in three phases of quantitative easing i.e. QE1, QE2, and QE3 and most recently has engaged in quantitative tightening where they are trying to reduce the value of assets on their books, by not purchasing additional government bonds when the old ones mature.

Legendary economist, Milton Friedman once said: Inflation is always and everywhere a monetary phenomenon. In other words, inflation is always caused by printing too much money. But the results are seen in prices of commodities like food, clothing, and energy after the printed money works its way through the economy. Many investors purchase gold in an effort to protect against this erosion of value. As economic uncertainty, inflation and market volatility increases, interest in gold as a hedge increases as well.

You May Like: How Much Is My Black Hills Gold Ring Worth

Why Did The Price Of Gold Soar In The 1980s

As the inflation crisis was in full swing in 1980, gold set a new record at $674.84. This was an increase of well above 1,600% over the span of one decade. When adjusted for inflation, this was also its highest price ever: $2,429.84.

Inflation, lack of economic growth, and soaring unemployment created the perfect storm of economic disaster, and many investors sought out gold as a hedge against the stagflation, causing its price to skyrocket. The history shows us that gold shines especially bright during times of severe crisis, which cause its price to break new records. And this is a great tool in a portfolio having an asset that grows when others dont.

What Caused Gold Prices To Spike In The 1970s

Golds value skyrocketed in the 1970s after the United States ditched the Gold Standard and switched to the unbacked by gold US dollar as fiat money.

In 1970, the price of gold was $38.90 an ounce, but as soon as we left the Gold Standard, people turned to gold in anticipation of the possibility of an inflation crisis, and that proved to be a wise decision. By the end of 1974, the price of gold hit $183.77 an ounce, showing over 450% growth in just four years.

With its skyrocketing value, a lot of investors had their eyes on gold by the end of the decade, and it would soon reach another high.

Read Also: How To Buy Gold On Nyse

Gold As An Inflation Hedge History Suggests Otherwise

- Gold investors often view it as a way to hedge against inflation risk.

- It has a mixed track record during past inflationary periods, according to Morningstar data.

- Investors may wish to consider upping allocations to other asset classes if they’re worried about inflation in the short to medium term, say financial experts.

Gold is often touted as a way to hedge against inflation a risk that’s top of mind for investors right now.

But gold hasn’t lived up to the hype. Its record has been spotty, according to historical data.

An investment that hedges against inflation would generally rise along with the rapid growth in consumer prices. However, gold yielded a negative return for investors during some of the highest recent inflationary periods in the U.S.

More from Personal Finance:States will start cutting off federal unemployment benefits this week

Investors worried about rising consumer prices may wish to consider other asset classes instead, according to Amy Arnott, a portfolio strategist at Morningstar.

“Gold is really not a perfect hedge,” said Arnott, who analyzed the returns of various asset classes during periods of above-average inflation.

“There’s no guarantee if there’s a spike in inflation, gold will also generate above-average returns,” she said.

For example, gold investors lost 10% on average from 1980 to 1984, when the annual inflation rate was about 6.5%, according to Arnott’s analysis.

The Cost Of Everyday Items In The 2010s Compared To Gold:

The upward trend continues into our current decade. Steak costs more. While its possible to get a cheap $200 suit, the cost of a proper one that looks good and fits well jumps up to $2,000 or more. And the average cost of a new car goes up another $5,000 or so.

The breakdown:

Cost of steak : $6.07

Cost of a nice suit: $2000 and up

Cost of a car: $31,352

Cost of an oz. of gold: $1420.25

You May Like: How Much Does Gold Cost In Wow

What Was The Highest Ever Gold Price In Ancient History

Roughly 50 years later, around 250 AD, it was debased even further to around 70 coins per pound. This accelerating debasement meant that the value of the currency dropped so much that Romes economy entered a state of extreme hyperinflation. Prices soared over 1000% across the ancient empire, and the Roman government attempted to sustain the empire with massive taxes to compensate. Many historians believe this economic collapse was actually one of the most significant factors leading to the fall of Rome.

