What Affects Gold Prices

Like all markets, gold prices are subject to forces of supply and demand. When it comes to gold, supply is affected by trading trends as well as by mining companies digging up more gold that they can put into the market. One of the key factors impacting demand is the current market sentiment on inflation. When inflation rises, the value of the dollar goes down, and some investors flock to gold in hopes that it serves as a stable store of value.

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

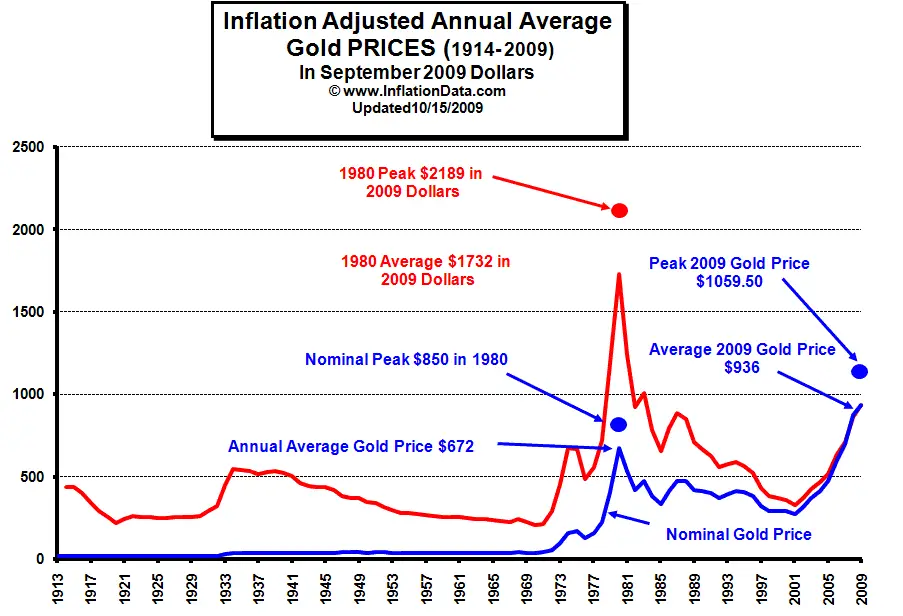

The Value Of Gold Since 1971 #: The Dramatic Peak In 1980

Weve been looking into the fact that commodity prices have fallen a lot vs. gold since 1971. This suggests to some that golds value has risen.

Instead, I propose that real commodity values have fallen. There are sixty pounds in a regular bushel of wheat. This is selling now for $4.30. Thats about seven cents a pound. That sounds pretty cheap to me. Absurdly cheap, actually.

I argued earlier that if gold rose in value, then crude oil must have risen too, because the value of oil, in terms of gold, is still roughly around where it was in the 1960s. If oil were much more valuable now than in the past, there should be some evidence of it in the real world, such as super-high-mileage cars. But, I see no evidence of that sort. In a similar vein, if wheat were really much cheaper today than in the past, we should see some evidence of it.

sWheatscoop. Kitty litter made of pure wheat.

There are 56 pounds in a standard bushel of corn, which you can buy for $3.63.

Lets look at the CRB commodity index since 1947.

As we can see, it was pretty stable in the 1980-2004 period. Anyway, there is not a clear declining trend here, just localized declines around 1985 or 2000.

The gold price went from $380/oz. in November 1979 to $850 in January 1980, and back down to $500 in March 1980. So, there wasnt twelve months for commodity prices to start to move. By 1981, the dollar was rising back towards $300/oz.

Notice the similarity?

