Why Central Banks Buy Gold

Paid for and posted byWorld Gold Council

4 Min Read

Gold has been an essential component in the financial reserves of nations for centuries, and its appeal is showing no sign of diminishing, with central banks set to be net purchasers of gold once again this year. Indeed, central banks now hold more than 35,000 metric tons of the metal, about a fifth of all the gold ever mined. But what is it about gold that has made it such a key asset for so long?

One of golds primary roles for central banks is to diversify their reserves. The banks are responsible for their nations currencies, but these can be subject to swings in value depending of the perceived strength or weakness of the underlying economy. At times of need, banks may be forced to print more money, since interest rates, the traditional lever of monetary control, have been stuck near zero for over a decade. This increase in money supply may be necessary to stave off economic turmoil but at the cost of devaluing the currency. Gold, by contrast, is a finite physical commodity whose supply cant easily be added to. As such, it is a natural hedge against inflation.

As gold carries no credit or counterparty risks, it serves as a source of trust in a country, and in all economic environments, making it one of the most crucial reserve assets worldwide, alongside government bonds.

So while the origin of the central banks buying gold may have changed over the years, the reasons for holding the asset have changed little.

How Much Gold Does The Us Have

As of November 30, 2018, the US Treasury claims that there is 261,498,926 oz of gold bullion in official US Gold reserves.

Among all nations in the world, the official US Gold Reserves are the most significant amount of official gold claimed by one country by far .

The Department of the US Treasury records official US gold reserve at the values stated in 31 USC § 5116-5117 which gets held to this day at $42.2222 USD per Fine Troy Ounce of gold.

The ongoing market value of the physical gold reserves held based on the fluctuating gold spot price as of February 13, 2019, was $344.4 billion USD.

Below we will break down where in the United States this gold is supposedly stored and in what quantities.

As well, we will show you a bit of shade on the supposed Fort Knox gold holdings, as its historical audit trail since the 1933 gold confiscation is dubious at best.

History In The Making

State Rep. Giovanni Capriglione first proposed establishing a Texas state bullion depository during the 2013 session. The depository envisioned in that bill was developed partly in response to the 2008 recession.

At the time, lawmakers also expressed an interest in moving the gold holdings of the University of Texas/Texas A& M Investment Management Company back to Texas. UTIMCO, an investment corporation that manages assets for the University of Texas and Texas A& M systems, has $861.4 million in gold stored at HSBC Holdings in New York City and pays storage fees of about $606,000 a year.

The 2013 bill would have relied on state funds to cover operating costs, estimated at nearly $28 million over five years. But it didnt pass.

Capriglione put forth another bill in 2015 , this time proposing the depository be established as an agency of the state under the Comptrollers purview and built and operated at the expense of a private entity, using no taxpayer dollars. Governor Abbott signed this bill into law on June 12, 2015, and summarized its unique nature:

Then began a two-year process for a team of Comptroller employees who logged countless hours of research, developed and executed a request for proposals and then evaluated proposals from six responding companies before selecting a finalist.

Also Check: How Much Does A Gold Bar Weigh Lbs

Us Gold Reserves Ownership

The official gold reserves of the United States of America are owned by the US Government. This can be confirmed in the US Treasurys monthly report Status Report of U.S. Government Gold Reserve which details the size of these gold reserves and their storage locations.

Although the US gold reserves are officially held by the US Department of the Treasury, they are predominantly held in custody by the US Mint on behalf of the US Treasury at a number of US Mint facilities. Note that the US Mint is a part of the US Department of the Treasury, and it reports to the Office of the Treasurer which is one of the Offices that the Treasury Department is structured into. The Treasurer reports to the Deputy Secretary of the Treasury, who in turn reports to the Secretary of the Treasury, who in turn reports to the US President.

Difference Between Vaulted Gold And Other Forms Gold Ownership

Buyers of vaulted gold acquire direct ownership in gold. Buyers of structured products, which are based on the price of gold, acquire a claim against the issuer of the product, but no outright ownership in gold. Exchange traded funds or exchange traded commodities can be backed by vaulted gold. In legal terms, the position of an owner of such shares with regards to the physical gold is very different from the one of an owner of outright vaulted gold.

