Want To Invest In Gold The Gold Experts At Oxford Gold Group Can Help You Today Give Us A Call

When you want to invest in gold for your savings or retirement fund, the experts at Oxford Gold Group can help. We understand the risks when investing in gold, both physically and monetarily. Our trusted team of gold experts will work with you through every step to ensure your investment is in safe hands.

Are you looking to invest in your retirement or saving account? If you let Oxford Gold Group help with your next investment, youll be on track to reaching your goal of the retirement or savings account you always dreamed of. Were proud to have helped thousands of investors build their retirement and savings accounts over the years. For testimonials, read our customer reviews.

Call us at, or visit our Contact Page for more information!

Can You Buy Gold At The Spot Price

Not likely. As noted, the spot price is determined by the action in the futures market. It is for unfabricated metal . There are value-added costs involved in transforming molten metal into a gold or silver coins, small bars, or jewelry. So premiums are charged along the way: by the refiner, the fabricator who manufactured the product, and the dealer who procures and sells the product.

Your cost will depend on the form of gold you buy.

What Is a “Premium?”

A premium is the amount over spot price that you pay. It is the sum of the additional fees charged to consumers for the services of refining, molding, fabricating, and handling precious metals.

The lowest-premium items are bars, which can be either poured or stamped. Coins and rounds carry slightly higher premiums, since they have more intricate designs and are always stamped. Gold jewelry tends to carry the highest premiums, given the craftsmanship involved .

All dealers charge a premium over the spot price. Heres how to find a reputable dealer with competitive premiums, along with advice on what to buy.

How Does the Gold Market Differ From the Stock Market?

The stock market involves the trading of stock, the transfer of shares from sellers to buyers. For the most part, buyers want to own that stock in their account until they sell it for a higher price. This holding period can be measured in seconds, decades, or any time period in between.

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

You May Like: How To Buy Gold In Robinhood

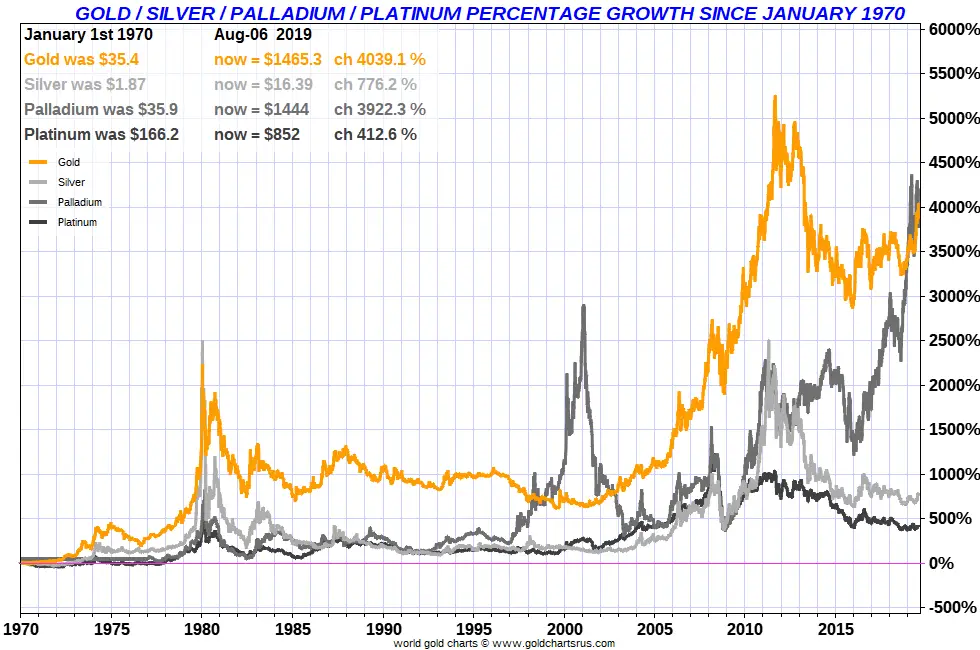

The Value Of A Gold Investment

Trading in gold should be seen as a long-term investment. Gold tends to hold its value well over the long term, but it is always susceptible to market forces. Historically, the price of gold has been shown to increase as the US dollar decreases, a comparative phenomenon known as the Gold Index. Additionally, gold prices have done well in even the most inflationary of periods. Investing in gold is an excellent way to keep a diversified portfolio for every investor.

