What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

Which Is The Largest Gold Producing Country

Before 2006, South Africa was the world’s dominant gold producer, followed by the United States of America, China, Australia, and Peru. More recently, other countries with greater land surface areas have surpassed South Africa. Since 2007, China has become the largest gold producing country, followed by Australia, United States, Russia, and Peru. South Africa sits in sixth position.

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

Also Check: Dial Gold Body Wash Tattoo

How Much Is 11 Ounces Of Gold Worth

troy

| 11 Troy Ounces of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

Read Also: War Thunder Golden Eagles

Spot Gold Price Vs Gold Futures Price

There is usually a difference between the spot price of gold and the future price. The future price, which we also display on this page, is used for futures contracts and represents the price to be paid on the date of a delivery of gold in the future. In normal markets, the futures price for gold is higher than the spot. The difference is determined by the number of days to the delivery contract date, prevailing interest rates, and the strength of the market demand for immediate physical delivery. The difference between the spot price and the future price, when expressed as an annual percentage rate is known as the forward rate.

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

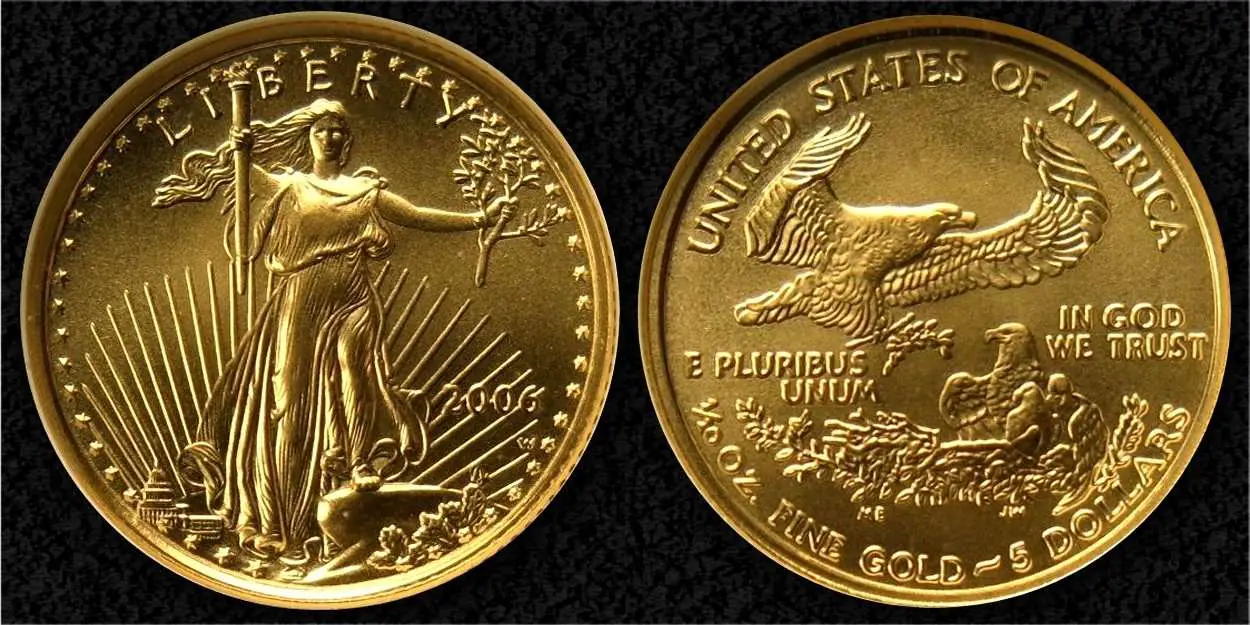

Recommended Reading: How Many Grams Is 1 10 Oz Of Gold

Spot Prices Emailed To You Daily

All checks, shipments, and correspondence should be sent to:

CMIGS 3800 N. Central Avenue, 11th Floor, Phoenix, AZ 85012

|

Onlygold did business at the same location for more than sixteen years. CMI Gold & Silver Inc. has done business from three locations in Phoenix since 1973. Both firms are Accredited Businesses with the Better Business Bureau, and neither firm has had a complaint filed with the BBBever! |

|

In addition to having really strong bids on gold, silver, platinum, and palladium in coin and bullion form, we also purchase a wide range of numismatic coins. We have especially strong bids for old US gold coins. |

How Tons Of Gold Flow Through The Gold Bullion Market

Since beginning in 1987, the London Gold Bullion Association has taken the position as the world’s dominant physical gold bullion settlement organization.

This situation or trend will likely remain so until the eastern world wrestles away gold price discovery power.

The ongoing disconnect from representative gold derivative traders and physical gold flows is a real phenomenon. Many of the individuals involved in day-to-day trading representing massive gold tonnage have often never even touched a Good Delivery 400 oz Gold Bar throughout their entire working career.

As well, since the LBMA established its dominance in the physical gold ton game, the daily west vs. east compounding daily gold price discovery leaves doubt. Much of what is perceived as gold price discovery has likely meant a more sophisticated western gold fiat price containment over the last three decades or longer. Similar to the attempt made to contain the gold price after World War 2 through the late 1960s with the country conspiring price rigging London Gold Pool.

