How To Calculate Zakat On Gold:

When your personal wealth is more than the Nisab amount, you are obliged to give Zakat. Nisab is the cut-off amount. So when your wealth is below the Nisab, you dont need to give Zakat. You use either the current market price of gold or silver to calculate Nisab. As the prices of gold and silver fluctuate it is always wise to check the current market rates.

Purify Your Wealth By Giving Zakat

It requires giving a calculated amount to the poor and needy. The more Zakat that is paid, the more beneficial it is to the poor and needy. There are many organizations all over the world that allows the users to pay their zakat online. First of all youll need to work out whether youre obligated to pay Zakat online by looking at whether what you own meets the Nisab.

The value of the Nisab in prophetic tradition is 87.48 grams of pure gold or 612.36 grams of pure silver so the monetary value of the Nisab will vary according to current prices. Due to the significant difference in the cost of gold and silver, the Nisab for silver is now much lower. Although both values can be used, many scholars advise that we apply the Nisab of silver when calculating our Zakat so more of us are eligible to pay it.

Before you pay your zakat online to any charity organization, you must know that Zakat should be calculated and paid on any surplus wealth that you have owned for at least one lunar year.

- Pensions

- The property you own for investment purposes

The easiest way to pay zakat online is to first calculate your zakat amount. There are many charity organizations who give you a facility of zakat calculator which you can use to calculate your zakat amount. These zakat calculators let you find out the monetary value of each type of wealth and then work out 2.5% of the total sum.

You can also Calculate zakat Online on your salary by using our Online Zakat Calculator on our website

Zakat On Gold Charity

Working out how to calculate your Zakat on gold is an important part of figuring out how much Zakat you need to pay.

For 12 Amazing Years at Penny Appeal, we have had a 100% Zakat policy that means that 100% of your Zakat payment will go to those in need, 100% of the time. That gives you 100% of the blessings!

Your Zakat on gold will make a real difference to people who need it most around our world.

When we think on the blessed payment of Zakat, we are reminded of the following Hadith:

Charity never decreases wealth.

Don’t Miss: Are Gold’s Gym Treadmills Any Good

How Much Does It Zakat For 75 Gold Tola

Zakat is one the essential part of Islam, and it is the fourth pillar of Islam. We can say Zakat is the sufficient amount of money that we give to needy people at the beginning of Ramadan. We provide an extraordinary amount of money that is clearly described in the Holy Quran.

Zakat is the way to purify our wealth, as we are Muslims, and according to us, it increases the amount of our money that we spend in the course of Allah and good deeds. We can say Zakat is another form of charity. You can also check how much it cost from Zakat Calculator UK.

We have a firm belief that if you spend money in Allahs way, then Allah gives us more than our fulfillment. It also helps to purify someones character because it frees us from desires and greed. Zakat also reminds us that the wealth we have is just because of Allahs blessing, and we are not taking it with us after death.

Am I Eligible To Pay Zakat As Per The Nisab

You are Sahib-e-Nisab and eligible to pay Zakat if the total of your assets values more than 7.5 tola/3 ounces/87.48 grams of gold, or 52.5 tota/21 ounces/612.36 grams of silver for a full lunar year. Since gold and silver are not used as currency in todays world, it is important to convert the Nisab into your local currency based on the current rate of either gold or silver on the day of calculation.

READ MORE: Want To Make A Donation? Check Out These Welfare Trusts in Karachi

Please note that well be using Pakistani Rupees as the default currency in our examples, to show you how to calculate Zakat in Pakistan, but all the rates and currency values will differ based on when you are calculating your Zakat and in which country.

You May Like: How To Invest In Gold On Robinhood

Why Is Zakat On Money Today Paid Based On Gold

The Prophet, on him be peace, indexed Zakat payment to the value of the silver dirham and gold dinar of Makkah, which was the currency of the time. So those weights must remain the method of measuring gold, silver, and all our currency for Zakat payments.

Muslims, moreover, have long converted to gold as the standard weight measure for the Zakat niâb threshold on currency because its coinage has proven the most constant stable measure of wealth.

To use silver directly as the niâb standard, as some today advocate, arguing that silvers lower threshold will benefit the poor by resulting in more Zakat payments, actually compels many poor themselves to pay Zakat, increasing their financial burden and further impoverishing them.

