Gold Bars Price Charts

Monex gold bullion price charts feature ask prices per ounce for .995 pure gold bars. The 3-Month Live chart incorporates the latest price per ounce for the current trading day, while the 6-Month Candlestick, 1-Year Close, 5-Year Close and 10-Year Close charts show the last gold bar price for the previous trading day. For more information about our gold bar price charts or products, call Monex now. Our Account Representative will provide you with free, insightful information to further expand on the benefits of precious metals investing.

American Silver Eagle Price Charts

As Americas only investment grade silver bullion coins, Silver Eagles are impressively substantial in size, design and quality. Research historical pricing data and track the latest prices with our interactive silver Eagle price charts.

onoff

Copy and Paste below code into your HEAD tag / before end tag of body to embed chart.

Copy and paste code below wherever you want your chart displayed.

Copy and Paste below code into your HEAD tag / before end tag of body to embed chart.

Copy and paste code below wherever you want your chart displayed.

How The Lbma Gold And Silver Prices Work

IBA operates electronic auctions for spot, unallocated loco London gold and silver, providing a market-based platform for buyers and sellers to trade.

The auctions are run at 10:30am and 3:00pm London time for gold and at 12:00pm London time for silver.

The final auction prices are published to the market as the LBMA Gold Price AM, the LBMA Gold Price PM and the LBMA Silver Price benchmarks, respectively.

The price formation for each auction is in US Dollars. IBA also publishes the benchmarks in British Pounds and Euros.

N.B. The gold and silver auctions settle against US Dollars only. The benchmarks in British Pounds and Euros are not tradeable directly through the auction.

The terms of reference of the Precious Metals Oversight Committee include reviewing the methodology.

The IBA Gold Auction: How it Works

Also Check: Does Kay Jewelers Sell Fake Diamonds

Strength Of The Dollar

As the leading global currency, the U.S. dollar generally has an inverse relationship with the price of silver. Silver market participants have seen a history of a strong dollar creating pressure on the price of silver. At the same time, many savvy investors watch for times when the dollar is strong to average down their holdings by finding bargain prices for their purchases.

Gold And Silver Futures Traded Higher On Thursday January 13 Taking Cues From The International Spot Prices

Domestic spot gold with a purity of 24 carats opened at Rs 48,080 per 10 grams.

Gold Price In India: Gold and silver futures traded higher on Thursday, January 13, taking cues from the international spot prices. On the Multi Commodity Exchange , gold futures due for a February 4 delivery, were last seen 0.18 per cent up at Rs 47,893, compared to the previous close of Rs 47,808. Silver futures due for a March 4 delivery were last seen 0.27 per cent higher at Rs 62,024 against the previous close of Rs 61,856.

Domestic spot gold with a purity of 24 carats opened at Rs 48,080 per 10 grams on Thursday, and silver at Rs 61,729 per kilogram – both rates excluding GST , according to Mumbai-based industry body India Bullion and Jewellers Association .

IBJA

Foreign Exchange Rates:

Globally, gold prices held near a one-week high hit in the previous session, as the U.S. dollar and Treasury yields retreated after inflation data came in line with expectations and reiterated the need for a quicker interest rate hike. Spot gold was flat at $1,825.82 per ounce. U.S. gold futures was also unchanged at $1,826.50.

Analyst View:

Ravi Singh, Vice President and Head of Research, ShareIndia: “In the current juncture, the momentum indicators like MACD, RSI and MAs are showing bullish trend in intraday and daily chart. The trend may continue and gain it’s strength on a breakout above 48,000 levels.”

Read Also: Buying Wow Gold Safely

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

How Long It Takes To Recover From Stock Market Crashes

Stock brokers will sometimes point to 100-year chart of the stock market and show that it always eventually recovers and heads higher, even after big crashes. What they dont show, however, is how long it takes to recover after accounting for inflation.

Some stock market crashes have taken a long time to get back to evenso long, in fact, that if the investor were to spend the proceeds theyd find that the same amount of cash wouldnt buy them as much. Because the recovery took so long, inflation eroded their purchasing power, despite gaining back all that theyd lost in the crash.

You May Like: Do Zales Sell Fake Jewelry

Golds Yin To The Stock Markets Yang

The reason gold tends to be resilient during stock market crashes is that the two are negatively correlated. In other words, when one goes up, the other tends to go down.

This makes sense when you think about it. Stocks benefit from economic growth and stability while gold benefits from economic distress and crisis. If the stock market falls, fear is usually high, and investors typically seek out the safe haven of gold. If stocks are rockin and rollin, the perceived need for gold from mainstream investors is low.

Historical data backs up this theory of negative correlation between gold and stocks. This chart shows the correlation of gold to other common asset classes. The zero line means gold does the opposite of that investment half of the time. If the line is below zero, gold moves in the opposite direction of that investment more often than with it if its above zero, it moves with that investment more often than against it.