Bullion banks offer so-called gold accounts. Allocated gold accounts provide investors with full ownership of vaulted gold, while unallocated gold accounts provide investors only with claims against the provider, rather than any outright ownership in gold. Typically, bullion banks do not deal in quantities of less than 1000 oz in either type of account, which means that gold accounts are mainly targeted at institutional or very wealthy private investors.

Recommended Reading: Free Golden Eagles War Thunder

How Much Gold Does The Us Government Have

Gold has been hoarded by governments and individuals for longer than history remembers because the precious metal is so valuable. There are an estimated 244 thousand metric tons of gold in the world, which if gathered together would total a giant cube measuring 28 meters on each side. But where is all this gold? Around half of all gold in use by humans today exists in the form of jewelry, but this only accounts for around 93 thousand tons. Another 53 thousand is unrecovered underground reserves of gold, which leaves approximately 78 thousand tons of gold unaccounted for.

The United States government holds a large reserve of solid gold, like many other nations around the world. In this article, well break down exactly how much of the global gold supply is sitting in underground vaults beneath US soil. Were also going to explain why it is that so many different countries have a gold reserve, and how vital these stores are to the economy. In addition, well go over the other global nations holding a significant amount of physical gold. Read on to discover why gold reserves are important.

What Is a Gold Reserve?

About half of the Treasurys stored gold, as well as valuables of other federal agencies, is kept at Fort Knox.

Why Does The U.S. Have a Gold Reserve?

How Much Gold Does The U.S. Government Have?

How Much Gold Does The United States Really Have?

Which Countries Have the Highest Gold Reserves?

Valuation Of Us Gold Reserves

Unlike most of the worlds central banks that value their official gold reserves at market prices or market-related prices, the US Treasury values its gold reserves at a statutory price of $42.2222 per fine troy ounce of gold. This valuation procedure is defined within 31 US Code § 5116-5117. The statutory price per ounce of $42.2222, or $42 2/9, has been used as the book value calculation price for the US gold reserves since 1973. As of 30 September 2016, the US gold reserves had a book value of just over US$11 billion. See Status Report of U.S. Government Gold Reserve reference link. Note that if valued using a market value benchmark , the US gold reserves would have been valued at US$345.8 billion as at 30 September 2016.

The US gold reserves are also specified at book value in US Reserve Assets Table 3.12 under line item Gold Stock.

The Federal Reserve does not hold any gold, but holds US dollar denominated gold certificates whose value is based on the statutory price of $42.2222 per fine troy ounce. These gold certificates arose from the Gold Reserve Act of 1934 under which the Federal Reserve banks were required to transfer ownership of all of their gold to the US Treasury in exchange for gold certificates. The gold certificates held by the Federal reserve are not redeemable into gold.

Also Check: 18karat Gold Price

What Kind Of Impact Would This Have On Russia

The move should further impact the country’s ability to launder money and will in effect apply secondary sanctions on people who trade in gold with Russia, experts say. “It is another way to close sanctions loopholes, and increase economic pressure on Russian entities,” said Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security. The ban on gold transactions is also an attempt to prevent innovative financial transactions through other countries that continue to do business with Russia.

The United States Bullion Depository

Avast amount of the U.S. gold reserves is stored in the vault of the United States Bullion Depository at Fort Knox. It is one of six facilities under the supervision of the director of the United States Mint, an official of the United States Department of the Treasury. Located 30 miles southwest of Louisville, Kentucky, adjacent to the Fort Knox military reservation, the depository is home to a large portion of the United States gold bullion, with the balance stored in the Philadelphia Mint, Denver Mint, West Point Mint and San Francisco Mint.

Construction of the U.S. Bullion Depository at Fort Knox was completed in December 1936, at a cost of $560,000. The gold was moved to the depository in 1937 by rail, through the United States Postal Service. This was the only method of providing insurance for the gold at the time.

Today, the facility is equipped with state-of-the-art security systems and the latest technological advancements. The depository is headed by an officer in charge who is responsible for ensuring the security of the bullion. The facility is protected by a group of federal police officers, who are hand-selected by the U.S. Mint Headquarters in Washington, D.C. These officers must complete a rigorous training program at the Federal Law Enforcement Training Center in Glynco, Georgia, and pass a thorough background investigation.

