Invest In Gold Etfs And Gold Mutual Funds

Investing in gold ETFs;and mutual funds can provide you with exposure to golds long-term stability while offering more liquidity than physical gold and more diversification than individual gold stocks. There are a range of different types of gold funds. Some are passively managed index funds that track industry trends or the price of bullion using futures or options.

The SPDR Gold Shares ETF , for example, holds physical gold and deposit receipts, and its price tracks the price of physical bullion. VanEck Vectors Gold Miners ETF , on the other hand, is a passively managed fund that tracks an underlying basket of stocks of gold mining and refining companies.

Gold mutual funds like Franklin Templetons Gold and Precious Metals Fund;are actively managed by professional investors. These funds aim to beat the returns of passively managed index funds. In exchange, they charge relatively high expense ratios.

Just remember, like gold stocks you arent buying gold, just paper that is theoretically backed by debt or equity of mining companies or futures and options contracts for physical bullion. This means the value of gold mutual funds and ETFs may not entirely match up with the market price of gold, and these investments may not perform the same as physical gold.

Fastest Growing Gold Stocks

These are the top gold stocks as ranked by a;growth;model that scores companies based on a 50/50 weighting of their most recent quarterly YOY percentage;revenue;growth and most recent quarterly YOY;earnings per share ;growth. Both sales and earnings are critical factors in the success of a company. Therefore, ranking companies by only one growth metric makes a ranking susceptible to the accounting anomalies of that quarter that may make one figure or the other unrepresentative of the business in general. Companies with quarterly EPS or revenue growth of more than 2,500% were excluded as outliers.

| Fastest Growing Gold Stocks |

|---|

Source:;YCharts

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

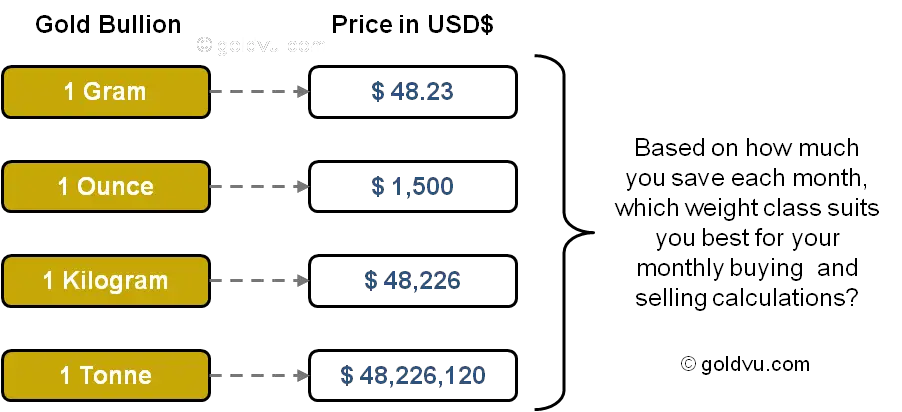

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

You May Like: What To Do With Old Gold Jewelry

When Is The Gold Price The Strongest

It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement; however, historically, there have been high and low seasonal period in the gold market. Historically, September is golds strongest month. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year. The worst month has historically been March, April and then June.

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value; however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Recommended Reading: How Much Is 5 Oz Of Gold Worth

Gold Price Factors Faq

The price of gold seems to move around quite a bit. What are some things that cause changes in the gold price?

Gold is a commodity that can have very rapid price changes during periods of high volatility and can also have very little price movement during quiet periods of low volatility. There are many different things that can potentially affect the price of gold. These issues include but are not limited to: supply and demand, currency fluctuations, inflation risks, geopolitical risks, and asset allocations.

Gold is viewed by some as a safe-haven asset for it is one of the only assets with virtually no counter-party risks . This is why golds value may potentially rise during times of economic instability or geopolitical uncertainty.

Isnt the price of gold too volatile for most investors?

Gold can, just like any other commodity, become volatile with rapid price changes and swings. The gold market can also, however, go through extended periods of quiet trading and price activity. Today many financial experts see gold as being in a long-term uptrend and that may potentially be one reason why investors are buying gold.

Why does gold trade essentially 24 hours per day?How often do gold prices change?

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market; however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Recommended Reading: What’s The Price For 1 Oz Of Gold

How Do Silver And Bitcoin Compare To Gold

Between the two, silver is much more similar to gold than bitcoin, but all three share a common trait as market or inflation hedges. Like gold, silver can also be used to make products or worn as jewelry. Bitcoin is a much newer asset, and without the centuries of data to draw on, its viability as a hedge is highly speculative compared to gold.

Barrick Confirms Per Share Distribution Amount For The Second $250 Million Return Of Capital Tranche

All amounts expressed in US dollars TORONTO, Sept. 02, 2021 — Barrick Gold Corporation today confirmed that the per share amount of the second $250 million tranche of a return of capital distribution totalling $750 million to be paid on September 15, 2021, will be $0.1405092, based on the number of issued and outstanding shares as of the August 31, 2021 record date. This follows the approval by shareholders at Barricks Annual and Special Meeting on May 4,

Don’t Miss: How To Get Free Golden Eagles In War Thunder

Dow Futures Fall 115 Pts; Core Pce Data In Focus

U.S. stocks are seen opening lower Friday, starting the new month as the last one ended with investors fretting about high inflation and the potential early withdrawal of monetary stimulus. At 7 AM ET , the Dow Futures contract was down 115 points, or 0.4%, S&P 500 Futures traded 14 points, or 0.3%, lower, while Nasdaq 100 Futures dropped 30 points, or 0.2%. The major indices ended September sharply lower, with the broad-based S&P 500 finishing the month down 4.8%, its worst month since March 2020.

