Adverse Effects And Responses

| Part of a series on |

Gold mining can significantly alter the natural environment. For example, gold mining activities in tropical forests are increasingly causing deforestation along rivers and in remote areas rich in biodiversity. Other gold mining impacts, particularly in aquatic systems with residual cyanide or mercury , can be highly toxic to people and wildlife even at relatively low concentrations.

However, there are clear moves by many in the non-governmental organization community to encourage more environmentally friendly and sustainable business practices in the mining industry. The primary way this is being achieved is via the promotion of so-called ‘clean’ or ‘ethical’ gold. The aim is to get all end users/retailers of gold to adhere to set of principles that encourage sustainable mining. Campaigns such as ‘No Dirty Gold’ are driving the message that the mining industry is harmful , and so must be cleaned up. Also, NGOs are urging the industry and consumers to buy sustainably produced gold.

Human Rights Watch produced a report in 2015 that outlined some of challenges faced globally. The report notes that

Along with many other reports and articles, this has had the effect of spurring retailers and industry bodies to move toward sustainable gold. Indeed, the World Jewellery Confederation insists that it does all it can to “Deliver a Sustainable and Responsible Jewellery Industry”.

Gold Miners Recorded Record High Margins Last Year

Gold Miners Recorded Record High Margins Last Year

Gold producers had their most profitable year ever in 2020, based on one metric. The average all-in sustaining cost margin, which is the gold price minus the cost to produce the metal, hit a record $828 per ounce, according to Metals Focus. What this means is that for every ounce of gold a mining company produced in 2020, it got to pocket $828 on average. This is comfortably higher than the previous record of $666 set in 2011.

Average all-in-sustaining cost

U.S. Global Investors

The price of gold hit a record high of $2,070 in 2020, which helped increase revenues. But companies have also been focused on cost discipline. We didnt see gold miners exploration budgets increase significantly in 2020, due in part to the pandemic, which forced mine closures in China, South Africa, Peru, Mexico and elsewhere.

Exploration spending in the goldfield rose about 1.2% from 2019 levels, to end at $4.34 billion. This came even as total nonferrous exploration budgets slipped to $8.3 billion, down 11% from the previous year, according to CPM Group data.

Exploration budgets vs. gold prices

U.S. Global Investors

The producer with the worlds lowest cost per ounce in 2020 was Polyus, according to Kitco News. The Russian miners AISC was only $604/oz. Among other companies in the top 10 were B2Gold , Centerra Gold , Kirkland Lake and Polymetal .

Record Financial Results for Precious Metal Royalty and Streaming Companies

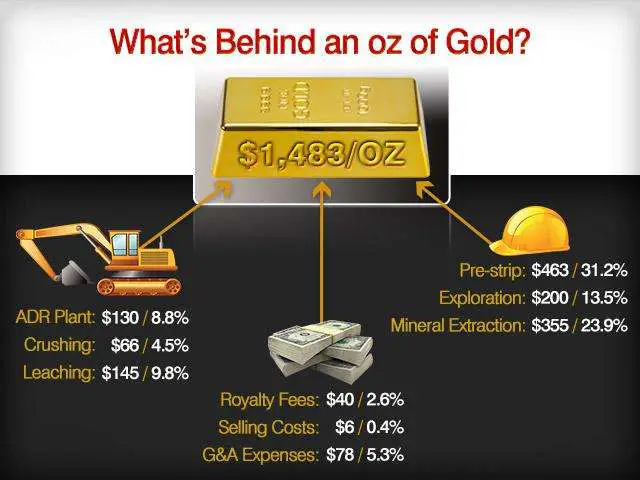

How Much Does It Really Cost To Mine An Ounce Of Gold

This article was published more than 7 years ago. Some information may no longer be current.

