How Much Is A Gold Bar Worth

One of the common questions we hear from potential investors who are interested in owning precious metals is: just how much is a gold bar worth?

Before we get down to the details, it is worth noting that not all gold bars cost the same. Even though some bars have similar size and weight, they were not necessarily bought for the same price. One of the reasons for this is the fact that the price of gold bars changes every day.

Currently, gold is worth $1,708,60 per ounce, but this price may change at any moment. Investors who own more gold bars will have more value, while those with coins and smaller gold bars have less worth.

Besides the market gold price, a few other factors impact the end value these factors include the current political situation, upcoming elections, the coronavirus, and the U.S. economy.

These are some of the factors worth examining further for potential investors who plan to own physical gold as part of their portfolio.

What Is Gold Bullion

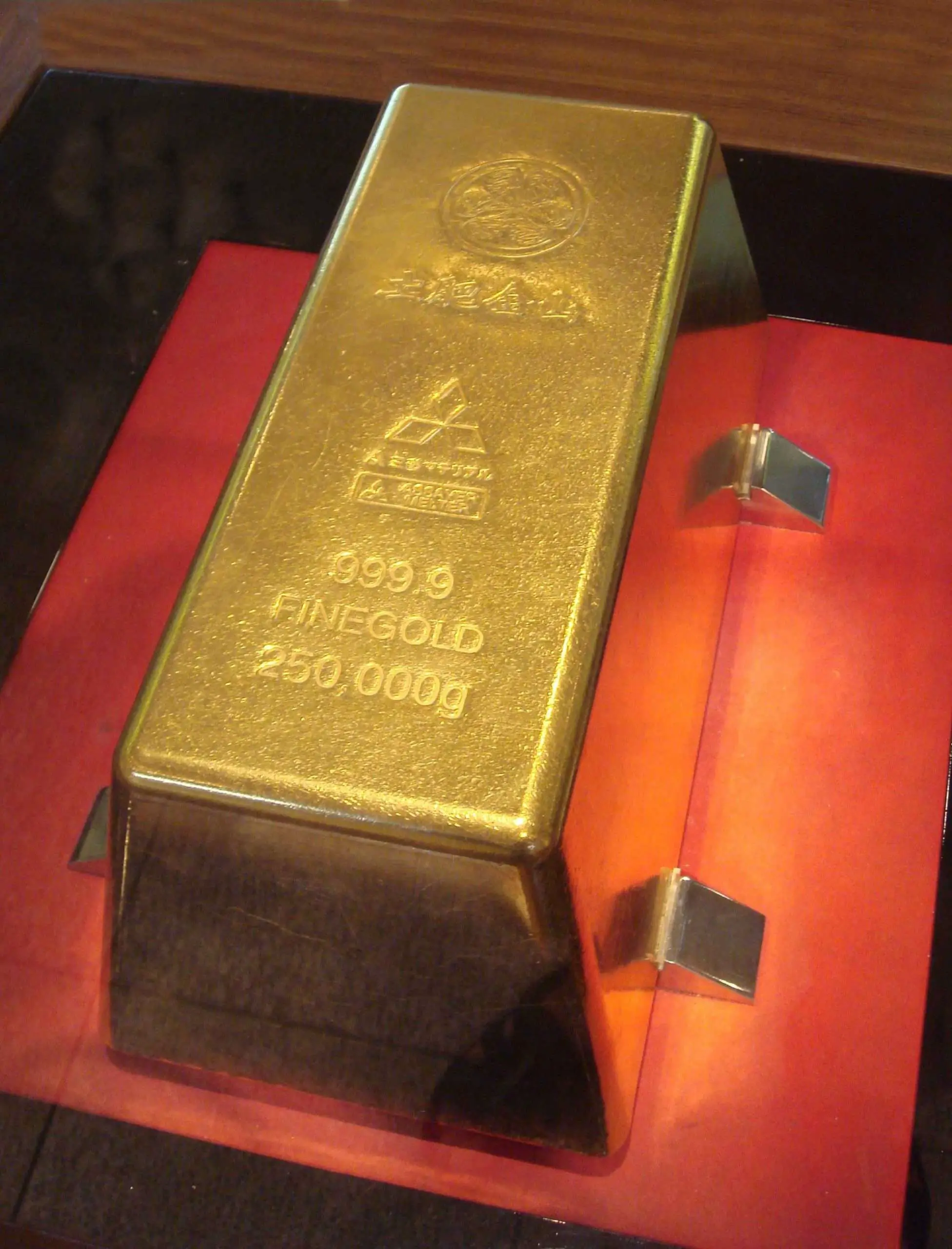

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Solid Pure 24k Gold Amounts

This calculator tool is based on the pure 24K gold, with Density: 19.282 g/cm3 calculated Gold can be found listed either in table among noble metals or with precious metals. Is it possible to manage numerous calculations for how heavy are other gold volumes all on one page? Yes, all in one Au multiunit calculator makes it possible managing just that.