Importance Of Spot Gold Price

Just like in any other form of investing, future ROI gained is set upon purchase. Tracking the live spot gold price should be the most important variable in your decision to invest. When purchasing any gold bullion investment, just like in all other forms of investing, buy your gold as low as possible and sell in waves near the peak.

You May Like: How Much Is 10k Gold Worth

The Silver Market Never Sleeps

The market remains open from 6 p.m. to 5:15 p.m. every day except Saturday. That means there is only 45 minutes a day when markets are officially closed.

However, given the immense number and volume of transactions being placed during opening hours, investors cannot afford to take their eyes off the live silver prices even one day a week.

Silver prices are volatile, changing every minute of the day. Stay as up-to-date as possible with live silver prices from SilverGoldBull.ca. Our online resource is the most accurate metric of live silver prices available. Simply hover over any point in time to see historical silver prices, or grab the sliders and make a particular selection to see more specific information about silver prices from that period of time.

What Happens To Precious Metal Prices In A Recession

Some metals tend to correlate strongly with the business cycle and may therefore perform poorly during a recession. Gold and silver are more counter-cyclical and can benefit from a bad economy accompanied by safe-haven flight out of the stock market.

The premier safe-haven hard asset is gold. Prices for the money metal have gained during five of the past seven recessions that have occurred since 1970. In 2008, gold was one of the only alternative investment assets to show a gain for the year.

Silver is less reliable during economic downturns. It performed fantastically during the stagflationary 1970s. But in general silver tends to fare poorly when a bad economy causes demand from industrial users to weaken.

Rising investment demand can make up some of that decline. Silver is historically and foundationally a form of money. During a financial panic or currency crisis, the masses may rediscover its monetary utility. That makes silver more promising to hold during hard times than a straight-up industrial metal.

Don’t Miss: How To Get Free Golden Eagles In War Thunder

How High Could The Price Of Gold Go

Gold has served as a safe haven for literally thousands of years. So if fear is high or a crisis develops in the markets or economy, investors instinctively rush to gold, and the demand pushes its price higher. Believe it or not, gold soared over 2,300% in the 1970s, because there was a series of crises underway two recessions, an energy embargo, runaway inflation, and sky-high interest rates. Combined, they served to push golds price to its inflation-adjusted all-time high.

We think there are a multitude of outsized current risk factors again, and that a series of crises is headed our way if so, gold and silver prices are likely to hit new all-time highs. A five-figure gold price is possible if the crises are severe enough. Heres what a dozen of the largest investment banks predict for gold prices in 2018.

What Is The Spot Price

The spot price is typically the base price of one troy ounce of a metal in any form. Any transaction you make in the gold market will be based upon the spot price.

Any quote of the spot price of gold in grams or kilos is typically just a conversion of the value in ounces, and not a separate trading market. Its the same for other currencies, like the euro or yuan, which are usually calculated using current foreign currency exchange rates.

Any buying and selling you want to do will be based upon the spot price at the moment of purchase or sale. Purchases are based on the ask price, and sales are based on the bid price.

Also Check: Can I Buy Gold Jewelry From Dubai Online

What Should My Decision Be If Im Only Interested In Building Up A Stockpile Of Physical Silver And Not Concerned With Collectability

If your only goal is to invest in silver and to do it in a way that allows you to create a significant buffer against devaluation and disaster, the best path forward is to buy low premiums silver rounds or silver bars. The amount you purchase initially will hinge on how much capital you have to invest. Those with limited funds might decide to buy a few ounces at a time.

