History Of Bitcoin Gold: Launch And Controversy

The legacy of Bitcoin Gold is one steeped in controversy from the beginning. On the same day of the October 2017 launch, BTG experienced a massive DDoS attack on its cloud site, and within days after the launch, miners accused one of the developers of Bitcoin Gold of having added in a 0.5% mining fee that was hidden from the mining community. There was also concern that Bitcoin Gold’s security measures were not as robust as they had initially claimed and these flaws could result in increased vulnerability to threats.

Similarly, the developers of Bitcoin Gold used what is called “post-mine” after the launch, which concerned crypto exchanges as they were considering listing BTG. This was the retroactive mining of 100,000 coins after the fork already took place. The way that this happened was through the rapid mining of about 8,000 blocks, the results of which were set aside as an “endowment” of sorts, to be used to grow and maintain the broader Bitcoin Gold network. About 5% of those 100,000 coins were set aside for each of the six primary team members as a bonus. The remaining 95,000 coins were set aside to support the growth of the BTG community’s ecosystem.

Continuing the long-term downward trend of dwindling nodes as Bitcoin Gold continues to stay afloat, as of June 1, 2021, Bitcoin Gold has 89 reachable nodes. The highest concentration of nodes is in Germany , with the next highest levels being the United States , France , Canada , and the Netherlands .

More Ups And Downs: Bitcoin Price From 2011

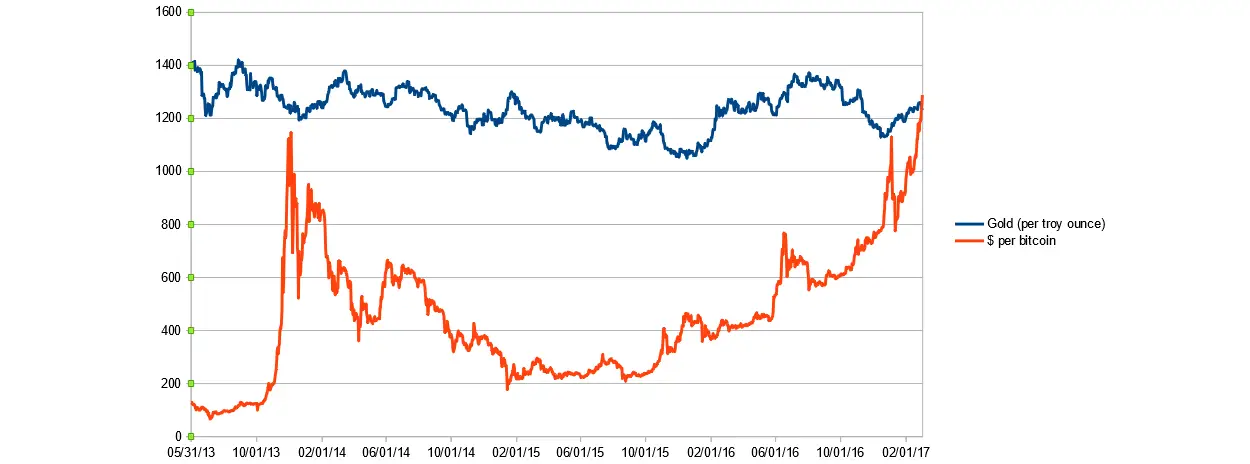

Despite these drawbacks, a quick glance at the Bitcoin price indicates it has only grown in popularity since 2010-11. Consider that in 2010 there were under 10,000 transactions/month, while in 2017 that number rose close to 10 million. Or the fact that the Bitcoin price was USD $0.08 cents in 2010, while in 2017 it clears over USD $10,000 at the moment.

Bitcoin prices have experienced incredible ups and downs since entering the stock market in 2010. Within one year of trading it hit parity with the USD. By July of 2011, it ballooned to USD $31, a huge surprise to investors and miners alike . Sure enough, by December 2011, the Bitcoin price dropped to USD $2.

Did the Bitcoin price remain low from then on? If you have learned one thing about the Bitcoin price by this point, its that it follows no rhyme or rhythm. The Bitcoin price began to rise between 2011-2013, even reaching into the thousands before dropping once again.