Convert gold measuring units between gram and troy ounces of gold but in the other direction from troy ounces into grams.

| conversion result for gold: |

| oz t |

Also Check: Buy Gold Now Or Wait

What Are The Factors That Affect The Gold Price

- 1. Demand and supply of Gold

- 2. Speculations

- Technology: 11%

- Unaccounted: 2%

They are available in markets. Bullion bars and coins are mostly used for investment of money, and jewelry is used to be worn, and it was used as an investment in the old-time, still, in some countries, it is used for investment.

Gold Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The gold price in CAD is updated every minute. The data comes from the gold price in US Dollars converted at the exchange rate of the USD/CAD pair.

You May Like: Kay Jewelers Sale 19.99

Buy Only Physical Gold

You can invest in gold by buying futures, ETFs that track the commodity, and many other financial instruments. While these methods are more convenient, it is not as safe or guaranteed as buying physical gold. When you own gold bullions, you can keep or trade it without encumbrances.

You may buy gold bullions online, or from known retailers in your area. Once you have the gold, secure it in a home safe or safety deposit box at your bank.

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

You May Like: Tinder Gold Free Code

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

How Much Is 100 Pounds Of Gold Worth

troy

| 100 Troy Pounds of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Don’t Miss: A Brick Of Gold

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Read Also: Gold Brick Weight In Pounds

Is The Price Of Gold Im Quoted Going To Be The Price I Pay

Gold prices change, and they can change quickly, even by the minute. This makes the prospect of buying gold a little nerve-wracking for some investors new to the process. You might wonder if the price youre quoted will be the gold price you pay if the prices fluctuate up and down constantly.

The good news is that gold bullion dealers “lock in the price” when your order is placed, so that will be the price of gold you pay regardless of what occurs afterwards. If youre buying gold online, then you can lock the price in at the checkout page. Then, youll have a specific amount of time to make your purchase and keep the current price of gold. If you take too long, the lock-in is removed, and youll pay the new price of gold instead .

However, understand that not all gold dealers offer online price lock-ins and purchasing options, so verify this before making any purchase decisions.

Is The Live Gold Price Just For The Us

Gold is traded all over the globe, and is most often transacted in U.S. Dollars. Gold can, however, also be transacted in any other currency after appropriate exchange rates have been accounted for. That being said, the price of gold is theoretically the same all over the globe. This makes sense given the fact that an ounce of gold is the same whether it is bought in the U.S. or Asia.

The price of gold is available around the clock, and trading essentially never ceases. While investors in the U.S. are sound asleep, for example, gold trading in Asian markets may be robust. The market is very transparent, and live gold prices allow investors to stay on top of any significant shifts in price.

The current gold price can be readily found in newspapers and online. Although prices per ounce in dollars are typically used, you can also easily access the gold price in alternative currencies and alternative weights. Smaller investors, for example, may be more interested in the price of gold per gram than ounces or kilos. Larger investors who intend to buy in bulk will likely be more interested in the gold price per ounce or kilo. Whatever the case may be, live gold prices have never been more readily accessible, giving investors the information they need to make buying and selling decisions.

Recommended Reading: Paint Colors That Go With Golden Oak Trim

How To Calculate The Gold Price

If you know the purity , weight unit, and your desired currency . Then provide these detail in the dropdown list mentioned above, and you will see the latest real-time gold rate calculation in your provided currency (currency rates are also latest and updated with 60 minutes interval. The complete description of how to use this calculator has mentioned below.

The Difference Between Standard Ounce And Troy Ounce

When gold traders mention ounces, they are referring to the troy ounce, not the standard measurement. The standard ounce , also called the avoirdupois ounce, is a metric in the US for measuring foods, but not precious metals.

A troy ounce of gold is equal to 31.1 grams of gold, while a standard ounce weighs less at 28.349 grams. If you think the slight difference between the two units of measurement wont significantly affect gold calculations, you are wrong.

Using the standard ounce instead of troy ounces for huge amounts of gold can lead to calculations that are up to 10% off the marka massive loss when trading on the gold market.

Even when dealing with small amounts of gold, problems arise when you use the wrong unit of measurement. For example, if you use a standard ounce of gold to make a piece of jewellery, it wont be as thick or as heavy as if you had used the troy system.