At noon on January 11, 2021, for example, niâb calculated on silver stands at just $481.95. This means a person with that amount of money, in all its forms combined, at the Zakat Due Date must pay 2.5% of it, or $12.04, in obligatory Zakat a burdensome duty for those struggling to sustain themselves and their families.

The niâb for gold at this same time is $5,074.50, at a Zakat payment of $126.86, a fair and, therefore, moral responsibility for the wealth God has given one.

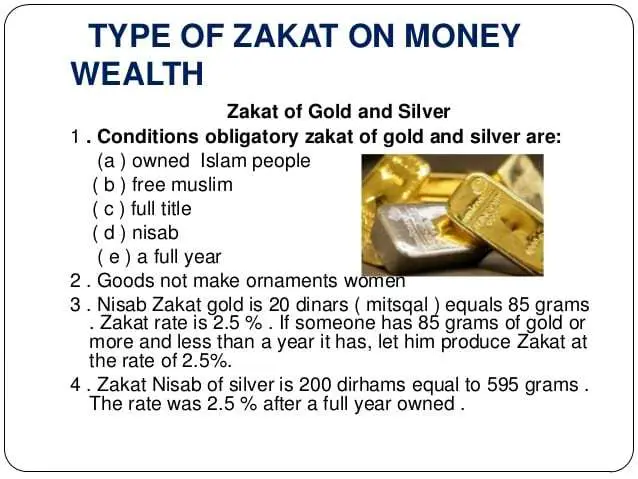

How Much Gold Do You Have To Have To Pay Nisab

The nisab is the minimum amount of wealth a Muslim must possess before they become eligible to pay Zakat. This amount is often referred to as the nisab threshold. Gold and silver are the two values used to calculate the nisab threshold. The nisab is the value of 87.48 grams of gold or 612.36 grams of silver.

Read Also: War Thunder 10000 Golden Eagles Code

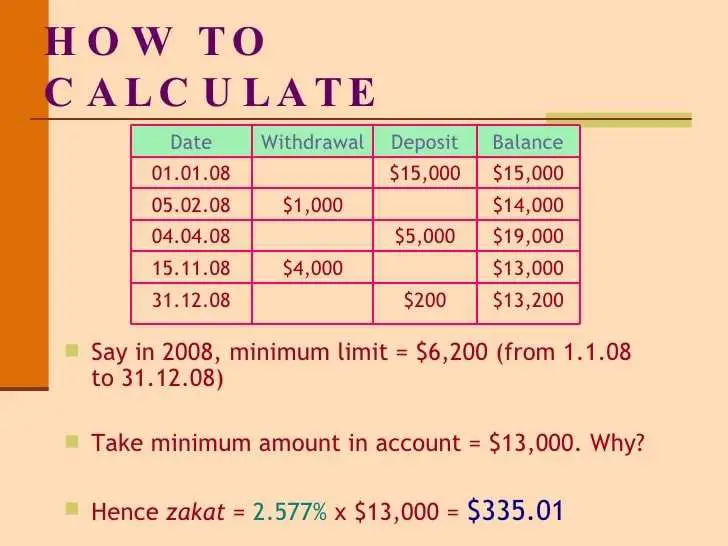

Calculating Zakat For 2021

So, youve calculated the Nisab and found out that youre eligible to pay Zakat for 2021. Well, while there are a number of Zakat calculators available online, most of them will not show you how theyve actually calculated Zakat for a particular year. In contrast, well take you through a step-by-step process to help you understand how to calculate Zakat on gold and all your other assets for one lunar year.

Firstly, remember that Zakat is applicable on savings and assets that are in excess of your belongings for personal use. Therefore, your house, your clothes, your car, your appliances, and other items of daily use are not included in the calculations for Zakat.

Zakah On Womens Gold Jewelryseptember 19 2006

Zakah On Womens Gold Jewelry

All Praises be to Allah, Lord of the worlds. Peace and blessings be upon Muhammed, his family his companions and all those who follow in their footsteps until the Last Day.

I chose do some research on the ruling of zakah on jewelry. Before starting this I was under the opinion that zakah was to be paid on everything as long as it met its nisab . As the prophet salalaahu alaihi wasalam encouraged us all men and women to give in charity. The wife of Abd-Allaah, said: The Messenger of Allaah said: Give in charity, O women, even if it is from your jewellery.

