Welcome Bonuses On The Amex Green Gold And Platinum

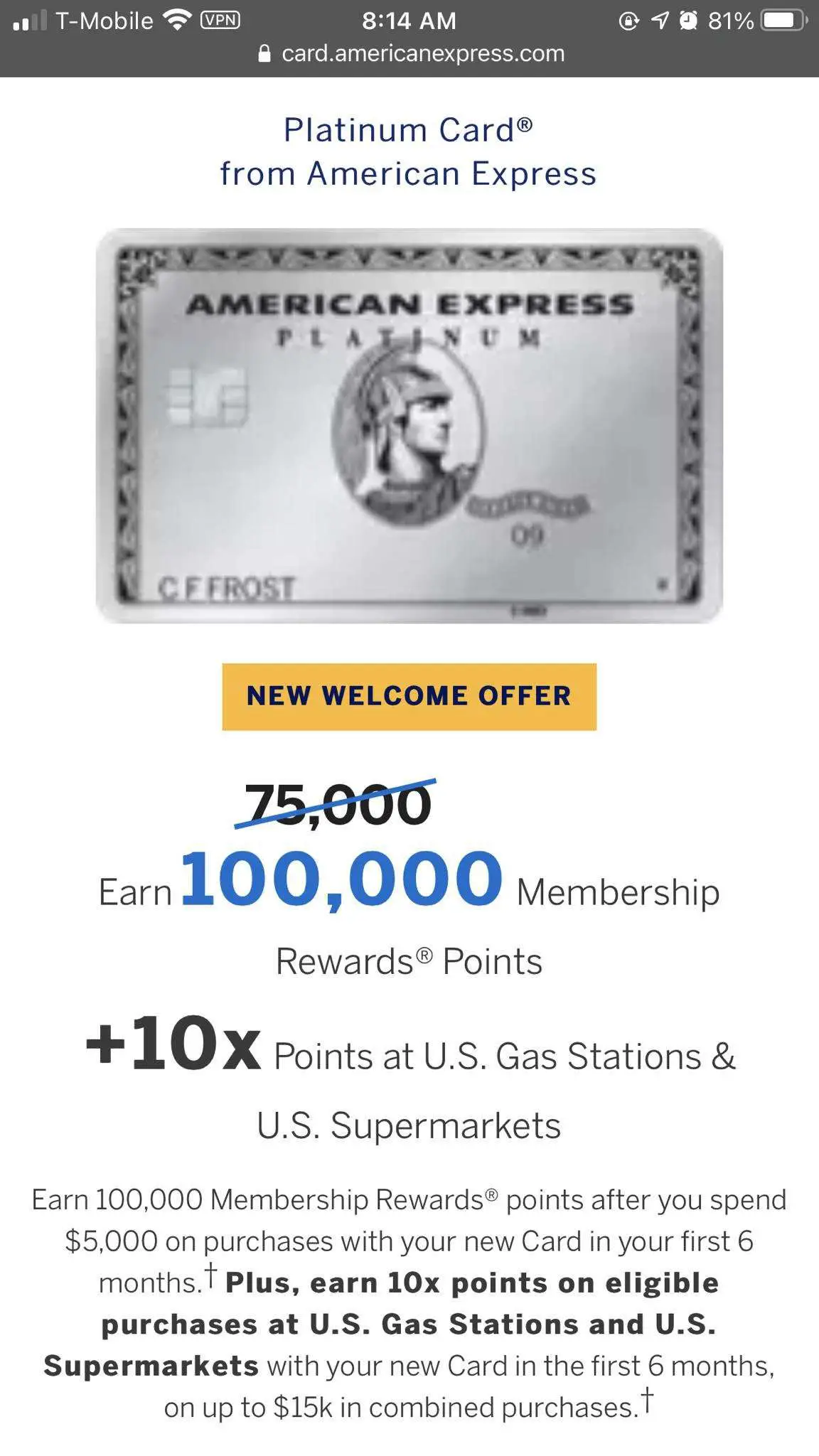

New Amex Platinum card members can earn 100,000 bonus points after spending $6,000 on purchases on the card in the first six months after opening the account. Thats the highest welcome bonus across all three cards, but its also the highest spending requirement.

In addition, people who apply for the Amex Platinum card now can also earn a whopping 10 points per dollar on eligible purchases at restaurants worldwide and when you Shop Small in the U.S. during the first six months of card membership, up to $25,000 in combined purchases.

