Whats The Price Of Gold Per Ounce

The price of Gold can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Gold per ounce, they are referring to the spot price. The spot price of Gold is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Gold per ounce.

Make Informed Decisions About Your Future

Gold Rate uses professional grade data sourced directly from gold dealers, exchanges or brokers with direct exchange relationships. All data sources are vetted by our team of economists, data scientists and finance experts so that you have knowledge you need when taking the future into your own hands.

Is The Price Of Gold Im Quoted Going To Be The Price I Pay

Gold prices change, and they can change quickly, even by the minute. This makes the prospect of buying gold a little nerve-wracking for some investors new to the process. You might wonder if the price youre quoted will be the gold price you pay if the prices fluctuate up and down constantly.

The good news is that gold bullion dealers “lock in the price” when your order is placed, so that will be the price of gold you pay regardless of what occurs afterwards. If youre buying gold online, then you can lock the price in at the checkout page. Then, youll have a specific amount of time to make your purchase and keep the current price of gold. If you take too long, the lock-in is removed, and youll pay the new price of gold instead .

However, understand that not all gold dealers offer online price lock-ins and purchasing options, so verify this before making any purchase decisions.

Read Also: War Thunder Golden Eagles Hack

What Are Benchmark Prices For Gold

There are no official opening and closing rates for silver or gold. As a result, traders are forced to peg their investment decisions on benchmark prices which are decided by different organizations during different times of the day. The technical lingo for benchmarks is also known as fixings.

The leading organization that maintains benchmarks for different precious metals is the London Bullion Market Association . It governs prices for gold and silver, both of which are well-respected benchmarks used by dealers in the precious metals marketplace.

The most typical way to determine benchmark prices is through electronic auctions between participating financial hubs such as banks.

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?

Recommended Reading: Is Dial Gold Body Wash Antibacterial

What Moves The Gold Market

While gold is one of the top commodity markets, only behind crude oil, its price action doesnt reflect traditional supply and demand fundamentals. The price of most commodities is usually determined by inventory levels and expected demand. Prices rise when inventories are low and demand is high however, gold prices are impacted more by interest rates and currency fluctuations. Many analysts note that because of golds intrinsic value, it is seen more as a currency than a commodity, one of the reasons why gold is referred to as monetary metals. Gold is highly inversely correlated to the U.S. dollar and bond yields. When the U.S. dollar goes down along with interest rates, gold rallies. Gold is more driven by sentiment then traditional fundamentals.