Recommended Reading: How Many Grams Is 1 10 Oz Of Gold

Golden Bull #: November 2015 May 2020

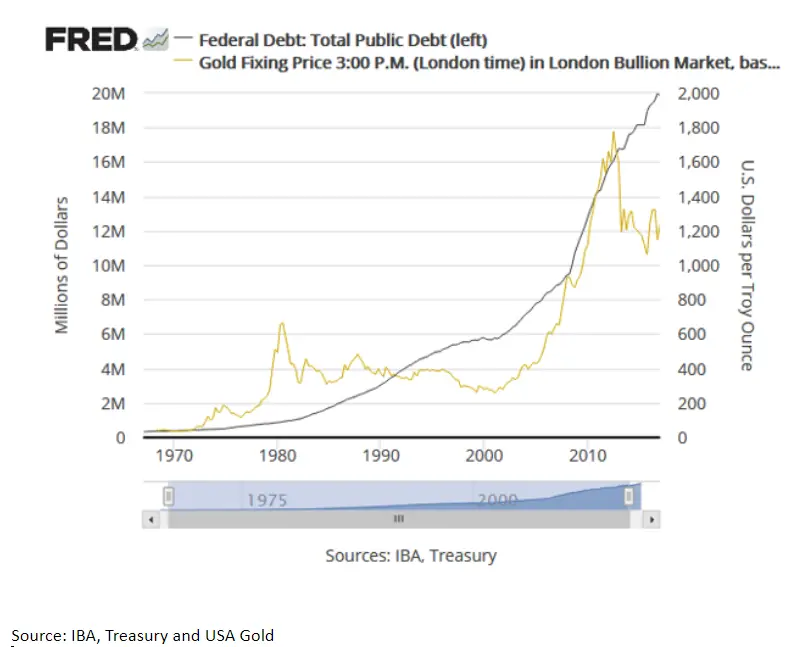

In the aftermath of the GFC, the Federal Reserve stoked an economic recovery with cheap money, seeing gold track to a low of $1,050 per ounce by December 2015. It was not until the election of a peculiar American president in 2016 that gold would rise again.

Pressure to increase interest rates, an aging debt-fueled economic recovery, a trade war with China, and the recent COVID-19 crisis has once again provoked economic uncertainty and a renewed interest in gold. With interest rates already at historic lows and quantitative easing as standard operating procedure, global economies are entering unprecedented territory.

There is still little insight into the direction of the economy but since November 2015 to May 2020, the price of gold has risen from $1,146 to $1,726 per ounce, 55% over 55 months.

Gold Inventories Are Uniquely Large

Gold has by far the largest above-ground stock of any commodity. It has been mined since antiquity, with about 5 120 million ounces produced since 1800. Although some gold has been lost or consumed for industrial purposes and not recycled, most still exists today, either in the form of bullion bars and coins, or as jewellery. These inventories are equivalent to over 40 years current annual consumption. While central bank holdings are precisely known, there are no reliable statistics on the exact quantity of the stocks privately owned. However, the simple proposition that together they amount to all gold produced since 1800 provides as good an estimate as any of their order of magnitude and this is the basis of my estimates that follow. To understand the gold price one must understand the history of this inventory.

Also Check: War Thunder Free Golden Eagles App

This Time It’s Different So Far

Whenever I talk to non-goldbug friends about gold, the most common objection I get from them about buying gold is: ‘It’s gone up too much’. I do sympathise with this sentiment although it’s one I’ve been hearing since about $700 an ounce.

However, gold’s ascent has actually been quite gradual. The table below from Goldmoney shows gold’s annual percentage gain since 2001 in the nine major global currencies. Australian dollar Canadian dollar Chinese renminbi euro Indian rupee Japanese yen Swiss franc British pound ).

Gold – % annual change

| 12.2 | 18.3 |

The strongest currency has been the Aussie dollar, against which gold has made average annual gains of 11.7%. The weakest currency has been the US dollar beating our own pound to the title by just 0.1%. Gold has made average annual gains of 18.4% against the US dollar.

Of all gold’s annual gains against all major currencies over the last ten years, the greatest was in 2008 against the pound, when our glorious leader Gordon Brown was in charge. It appreciated by 43.7%.

Brown’s record with gold really isn’t very good, is it?

Over those ten years there have been periods were gold has actually fallen against some currencies. In 2008, for example, it fell by 14% against the Japanese yen.

But it’s still a steady, gradual increase. It’s nothing stellar or exponential.

Golden Bulls: Visualizing The Price Of Gold From 1915

Some people view gold as a relic, a thing of kings, pirates, and myth. It does not produce income, sits in vaults, and adorns the necks and wrists of the wealthy.

But this too is just myth.

In fact, as a financial asset, golds value has shone over time with periods of exceptional performance, one of which may be occurring now.

Todays infographic comes to us from Sprott Physical Gold Trust and outlines the history of the price of gold from 1915 to 2020 and three bull markets or Golden bulls since 1969, using monthly data from the London Bullion Market Association.

But first a little history

Recommended Reading: How To Get Free Golden Eagles In War Thunder

Gold Spike: January 1980

When did the Gold Market last trade above $800 per ounce? A quick look back to Jan. 1980…

“THE GOLD MARKET has gone nuts,” said a dealer to me today. Anyone looking to Buy Gold Today might think the same.

Surging by more than 25% in the last 12 weeks alone, the Dollar Gold Price has now traded above $800 per ounce for three sessions.