The Amex Gold card offers the next best welcome bonus offer. You can earn 60,000 bonus points after you spend $4,000 on purchases in your first six months after opening the account. That means youll have to spend an average of $667 per month to earn the bonus points, which is easier than the $1,000 monthly average youd need to meet the minimum spending requirement on the Amex Platinum.

Finally, the Amex Green comes with a welcome offer for new card members of 45,000 bonus points after you spend $2,000 on purchases in the first six months after opening the account. Thats a significantly lower spending requirement than either of the other two cards, and the annual fee on the Amex Green is also the lowest of the three.

Frequent flyer website The Points Guy values American Express Membership Rewards points at 2 cents apiece. That would make the welcome bonus on the Amex Green worth $900, the Amex Gold worth $1,200 and $2,000 on the Amex Platinum.

Enjoy Premium Lounge Perks

In exchange for an annual fee of $695 , no other credit card will give you access to as many premium airport lounges as the American Express Platinum card. Owning the card will grant you entry to the exclusive Centurion Lounges and the newly rebranded Centurion Studios. These lounges are reserved just for cardholders of the Platinum, The Business Platinum Card® from American Express and the even more exclusive invitation-only Centurion® Card from American Express*.

Youll also get access to Delta Sky Club lounges when flying same-day on Delta Priority Pass Select lounges and more. If you want your airport hang time to be more comfortable and theres an airport lounge of nearly any brand, this card has you covered.

Everyday Is More Rewarding With The Nations Trust Bank American Express Gold Card

As a Gold Cardmember, you can rely on the Nations Trust American Express Card as your ideal partner for your everyday experiences from grocery shopping at the supermarket to pumping fuel from dining with your companion to going on vacation with your family. As a member, you can start enjoying a range of privileges including unlimited personalized service, travel opportunities, easier financial management and 24-hour customer service around the world.

Membership Rewards Program – Enjoy exclusive redemption offers when you enroll for Membership Rewards. As a Gold Cardmember, you can enjoy special redemption programs daily with our extensive partner network from dining, shopping, travel, online beauty & wellness and many more.Enroll Now! Call us on and talk to our customer service agents or visit the Membership Rewards page on www.americanexpress.lk

Overseas Travel Insurance – Our complimentary insurance cover will provide you 24-hour Medical Assistance Services, Common Carrier Baggage Loss, Baggage Delay, Travel Accidental Death and Dismemberment, Accident and Sickness, Trip Delay and Trip Cancellation every time you

- Assistance with travel arrangements and travel bookings

- Medical Emergency assistance and referrals overseas

- Assistance with car rental, cultural information and city maps

- Replacement of lost / stolen cards

Simply call the American Express Global Assist Hotline on outside Sri Lanka for any of the above assistance services.

Read through the cardmember agreement:

Also Check: 400 Ounces Of Gold Worth

Total Number Of Credit Cards

Finally, American Express will limit many people to a total of four credit cards although some people are able to get more.

In some cases, you may need to cancel a credit card so that your total number of cards will be under four in order to make yourself eligible for another credit card.

In this case, you would likely want to consider canceling your newest card first so that your oldest card can continue to age.

But in some cases, you may be getting so much value from your newest cards that you dont want to cancel those. So it often comes down to a balancing act of: how much value are you getting from your cards versus how much value do you think you will get from the age of your account?

What Is The Best Visa Credit Card For Rewards

Bonus Mile credit cards are the best bonus credit cards available for a long period of time. Hotel price cards. Hotel loyalty cards can probably save you more money, as the cost of your hotel stay is usually much higher than the cost of your plane ticket.

Instant approval virtual credit cardWhat you should know about instant approval credit cards? Instant approval credit cards often refer to two things: instant approval or guaranteed approval. While the former can be a useful feature for those seeking immediate access to credit, the latter is fraught with financial difficulties and should be avoided.How does instant online credit card approvals work?When you order an Instant Authoriza

Don’t Miss: 18k Gold Per Ounce

Active Duty: Military Lending Act

The Military Lending Act waives the annual fees for personal American Express cards, but not business cards.

MLA is not to be confused with Servicemembers Civil Relief Act , which no longer qualifies for waived fees.

Under MLA, you can get the Platinum , Platinum Schwab, or Platinum Morgan Stanley — or all 3 — and the fees should be waived.

Before canceling the Platinum cards, you would want a solid foundation of cards with no annual fee downgrade paths to preserve your credit history. Once you stop qualifying for MLA, your annual fees will hit upon renewal. The Platinum cards can only be product changed to the American Express Gold Card and the American Express Green Cards, which both have annual fees.