Recommended Reading: Kays 19.99 Sale

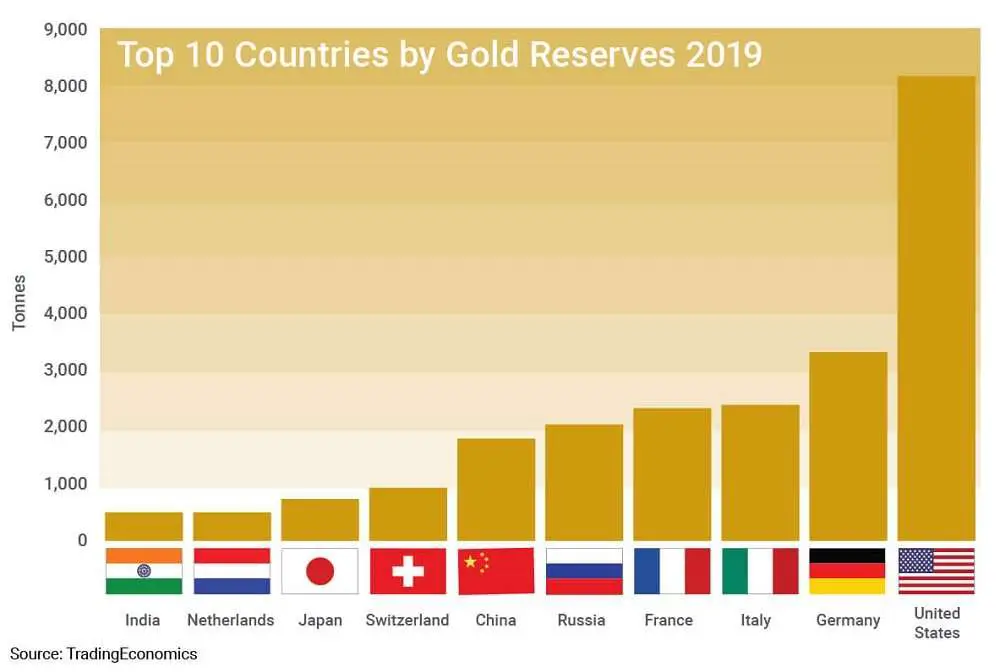

Top 10 Countries With Largest Gold Reserves

Beginning in 2010, central banks around the world turned from being net sellers of gold to net buyers of gold. Central banks around the world bought 272.9 tonnes of bullion in 2020.

Central banks have been net buyers of gold for 11 consecutive years. According to World Gold Council data, central banks around the world bought 272.9 tonnes of bullion in 2020.

Purchases last year were a whopping 60% lower than the record 668 tonnes added in 2019. The COVID-19 pandemic was a stronger driver for some central banks to sell reserves and inject liquidity into their economies. Purchasing was concentrated in the first half of the year, then turned nearly nonexistent in the third quarter and resumed in the last three months of the year.

The top 10 central banks with the largest gold reserves have remained mostly unchanged for the last few years. The United States holds the number one spot with over 8,000 tonnes of gold in its vaults nearly as much as the next three countries combined and accounting for 79% of total reserves. The only countries where gold represents a higher percent of reserves are Portugal at 80.1% and Venezuela at 82.4%

Below are the top 10 countries with the largest gold holdings, with the rankings remaining unchanged from 2019. Figures are as of April 2021 and do not include the International Monetary Fund as a country, or else it would hold the number three spot with 2,814 tonnes.

Tonnes: 612.5

Percent of foreign reserves: 67.4 percent

What Countries Have The Largest Gold Reserves

The United States holds the largest stockpile of gold reserves in the world by a considerable margin. In fact, the U.S. government has almost as many reserves as the next three largest countries combined . Russia rounds out the top five. The International Monetary Fund is reported to have more gold reserves than Italy but less than Germany.

Gold has served as a means of exchange, to varying degrees, for thousands of years. For much of the 17th to 20th centuries, the paper money issued by national governments was denominated in terms of gold and acted as a legal claim to physical gold. International trade was conducted using gold. For this reason, countries needed to maintain a store of gold for both economic and political reasons.

