$5000 An Ounce Or More

If you are not looking at gold, you could be kicking yourself later. It wouldn’t be shocking to see gold at $5,000 an ounce or more by 2030. There are too many good things happening for gold and in the next decade they could really give the yellow metal a boost reckless government spending across the globe, central banks buying gold, gold grades in the ground diminishing, exploration spending dropping and the list goes on.

Moe Zulfiqar, Senior Analyst, Lombardi Letter

Perception And Its Impact On Gold Prices

More than any other commodity, the price of gold rises mainly because people think it will. For example, people may believe that gold is a good hedge against inflation, and as a result, they buy it when inflation rises. There is no fundamental reason gold’s value should increase when the dollar falls. It’s simply because people believe it to be true.

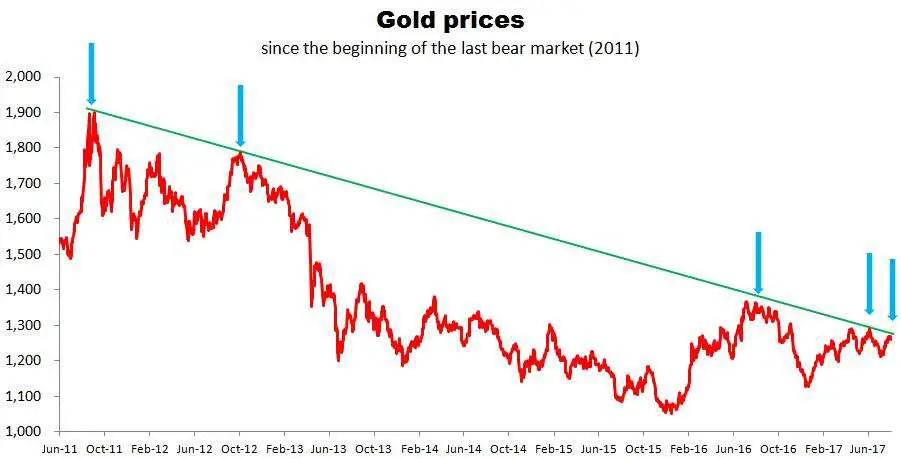

Three years after gold hit a 2011 high of $1,896.50 per ounce, it fell by more than $800 per ounce to $1,050.60 per ounce on Dec. 17, 2015. Over the next two years, by the end of 2017, gold prices had climbed to $1,300 an ounce because the dollar weakened. There was no inflation, and the stock market was setting new records. These are both historic drivers of rising gold prices. It was only the perception of possible inflation, due to the dollar’s decline, that sent gold prices higher.

In 2020, the economy came to a standstill due to the COVID-19 pandemic and by August, gold prices had crossed $2,000 an ounce. By 2021, gold prices hovered between $1,600 and $2,000 per ounce.

Golds Leading Indicator #: Euro

Gold tends to go up when the Euro is in a bullish mindset. Consequently, when the USD is rising it puts pressure on gold.

The long term Euro chart suggests that the Euro is hitting support. The 110 level in the Euro index better holds. IF, and thats a big IF, the Euro turns higher in 2022 AND respects 110 it will be supportive of higher gold prices in 2022. Our 2022 gold price forecast will get a confidence vote from the Euro.

Similarly, the USD is really bullish right before 2022 kicks in. Thats why we believe that gold cant accelerate yet, it needs the USD to complete its bullish move and turn flat or lower. Thats when gold will break out from its 2011 ATH and accelerate its bull run.

The next chart shows the periods in time in which the otherwise positively correlated Euro and gold were diverging. It has been only a few times in 2 decades. The Euro is our #1 leading indicator for gold. The Euro cannot fall in order for gold to start and accelerate its bull run, thats the conclusion.

You May Like: Current Price Of 18k Gold Per Gram

Gold Price Forecast: 2021 2022 And Long Term To 2030

During the last year, the gold price increased from $1,479.13 to $1,858.42, marking a 25.6% growth year-over-year. In the first month of 2021, gold prices averaged $1,866.98/oz, 0.46 percent up from December. The World Bank predicts the price of gold to decrease to $1,740/oz in 2021 from an average of $1,775/oz in 2020. In the next 10 years, the gold price is expected to decrease to $1,400/oz by 2030.