Value Of Gold Per Ounce

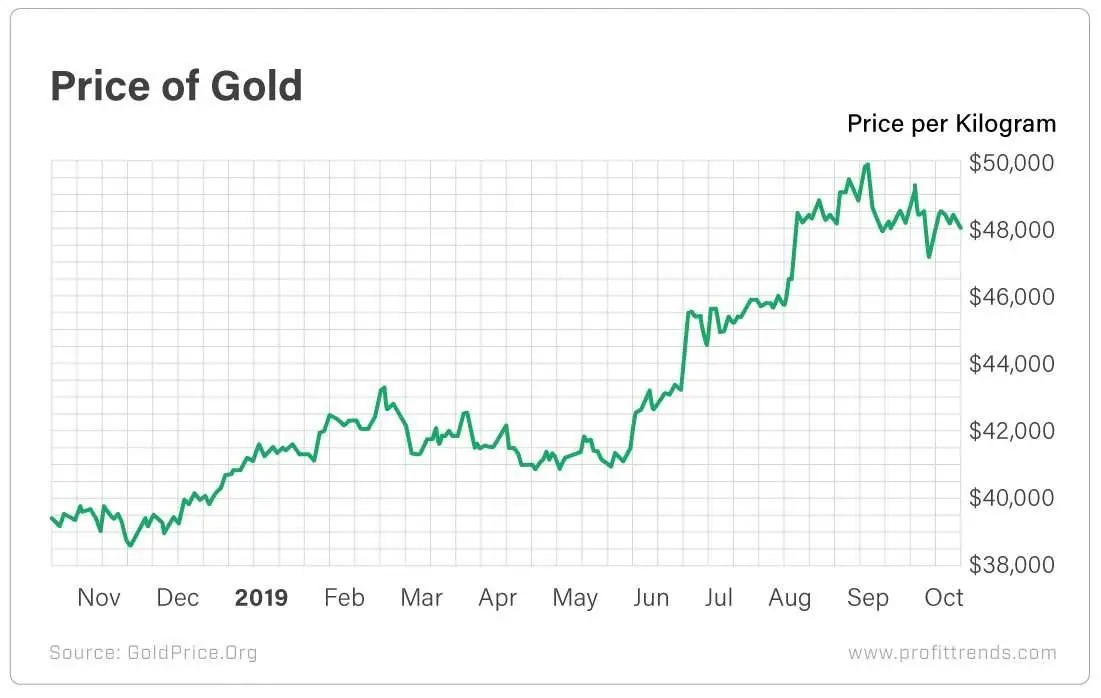

Are you wondering, “what’s the price of gold”? The live chart above shows the current spot value of gold per ounce in US dollars. You can change the currency by using the menu at the top of the chart.

As with the other charts located on this site, just hover your mouse over the graph to see the particular price at a given time.

Read Also: How Much Is 18 Karat Gold Per Ounce

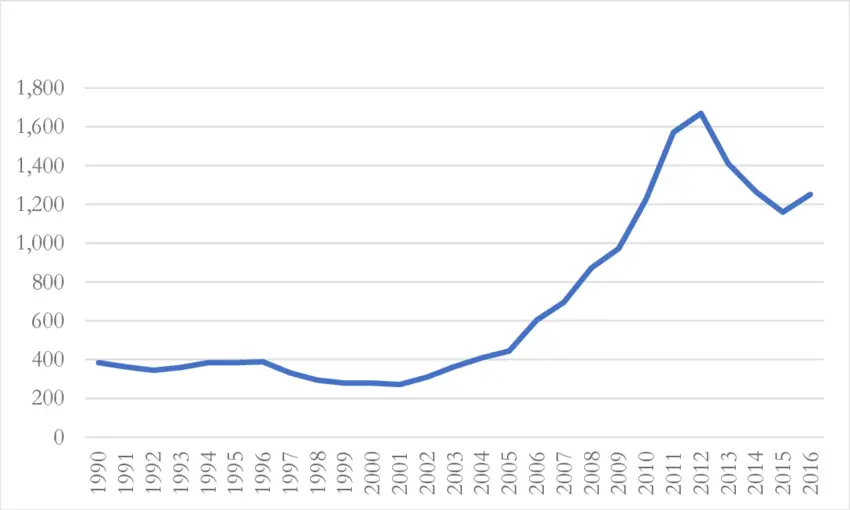

What Are The Largest Gold Producing Countries In The World

The following are four largest gold producing countries, and they are producing more than 40% gold out of 2990 MT . Some decades before, they were not appearing in the map of the largest gold producers, but recently they became the leader of the gold market. These countries significantly affect the price of gold. They had the largest gold reserves and underground unmined gold. Though, there are some countries of the world, which claims of owning huge gold reserves. But there is no authentic proof of that.

1. China:

As per a survey conducted in 2014, China produced 450 Metric tons of gold, which is 15% of the world . Of course, China had a vast territory, and it has more mines than any other country of the world, still a considerable amount of gold underground that is around 1,900 tons, and had about 1762 ton gold reserves, and ranked on the sixth number. Therefore, China influence the International gold market, and can drive gold price up or down. The demand for Gold in China is also increasing day by day, and a significant percentage of gold is using in jewelry.

2. Australia:

3. Russia:

It produced 247 metric tons of gold that are closer to Australia, and 3rd number in the list of largest gold producing countries. In January 2016, Russian gold reserves exceeded the 1414 tons limit and currently in the list of owning most gold reserves. Russia does not export a considerable amount of gold but imports to increase the reserves. Around 5,000 tons are underground and unmined.

Is Gold Always Traded 24/7 If Not Is There A Set Open And Close

Trading for gold takes place Sunday through Friday, 23 hours a day. It is common for OTC markets to overlap. No market actively trades between 5 PM and 6 PM ET. Because of the presence of OTC markets, there are no closing or opening prices for spot gold.

For large scale transactions, most gold traders will utilize the benchmark price from specific periods during the trading day.

