Free Silver Elite Status

How often does a card with no annual fee come with complimentary elite status? The Hilton Honors Amex confers Silver status, the base level in the Hilton Honors program.

While Hilton Honors Silver wont get you too many perks, it unlocks a key benefit thats a must-have for award travelers: Youll get your fifth night free on award stays and you can only imagine how the savings add up if you are staying at expensive properties.

Other perks of Silver elite status include a 20% points bonus on stays and two complimentary bottles of water per stay at most properties.

If you spend $20,000 or more on eligible purchases with your Hilton Honors Amex in a calendar year, youll even receive Gold elite status through the end of the next calendar year for perks like breakfast credits and preferred room upgrades upon availability.

Amex Platinum Perks And Credits

To justify its $695 annual fee, the Amex Platinum comes with a ton of perks. There are too many benefits to list them all, but Ill go through some of the highlights.

First, the card offers over $1,600 in annual statement credits, including:

- Up to $200 airline incidental credit Not valid for the purchase of airfare, but you can use this credit for incidental charges like seat selection, bag fees, lounge access, etc.*

- Up to $200 in annual Uber cash Up to $15 a month with a $20 bonus in December when you add your card to your Uber account.*

- Up to $100 annual Saks Fifth Avenue credit $50 valid for purchases made between January and June, and another $50 for purchases made between July and December.*

- Up to a $200 annual hotel credit Valid on prepaid Amex Fine Hotels and Resorts or The Hotel Collection bookings with Amex Travel when you pay with your Amex Platinum.*

- Up to $189 annual CLEAR® credit to cover your annual membership.*

- Up to $240 annual digital entertainment credit $20 in monthly statement credits when you pay for eligible purchases with the Amex Platinum at select partners.*

- Up to $300 annual Equinox credit $25 in monthly statement credits on select Equinox memberships of Equinox+ app.*

- Up to a $155 statement credit that covers the cost of an annual Walmart+ membership when paying with their Amex Platinum. Plus Ups are excluded.*

*Enrollment is required for select benefits, and terms apply.

Enrollment required for select benefits.

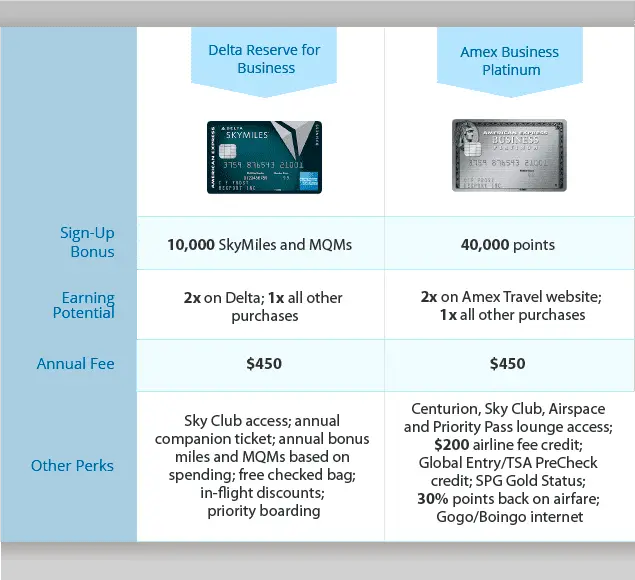

Here’s How Amex Delta Platinum Upgrade Offers Work:

- You won’t be eligible for an upgrade until you’ve had an American Express credit card account for at least 13 months.

- American Express will decide whether or not to approve you for an upgrade based on your credit reports, income, and payment history.

- American Express does not do a hard inquiry on your credit when you ask for an upgrade, so there’s no risk to requesting one.

- If you are approved for an upgrade, you will receive your new card within 7 days. You can keep using your old card until your new one is activated.

- Since you’re not opening a new account, your old account information will stay the same.