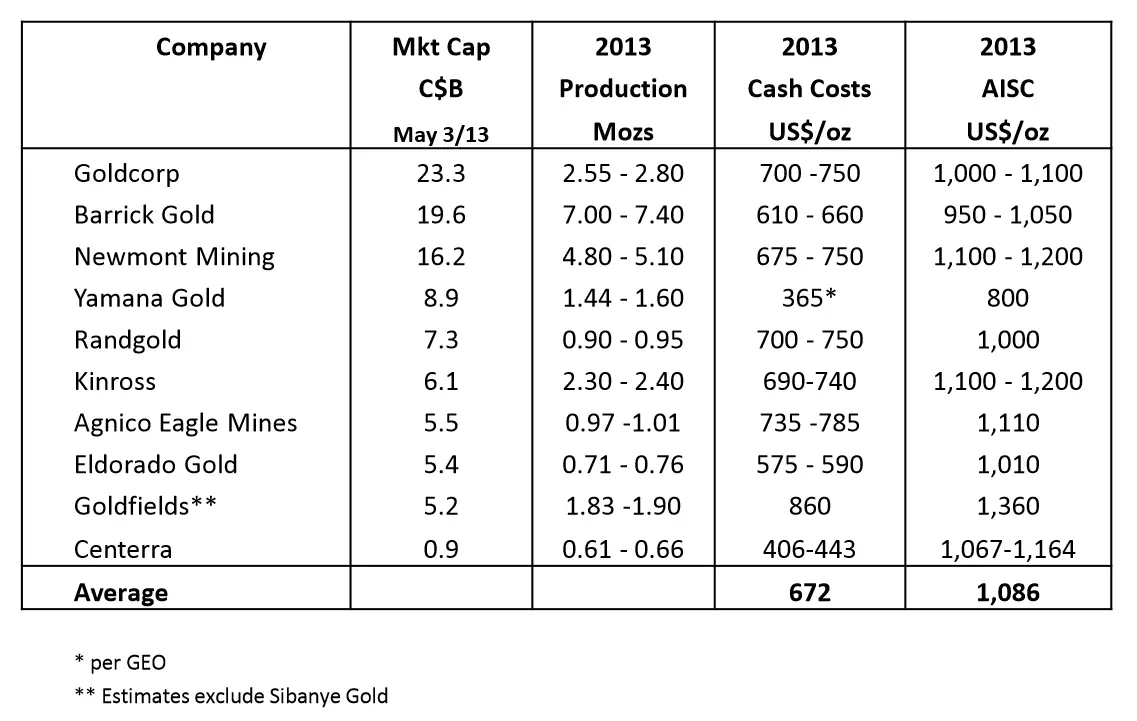

A scan of major gold producers’ earnings suggests the cost of mining gold has risen dramatically over the past few years.

Part of that is a true increase, owing to inflation and the expense of digging out tough-to-reach grades. But most of it is due to a change in the cost metric that gold miners emphasize in their reports to the investing community.

For years, miners liked to talk about “cash costs,” the mine-level expenses of pulling an ounce of gold from the ground. For the most part, cash costs ran from $500 to $800 per ounce, depending on a miner’s properties.

There was a problem, however: Even as the price of gold skyrocketed to nearly $1,900 per ounce, miners weren’t reporting wild windfall profits on their bottom lines. That’s because cash costs left out a host of expenses, from the costs of running the company to annual spending on equipment.

The new “all-inclusive” measures attempt to solve that. The most frequently used metric, “all-in sustaining costs,” puts the cost of extracting an ounce of gold at more than $1,000 industrywide and explains why miners are having a rough go at profitability when gold sells for a couple hundred dollars more than that.

“The old led to a lot of misunderstanding about the ability of cash flow that would be there for equity holders,” says Jorge Beristain, an analyst for Deutsche Bank.

Read Also: How Much Does A Brick Of Gold Cost

Production Cost Metrics: Whats Useful

GFMS contends that the gold mining industrys historic preference for reporting and comparing cash cost parameters, rather than adopting a profitability measure that is more reflective of the true, fully loaded costs of production, has ultimately proved misleading and counterproductive.

The fixation on cash costs has fostered a general perception that global gold mine margins are higher than is actually the case.

All-in cost is a proprietary GFMS Mine Economics $/oz cost metric, designed to reflect the full marginal cost of gold mining. In addition to mine site cash expenses , refining charges, royalties and production taxes, by-product credits, depreciation, amortisation and reclamation cost, it includes ongoing capital expenditure, indirect costs and overheads. The latter includes corporate administrative costs, interest charges, mine site exploration and any extraordinary charges, such as retrenchment costs, carrying value write-downs, etc.Ongoing capital expenditure is defined as capital expenditure necessary to sustain production rates at a mine. The global average all-in cost for 2009 was $717/oz, up $27/oz on 2008.

The fixation on cash costs has fostered a general perception that global gold mine margins are higher than is actually the case.

Gold Price Prediction Trends & 5

Jeff Clark, Senior Analyst, GoldSilver.com

Most price forecasts arent worth more than an umbrella in a hurricane. There are so many factors, so many ever-changing variables, that even the experts usually miss the mark.

Further, some forecasters base their predictions on one issue. Interest rates will rise so gold will fall. Thats not even an accurate statement, let alone a sensible prediction .