Don’t Miss: Kay Jewelers 19.99 Ring

What Is The Gold Jewelry Price Calculator

Gold ornaments comprised of various purity level, 24K is the purest form of gold, while 22k gold consist of little impurity used to make the gold ideal for jewelry designs like the bangle, ring, etc. 22k jewelry is comprising of standard quality gold, but some contain low karat , e.g., 20k, 18k, 16k, etc. Detail of gold jewelry price calculator.

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

You May Like: 400 Oz Gold Bar For Sale

How Can I Sell My Owned Gold

It depends upon the nature of the gold you have owned. It may be gold coins, bangles, necklaces, rings, bracelets, earrings. There are many places available in every country for selling those gold items. However, the selling price may be different in different locations, time, and other factors. Here you can find more information about how to sell gold.

What Are The Largest Gold Producing Countries In The World

The following are four largest gold producing countries, and they are producing more than 40% gold out of 2990 MT . Some decades before, they were not appearing in the map of the largest gold producers, but recently they became the leader of the gold market. These countries significantly affect the price of gold. They had the largest gold reserves and underground unmined gold. Though, there are some countries of the world, which claims of owning huge gold reserves. But there is no authentic proof of that.

1. China:

As per a survey conducted in 2014, China produced 450 Metric tons of gold, which is 15% of the world . Of course, China had a vast territory, and it has more mines than any other country of the world, still a considerable amount of gold underground that is around 1,900 tons, and had about 1762 ton gold reserves, and ranked on the sixth number. Therefore, China influence the International gold market, and can drive gold price up or down. The demand for Gold in China is also increasing day by day, and a significant percentage of gold is using in jewelry.

2. Australia:

3. Russia:

It produced 247 metric tons of gold that are closer to Australia, and 3rd number in the list of largest gold producing countries. In January 2016, Russian gold reserves exceeded the 1414 tons limit and currently in the list of owning most gold reserves. Russia does not export a considerable amount of gold but imports to increase the reserves. Around 5,000 tons are underground and unmined.

Also Check: Does Blizzard Ban Gold Buyers

One Gram Of Gold Converted To Ounce Equals To 0032 Oz T

How many troy ounces of gold are in 1 gram? The answer is: The change of 1 g unit of a gold amount equals = to 0.032 oz t ) as the equivalent measure for the same gold type.

In principle with any measuring task, switched on professional people always ensure, and their success depends on, they get the most precise conversion results everywhere and every-time. Not only whenever possible, it’s always so. Often having only a good idea might not be perfect nor good enough solutions. Subjects of high economic value such as stocks, foreign exchange market and various units in precious metals trading, money, financing , are way too important. Different matters seek an accurate financial advice first, with a plan. Especially precise prices-versus-sizes of gold can have a crucial/pivotal role in investments. If there is an exact known measure in g – grams for gold amount, the rule is that the gram number gets converted into oz t – troy ounces or any other unit of gold absolutely exactly. It’s like an insurance for a trader or investor who is buying. And a saving calculator for having a peace of mind by knowing more about the quantity of e.g. how much industrial commodities is being bought well before it is payed for. It is also a part of savings to my superannuation funds. “Super funds” as we call them in this country.

List with commonly used gram versus troy ounces of gold numerical conversion combinations is below:

- Fraction:

Is A Gold Etf The Same Thing As Buying Physical Gold Bullion

No, theyre not the same at all. There are actually crucial differences between bullion and ETFs.

Yes, you can invest in gold ETFs if you prefer to perhaps trade in the short term. However, it is important to understand that gold ETF exposure will not provide you with actual gold bullion that you can own and hold outside the financial system. Gold ETFs also always continuously charging fees which can eat into your investment capital over the years. You can find some of those fees, when you learn about the best ways to buy physical gold bullion.

While most gold ETFs are supposedly backed by gold, you will likely not pay the bullion price nor receive any gold bullion at all for your investment. They are priced very differently, and they trade on the market in a completely different manner than physical gold, as well. Theyre also affected by other forces, so they may not make a good investment choice for your specific situation. If youre considering an ETF rather than physical bullion, think long and hard about it. Most investors prefer owning the actual physical precious metal itself. Gold ETFs often obstruct investors from many of the best safe haven aspects which actual gold bullion offers.

You May Like: Kay Jewelers Adoption Jewelry

I’ve Heard That Gold Traded 24/7 Is That True Is There An Open And A Close

Gold, actually trades 23 hours a day Sunday through Friday. Most OTC markets overlap each other there is a one-hour period between 5 p.m. and 6 p.m. eastern time where no market is actively trading. However, despite this one hour close, because spot is traded on OTC markets, there are no official opening or closing prices.

For larger transactions, most precious metals traders will use a benchmark price that is taken at specific periods during the trading day.