Also Check: Do Diamonds Look Better In White Or Yellow Gold

Why Is Gold Mostly Quoted In Us Dollars

While you can buy gold in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Given that the U.S. is the worlds biggest economy and one of the most stable, the dollar has become a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Reserve currencies are used to settle international transactions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

How To Buy Silver

First, decide what kind of Silver youre interested in buying. There are several types of Silver, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Silver bullion, choose between Silver coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Silver. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Silver in their own vaults or lockboxes at home, as well.

Also Check: Gold Teeth Dentist New Orleans

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

- American Eagle

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

You May Like: How To Get Free Golden Eagles In War Thunder

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

Why Investors Prefer To Buy Gold

Investors see gold as opposing power against bad central-bank policies and inflations. Most of the investors observe gold as insurance against the financial instability, uncertain situations, high government expenditures, non-desirable policy of the central bank. The standard 24k gold becomes the ideal choice when real returns on bonds and cash are decreasing or falling, irrespective of a rise of the nominal interest rate.

Read Also: War Thunder Unlimited Golden Eagles Hack Tool

Understanding The Difference Between One Ounce And One Troy Ounce

Troy ounce has been used historically by the Roman Empire to weigh and set prices for precious metals. Back then, all currencies were valued in terms of their equivalent weight in gold . This process was later borrowed by the British Empire which tied one pound sterling to one troy pound weight in silver.

The US also used the troy ounce system in 1828. A troy ounce is bulkier than one imperial pounce by about 10 percent. A troy ounce is equivalent to 31.1 grams in weight, while an imperial ounce is equal to 28.35 grams.

What Is The Lbma

Based in London, the London Bullion Market Association is an international trade association, which represents the precious metals markets including gold, silver, platinum and palladium. It is not an exchange. Its current members include 140 companies made up of refiners, fabricator, traders, etc. The LBMA is responsible for setting the benchmark prices for gold and silver as well as for the PGMs. For the refining industry, the LBMA is also responsible for publishing the Good Delivery List, which is widely recognized as the benchmark standard for the quality of gold and silver bars around the world.

Also Check: New Orleans Gold Teeth Dentist

The London Bullion Market Association Gold Fix

What is the “gold fix” or “gold fixing”? The LBMA “gold fix” occurs twice a day and is a benchmark for the industry. How is the price of gold and silver determined? The price fix is set at 10:30 and 15:00 London time after auctions between some of the biggest traders in the gold industry. The fix allows for a more streamlined process of buying and selling and is used by gold mines, refineries and central banks. Most retailers and smaller businesses still operate on the live gold price and on this site the price you see for a gold coin or a gold bar at the live current gold rate.

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

You May Like: Wow Classic Gold Buying Ban

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

Buying Gold For Investment

Although no investment is completely devoid of risks, gold is one of the few assets that come with no strings attached. It is a great way to diversify your portfolio because prices have historically grown with the passage of time. Many people see gold as a stable form of investment because prices continue to lurch ahead even though bonds, stocks, and the US currency come crashing down.

Recommended Reading: How Much Is 10k Rose Gold Worth

What Is Silver Bullion

Silver bullion refers to a Silver product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Silver bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Silver bullion, meaning the product is either 99.9% or 99.99% pure Silver.

Can Gold And Silver Prices Double Or Triple As Rising Inflation Destroys Savers Wealth

Now imagine you had two $20 bills in 1933 and you put one of them under your mattress and turn the other one into an ounce of gold. Fast forward to today, 88 years later. The $20 under your mattress can buy you a couple of burgers, some fries and if you are lucky, you might get some change back. However, the ounce of gold you had purchased, if you sold it at todays spot price of $1730, it would enable you to go back to that same store in Beverly Hills, buy that same suit and never hear the end of it from your family and friends on the insanity of having spent that much money on a single suit.

The purpose of that example was to demonstrate how much the value of your money has dropped over the years and how gold could have prevented that loss in your purchasing power almost a century later.

If you purchased 100 shares of a companys stocks, and year after year, you saw the value of those shares dropped, how long would you hold on to it before you finally throw in the towel and dump it? The late Wall Street legend Richard Russell once asked in reference to the value of US dollar. A year, 5 years? How about 10 or 20 years? Even the most patient and optimistic investors would probably give up by the 2nd or 3rd year, cut their losses, dump the stocks and move on to something more stable. So ask yourself this question, if US Dollar was a stock, would you buy it? he concluded.

The simple truth is that US Dollar has been in steady decline since early 1900. According to

You May Like: 24k Gold Purity