What Factors Set Up Gold Price To Reach Its Various High Points Through Modern History

The gold price set a new high in August 2011 at $1,825 as investors looked for a way to hedge against the market turmoil following the Great Financial Crisis of 2008, which swept across the globe. The burst of the housing bubble drove the world into a deep crisis that would linger for years, and when the US entered a debt-ceiling crisis and both Moodys and S& P downgraded the outlook on US finances, investors flocked to gold.

In early August 2011, S& P issued the first-ever downgrade of the federal governments credit rating, and as a result stock prices plummeted, and gold its top gold price at that time.

Whether you look at the nominal gold price or its price adjusted for inflation, there is one clear conclusion you can make: The price of gold has been on an upward trajectory, especially since Nixon took the US off the Gold Standard. You can also read about what experts think gold will be worth in 5 years here.

The chart below shows the nominal price of gold over the last 100 years.

And this chart shows the value of gold when adjusted for inflation.

Read Also: What Time Do The Golden State Warriors Play Tonight

How Does Inflation Affect The Price Of Gold

Published on April 27, 2018 by Tim McMahon

Gold bugs often fear inflation and believe that gold will generally increase in price when inflation is high. But the correlation is not as simple as when inflation increases the price of gold increases. If it were, the inflation adjusted price of gold would be virtually flat. And as we can see from the chart below the red line is far from flat.

From 1913 through 1970 the nominal price of gold was fixed by the government and so it remained relatively stable but that didnt mean that the purchasing power of an ounce of gold remained stable. From 1880-1914 the U.S. dollar official gold price was $20.67 per ounce. But inflation was rampant in the economy so it was getting more and more difficult for the government to maintain the fiction that gold was only worth $20.67. At that price Foreign governments would have depleted the U.S. gold reserves since it would be like being able to buy gold at a discount for them.

Chart #1

Rather than simply repricing Gold at its real price and allowing the citizens to be richer, Roosevelt perpetrated one of the greatest frauds ever on the American public. He forced U.S. citizens to sell their Gold at the official price of $20.67 and once he had collected all the Gold into government coffers, then he adjusted the price to its real free market price of $35 per Troy ounce. Thus, the government made a handsome 69.33% profit in a few months .

So, is inflation good or bad for the price of gold?

Quantitative Easing And The Gold Price

The gold price is primarily driven by monetary factors such as the size of the monetary base, interest rates and inflation. For the last 5 years, a period dubbed The New Normal, the most important driving force behind these factors are the monetary stimulant programs from central banks around the globe, but especially the FED. The Quantitative Easing 1 program, which was launched on November 28th 2008, a few months after the Lehman Brothers bankruptcy, saw the gold price increase from $814 to $1116. The program ended on April 2th 2010, giving gold an increase of . QE2 was launched in November 3th 2010 to stimulate the US economy. It drove the gold price from $1359 to $1508 . The law of diminishing returns predicts the next money printing program would have even lower returns. QE3 the latest reincarnation of monetary expansion which was launched in September 13, 2012 lost its positive effect on precious metals. In May 2013, gold prices were crushed and only slightly recovered afterwards. At the end of 2013, gold prices declined from $1731 to $1202 .

Also Check: Michael Kors Gold Chain Purse

On The Anniversary Of The Metals Unleashing By Nixon Golds Believers May Be Disappointed By The Record

Listen to article

On a Sunday evening 50 years agoon Aug. 15, 1971, to be exactthen-President Nixon interrupted Bonanza, one of the most popular TV shows of that era, to announce that he was ending the convertibility of the U.S. dollar into gold. Many consider it to be one of the most consequential decisions he made.

Up until this closing of the gold window, foreign central banks had been able to convert U.S. dollars into gold bullion at the fixed price of $35 an ounce. In theory, this had imposed a strict monetary discipline on the Federal Reserve, since inflating the money supply could have caused a run on Fort Knox, where the U.S. stored its supply of gold. And inflation did indeed jump in the years following Nixons decision to remove that restraint. So did the price of gold, which today is 50 times as high as it was that day.

Continue reading your article witha WSJ membership