Those with more capital might consider buying larger bars with each purchase. However, those buying larger sized bars will ultimately see the lowest price per ounce of silver. The reason is it costs companies less to create larger bars than it does smaller ones. In a way, its a lot like buying in bulk. The more ounces you buy at once , the lower the price will likely be. Note that this does not generally apply to buy multiple one-ounce silver bars. In so doing, you will still pay a higher price of silver per ounce than if you were to buy larger silver bars.

Why Are Gold And Silver Prices Being Suppressed

Gold and silver are the ultimate forms of money. When they are rising rapidly in value versus fiat currencies and paper assets, governments, central banks, and investment banks on Wall Street get nervous. A sharp rise in precious metals prices suggests not all is well in the financial world.

The bullion banks can try to combat rising demand for physical metal by flooding futures markets with paper sell orders. It might work in the short-term, but it will ultimately fail if the paper market loses credibility.

Spot prices could diverge from real-world pricing in the markets for physical precious metals. For example, during periods of extreme stress in markets it may be impossible to obtain physical metal anywhere near the quoted spot price. Premiums on retail bullion products may surge as a consequence. When the physical market diverges from the paper market, wholesale over the counter prices may be more realistic than spot prices.

Recommended Reading: Heaviest Credit Cards 2020

How Is The Gold Per Ounce Price Determined

Gold is a leading globally bartered asset that is traded on numerous futures markets. The most renowned and recognized exchanges include the New York Mercantile Exchange, the Chicago Mercantile Exchange, the Hong Kong Mercantile Exchange, Zurich, and London. COMEX is the essential business sector for exchanging metals, such as gold, silver, copper, and platinum. Once known as the Commodity Exchange Inc., COMEX converged with the New York Mercantile Exchange in the early 1900s and was designated as the primary division responsible for the precious metal exchange, including but not limited to the designation of the spot price of gold.

When determining the spot price of gold, it is important to note that the calculation is based on the front-month futures contract which is traded on the COMEX. The term front-month is utilized in futures trading in reference to the contract month with an expiration date nearest to the present date, which is usually around the same time.

Approximately 31.1035 grams of 24 karat pure gold makes up a troy ounce, while a kilogram consists of 32.15 troy ounces. The gold spot price per ounce is influenced by various factors, including these major ones:

How Often Do Gold Spot Prices Change

Spot prices for gold are constantly changing, as can be seen on any gold price chart. The price floats freely on the market and responds to real-time trading behavior.

U.S. markets close at 5:15 pm in New York, but gold continues to trade âovernightâ in Asian and Australian markets. Today’s gold price is rarely the same as yesterday or tomorrow. Therefore the spot price can change at virtually any time.

Historical charts before about 1950 don’t reflect this. Reliable data about the historical gold price is harder to find. Gold prices today are more dynamic and well-documented.

Recommended Reading: How Much Is 10k Gold Worth

Is There A Gold Spot Price Calculator

On our SilverGoldBull.ca website we display the price of gold in a number of different measurements gold prices per gram, gold prices per ounce, and even gold prices per kilo. Our calculator uses the most up-to-date live gold price data to ensure you are able to make the wisest decisions possible. When purchasing your gold bullion investments, make sure you take advantage of the most ideal gold prices, thereby securing a maximum ROI in the long term.

History Of Silver Prices

Silver and silver prices have played an important role in human cultural and economic development. The status of silver as a precious commodity made silver an important currency in early market economies, while its aesthetic appeal has remained strong ever since silvers discovery in Ancient Egypt.

To the Egyptians of the Old Kingdom, the silver price was initially deemed higher than gold. Egyptians were already familiar with gold, and Pharaohs had no trouble collecting it for jewelry & personal use. However, when silver found its way into the Empire, it quickly bore high prices as one of the most sought-after precious metals. Part of the reason for the heightened status of silver was that, because silver had never been seen before, the Egyptians assumed it was rarer than gold. Pharaohs and the wealthy upper class of Egyptian society were mesmerized by the shimmering quality of silver, and for many years in the Old Kingdom, silver had higher prices than gold.