There is no contemporary government that requires all of its money to backed by gold. Nevertheless, governments still house huge stacks of bullion, which are measured in terms of metric tons, as a failsafe against hyperinflation or another economic calamity. Every year, governments increase their gold reserves by hundreds of tons.

For businesses, gold represents a commodity asset that is used in medicine, jewelry, and electronics. For many investors, both institutional and retail, gold is a hedge against inflation or recession.

Recommended Reading: Free Month Of Tinder Gold

Largest Producers Of Gold By Country

China, Australia and Russia are the largest producers of gold in the world, but which countries round out the list? Find out here.

Gold has been making consistent gains in 2020 so far, even surging to more than US$2,000 per ounce over the summer, a level never seen before.

The yellow metals price increase has come on the back of uncertainty surrounding the economic impact of the COVID-19 pandemic, as well as political turmoil in the US and beyond.

These circumstances have left investors wanting gold. But at the same time, supply disruptions caused by the coronavirus have made experts wonder how gold production will be affected.

According to the US Geological Survey, in 2019, gold mine production worldwide came in at approximately 3,000 metric tons , which is on par with the gold mined in 2018.

Its too soon to tell what the numbers will look like for 2020 for now its only possible to examine the 10 top gold-producing countries that contributed to that output last year. Read on for a rundown of each country and how they contribute to global gold production.

Gold Reserves Still In The Ground

Another distinction that needs to be drawn is between the level of gold “reserves” that a country’s central bank holds as part of its foreign currency reserves, and the gold reserves that concern investors in gold mining companies — gold reserves that are in the ground, economically recoverable by mining, but not yet mined.

Here, too, the United States ranks fourth in the world — this time behind Russia and South Africa, and also again behind Australia. With 9,000 tons of gold reserves in the ground, Australia is the world’s richest repository of gold reserves under this definition of the term.

What’s interesting in this particular set of USGS data is that, according to the survey, at current global gold production levels , global reserves of gold will be exhausted in about 17 years. Both U.S. and Canadian mines look likely to be played out in just over a dozen years. Ghana has a bit longer — about 12.5 years — before its gold reserves are exhausted by mining. China, on the other hand, which is mining gold at a frenetic pace today , could be out of natively produced gold within less than half a decade. At that point, China will need to buy gold abroad if it intends to continue growing its gold reserves.

Investors looking to own profitable miners for the long term might be well advised to focus their efforts on miners holding a significant interest in mines in these last three countries.

You May Like: War Thunder Eagles Hack

Germany: 33624 Tonnes Of Gold

Germany’s gold reserves are held at the Deutsche Bundesbank in Frankfurt am Main, the New York branch of the Federal Reserve Bank of the United States, and the Bank of England in London. Germany completed a four-year repatriation operation in 2017 to return 674 tonnes of gold to its own vaults from the Banque de France and the Federal Reserve Bank of New York.

How Much Gold Does The United States Have

United States Gold Reserves Are The Largest in The World

U.S. Gold Reserves

The United State lists its gold reserves at 8,133.50 tons. This number has not changed since 1971. During World War II, U.S. gold holdings peaked at over 20,000 tons. During and after World War II, many western European nations shipped their gold to New York Federal Reserve vaults in the United States for safe keeping. Over the past several years, some of the gold belonging to Germany and the Netherlands has been returned.

Where Did The United States Gold Come From?

Prior to 1933, the United States and other nations used gold coins for general circulation. Many countries also settled their international trade in gold. This required countries to hold gold in reserves for international payments. A country with net exports would build its gold reserves, while countries with net imports would deplete their gold reserves to pay for the imports.

In May 1933, by Excecutive Order, President Franklin Delano Roosevelt ordered the return of all gold coins circulating in the United States and other gold bullion held by U.S. citizens. In exchange the US government paid then then market price of $20.67 an ounce. In January 1934, the US Congress passed the Gold Act that revalued gold at $35 an ounce.

Where is the United States Gold Held?

The remaining U.S. gold is held at the vaults of the New York Federal Reserve and at US Mint locations in Denver, Colorado and West Point, New York .

Do Gold Reserves Matter?

Also Check: Selling Rs3 Gold