In 2020, the high level of uncertainty observed in the global economy due to the outbreak of Coronavirus fueled demand for the yellow metal. In 2021, the gold price is predicted to gradually fall as uncertainty has decreased, but volatility is still high.

Investors’ expectations for an economic recovery due to vaccinations cautiously suggest a decline in gold prices, however, any event in 2021 that could increase volatility and uncertainty may put upward pressure on gold prices as low-to-negative interest rate conditions and loose monetary policies persist.

Does The Price Of Gold Go Up When The Stock Market Goes Down

The price of gold is often negatively correlated to the stock markets. When the markets go down, gold prices usually go up. However, this is not always true. Sometimes the price of gold and stocks both go up and down in unison. Fundamental factors play an important role and need to be carefully analyzed. Historically, however, the price of gold is not tied to the fluctuations of stock and bonds. This is one of the chief reasons when one should have gold in their portfolio â to protect the long-term value of your investments.

Also Check: Kay Jewelers Ring 19.99

Ques Where Can We Find A Gold Rate For The Next 30 Days

Answer Market predictions often carry a lot of error and uncertainty, while it can be a hard task to look for reliable sources when it comes to gold rate predictions. We provide our readers with a thorough gold rate map for the next 30 days, talking about the most precise predicted rates with at most certainty.

Golds Leading Indicator #: Bond Yields

Bond yields are inversely correlated to gold. They are not as strong a leading indicator as the Euro. Gold can rise when bond yields are flat or range bound.

The weekly bond yields chart is now in a narrow range. Any fast move higher will push gold back. A slow rise or range bound setup can support rising gold prices.

Also Check: Spectrum Triple Play Gold Channels

Gold Charts That Support Our Forecast

The power of the pattern.

Chart patterns have a lot of predictive information provided they have a reliable setup. A reliable pattern has a reliable outcome until proven otherwise.

If we look at the daily gold chart we can very clearly see a reliable reversal setup right below 2011 ATH. The grey box depicts the reversal we are referring to. Thats the viewpoint on the price axis of the chart.

On the timing axis of the chart we see that gold is about to complete this nice reversal at the end of this year. In other words it took gold the entire year 2021 to complete a reversal.

Pretty powerful combination. It certainly justifies much higher gold prices to come in the not too distant future. The chart pattern justifies our $2,500 gold price forecast for 2022.

The weekly chart puts the 12 month reversal below ATH into perspective. It comes after a 9 year reversal on the gold chart.

The combination of the daily and weekly chart patterns clearly make the point of much higher gold prices underway, its a matter of WHEN not IF.

If we take an even bigger picture view with the monthly gold chart we see how this 12 month reversal after a 9 year reversal both come after a huge 9 year uptrend.

We add the quarterly gold chart to the mix and we only get more confirmation of an orderly setup.

Yes, we strongly believe that our bullish gold forecast for 2021 is simply delayed with one year. Its postponed to 2022. And this makes our 2022 gold forecast even more bullish than the one of 2021.

Is It The Right Time To Buy Gold And Silver

At the current levels, MCX gold is 15 per cent or Rs 8,398 per 10 gram off from its record high level of Rs 56,191 per 10 gram hit in August 2020. While MCX silver plunged 26.4 per cent or Rs 16,299 per kg from its all-time high of Rs 77,949 per kg. Bhavik Patel believes gold and silver will see some more downside as they were unable to surpass their resistance. Gold should be accumulated around 47000 levels while silver should be accumulated around 60000 levels. We would recommend to wait for some correction before buying, Patel added.

Anuj Gupta, VP Research, Commodity & Currency, IIFL Securities believes that despite an over 4 per ent negative return, long-trend of gold seems to be up. MCX gold has a strong support at 47000. We recommend to buy gold around Rs 46800-47000 with the stop loss of 46200 levels for the target of 48500 levels. Wait for more corrections to buy as dollar index strengthening, Gupta advised. He also added that investment demand and inflationary pressure may support gold prices going forward.