But there is value in considering predictions. It can solidify why one has invested, offer factors that may have been overlooked, or even cause one to revise their expectations.

So while we take predictions with a grain of salt, lets look at what might be ahead for gold price in 2021 and the next 5 years. Well first summarize what many analysts are predicting, and then look at the factors that are likely to have the biggest impact on gold. Ill conclude with the probable prices I see based on those factors, as well as some long-term projections.

This will be fun, so lets jump in!

Read Also: Spectrum Gold Package Price

Bitcoin Mining Is A Long

So how much does it cost to mine 1 bitcoin? It costs a lot, both in upfront mining equipment costs and electricity.

You can spend $10,000 on a miner and $2,000 per year on electricity to generate a profit of around $2,500.

If you have the patience, and the funds to invest in quality mining hardware, bitcoin mining can be a profitable endeavor in the long term.

Looking for more crypto and investing ideas? Visit our blog now to keep reading.

ORIGINALLY PUBLISHED ON

How Much Does It Cost To Pan For Gold In Alaska

Private and public lands are designated for gold panning, and the cost ranges from free to $50. Here are some of the most popular spots to go to find the shiny stuff, at a low cost: Fairbanks, AK. Home to some of the most famous mining attractions in the state, Fairbanks has a range of locations for gold panning.

Where can I metal detect for gold in Alaska?

The Fortymile district is really just the U.S. side of the famous Klondike goldfields of Canada. It is one of the earliest areas to see mining activity in Alaska, with gold rushes in the 1880s.

Where can I pan for gold for free in Alaska?

There is gold all over Alaska, and it is far from mined out.

- Fairbanks: Visit the El Dorado Gold Mine for a unique panning experience.

- Hope, in the Kenai Peninsula: This small town of 200 offers public panning in Resurrection Creek.

- Girdwood:

- Bachelor Creek:

Is there gold in Eagle River Alaska?

Reserves at the Eagle River Mine have been estimated as high as 750,000 tons of ore with an average of 0.2 ounce of gold per ton .

Is gold mining in Alaska profitable?

For 2018, gold worth $888,302,130 accounted for 28% of the mining wealth produced in Alaska. In comparison, zinc and lead mainly from the Red Dog mine, accounted for 66% silver, mainly from the Greens Creek mine, accounted for 6.6% and coal accounted for 1.1%.

Is there gold all over Alaska?

Don’t Miss: 400 Oz Gold Bar Size

How Much Does It Cost To Mine 1 Bitcoin

Bitcoin has come a long way since 2009. What started in obscurity on the internet has exploded into a $3 trillion cryptocurrency market in just over a decade.

Of course, those who have experienced the biggest rewards are those who got their hands on bitcoin early on. Back then, anyone could mine bitcoin using their spare computer.

Today, bitcoin mining is still a highly profitable business. However, the competition is at an all-time high, and the use of the highest-quality computers is necessary to actually earn any money.

So how much does it cost to mine 1 bitcoin? If you can mine 1 bitcoin, you can make anywhere from $30,000 to $60,000, depending on the state of the crypto market.

Keep reading our bitcoin mining guide below to learn all about the mining process, what it takes to get started, and what the ongoing and upfront costs are when it comes to crypto mining.

Why Invest In Gold

Although people will have their own reasons to invest in gold, for many, gold investment is about preserving and protecting their wealth.

In terms of wealth preservation, around £200 would have bought you an ounce of gold towards the end of 1990. If you had bought an ounce of gold, and kept £200 as cash, the gold would now be worth around 650% more. However, the cash would not have increased in value and, due to inflation, would actually be worth less.

Similarly, many choose gold to protect the rest of their portfolio from risk and to add diversity to their portfolio. Very few people would choose to invest all their money in gold as it is always advisable to create a balanced portfolio containing different types of investments. Many investors choose gold for that very reason, allowing them to diversify into different areas. This is said to be because the price of gold is usually negatively correlated to the stock markets gold often risies when other markets fall. This is why, traditionally, gold is seen as a safe-haven investment. In times of market volatility, where stocks and shares plummet, part of this decrease is due to investors moving away from riskier assets into the safe haven of gold.

Lastly, some investors choose gold because of the possible financial returns, especially over a longer period of time. Put simply, if you buy it and hold it until the price goes up, you can sell it hopefully for a profit.