Stocks Have a Negative Correlation to Gold

You can see that, on average, when the stock market crashes , gold has historically risen more than declined. Gold has also historically outperformed the cash sitting in your bank account or money market fund. Even real estate values follow gold only a little more than half the time.

This is the practical conclusion for investors:

- If you want an asset that will rise when most other assets fall, gold is likely to do that more often than not.

Theres one more possibility we have to consider

Gold Price Today: 10 Grams Of 24

In New Delhi and Mumbai, ten grams of 22-carat gold are bought and sold at Rs 46,960 and Rs 47,110 as per the Good Returns website.

Representational image. PTI

The trading price of ten grams of 24-carat gold in India stands at Rs 49,100 today, 14 January, after witnessing a rise of Rs 160 from yesterdays vending price that was Rs 48,940. On the other hand, silver is being purchased at Rs 62,000 for one kilo after observing a drastic fall of Rs 3000 from yesterdays procuring price which was Rs 65,000.

Every day the price of the precious yellow metal changes due to significant factors like excise duty, state taxes and making charges. Here is a list of gold rates in a few major Indian cities on 14 January:

In New Delhi and Mumbai, ten grams of 22-carat gold are bought and sold at Rs 46,960 and Rs 47,110 as per the Good Returns website. In Chennai and Kolkata, the price of the precious yellow metal can be procured at Rs 45,190 and Rs 47,210 for the same quantity.

As of 24-carat gold rate, 10 grams in the national capital and financial capital is being sold at Rs 51,220 and Rs 49,100. The much-in-demand metal is being vended in the city of joy and city of temples at Rs 50,000 and Rs 48,200 respectively for 10 grams.

In Hyderabad and Bengaluru, 10 grams of 24-carat gold is traded at Rs 49,100 and 22-carat of purity is being purchased at Rs 45,000 in both these southern cities for the same quantity.

India News and Entertainment News here. Follow us on , and .

TAGS:

Read Also: War Thunder Cheats Golden Eagles

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

What Happened To Gold And Silver Prices During The Great Depression

During the Great Depression, gold and silver gained tremendous purchasing power versus stocks, real estate, and other assets in the economy that were going down.

The Dow:gold ratio measures how highly valued the stock market is compared to gold. The Dow:gold ratio tends to move lower during both deflationary depressions and inflationary panics . At the bottom of the Great Depression, Dow:gold reached a 1:1 ratio. That same 1:1 ratio was briefly reached again in January 1980 when both gold prices and the Dow Jones Industrials sported an 850 handle.

Of course, back in the 1930s, gold and silver were still an integral part of circulating U.S. currency. Some politicians began to see gold as an impediment to stimulating the economy.

In 1933, the government banned private ownership of gold bullion and ordered it all to be turned in. Since the U.S. dollar was then still pegged to a fixed gold price, President Franklin Roosevelt wanted to make sure that only the government benefited from his scheme to raise the gold price from $20.67 to $35.00 an ounce. That massive manipulation expanded the money supply, devalued the dollar, and raised price levels.

Don’t Miss: Is Blue Cash Preferred Metal

What Is The Spot Price

The spot price is typically the base price of one troy ounce of a metal in any form. Any transaction you make in the gold market will be based upon the spot price.

Any quote of the spot price of gold in grams or kilos is typically just a conversion of the value in ounces, and not a separate trading market. Its the same for other currencies, like the euro or yuan, which are usually calculated using current foreign currency exchange rates.

Any buying and selling you want to do will be based upon the spot price at the moment of purchase or sale. Purchases are based on the ask price, and sales are based on the bid price.

Gold Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The gold price in CAD is updated every minute. The data comes from the gold price in US Dollars converted at the exchange rate of the USD/CAD pair.

Recommended Reading: How To Buy Wow Gold Safely

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2. Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

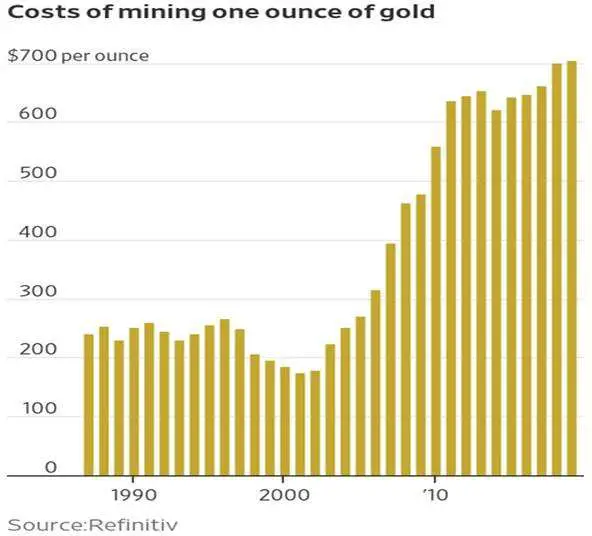

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

Factors That Influence Silver Prices

By its very classification as a precious metal, silver finds itself in a small group of valuable commodities that includes gold, platinum, and palladium. This beautiful white metal has always been in demand because of its unique characteristics and relative scarcity. While demand for silver has been constant, prices can fluctuate frequently. Following are 10 factors that affect changes in the price of silver.