The American Express Gold Card

The Gold card comes with an annual fee of $250, and there is no annual fee for adding any additional cards to a Gold account. One of the biggest perks for any cardholder is the membership rewards program, which allows consumers to earn points as they use their credit cards.

The Gold card is geared toward people who are big shoppers, eat out a lot, and do a lot of everyday spending. American Express Gold cardholders can earn four points for every dollar spent at U.S. restaurants and U.S. supermarkets , three points for every dollar spent booking flights with airline companies or through the American Express travel website, and one point for every dollar spent on any other purchase.

As of February 2021, first-time cardholders are also eligible for 60,000 points after you use your card to make $4,000 in purchases for the first six months of account membership.

Unlike traditional credit cards, American Express cards do not have a regular APR or charge interest, as all balances must be paid in full each month. However, the Gold card does offer cardmembers the flexibility to pay for purchases of $100 or more over time at a set interest rate.

Read Also: Price Of 18k Gold Per Gram

You Can Only Earn A Welcome Bonus Once Per Card Per Lifetime

Welcome bonuses go up and down but you can only earn a bonus once per card, per lifetime, on all American Express cards. So it makes the most sense to apply when there are increased limited-time offers because you never know if or when a bonus will increase again.

Keep in mind, you can still earn the bonus on different card products. For example, youre eligible for a bonus on both The Platinum Card® from American Express and the Amex Business Platinum Card because one is a personal card and the other is the small business version.

Amex has additional rules that may restrict you from earning a bonus if youve already applied for lots of cards:

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Fortunately, Amex will now tell you up front if youre not eligible for a welcome offer when youre applying online.

Travel Perks Winner: Amex Platinum

When debating the benefits of the Amex Platinum vs. Gold, the Amex Platinum easily comes out ahead in terms of travel perks based on a few factors. It starts with the fact that you get Priority Pass Select airport lounge access . This card also lets you enter American Express Centurion Lounges, as well as Delta Sky Clubs, when you fly with Delta.

Other travel benefits you get with the Amex Platinum include Gold elite status with the Marriott Bonvoy and Hilton Honors programs and access to the American Express Fine Hotels and Resorts program. Of course, youll also get up to $100 in credits toward Global Entry or TSA PreCheck and up to $200 in airline fee credits for incidentals, as previously mentioned.

Finally, the Amex Platinum also comes with its own VIP concierge service.

Read Also: How Much Money Is A Brick Of Gold

Is The Amex Gold Card Worth It

The American Express Gold Card is worth it if you can get enough value from its rewards and benefits to offset the $250 annual fee. Since the Amex Gold provides up to $120 in Uber Cash and up to $120 in dining credits each year, its typically not difficult to get your moneys worth from the card. And thats not including earning Membership Rewards points on everyday purchases. Select benefits require enrollment.

The American Express Platinum Card

The Platinum Amex card offers members five points for every dollar spent on flights booked directly through airlines or through the American Express travel site, five points for prepaid hotels booked through amextravel.com, and one point for every dollar spent on other purchases.

The Platinum welcome bonus as of February 2021 gives cardholders 75,000 points when they spend $5,000 or more in the first six months of account membership. This is the equivalent of $855 for flights booked through the Amex travel website. However, if you decide to add up to three additional cards on your Platinum account, expect to pay an extra annual fee of $175. Each card after that will be billed a $175 annual fee, as well.

The Platinum card is great for people who love to travel. There are obviously many more perks that come with the Platinum card than with the Gold, especially when you consider the higher annual fee. Rewards can be used for merchandise, gift cards, dining, shopping, entertainment, or for use at the Amex travel website. Points can also be transferred to other frequent flyer programs.

The Platinum card offers Uber ride credits in the United States, giving cardholders a maximum of $15 in credits each month. The card also comes with an annual $200 incidental airline fee credit on the eligible airline of your choice, giving passengers complimentary checked baggage and an in-flight meal with qualifying airlines.

Read Also: Molar Weight Of Gold

Can You Keep Your Membership Rewards Points When Cancelling An American Express Card

Since late 2017, there has been a solution that:

- lets you keep your Membership Rewards points account open, and

- allows you to stop paying an annual fee for either the Gold or Platinum charge card

This card is the answer:

You can apply for the little-known American Express Rewards Credit Card. Full details are on the American Express here.

This card has NO ANNUAL FEE and lets you collect Membership Rewards points.