What exactly was keeping the Bitcoin price from solidifying? A lot of things, but mainly a solid user base. From 2013 to 2016 Bitcoin prices began to solidify around a growing base of users. Prices hovered around USD $500 during these years, with no clear avenue for expansion in sight until 2017 when the stock began its steady rise.

Will Bitcoin Gold Reach $170

Given that the coin is currently trading at about 44 USD, it will require a four times increase in price to reach the $170 mark. On May 6, 2021, the value of BTG rose to $168.19, and experts are forecasting a bullish price action in the future, as seen from the Bitcoin Gold price prediction.

No one can say what the price of a digital currency will be, but if we are to go by the Bitcoin Gold price prediction and previous price actions, BTG could reach an expected maximum price of $170 by 2024.

Cryptocurrency investments are profitable but highly speculative and very risky. A coin could hit a new high price, and in the next minute, lose all its gains. Hence, always consult with professionals before investing.

Don’t Miss: How Much Is 1 Oz Of 24 Karat Gold Worth

Bitcoin Gold Price & Market Data

Bitcoin Gold price today is $51.23 with a 24-hour trading volume of $9,615,454. BTG price is down -3.3% in the last 24 hours. It has a circulating supply of 18 Million BTG coins and a total supply of 21 Million. If you are looking to buy or sell Bitcoin Gold, Bitfinex is currently the most active exchange.

Bitcoin Gold hopes to change the paradigm around mining on the Bitcoin blockchain. According to the founders, the Bitcoin blockchain has become too centralized. Large companies with huge banks of mining computers now mine the vast majority of Bitcoin. For the founders of Bitcoin Gold, having large companies control the Bitcoin network defeats the purpose of a decentralized ledger and peer-to-peer currencies. In response, theyve initialized the Bitcoin Gold project. Its an alternate fork of the Bitcoin blockchain that implements changes that make mining more equitable.

Is Bitcoin Gold Price Forecast Always Accurate

There is no 100% guarantee that the actual price dynamics of BTG will follow a forecast or any particular approach. However, a price forecast provides extensive market insight into a coin of interest.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Read Also: What Is There To Do In Golden Colorado

Similarities Of Gold And Bitcoin

Cant Be Hyperinflated

One of the most obvious similarities between gold and Bitcoin is the cap on the quantity available. Whereas fiat money can be printed into infinity, both gold and Bitcoin have specific restrictions on the amount that can be introduced into the economy.

For Bitcoin, there is a 21 million bitcoin limit imposed into the mathematical algorithm and this number cant be increased. As for gold, the yearly new supply is limited to around 2,500 tons as the world gold supply dwindles or becomes harder to reach using modern gold mining techniques.

Deflationary

Keynesian economists biggest criticism of gold and perhaps also of Bitcoin, is that they are deflationary in nature, due to the supply limitations mentioned above. They believe deflation creates what are called “liquidity traps”. Thidea is that if the value of money is constantly going up, people may hoard it, and there won’t be anyone spending money or loaning it out. Business won’t be able to sell goods or get additional capital to increase production because of this hoarding.

Gold and bitcoin have no owner or central entity keeping it together. In golds case, it is a part of the planet. as for Bitcoin, it is an open source software that is maintained by a network anyone can transact on. Attacking or manipulating these decentralized currencies is likely to result in financial loss for the attacker and an increase in perceived value of the asset once it resists the attack.

Minimum Counter Party Risk

Is It A Good Time To Trade Bitcoin For Precious Metals

Definitely! Cryptocurrency and precious metals are becoming highly sought after because of fears of inflation pegged to fiat currency. As inflation increases, the dollar decreases, leading to gold, silver, and now Bitcoin to rise in value.

Now, Bitcoin does have its downsides, like market volatility and government regulations increasing more frequently. Because of cryptocurrency uncertainties, many investors continue to buy more stable assets and stores of value like gold, silver, platinum, and palladium.

Also Check: Where To Buy Gold For Investment

Bitcoin Gold Price Prediction 2025

Several analysts in the cryptocurrency space quite agree on a positive price momentum for Bitcoin Gold, but with the much-expected variation in price predictions. The growth of Bitcoin Gold by 2025 will be dependent on several parameters, including the integration of notable features into its blockchain and the overall dynamics of the crypto market.

Cryptoground says Bitcoin Gold will trade at $415.5719.