Read Also: Is The Delta Gold Card Metal

What Are The International Major Gold Markets

In order to establish rules designed to prevent market manipulation, abusive trade practices and fraud, the global gold markets are overseen and regulated by governmental and self-regulating organizations. Globally, there are four important international gold exchange markets, they are London Gold Market , America Gold Market , Zurich Gold Market and Hong Kong Gold Market . The Japanese gold market is also important. By linking these markets, gold trading can be achieved within 24 hours of continuous trading in the worldwide network.

The London gold market is by far the largest global centre of OTC transactions. Its gold spot-price is fixed twice each business day at 10:30 am and 3:00 pm in USD, GBP, and EUR. London prices have a great influence on the world gold market price.

Gold Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The gold price in CAD is updated every minute. The data comes from the gold price in US Dollars converted at the exchange rate of the USD/CAD pair.

You May Like: Xbox Gold Worth It

What Is Gold Karat

Its means purity level of gold, the 24K gold is 99% pure, while 22k gold is jewelry ideal. Its formula for calculation of karat is = Karat/24. e.g., 22k gold can be calculated like = 22/24 = 0.916 = 91% pure gold, which is also called 916 gold. Therefore the 22k gold coins and products stamped with 916 seals.

Gold As An Investment

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

Recommended Reading: How Much Is 10k Gold Worth

What Is The Price Of The Gold And Silver Ratio

The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold.

Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold.

Calculation : Gold Buyers

This calculation determines how the price compares relative to the value of gold metal from calculation 1.

This calculation is useful for people buying gold. In general, how far the price deviates from the gold metal value determines if it is cheap or expensive.

| Price |

|---|

| Step 1: Calculate gold metal value |

|---|

| Gold metal value = Price ÷ Value of gold metal × 100= 0 ÷ 0 × 100= 0 % |

Recommended Reading: How To Get Free Golden Eagles In War Thunder

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

If The Gold Spot Price Increases Just Before I Make My Online Purchase Am I Going To Be Charged A Higher Amount

Yes. The spot price of gold fluctuates on a constant basis. Thus the prices for individual items are updated every minute. The price you will pay is locked in before checkout.

In the case of a bank wire purchase, the spot price will be locked in for 24 hours or until the next business day. For more information on bankwire pricing, see our policy on bankwires.

Don’t Miss: What Dentist Does Gold Teeth

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

What Is Oz Gram Kilo Tola

Gold and most precious metals prices are quoted in troy ounces however, countries that have adopted the metric system price gold in grams, kilograms and tonnes.

Grams = 0.032151 troy ounces

Tael = 1.203370 troy ounces

Tola = 0.374878 troy ounce

Though not as popular as kilograms and grams, Tael is a weight measurement in China. The tola is a weight measurement in South Asia.

Also Check: What Dentist Does Gold Teeth

Whats The Price Of Gold Per Ounce

The price of Gold can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Gold per ounce, they are referring to the spot price. The spot price of Gold is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Gold per ounce.

Is Gold Traded 24 Hours A Day

Yes. Gold trades on exchanges located around the world. Even when one exchange is closed for the night, there is another somewhere else that is active.

Electronic trading of gold goes on continuously. This is reflected in the Globex gold price overseen by the CME Group. Globex prices are updated moment to moment based on futures trading.

24-hour gold trading means that gold product prices always fluctuate.

Also Check: Buy Gold From Dubai Online

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

You May Like: Buy Gold From Dubai

How Can I Sell My Owned Gold

It depends upon the nature of the gold you have owned. It may be gold coins, bangles, necklaces, rings, bracelets, earrings. There are many places available in every country for selling those gold items. However, the selling price may be different in different locations, time, and other factors. Here you can find more information about how to sell gold.

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

Recommended Reading: War Thunder Golden Eagles Generator

What’s The Live Gold Price

The Live Gold Price we use to help you estimate the current Karat Value of Gold is provided by one of Australia’s international market partners. They are a market-leading Gold and Metals Commodity pricing exchange service similar to Kitco. The current live gold price is $2,440.70 .

Our Live Gold Price is sourced from our friends at Gold Price Live Australia who provide up to the minute live gold price information.

What Makes Gold A Precious Metal

This is a classification of specific metals that are considered rare and have a higher economic value compared to other metals. There are five main precious metals openly traded on various exchanges, gold is the biggest market. Gold is sometimes referred to as monetary metals as it has historical uses as a currency and is seen as a store of value. While relatively small, gold does also have an industrial component because it is less reactive, a good conductor, highly malleable and doesnt corrode.

You May Like: Who Makes Gold Peak Tea

How Much Is A Nugget Of Gold Worth

Alan, reDollar expert answered

We have to differ between natural gold nuggets and artificial, human created, gold nuggets to talk about how much they are worth. While bigger natural gold nuggets are reflecting a value higher than the gold price, humanly created gold nuggets are always only worth the current gold price. Small natural gold nuggets, mined from Alaska to Australia, are also only worth the gold price because they are not either really rare or exceptional.

Natural Gold Nuggets

Most natural gold nuggets appear either as a pure nugget or in combination with a host rock like quartz. North American mined natural nuggets usually contain approx. 95% pure gold while Australian mined nuggets can contain up to 99% pure gold. A natural 1 gram gold nugget containing 95% pure gold is worth $48.63, today.

Please also check our value-examples further down this page to get an idea how much bigger-sized gold nuggets are worth.

Artificial Gold Nuggets