It didn’t even manage that at its all-time top of Jan. 1980.

The famous peak of $850 per ounce recorded at the Afternoon Fix in London on 21st Jan. 1980 marked the end of a nine-year bull market in gold, unleashed when Richard Nixon cut the US Dollar free from its “golden fetters” and stopped paying foreign governments in bullion.

Nixon killed what little life was left in the Bretton Woods agreement, built amid the devastation of World War II to help Europe recover its faith in credit and currencies. The result?

“Inflation in most countries at the end of 1979 was running in double digits,” writes Peter Bernstein in his classic The Power of Gold. Pointing to the OPEC-led spike in oil prices, he also notes that “political conditions were perhaps even more frightening.

“Iranian radicals in Nov. 1979 took over the US embassy in Tehran…At the same time, the Russians were building up their strength in southern Yemen near Saudi Arabia, near Afghanistan’s border with Iran, and near Bulgaria’s border with Yugoslavia.”

Do you really expect Ben Bernanke to support a “Strong Dollar” with higher interest rates anytime soon today…?

Renewed Interest In Gold As A Financial Asset

Currently central banks own 1 039 million ounces of gold and private stocks in the form of jewellery and bars amount to about 4 200 million ounces. This estimate implies that private stocks are currently worth about US$5.4 trillion. This huge inventory has been accumulated partly because gold is the metal of choice for jewellery, and partly because it is regarded as a store of value in times of social and political disorder.

Since 1980 gold demand has been mainly for the fabrication of jewellery and its role as a financial asset has retreated into the background. This may be changing. As governments seek to interfere in all aspects of economic activity and central banks have embarked on radical monetary experiments which distort asset prices, gold as a store of value, which is not someone elses liability, is attracting renewed interest among a diverse group of investors. The amount of gold in private hands is large enough for it to play a significant role in the portfolios of investors who fear the consequences of the current fashion among central banks to promote inflation. We are heading back to the 1970s. Then it was the inadequate response of central banks to inflation which gave gold its attraction. Today it is their response to deflation.

Since 1980 gold demand has been mainly for the fabrication of jewellery and its role as a financial asset has retreated… This may be changing

Don’t Miss: Selling Gold Bars Rdr2

The Great Bear Market From 1980 To 1999

As one would expect, the longer-term response to higher prices was ultimately an increase in supply, in part from renewed interest in exploration for mineable gold. The development of high-altitude helicopters gave geologists greater access to much of the Andes and Rockies. During the 1970s heap leaching technology was developed, which significantly cut the cost of developing low-grade open-cast mines. Large-scale earth moving equipment reduced mining costs. While SA production declined, production elsewhere, driven by new technology, grew strongly.

In the 20 years to 2000 annual world production almost doubled to 82 million ounces. All this gold went to the private sector, whose inventory rose from 1 600 to 2 900 million ounces, but the price gradually declined reaching a low of US$254 in August 1999. The funding of new mines had an adverse impact on the price because they were financed by selling production forward. To make long-term forward prices, bullion banks borrowed gold from the central banks and sold this in the spot market. Mines locked in prices, which made them profitable.

However, when prudent monetary policy eliminated inflation after 1980 there was no longer a strong rationale for continuing to hold gold. Attitudes changed as wealth shifted to a younger generation, which had been educated in business schools rather than by the Second World War. Gold became an asset you sold rather than kept. Europe became a seller of gold previously held as an investment.

Historical Gold Rate Trend In India

The below chart represents the historical movement of gold prices in India:

| This chart contains the average annual price for gold from 1964 present. |

YearPrice YearPrice Rs.63.25Rs.4,334.00Rs.71.75Rs.4,140.00Rs.83.75Rs.4,598.00Rs.102.50Rs.4,680.00Rs.162.00Rs.5,160.00Rs.176.00Rs.4,725.00Rs.184.00Rs.4,045.00Rs.193.00Rs.4,234.00Rs.202.00Rs.4,400.00Rs.278.50Rs.4,300.00Rs.506.00Rs.4,990.00Rs.540.00Rs.5,600.00Rs.432.00Rs.5,850.00Rs.486.00Rs.7,000.00Rs.685.00Rs.8,400.00Rs.937.00Rs.10,800.00Rs.1,330.00Rs.12,500.00Rs.1,800.00Rs.14,500.00Rs.1,645.00Rs.18,500.00Rs.1,800.00Rs.26,400.00Rs.1,970.00Rs.31,050.00Rs.2,130.00Rs.29,600.00Rs.2,140.00Rs.28,006.50Rs.2,570.00Rs.26,343.50Rs.3,130.00Rs.28,623.50Rs.3,140.00Rs.29,667.50Rs.3,200.00Rs.31,438.00Rs.3,466.00Rs.35,220.00Rs.48,651.00

*The price of gold showed a fluctuating trend through the year of 2020 after opening the year on a positive note due to the COVID-19 pandemic. With the precious metal serving as a safe-haven for investors, the demand for gold increased and so did its price. The equities market suffered during the pandemic but showed signs of recovery at the end of 2020 when the price of gold declined marginally.