There’s also a different type of Amex Delta Platinum upgrade offer. Card members can earn up to 25,000 Medallion Qualifying Miles in their first year, and 20,000 every year after that. If you earn 25,000 Medallion Qualifying Miles and spend $3,000 on Delta purchases, you’ll earn Medallion status. Medallion members are eligible for available complimentary seat upgrades on all Delta flights.

To log in to your Delta SkyMiles® Gold American Express Card account, go to the on the American Express website or mobile app and enter your username and password in the appropriate fields. Then, click the Log In to access your online account. If you don’t already have an account, you will need to start by clicking Create New Online Account in order to set up a username and password.

You May Like: Gold And Diamond Cross Pendant

Who Should Get Chase Sapphire Preferred

The cards annual fee of $95 is hard to beat, especially if you dont think you would use the Uber and dining credits the American Express Gold Card offers.

But consider your own spending habits.

Chase Sapphire is also good for people who arent avid travelers because of the Pay Yourself Back program that allows cardholders other ways besides travel to redeem their points at the same high conversion rate.

The value of points redeemed through Pay Yourself Back can be up to 1.5 cents for Airbnb and Away, dining at restaurants, through takeout, and by delivery services, and donating to select charities.

Even though the categories seem limited, this program shouldnt be overlooked.

If you had 15,000 points you could redeem on an eligible purchase , instead of being valued at $150, they would now have a value of $225.

Thats the same as if you had redeemed them for travel through Ultimate Rewards. Its also much better than if you opt for Cash Back.

What’s So Special About The American Express Black Card

The invitation-only Black Card is aimed at high-net-worth individuals who travel frequently. Starting your membership will cost you a $10,000 initiation fee, and there’s a $5,000 annual fee.

The privileges of a black card include upgrades on flights, hotels, and rental cars, as well as access to exclusive airport lounges. Black cards also offer private concierge service, as well as early access to concert tickets, and there are even rumors it can provide charter jet service.

Recommended Reading: Which Is Better Gold Or Platinum

Is The Gold Card For Me

Some say that the Platinum card is simply a dressed up Gold card. The Gold card will cost you a $250 annual membership fee. While the Platinum account charges no interest because balances must be paid in full each month, the Gold card offers the option of carrying a balance on certain purchases over $100 with interest. The Gold card also offers a bunch of benefits similar to those from the Platinum card, although at reduced levels.

Is The Amex Platinum Worth It

The Platinum Card® from American Express can be worth having if youre a frequent flyer and you can use the cards various travel benefits.

Earning 5x Membership Rewards on qualifying flights and hotels along with the 1:1 point transfers is a good start.

But, to justify the $695 annual fee, you will need to use some or all of these benefits:

- Global Lounge Collection airport lounge benefit

- Trip cancellation and delay benefits

Staying at upscale hotels can easily utilize the hotel credits. Several flights and lounge visits can use the airline fee credit and airport lounge benefits.

Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more.

For rates and fees of The Platinum Card® from American Express, please .

For rates and fees of The American Express® Gold Card, please .

The comments on this page are not provided, reviewed, or otherwise approved by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Editorial Note: The editorial content on this page is not provided by any bank, credit card issuer, airlines or hotel chain, and has not been reviewed, approved or otherwise endorsed by any of these entities.

Contents

Also Check: Can You Buy Gold For Wow Classic

$10 Monthly Dining Statement Credit

Earn up to $10 in statement credits each month when you pay with the Gold Card at participating partners. You must enroll in the benefit to receive the credits.

If you maximize the $10 statement credit each month, youâll receive an annual savings of $120.

Participating partners:

- Participating Shake Shack locations. Excludes Shake Shack locations in ballparks, stadiums, airports and racetracks.

Metal Credit Card Faqs

Which credit cards are metal?

Here are the best metal cards according to ValuePenguin:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Chase Sapphire Reserve®

- Capital One Savor Cash Rewards Credit Card

- Amazon Prime Rewards Visa Signature Card

These are some additional metal credit cards, including some very high-end exclusive picks, as well as airline and hotel branded cards:

- J.P. Morgan Reserve Card

- Centurion® Card from American Express

- Mastercard® Gold Card

- IHG® Rewards Premier Credit Card

- U.S. Bank Altitude Reserve

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Platinum American Express Card

Do metal credit cards set off metal detectors?