For simplicity, I will occasionally refer to this card as ARCC as American Express Rewards Credit Card is a bit of a mouthful.

Redeeming Membership Rewards Points

There are a few different ways to redeem American Express Membership Rewards points, but the best way is to transfer to the airline or hotel points programs below.

Our favorites are ANA, Aeroplan, LifeMiles, and Iberia Avios. American Express also occasionally offers transfer bonuses, which increases the value of their points by 20 to 50%.

| Membership Rewards Transfer Partners |

|---|

Also Check: Where Can I Buy A Bar Of Gold

How Do You Activate A Visa Card

You can find the activation number on the label on the front of your new Visa card. Call the phone number from any touch-tone phone. Follow the automatic instructions and select the option to activate your Visa card. Depending on the type of card, the number may go directly to the activation option.

How to build credit with a credit cardWhat is the best credit card for establishing credit?Capital One Platinum Credit Card: Ideal for getting a loan.Chase Freedom Unlimited – the best for the future.Discover Safe Credit Card – Ideal for beginners.Bank of America Cash Rewards Student Credit Card – Ideal for Students.Citi Double Cash Card – Ideal for cash back packages.How to establish credit without a credit card?

Us Bank Visa Platinum Card Offer

The Visa Platinum debit card offers an introductory period of 0% per year for purchases within the first 20 accounting cycles of account opening and for balance transfers within the first 60 days. After that, the standard APR applies.

Best business credit cards for startupsWhich are the best startup business cards?Ink Business Preferred credit card.Ink Business Unlimited credit card.American Express Blue Business Cash card.American Express Gold business card.American Express Business Platinum card.Bank of America Business Advantage Cash Rewards Mastercard Credit Card *.What are the best business credit cards f

You May Like: How To Get Free Tinder Gold

What Are The Benefits Of The American Express Platinum Card Points

Points Benefits with American Express Platinum: Reward for spend. The American Express Platinum Card allows you to collect available membership rewards points. Benefits: benefits of the card. For the most part, the American Express Platinum Card offers a long list of benefits.

Difference between secured and unsecured credit card

Income Requirements For The Amex Platinum

There is also no strict income or salary requirement for the Platinum Card.

Platinum Cardholders, on average, do have very high incomes though.

But there are reports of people getting approved with incomes in the $50,000 range or below. Once again, your history with Amex could be a major factor for getting approved if you are a borderline candidate.

You should know that thanks to the Credit Card Act of 2009, you are allowed to report the income of your spouse and/or family members so long as it is reasonably accessible to you and you are 21 years or older. Learn more about what kind of income is reasonably accessible here.

Related: Does Income Affect Your Credit Score?

You May Like: Buy Wow Gold Safely

How Long To Wait

If you are getting ready to apply for your first American Express card and you decide to go with one of the easier options to get approved for then you might want to wait 6 months to a year to apply for the Platinum Card.

That should give Amex some time to learn to trust you.

Some like to wait even longer to establish their credit history, but generally 6 months to one year is enough time for banks to start trusting you a little bit.

Live The Platinum Lifestyle

With a wide variety of benefits to fit every lifestyle, youre sure to find some ways to upgrade your life with what The Platinum Card provides. Start with a $20 per month credit for purchases or subscriptions with Audible, The New York Times, SirusXM and Peacock after you enroll.

Add in up to $200 per year in Uber Cash good for U.S. Rides and Eats , $100 in Saks Fifth Avenue credits , and $25 per month in credits for select Equinox memberships or a digital subscription to Equinox+ when you pay with your card. Each of these benefits requires enrollment.

To top it off in style, you will also have access to up to 40% off of a membership for the Premium Private Jet Program with Wheels Up and up to $2,000 in initial flight year credits for when you need to book a private charter flight or two.

You May Like: 1 Brick Of Gold

Dont Forget About The 35% Rebate For Amex Business Platinum Cardholders

When you use Amex Pay With Points, you get 1 cent per point toward your ticket. But those with the Amex Business Platinum Card can get a 35% points rebate :

- 35% of your points back for ALL First Class or Business Class flights booked through the Amex travel portal

- 35% of your points back for all flights, including coach tickets, booked with your selected airline through the Amex travel portal

The card has a $595 annual fee .

Just note, you must redeem at least 5,000 points to use Pay With Points. And keep in mind, getting 35% of your Amex Membership Rewards points back is automatic, but youll have to wait 8 to 10 weeks to see them in your account.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: 18k White Gold Price Per Ounce