Its important to note that the gold prices would fluctuate during the year and the amount mentioned below is a representation of the average price for that year.

Also check : Today’s Gold Rate in India

Don’t Miss: How To Get Gold Medallion Delta

Does Volatility In Gold Prices Affect Interest Rates

Interest rates are tied to inflation, so they have historically been closely related to gold prices, as well. When the dollar’s strength increases and inflation decreases, then interest rates could be expected to fall at the same time as gold prices. Inflation is decreasing, so cash-like investments don’t need to offer such high interest rates, and fewer people are rushing to gold as a stable store of value.

Gold Price Gbp Gold Price Euro Or Gold Price Usd

View the gold price GBP, gold price EURO and gold price USD.

See how the price of gold has changed over time and see how it also changes in each currency during periods of inflation and deflation. The gold price UK chart is available to view gold prices over a very long time in order to understand will gold rebound and what factors contribute to its rise and fall.

Other longer-term price charts include gold price over 50 years, gold price over 25 years, gold price over 10 years, gold price over 5 years, gold price over 3 years.

See the effect of countries coming off the gold standard in 1971, see the effects of world wars on the price of gold. You may be able to reach your own conclusions about the effect of political turmoil and economic conditions on the gold price history!

Also Check: Is Dial Gold Body Wash Antibacterial

What To Lookout For Price Of Gold 1980

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

What Has Driven Changes In The Gold Price

Over the past several decades, the price of gold has been influenced by many different factors. Golds price history has seen some significant ups and downs, and dramatic changes in price may be fueled by such issues as central bank buying, inflation, geopolitics, monetary policy equity markets and more.

One of the biggest drivers of gold is currency values. Because gold is denominated in dollars, the greenback can have a significant impact on the price of gold. A weaker dollar makes gold relatively less expensive for foreign buyers, and thus may lift prices. On the other hand, a stronger dollar makes gold relatively more expensive for foreign buyers, thus possibly depressing prices. Fiat, or paper currencies, have a tendency to lose value over time. If this continues to be the case, gold could potentially continue in an uptrend as investors look to it for its perceived safety and its potential as a hedge against declining currency values. Gold has long been considered a reliable store of wealth and value, and that reputation is not likely to change any time soon.

Although past performance is not necessarily indicative of future results, golds price history can potentially provide clues as to where it could be headed. Looking at past price data, for example, may help with spotting uptrends or downtrends. Investors may also potentially spot tradable patterns within the price data that can potentially lead to solid buying or selling opportunities.

Also Check: Does Kay Jewelers Sell Real Gold

Historical Gold Price And Charts In Canadian Dollar

Here is the Gold to Canadian Dollar Chart. Select a time frame for the chart 1 month, 3 months, 6 months, year to day, 1 Year and all available time which varies from 7 to 13 years according to the currency. You can also, download the chart as a png or jpeg image or as a pdf file or directly print the chart by clicking on the corresponding button in the top right of the chart.

Derivatives Cfds And Spread Betting

Derivatives, such as gold forwards, futures and options, currently trade on various exchanges around the world and over-the-counter directly in the private market. In the U.S., gold futures are primarily traded on the New York Commodities Exchange and Euronext.liffe. In India, gold futures are traded on the National Commodity and Derivatives Exchange and Multi Commodity Exchange .

As of 2009 holders of COMEX gold futures have experienced problems taking delivery of their metal. Along with chronic delivery delays, some investors have received delivery of bars not matching their contract in serial number and weight. The delays cannot be easily explained by slow warehouse movements, as the daily reports of these movements show little activity. Because of these problems, there are concerns that COMEX may not have the gold inventory to back its existing warehouse receipts.

Outside the US, a number of firms provide trading on the price of gold via contracts for difference or allow spread bets on the price of gold.

Recommended Reading: How Many Grams Is 1 10 Oz Of Gold