While the sensitivity of metal detectors varies, Capital One’s metal credit card should not set off metal detectors, according to Meredith Reilly, senior communications manager for Capital One. However, the American Express public affairs says the best bet is to remove the cards from your pocket before you walk through and send the cards through the conveyor belt.

Which Chase credit card is metal?

The Chase Sapphire Preferred® Card and the Chase Sapphire Reserve® Card are both made of metal.

Does USAA have a metal credit card?

USAA does not seem to offer a metal credit card at this time.

Does Capital One have a metal credit card?

Does Bank of America have a metal credit card?

What are metal credit cards made of?

Read Also: Should I Buy Gold Or Silver

American Express Gold: Earning Rate

The American Express Gold Card is great for everyday spending. The card earns 4 Membership Rewards® points per dollar at restaurants, plus takeout and delivery in the U.S., 4 Membership Rewards® points per dollar at U.S. supermarkets , 3 Membership Rewards® points per dollar on flights booked directly with airlines or through American Express travel and 1 point per dollar on other eligible purchases.

Not only are these generous bonus categories but youll also earn some of the most valuable rewards points available. Amex Membership Rewards can be transferred to close to two dozen airline and hotel loyalty programs, most of them at a one to one ratio or better. Transfers to JetBlue TrueBlue are the exception, with a ratio of 250 to 200. American Express also runs the occasional bonus point promotion, so you can get 20% or more miles when transferring them to specific partners. Transfer bonus promotions can be an excellent way to save on award bookings and stretch your rewards even further.

Earn A Simple Flat Rate On All Of Your Spending

Using the Amex Platinum and the Amex Gold does require a bit more mental energy than a card that earns the same flat rate on every purchase. If you feel like its more hassle than its worth to remember which card to use when, consider a card like the Citi® Double Cash Card which has no annual fee and earns 2% cash back on all purchases1% when purchases are made and another 1% when theyre paid off.

You May Like: How To Buy Gold Ingots

Welcome Bonus: Platinum Card From American Express Helps You Earn More Points

Heres why: The Platinum Card® from American Express offers a gigantic welcome bonus. Youll earn 100,000 Membership Rewards® points after spending $6,000 on purchases during the first 6 months of card membership. Depending on how you redeem, we think it could be worth about $2,070, based on .

And though its lower, the American Express® Gold Cards 60,000-point welcome bonus is nothing to shrug at. Depending on how you redeem the points, we think it could be worth an estimated $1,242. Youll earn the bonus after spending $4,000 on eligible purchases during the first 6 months of card membership.

Heads up: When it comes to credit cards, welcome bonuses can and do change, and issuers sometimes advertise limited-time offers. Youll want to check the latest offers for any credit card youre interested in.

Best Metal Credit Cards Of September 2022

The Platinum Card® from American Express is the best metal card if you value luxury gain access to the best airport lounge network, including Amex Centurion Lounges.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.Terms apply to American Express benefits and offers. Visit americanexpress.com to learn more. Citi is an advertising partner.

There is something sleek and stylish about carrying a metal credit card. While that feature in and of itself shouldn’t influence you to choose a particular card, there are several metal cards on the market that also happen to be terrific for earning rewards, travel benefits and other perks.

You May Like: Where To Sell Gold Dental Crowns

Does It Make Sense To Have The Amex Gold And Platinum

Having both the Amex Gold and Amex Platinum can make sense if you use both cards enough to offset the annual fees.

You can use the American Express® Gold Card for its dining credits and 4x purchase rewards on dining and supermarket purchases. Then, you can use The Platinum Card® from American Express for travel bookings to earn 5x Membership Rewards along with the various travel credits and elite traveler benefits.