Don’t Miss: War Thunder Golden Eagles Hack

About The Lbma Gold Price And Lbma Silver Price

The LBMA Gold Price and LBMA Silver Price are the global benchmark prices for unallocated gold and silver delivered in London.

Producers, the investment community, banks and central banks, fabricators, jewellers and other consumers as well as market participants from around the globe, transact during the IBA Gold and Silver Auctions and use the benchmarks as reference prices.

The ability to transact and reference a single transparent price, produced by a regulated benchmark administrator provides significant benefits to the market. The LBMA Gold Price and LBMA Silver Price facilitate spot, monthly averaging, cash-settlement, location swaps, fixed for floating swaps, options and other derivative transactions important to price risk management.

Please read IBA’s benchmark and other information notice and disclaimer.

Are Gold And Silver Prices Correlated To Platinum And Palladium Prices

All precious metals share some positive correlation with each other, especially during times of inflation. However, platinum and palladium are more sensitive to the economic cycle and to automotive demand in particular.

While gold and silver are money, platinum and palladium historically are not. They therefore dont see much investment demand.

Palladium tends to be the least correlated to the other precious metals and often seems to march to the beat of a different drummer. That makes it useful potentially as a portfolio diversifier.

Read Also: How To Buy A Brick Of Gold

What Amount Of Gold Does The Spot Price Refer To

The spot price always refers to the cost of one troy ounce of gold. Precious metal weights are traditionally measured in troy ounces. A troy oz is equal in weight to 31.1 grams .

Live spot prices also always refer to .999 fine gold or better. The Royal Canadian Mint is renowned for using .9999 fine gold for its 1 oz Gold Maple Leaf coins.

On the daily gold market, 1 ounce gold bullion coins are often the most common. The smallest size you will find is probably a 5 gram gold bar.

Does The Monetary Denomination Of A Gold Coin Affect Its Overall Value

Not particularly. Having a legal tender status, in and of itself, can help increase the total value of a coin. But the actual face value or denomination has little to no bearing on that value. It doesn’t mean the coin contains an amount of gold worth the face value. It’s actually much higher.

Typically, the specific issuing country will have more effect on the total value of the coin. Investors prefer coins minted by major economic powers, such as the U.S., China, Great Britain, or Canada.

Read Also: War Thunder Gold Eagle Hack

Price Predictions For Gold And Silver

Gold and silver prices dont rise or fall for the same reasons that stock prices do. In general, gold is inversely correlated to the stock market. Precious metals are a historical safe haven, so if investors get skittish about stocks or fearful of what could happen in that market, they tend to buy gold, pushing its price higher. Conversely, if investors are confident that the stock market will rise, thats where theyll invest the gold price tends to fall.

Gold and silver performance depends on more than just the stock market, though. Since precious metals are, among other things, a store of value, their prices tend to rise when times are tough, whether those tough times be economic, monetary, financial, or geopolitical in nature. History also shows they perform well when inflation climbs.

In addition, gold and silver are money, and a hedge against financial catastrophe. If worse comes to worst if there is hyperinflation and a loss of confidence in fiat currencies precious metal coins will be one of the only methods of payment nearly universally recognized as having real and permanent value, and are likely to be accepted in exchange for goods and services.

Industry Leaders In The Commodities And Exchange Spaces

Kinesis was founded by strategic partners, Allocated Bullion Exchange , a leading online exchange platform for physical bullion, with deep expertise gained from over 10+ years in the precious metals industry.

Prior to the conception of ABX in 2011, the precious metals trading industry was ingrained with systemic inefficiencies and run on archaic trading practices, where manual trading and open outcry were the norm. The manual trading process was problematic, expensive and inefficient, and in desperate need of transformation.ABX, headed by Thomas Coughlin, recognised the opportunity for technological evolution. The company began laying the mass technological infrastructure for the first truly global electronic institutional exchange for allocated physical precious metals. Over the course of the last decade, ABX has modernised, globalised and integrated the precious metal markets, redefining the way physical bullion is traded. The result, an introduction of unprecedented efficiency, security, confidence, cost-effectiveness and accessibility to the physical precious metals industry.

ABX is no stranger to the disruptive force of technological progress. Kinesis brings ABXs experience of wholesale systemic innovation to our mission to revolutionise the global monetary system. A mission in safe hands, steered by the invaluable industry insight of ABX.

Also Check: Does Blizzard Ban Gold Buyers