You May Like: Heaviest Credit Card

Invest In Gold By Purchasing Stock In Gold Miners

Investing in the stock of companies that mine, refine and trade gold is a much more straightforward proposition than buying physical gold. Since this means buying the stocks of gold mining companies, you can invest using your brokerage account.

Some of the most popular stocks in this sector include:

- Newmont Corp. . Newmont is the worlds largest gold mining company, headquartered in Colorado. It operates mines in North and South America as well as Africa.

- Barrick Gold Corp. . This gold mining giant is headquartered in Toronto and operates in 13 countries around the world.

- Franco-Nevada Corp. . Franco-Nevada doesnt own any gold mines. Instead, it buys the rights to royalties from other gold miners.

Keep in mind, though, that the of gold companies are correlated with gold prices but also are based on fundamentals related to each companys current profitability and expenses. This means investing in individual gold companies carries similar risks as investing in any other stock. Single stocks may experience a certain level of volatility and do not provide you with the security of diversified funds.

Recommended Reading: How Do I Invest In Ripple

When Is The Best Time To Invest In Gold & Silver

Much like investing in stocks, its generally not possible to time purchases and sales of gold and silver with any precision. But as a general rule, the best time to buy any asset is when its either undervalued or in a prolonged holding pattern.

There doesnt seem to be much evidence that either gold or silver are currently undervalued. But the markets for both metals have been quiet for the past few years, particularly since gold hit an all-time peak price of $1,900+ in August 2011.

It has since eased back, but has been hovering around $1,500 during much of that time. With metals prices trading in a tight range in recent years, now seems to be as good a time as any to buy in.

While we seem to be in the late stages of the current economic and financial market upturns, storm clouds are certainly gathering on the horizon.

Since precious metals tend to react to instability, theres plenty to be found. Examples include:

You May Like: I Want To Invest 1000 In The Stock Market

Recommended Reading: Banned For Buying Gold Wow 2021

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Gold In The Modern Economy

Even though gold no longer backs the U.S. dollar , it still carries importance in todays society. It is still important to the global economy. To validate this point, there is no need to look further than the balance sheets of central banks and other financial organizations, such as the International Monetary Fund. Presently, these organizations are responsible for holding almost one-fifth of the worlds supply of above-ground gold. In addition, several central banks have added to their present gold reserves, reflecting concerns about the long-term global economy.

Don’t Miss: How To Get Free Golden Eagles In War Thunder Ps4

Operating Costs Data On Mill

Only rough estimates of milling costs can be made without study of each individual case, as these are determined largely by local conditions that are peculiar to each problem.

To aid in arriving at approximate operating costs, we are giving four charts with curves showing operating costs for the different standard methods of treating ores. These charts show the costs compiled from actual operating figures secured from a number of mills operating under varying conditions. These figures show that operating costs do not increase greatly as one would naturally suppose when smaller tonnages are handled.

In studying the various factors affecting milling costs, the one point that is most noticeable is the effect of operating time on these costs. Plants that have mechanical difficulties show costs greatly in excess of those with full operating time working under comparable conditions, and this demonstrates clearly the importance of having fool proof and ruggedly designed machinery that will run 24 hours per day. Modern milling equipment must be able to take care of overloads and handle oversize material without choke-ups and the resulting shut-downs. One must always keep in mind that after all a machine, a mill, or a process is only as strong as the weakest link.

Parker Schnabel Understands Dirt

Parker Schnabel doesnt believe that gold mining is about gold. The 25-year old Gold Rush stars gold mining philosophy is about moving dirt. Moving dirt fast and efficiently is key to his success. It can be 20 feet to possible gold. Gold Rush fans know that if maps indicate an old stream or waterfall, they may need to risk it and dig even deeper. That is one of those good decisions that better pay off, or you are leaving the Klondike with nothing but a shattered gold dream.

That 20-odd feet of dirt is not just the same dirt. It is two tricky layers before you hit pay. First, a layer of permafrost and a layer of rocks before you get to the paydirt. The permafrost removal is tricky. If you wait too long, the permafrost melts into black muck that totally halts your production. The cleanup dirt is called the tailings. This is the dirt residue after the pay dirt has been washed through. The most important dirt is the pay. This is the dirt where there are hopefully some golden grains and nuggets mixed in. This type of dirt needs to be sluiced. This all takes a lot of labor, and that costs some money, too. Parker doesnt share what he pays his employees.

Then there is the environmental cleanup. This is done after the team finishes mining a cut. Parker explains that mining actually helps the land, because they have stripped through the permafrost, and more can grow on that land that has been mined.

Don’t Miss: Free Eagles For War Thunder