Although the majority of the scholars agree that zakah is not to be paid on womans gold jewelry, which she wears daily. They do agree that if the person is capable of giving the zakah they should. Because ultimately the zakah is for the poor and you will be rewarded for that. The calculations for the zakah on gold are as follows that is 20 Mithqal then one should pay ½ Mithqal as Zakah, i.e., 2.5% of the value of gold. Then one Islamic year should pass after possessing the money.

May Allah guide us all to that wish is best. Ameen

Don’t Miss: War Thunder Golden Eagles Generator No Survey No Password

Calculate Zakat On Gold By Using Our Zakat Calculator :

Calculating Zakat on gold jewelry seems to get complicated leaving men and women confused most of the time. This happens due to the lack of precise and clear knowledge about the Shariah laws on Zakat.

However, Transparent Hands has introduced an online calculator to make our Zakat calculations easier. This online calculator is a simple tool where you are required to insert the following information:

- Bank Savings

- Loans

- Value of shares/stocks/bonds

- Amount of Gold/Silver

- Nisaab of silver

How Is Your Zakat Used

Zakat is so much more than a yearly obligation. Its a revolutionary concept with the potential to ease the suffering of millions around the world. Its so important in our religion that it is mentioned over 30 times in the Quran, and very often together with the establishment of prayer.

Allah defines the true believers as those who are steadfast in prayer and give Zakat. Because of this, we are set apart as a people who strive not only toward inner refinement but also public service through our Zakat.

How then is your Zakat used to change lives? The purpose of Zakat is to make sure the poor and the needy, the vulnerable and the disadvantaged are looked after. Its meant to ensure that our collective wealth finds a way to those who need it the most.

At Islamic Relief, we strive to distribute your Zakat in a way that empowers people to break the cycle of poverty. Our goal is to provide relief, and ultimately bring people out of their difficult circumstances by helping them become financially independent.

Recommended Reading: Can You Get Banned For Buying Gold Osrs

Total Up All Your Sources Of Income:

Tally up all the assets that you have owned for the past year. This includes:

Cash + Gold & Silver + Debts Owed to You* + Investment Property* + Shares & Stocks* + Investment & Saving Funds* + Business Assets* = Your Total Income

Those above marked with an asterisk have some special considerations and instructions. Consult our Zakat Guide Booklet for details.

The Concept Of Deduction Of Zakat At Source

Zakat not only helps us purify our monetary assets but is also a means of helping the poor and needy in society as a whole. Use the methods explained above to calculate your Zakat for 2021 and find its rightful owner within your community.

While you are making the calculations, an important fact to remember is that Pakistan is among some of the Muslim countries where Zakat is obligatory and collected by the state on savings and profit and loss sharing accounts. This practice is called deduction of Zakat at source and is performed by all banks across the country on the 1st of Ramadan.

Therefore, if you are not exempt from Zakat and have more than the Nisab calculated by the State Bank of Pakistan for a particular year, the amount of Zakat will be deducted at 2.5% of your account balance. The collected Zakat is then sent to the Bait-ul-Maal run by the Government of Pakistan to help the needy and the poor. You do not need to calculate and pay your Zakat on your savings account under such circumstances.

You May Like: Where To Sell Gold Rdr2

Is The Position That Womens Jewelry Is Zakat

Yes, for 10 reasons:

The prophetic statements scholars use to support Zakat on jewelry are controversial regarding their authenticity or subject to interpretations that also disallow Zakat on womens jewerlry or specify Zakat for its presence in extravagance or, perhaps, apply uniquely to the wives of the Prophet, on him be peace.

The Qurans statement that prohibits Muslims from hoarding gold and silver strongly indicates that this means in their forms as currency, as minted money or measured, circulated exchanges of value. Yet as for those who hoard up gold and silver and do not spend it in the path of God .

Zakat is imposed on growth assets only, not on items of personal use. Jewelry is unquestionably meant for personal use. Muslim scholars, moreover, agree on the allowance of jewelry for women, as well as the permissibility of gold and silver for women in the form of jewelry.