Don’t Miss: Pay Golden Gate Bridge Toll Invoice Online

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Gold Futures Traded Lower On Monday October 11 As The Yellow Metal Took Cues From International Markets On The Multi Commodity Exchange Gold Futures Due For An December 3 Delivery Were Last Seen Trading Lower By 037 Per Cent

Gold Price In India: Gold futures traded lower on Monday, October 11, as the yellow metal took cues from international markets. On the Multi Commodity Exchange , gold futures due for an December 3 delivery, were last seen trading lower by 0.37 per cent – at Rs 46,864, compared to their previous close of Rs 47,037. Silver futures due for a December 3 delivery were last down 0.52 per cent at Rs 61,480 against a previous close of Rs 61,801.

Domestic spot gold with purity of 24 carats opened at Rs 46,966 per 10 grams on Friday, and silver at Rs 61,475 per kilogram – both rates excluding GST, according to Mumbai-based industry body India Bullion and Jewellers Association .

Foreign Exchange Rates:

The dollar was underpinned as U.S. yields outpaced those in Germany and Japan, lifting it to the highest since late 2018 on the yen at 112.67. The dollar index held at 94.133, just off the recent top of 94.504.

The firmer dollar and higher yields have weighed on gold, which offers no fixed return, and left it sidelined at $1,756 an ounce.

What Analysts Say:

Ravindra Rao, CMT, EPAT, VP- Head Commodity Research at Kotak Securities:

Recommended Reading: Kay Jewelers Guest Appreciation Event

Where Is The Best Live Silver Prices Listing

You will not finder a better resource for observing the live price of silver than our silver price tracker. We measure fluctuations in the price of silver, gold prices and platinum prices as they are happening in real time. SilverGoldBull.ca is the ultimate hub for measuring the ever-changing silver price. Monitor the live price of silver with our silver price chart data and absorb insights into past silver price trends & potential future prices of silver. Silver prices change every minute of the day, so stay informed and invest in silver wisely.

Use Silver Prices To Gain Economic Insight

Silver prices traditionally make sudden jumps as global economies turn bearish, so by monitoring live silver prices you will be able to gain major insight into the health of the global markets. When silver prices spike, you can be sure turbulent and uncertain times are here if not fast approaching, so be sure to monitor our live silver prices to gain insight into these unpredictable market signals for the betterment of your entire investment portfolio. Simply drag the left and right sliders to select any time period for insights into past silver prices.

Also Check: What Dentist Does Gold Teeth

From Where Does The Silver Spot Price Come Who Sets The Silver Prices Today

The fluctuating spot price of silver gets mostly set by COMEX headquartered in New York and gets based on the amount of highest traded near-term silver futures contracts. As with the spot price of gold, the spot price of silver is relatively the same around the world, even though it trades in many separate exchanges valued in various other fiat currencies.

Note that the NYMEX in New York mostly sets both platinum prices and palladium prices daily.

The silver spot price market is open almost 24 hours per trading day, with a 60-minute closed period each day between 5:00 EST and 6 PM EST.

The silver price per ounce, therefore, changes almost always, and you must have an up to date silver price chart to compare the current silver price to historic silver prices. This page will provide you with information about the overall trend, whether moving up, down, or staying static.

Changes In Spot Price

As mentioned above, there are many reasons for the spot price of gold to change or the fluctuation of contango and backwardation in futures. But what exactly changes the spot price of gold?

Gold prices can vary for more specific global reasons, like the economy, activity in the U.S. Federal Reserve, worldwide political news, gas and oil prices, and supply and demand. Just like with every commodity around the world, gold experiences stagnant periods of slight movement or periods of more movement and activity in the market.

Supply and demand control worldwide markets for gold and other precious metals. Every minute, the spot prices for gold change in the market, causing investors to keep track of their gold assets each day to see if theyre in a period of activity or stagnation. Some of the most known stock markets in the world are the New York Stock Exchange , New York COMEX, among other regions such as Hong Kong, London, and Zurich. COMEX is the primary market for precious metals, and spot gold prices come from futures traded on COMEX.

You May Like: Who Makes Gold Peak Tea