If the price momentum is bullish by the turn of 2025, we expect BTG/USD to trade above the $300 mark and possibly aim for higher price targets.

How Forks Affect Bitcoin Price

Forking has a direct impact on the Bitcoin price, often defined by short-term loss and long-term gain. Hard forks in particular, force a short-term loss of value to the Bitcoin stock overall, especially for the fork without the majority.

Consider the shift that occurred between Bitcoin and Bitcoin gold. The Bitcoin price has remained very strong in the long-term, while the Bitcoin gold price initially dropped 60 percent before gradually making noticeable gains. Forks can happen at any time, and will certainly lower the Bitcoin price for weeks following the change.

Holders of Bitcoin prior to the fork will benefit tremendously from a fork because they will now own copies of each side up to the split. So, if the Bitcoin price drops a little bit it is not felt by the investors, who all make close to double their money as long as its in their own wallet.

Are you wondering about the Bitcoin price today? The speed at which Bitcoin price has been changing is unparalleled on the market. Keep up to date with the latest Bitcoin price and Bitcoin cash prices today so you dont miss out on a major fork!

Don’t Miss: Can You Hold Gold In An Ira

Why Gold Is The Better Bet Next Year

Bitcoins incredible run has overshadowed gold to close out the year, but that should take nothing away from the old guards performance in 2020. Investors rushed to gold, as the COVID-19 pandemic sowed massive uncertainty over the course of this year. The yellow metal managed to rise above $2,000/ounce in the summer. It has since retreated but still sits at a respectable $1,880/ounce at the time of this writing.

Predictably, gold mining stocks have benefited in a big way from the rally. Yamana Gold, a top Canadian gold producer, has seen its stock increase 46% in 2020 as of close on December 17. Shares are up 59% year over year. While the spot price of gold has retreated marginally, the year-over-year increase is still great news for the profitability of gold miners. Still, could gold break its all-time records in the coming year?

Low interest rates and loose monetary policy is certain to carry into 2021 and beyond. Governments around the world are reeling from this crisis, and investors should expect a fresh batch of stimulus packages in the new year. As the global recovery gathers steam, some experts predict that the U.S. dollar will continue to weaken. This is a bullish sign for gold.

Who Are The Founders Of Bitcoin Gold

Bitcoin Gold was founded by a group of enthusiasts with diverse backgrounds and skills. Hang Yin is a co-founder and lead developer at Bitcoin Gold. He graduated with a degree in computer science from Fudan University in 2015. His professional career started right after he graduated. In late 2015, Yin became a software engineer for Google. After three years with the tech giant, Hang Yin decided to venture into entrepreneurship by starting Bitcoin Gold. In 2018, he also participated in the founding of HashForests.

is the second co-founder of Bitcoin Gold, and he is also a board member at the company. He graduated with a degree in computer software engineering from the Technical University of Sofia, and his professional path started as a food service worker at McDonalds. In 2015, he became an assistant professor at the Technical University of Sofia, and in 2016, he started a job as a lead iOS developer at phyre JSC. Since co-founding Bitcoin Gold in 2017, he has also launched another company called GoStartups.net. Currently, Kuvandzhiev is also the CEO of Assetify.

What Makes Bitcoin Gold Unique?

Bitcoin Gold is a unique combination of the inherent properties of the original Bitcoin blockchain and an innovative approach to blockchain development and applications. As a hard fork of the original Bitcoin token, BTG aims to revolutionize the mining process by introducing a new proof-of-work algorithm that combats the scalability issues Bitcoin struggles with.

Related Pages:

Don’t Miss: Who Buys Gold In Lexington Ky

Why Is Bitcoins Price So Volatile

Bitcoin is a particularly volatile stock because it is subject to excess speculation. Many venture capitalists and investment banks have bought up huge amounts of Bitcoin under the assumption it will become a commonly used currency. This remains to be seen, but the expectation has certainly affected the Bitcoin price.

Aside from excess speculation, here are several factors that influence the Bitcoin price today:Still in Development Stage. Unlike a precious metal like gold, which has been a part of human civilization for thousands of years, Bitcoin has only been in existence for nine years. It is still in a development stage, and as such, it is unclear how long it will take for the Bitcoin price to stabilize.Hacking Affects Its Value. Whenever there are security threats in the network, its value and Bitcoin price sinks dramatically.Issue of Scale. Debates within the community are on-going as to the future of Bitcoin. If the community fragments, it will take longer for Bitcoin to scale up in size.General Knowledge. The more average investors put a little money into Bitcoin, the higher the stock will go. Like any other currency, the more people use it the more value Bitcoin price accrues.