Gold Prices End Higher To Notch A Modest Weekly Gain

Gold futures end higher on Friday, tallying a small gain for the week, with prices finding some support from weakness in the dollar and government bond yields after a reading on the cost of U.S. goods and services revealed a sharp rise for August.

Gold has had a rough go the last several months. Prices remain under pressure, and a deeper breakdown remains possible. Below are the key levels for October.

Read Also: Why Is The Gold Silver Ratio So High

What Is The Best Way To Buy Gold

If you’re looking to buy physical gold, buying online is probably your simplest option. Reputable dealers will sell marked gold coins and bars that show information about their origin, weight, and purity. When buying online, make sure that the seller fully insures their shipments. If buying stock or ETFs, consult with your financial advisor and procure stock through well-known stockbrokers or trading apps.

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Don’t Miss: Can You Hold Gold In An Ira

Donlin Gold Initial 2021 Drill Program Results Continue To Deliver For Project Advancement

FIGURE 1 Drill Hole Collar Locations Depicted grid system is based on NAD83 UTM zone 4N coordinates. Results Support Mineral Resources, With Significant New High-Grade Intercepts Improving Definition of Controls on Mineralization Has Been Beneficial in Preparation for the Feasibility Study Update ANCHORAGE, Alaska, Sept. 02, 2021 — Donlin Gold LLC , owned 50/50 by Barrick Gold Corporation and NOVAGOLD RESOURCES INC. (NOVAGOLD

A Brief History Of Gold

In order to fully understand the purpose of gold, one must look back to the start of the gold market. While gold’s history began in 2000 B.C, when the ancient Egyptians started forming jewelry, it wasn’t until 560 B.C. that gold started to act as a currency. At that time, merchants wanted to create a standardized and easily transferable form of money that would simplify trade. The creation of a gold coin stamped with a seal seemed to be the answer, as gold jewelry was already widely accepted and recognized throughout various corners of the earth.

Following the advent of gold as money, its importance continued to grow throughout Europe and the U.K., with relics from the Greek and Roman empires prominently displayed in museums around the world, and Great Britain developing its own metals-based currency in 775. The British pound , shillings and pence were all based on the amount of gold that it represented. Eventually, gold symbolized wealth throughout Europe, Asia, Africa, and the Americas.

Recommended Reading: What’s The Best Karat Gold

What Is Oz Gram Kilo Tola

Gold and most precious metals prices are quoted in troy ounces; however, countries that have adopted the metric system price gold in grams, kilograms and tonnes.

Grams = 0.032151 troy ounces

Tael = 1.203370 troy ounces

Tola = 0.374878 troy ounce

Though not as popular as kilograms and grams, Tael is a weight measurement in China. The tola is a weight measurement in South Asia.

The Us Bimetallic Standard

The U.S. government continued on with this gold tradition by establishing a bimetallic standard in 1792. The bimetallic standard simply stated that every monetary unit in the U.S. had to be backed by either gold or silver. For example, one U.S. dollar was the equivalent of 24.75 grains of gold. In other words, the coins that were used as money simply represented the gold that was presently deposited at the bank.

But this gold standard did not last forever. During the 1900s, there were several key events that eventually led to the transition of gold out of the monetary system. In 1913, the Federal Reserve was created and started issuing promissory notes that could be redeemed in gold on demand. The Gold Reserve Act of 1934 gave the U.S. government title to all the gold coins in circulation and put an end to the minting of any new gold coins. In short, this act began establishing the idea that gold or gold coins were no longer necessary in serving as money. The U.S. abandoned the gold standard in 1971 when its currency ceased to be backed by gold.

Recommended Reading: How To Prospect For Gold

What Is Level Ii Market Data

On many trading apps like Robinhood, the objective of the firm is to keep things simple. This is evident by only providing Level I Market Data. With this level of detail, you are only able to see minimal information about the bid and ask on different securities.

As a long-term investor, this likely won’t make a huge difference. But as an active trader, you’ll want to have as much information as possible before you trade. That’s where Level II Market Data comes in.

Level II Market Data provides additional data about the bid and ask prices of the securities. Instead of just showing you the current bid and ask, you’ll be able to see the next 10-15 bid and ask prices as well as the lot size of each. This provides you with a wider picture of the market for each stock and gives you a leg up over other traders.

Without this information, active traders are putting themselves at a bit of a disadvantage. While you’ll need to pay $5 a month on Robinhood for this kind of data, there are other apps like Moomoo that provide Level II Market Data for free.

Robinhood Gold Review : Is Robinhood Gold Worth It

Robinhood is an investing platform that opens the doors to financial markets by offering commission-free trades on a sleek and clean mobile app.

There is no account minimum to get started and no fees to open an account, transfer funds, or maintain an account.

However, for just $5/month you can access a premium subscription called Robinhood Gold. But, is the $5 per month worth it?

Here’s what we think…

Don’t Miss: How To Buy Gold Pass In Clash Of Clans

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

Also Check: Can You Buy Gold On Etrade

Barrick Eyes New Mines Not Deals For Future Growth

Barrick Gold Corp Chief Executive Mark Bristow spent years burnishing his reputation as an aggressive dealmaker, but he says now he is focused on new mines that he hopes will boost profit and the company’s sagging stock price. The strategy eschews the acquisition appetite that made Barrick what it is today and instead pins the company’s growth on exploration projects in Egypt, Nevada, Guyana and elsewhere. Barrick’s shares have lagged rival Newmont Corp and the S&P 500 this year, putting pressure on Bristow and his management team.