Limitations On Travel Spending

Although transferring points for travel is a clear benefit of the Amex Gold and is arguably its best redemption option, rewards for spending on travel are a bit underwhelming. Youll earn just 3 points per dollar on flights booked directly with airlines or through the American Express Travel portal.

Although this rewards rate is solid at a glance, its held back by the fact that only airfare purchased through American Express Travel counts as travel with the Amex Gold. You wont earn bonus points for flights booked with third-party travel flights or for hotel bookings or rental cars.

Read Also: What Is Gold Filled Mean

Earning Points With Amex Platinum

With the Amex Platinum Card, you’ll earn 5x Membership Rewards Points per dollar spent on flights booked directly with the airline or through amextravel.com. For this reason , we think it is the best card for booking airfare.

You’ll earn 1x point per dollar spent on all other purchases.

The Amex Gold Card always earns 4x points per dollar spent on groceries and at restaurants. Long term, it’ll earn you more points and makes more sense for your everyday spending.

You’ll earn more with these three categories than you will with just flights on the Amex Platinum Card.

Travel Perks On The Amex Green Gold And Platinum Cards

The one area where youll see a huge difference across these three Amex cards is when it comes to travel benefits. The Amex Green and Amex Gold cards have fairly limited VIP travel perks, but theyre overflowing on the Amex Platinum card.

With the Amex Platinum, youll receive complimentary Gold elite status with both the Hilton and Marriott hotel chains. Having Gold status at both chains will help you with upgraded rooms, getting a late checkout, earning bonus points on your stay and more. At Hilton properties specifically, Gold status will even sometimes earn you lounge access or complimentary breakfast.

The Amex Platinum also comes with a ton of lounge access opportunities to make your airport experience more enjoyable. This is the only personal card that gives you access to American Express Centurion Lounges, the Global Lounge Collection, Delta Sky Clubs and a Priority Pass Select membership. In total, thats over 1,200 lounges around the world.

Youll also have access to trip cancellation and interruption insurance with the Amex Platinum card up to $10,000 per covered trip but not with the Amex Green or Amex Gold card. However, all three cards have trip delay insurance, which covers out-of-pocket expenses incurred when a flight is delayed. The Amex Green and Amex Gold cards will cover you up to $300 per trip if your trip is delayed more than 12 hours, while the Amex Platinum covers up to $500 for a trip thats only delayed six hours.

Don’t Miss: Is Gold Going Up In Value

Unparalleled Perks Especially For Foodies

Points arent the only key benefit of the American Express Gold Card. There are several other perks that cardholders must take advantage of if they want to recoup the cards annual fee and then some, ranging from luxury travel benefits to dining credits.

If you are a frequent traveler, the travel credits and benefits that come with the American Express Gold card are very appealing. For more luxury travelers, however, American Express offers a card that is even more packed with plush perks. The Platinum Card® from American Express comes with a steep $695 annual fee, but it is loaded with travel benefits that make it a great choice for travelers who value luxury perks like lounge access, entertainment credits and other convenient benefits.

See related: Amex Gold vs. Amex Platinum

Earning Greater Rewards On Large Purchases

The Business Platinum Card® from American Express card offers a unique benefit for cardmembers making large purchases. If you charge an eligible purchase of $5,000 or more on your card, you will receive 1.5 Membership Rewards® points per dollar on the purchase. For businesses that make lots of large purchases in categories that dont typically earn bonuses on business credit cards, charging to the Business Platinum card is a great way to increase your rewards. American Express will give you up to 1 million additional points in large purchase bonuses per calendar year.

Recommended Reading: How Much Is 2 Kilos Of Gold Worth

What I Recommend For Military Servicemembers

Military servicemembers should get both the Amex Gold and Amex Platinum. I recommend getting an Amex Gold card first and then opening an Amex Platinum once you have completed the minimum spend on the Amex Gold card.

Also remember that military spouses also get their annual fees waived. Spouses can refer each other to earn even more points! I explain how that all works in my Ultimate Military Credit Cards Course.

Let me know in the comments if you opened both cards!