Read Also: How Much Does A Brick Of Gold Cost

Factors Most Likely To Influence Silver Prices

While there are a number of variables that can impact the silver price, lets look at those most likely to play out this year and beyond and determine if theyre likely to push the price higher or lower

Industrial Demand

Roughly half of all silver goes toward a variety of industrial applications . Demand from industrial users usually doesnt fluctuate all that much, but the next four years is likely to see a substantial increase due to Bidens green policies.

Thats because silver is a key component in many green technologies. Since it is most the most conductive of the metals, it is vital to making green technologies what they are. Check out just how much silver demand will grow under Biden in this article.

If industrial demand grows as I expect, the silver price is likely to increase…

RESULT: HIGHER SILVER PRICE

Investment Demand

The factor that has the biggest impact on the silver price at any time is not industrial demand or jewelry demand. It is investment demand. Heres the evidence

This chart, going back to 1960, demonstrates the link between investment demand and prices. The red shaded areas show that selling from investors led to lower or weak price, while the green shaded areas show that rising demand from investors led to rising prices.

The key to this chart is that when investment demand shifts from net selling to net buying, the price has risen . As such

- As investment demand goes, so goes the silver price.

So are investors buying or selling silver?

Gold Prices In The 21st Century

Gold found its prices rising on a financial market in 1979, when prices were topping out in dollars at 850 dollars per ounce in early 1980. Since then, the market went through a correction and prices have risen and dropped to date.

Let’s take a look at how the prices have changed in the last 20 years.

You May Like: Weight Of Brick Of Gold

Follow Our Gold Forecasts In Our Free Email Newsletter

We absolutely recommend to subscribe to our free newsletter in order to receive future updates. We publish updates on our gold forecast. But we also do publish other forecasts.

We continuously, throughout the year, publish updates on our annual forecasts. Any revision in our forecast are published in the public domain and appear in our free newsletter. Therefore, the only way to track the pulse of markets and stay tuned with our forecasts is to

Will Gold Prices Fall Anytime Soon

Gold prices have been experiencing uncertainty in the MCX since last month. The market is obviously quite down than it was eight to nine months ago.

On 4th August, in MCX the gold market opened with Rs. 47920 . The scale went highest to Rs. 47950. It has seen a 0.17% change in the price. Besides gold, silver started with Rs. 67956 and last traded with Rs. 68156. These fluctuations are impacting the prices of gold in every city in India.

Also Check: How To Get Tinder Gold Free

If Inflation Is Rising Why Is Gold Price Still Down Lobo Tiggre Answers

Kitco News

– Gold has held a strong relationship with inflation expectations but more importantly, gold tracks real interest rates, so if nominal rates rise faster than inflation, then gold would see pressure, said Lobo Tiggre of The Independent Speculator.

“Look at commodities prices. Look at copper, and nickelmulti-year highs. But even things like food and oil also heading upwards, but the headlines about food that strikes me as the kind of thing that the powers that be really can’t ignore. It could be a while before higher copper prices translate into higher prices into Walmart, but if grains are going up, that translates very quickly to higher food prices, Tiggre said.

When the real interest rate, which is the nominal yield minus the inflation rate, trends up, gold tends to fall under pressure.

“We’re looking at expectationsthe real rate, you take CPI and you take the nominal rate and you subtract the CPI. You have the nominal rate moving with the expectations, now, but you have CPI not moving yet, so mathematically, you’re going to see a situation where the real rate, it’s not turning into positive territory yet but it’s less negative and that directional change matters, Tiggre said.

Should the stock market fall even more as yields rise, the Federal Reserve may have to intervene, Hug said.

“If that Dow into serious trouble, I think the Fed steps in here,” he said.