Scholars, including the Hanafis, agree that Zakat exempts items of intrinsic value even expensive articles for personal use, like draft and riding animals, tools of craft or trade, and houses of primary residence. By analogy, scholars exempt from Zakat other things that are principally for personal use cars as means of personal transportation, for example, a farmers equpiment, a scholars books, furniture, clothing, utensils, and so on. It is inconsistent to sanction from Zakat these possessions as personal use items while not allowing jewelry women wear as articles of personal use.

Why Has Allah Imposed Zakat On Gold

Allah has forbidden hoarding of gold in severe terms in the Quran because of its essential value to the economic life of the community and because that obsession quickly becomes a sickness of the human soul.

Yet as for those who hoard up gold and silver and do not spend it in the path of God give them heavy tidings of a most painful torment on a Day Hereafter when gold and silver shall be heated in the Fire of Hell. Then their foreheads and their sides and their backs will be branded with it : This is what you have hoarded up for yourselves! So taste now what you used to hoard up!

Hence, the Prophet, on him be peace, instructed Muslim guardians to invest the money of the orphans in their care so annual Zakat payments would not consume it before they come of age and assume investment control of it.

The detailed answer:

Gold in all its forms coin, bullion, and handicraft and whether held as personal or business wealth, accrues due Zakat every lunar year that it reaches its established Zakat niâb of 85 grams, excepting jewelry women use to adorn themselves.

There is unanimous agreement among Muslim scholars that any Muslim who owns gold or silver must pay Zakat on it as currency. This means there is Zakat on all money. The Prophet, on him be peace, said: On silver, 2.5% is due.

Don’t Miss: How Much Is 10k Gold Worth

Do We Use The Same Gold Weight As The Prophet On Him Be Peace

Scholars, Muslims, and others have matched the exact equivalent of the gold dinar of the prophetic generation to our weights for Zakat on gold today through preserved samples of coinage called mithqal.

The second Rightly Guided Caliph and Companion Umar ibn Al-Khaâb himself standardized the legal weight of the dirham and the Caliph Abdul-Malik minted all coins of the realm on that legal weight. Many historians have established that 10 silver dirhams equaled a specific weight as measured against a mithqal.

It is unanimously agreed upon since the early ages of Islam, the era of the Companions and the Successors, that the weight of a silver dirham is equal to seven-tenths the weight of a gold dinar .

Calculate Zakat On Gold

When you want to calculate Zakat on gold then the Nisab is the cash equivalent of 3 ounces/87.48 grams of gold

For example, if each ounce of gold is currently worth $43, the Nisab using the gold calculation is . If your personal wealth is above $129, you owe zakat.

People also face trouble when calculating Zakat on gold jewelry. This confusion mainly occurs due to a lack of clear information on the subject. At first, you need to know that zakat is only due on gold or silver jewelry. There is no Zakat due on platinum or palladium, Diamonds, and gemstones like pearls, sapphires, rubies, corals, etc.

If your gold jewelry is made up of a mixture of metals you are only required to pay Zakat on the gold. You can also give actual gold in Zakat. For example, if someone has gold jewelry that weighs 100 grams, they can give 2.5 grams of gold as Zakat on the jewelry.

If there are diamonds, gemstones, pearls, etc, set within your gold jewelry, take it to a professional jeweler when you need to find out the weight of the gold. A professional jeweler will have the knowledge and experience required to assess the weight of the gems and will be able to give you the best approximate weight of the stones. Now to calculate Zakat on your gold jewelry, you can use this simple method.

The total weight of jewelry the weight of other stones x the price of gold x 2.5%

Also Check: How Many Grams Is 1 10 Oz Of Gold

How Does Zakat Help People Around The World

Your Zakat has supported communities to build sustainable livelihoods in the face of climate change and to build better lives for vulnerable orphans and families across the globe. Alhamdulillah, your Zakat has the power to transform peoples lives. Help make this happen. Give your Zakat for the love of Allah . Give your zakat today!

What Are The Rules Of Zakat

Zakat is obligatory on someone who is:

- A free man or woman: A slave does not have to pay zakat.

- A Muslim.

- Sane: The person on whom zakat becomes obligatory must be of sound mind according to Imam Abu Hanifa.

- 4.An adult: Children do not have to pay zakat, even if they own enough wealth to make zakat obligatory.

Read Also: What To Mix With Bacardi Gold