How To Buy And Sell Bitcoin Gold

Like Bitcoin, Bitcoin SV, and other coins, Bitcoin Gold can be purchased or sold on cryptocurrency platforms that support the ecosystem. You can also swap/sell BTC for BTG on a Bitcoin exchange.

Heres how to buy Bitcoin Gold:

- Look for a secure cryptocurrency exchange.

- Set up an account.

- Provide identification and payment details where necessary.

- Fulfill KYC requirements.

- Determine the amount of coin you want to buy, confirm the exchange rates, and buy Bitcoin Gold.

- If you prefer hardware wallets over digital wallets, that option is available too.

Heres how to sell Bitcoin Gold:

- Ensure that you already have your Bitcoin Gold coin in your wallet.

- Visit any secure crypto platform with support for BTG, and type in your sell amount.

- If the rates work for you, sell your Bitcoin Gold.

- If youre selling for another digital asset, ensure that the receiving address is secure.

Also Check: How To Buy Gold In Robinhood

Will Bitcoin Futures Help Limit Volatility

It is likely that Bitcoin futures investing will ease the volatility of Bitcoin prices. Once the Chicago Mercantile Exchange begins accepting futures, investment banks will instantly begin trading in the cryptocurrency. Why? Because futures represent a slight bit of regulation on the Bitcoin price that should help keep it from the boom and bust cycle its in today.

Are There Any Security Concerns Using Bitcoin

Using Bitcoin is an extremely safe way to make purchases or exchange currency. Your data is anonymous in the system and the only identifier is your Bitcoin address. This will allow you to purchase your gold without telling the world that you did so.

Another security feature you will find is that all transactions are encrypted. Nodes on the network will go through a process of solving extremely complex formulations and then submit Proof of Work so that it can get verified. When the majority of the node network agrees that the formulations are correct, then the transaction is complete.

Since all of these security features are extremely complex, no one can manipulate the transaction without the verification process. As soon as the transaction is applied to the blockchains ledger, no one can change it.

Recommended Reading: How To Prospect For Gold

What Makes Bitcoin Gold Distinctive:

- Faster payment process as the cost of transaction is kept low to enable investors to transact using the credit card

- Low/minimal payment fee and no hidden or hefty charges

- Not dependent on any payments from the bank or its network accessibility as no approval required from any third party

- Alternate to physical commodity

- Easy to store and secure, offering maximum reliability without going through the trouble of carrying bulky bags

- Power in the hands of user and investors eliminating the role of intermediary

- Confidentiality of investor and transaction preserved with utmost discretion as no KYC revealed and payments are not linked to traditional verification

- Acceptance of costs from any source or origin

- Enabling payments and transfers through the press of a button on users cell phones

- The most important feature, they are Fraud-proof as they are stored in a public ledger, and all coin owners are encrypted toensure the legitimacy of record-keeping

Why Was Bitcoin Created

Bitcoin was created in response to the financial crisis of 2008, when it became clear to Mr. Nakamoto and other activists that the global financial elite were leading people astray. Bitcoin offered its users the chance to circumvent financial authorities and keep currency exchange away from private interest.

Here are a few issues with the global banking system that Mr. Nakamoto addresses with Bitcoin:Lack of Transparency. Many people take issue with the investment work done by banks in private. There is no prerogative for a conventional bank to be up-front with their investments, and this makes it harder for customers to hold trust. Bitcoin is meant to encourage more transparency and accountability in the banking sector by forcing financial institutions to adopt similar measures or letting customers choose Bitcoin over conventional banks.Move away from the floating exchange rate. The ability for central banks to print money when the economy lags has created a tremendously unstable economic system. Bitcoin operates on a finite supply and, much like the gold standard, could become an effective solution to the floating exchange rate if the Bitcoin price ever stabilizes.Reduce influence of banks and governments in the economy. The government bail-out of big banks in 2008 made it clear to Mr. Nakamoto that the current system was broken and an alternative system was needed.

Don’t Miss: Can You Buy Gold Bars From Us Mint