What To Watch For

Milling-Stanley expects gold to exceed $2,000 by the end of the year and he is not convinced the Fed will raise rates even if inflation climbs in subsequent years. Adding that President Bidens multi-trillion-dollar infrastructure programs will lead to rising deficits, interest rates will have to remain low. Contrarily, Lloyd expects gold to finish the year at $1,700. Radomski, however, expects gold to keep declining over the next several months, sliding to as low as $1,500 or even lower and then recovering to the $1800 range by year end.

Read Also: Buy Wow Gold Safely

Effect Of Gold Rate Fluctuation

The rate of gold to the end customers depends on its status in the market. As discussed above, the factors that contribute to the rate of gold are dynamic and define the price.

Depending on those factors, the price fluctuates, leading to potential buying, selling, and investing by customers. These fluctuations attract customers if theyre stable and gradually increase or decrease at a slow pace.

During this period, buyers decide the best suitable time to perform activities on the asset. For example, now is the best time to buy gold.

It is because of the prediction that the rate will grow quicker and more than a few hundred dollars for the next few quarters.

Therefore, if a wise decision takes place, the buyer can buy the gold at the current price and sell it in the coming quarters to gain profit.

But, a point to note is that there can be uninvited spikes and lows in the price. It means that buyers or traders need to be extra conscious of the same terms.

How Do You Forecast The Price Of Gold

Predicting gold prices can be said to be both a science and an art. For example, analysis of gold supply and demand is scientific and completely objective whereas aspects of technical and sentiment analysis of the current gold market can be more of an art as it relies on the skills and perspective of the gold analyst.

Generally speaking, when the focus of the gold forecast is longer term then analysis of the fundamentals, ie scientific analysis, comes to the fore.

For shorter-term predictions of gold prices, the price of gold in the coming weeks and perhaps few months, technical analysis of past and current gold prices, market trends, as well as current market sentiment can be more actionable predictors. Here, the fundamentals can still play a role but generally serve more as background details.

Also Check: Does Kay Jewelers Sell Real Gold

Gold Gives Up November Gains

The gold price dropped from $1,783.90 an ounce at the end of October to $1,763.90 on 3 November, as the US Federal Reserve indicated in a statement that it would begin reducing the monthly pace of its net asset purchases by $10bn for Treasury securities and $5bn for agency mortgage-backed securities.

The price then moved up to a five-month high of $1,872.80 an ounce on 17 November, as the Fed indicated that it would not rush to raise interest rates. The gains were accelerated as the Bank of England decided against raising its interest rates, against expectations. Higher interest rates can be bearish for gold as investors tend to shift their money out of gold holdings into assets that pay interest.

A 31-year high in the US inflation rate in October at 6.2% added further support to gold as an inflation hedge.

However, the gold price subsequently dropped back as the US dollar strengthened in response to stronger US retail sales, and a rise in US Treasury yields following the renomination of Federal Reserve chairman Jerome Powell for a second term.

The market found support towards the end of November around $1,780 an ounce, close to its 50-day and 200-day moving averages , as a new Covid-19 variant emerged. But the price slid lower to $1,776.50 on 30 November, and continued to decline into early December, falling to $1,762.70 on 2 December.

David Beatty of deVere Group noted:

Why Capital.com?

No commission

Competitive spreads

What Makes Gold Prices To Fluctuate

Gold prices show the real state of a country’s economic health. When the prices for gold go up, it signals an unhealthy economy. This is because investors tend to buy more gold, to protect their wealth from an economic crisis or inflation. And as demand increases, so does the price. On the other hand, when the prices are low, the economy is in perfect health. This makes real estate, bonds, and stocks more profitable investments. Hence the demand for gold is low. The key takeaways are that gold prices reflect the thoughts and beliefs of commodity traders. For example, if the general perception of the economy is poor, they will buy more gold. If investors think that the economy is great, they buy less.

You May Like: War Thunder Golden Eagles App

Gold Price Prediction For 2022

-

After performing poorly in 2021, gold prices are historically undervalued and should do much better in 2022.

-

Gold could remain soft in the first quarter but starting in Q2, we see the potential for a strong breakout advance.

-

If gold adheres to our technical outlook, we think prices could reach $3000 by the end of next year.