When Did The United States Go Off The Gold Standard

H.J. Res. 192, approved by President Roosevelt on June 5, 1933, provided that obligations payable in gold or specific coin or currency are contrary to public policy, and that those obligations could be discharged dollar for dollar in legal tender. After that resolution was adopted, currency of the United States could not be converted into gold by United States citizens, but the Treasury would convert dollars into gold for foreign governments as a means of maintaining stability and confidence in the dollar. Because the dollar was no longer freely convertible, one could consider that the United States was no longer on the gold standard at that time. If, however, one considers the gold standard as a monetary system in which the unit of money is backed by gold even if the monetary unit cannot be converted into gold, one could argue that the United States went off of the gold standard on August 15, 1971 when President Nixon announced that the U.S. dollar would no longer be convertible into gold in the international markets. The President was able to suspend the ability to convert the dollar into gold because there was no legal requirement that the United States exchange gold for dollars. On December 18, 1971 the President devalued the dollar, and even though the devaluation was effective immediately, only Congress could officially change the gold value of the dollar. Early in 1972, Congress passed Public Law 92- 268, which gave formal approval to the December 1971 devaluation.

Can The Us Back The Dollar With Gold

”Over the weekend I’ve been mulling over the US’s problem of its falling dollar . If I was Secretary of the Treasury, I would ask myself, ‘What could I do to render the dollar more attractive?’ Here’s an idea that occurred to me, and this is what I might do.

The US owns the largest hoard of gold on the planet . Suppose the US decided to back the ‘dollar’ with gold. That would immediately make the dollar more attractive to dollar-holders. But if the US decided to back the dollar with gold, skeptical investors, worldwide would be likely to turn in all their dollars to the US and soon clean out the US’s hoard of gold.

But suppose the US unilaterally announced that the price of US gold from now on would be $5,000 per ounce. This would mean that an investor would have to turn in $5,000 in cash in order to receive just one ounce of US gold. My guess is that few investors would be willing to turn in $50,000 of their money to receive only 10 ounces of gold.

The dollar would be backed by gold, making it a one-of-a-kind currency, but few people would be willing to turn in their dollars for ‘expensive’ US gold.

Nevertheless, the dollar would be the only gold-backed currency on the planet. And that would render the dollar a wanted currency, perhaps the world’s most wanted currency, because it would be the only currency backed by something tangible.

Open An Offshore Bank Account

If youre going to keep your money in the bank, at least keep it in a bank returning some interest. I recently wrote about countries with ultra-high interest rates on savings in their local currency. Its possible to earn 9%, 10%, or even 16% on foreign currency deposits in sound banks some of these banks are actually better than your local bank in the US, Canada, or Australia.

While a 9.5% term deposit in, say, Georgian lari may not sound attractive, consider that not only does Georgias economy have more room to grow, but that the lari has maintained relatively low volatility against the dollar in recent years. In the mid-term, you can earn a high interest rate for several years and convert back to your base currency when exchange rates are most favorable.

Neither currency is backed by gold, but you can at least grow your money. Youll also enjoy freedom from capital controls that prevent movement of money or lock you into a specific currency. If your money is in an offshore bank, youll have the ability to convert your laris or whatever else youre holding back to any currency of your choice, rather than being forced to hold a currency that could decline at the hands of the government.

If you dont think its possible, just ask my friends in Russia, Serbia, Montenegro, or Venezuela.

Recommended Reading: Does Kay Jewelers Sell Real Gold

Why Is Fiat Money Valuable

In contrast to commodity-based money like gold coins or paper bills redeemable for precious metals, fiat money is backed entirely by the full faith and trust in the government that issued it. One reason this has merit is because governments demand that you pay taxes in the fiat money it issues. Since everybody needs to pay taxes, or else face stiff penalties or prison, people will accept it in exchange . Other theories of money, such as the credit theory, suggest that since all money is a credit-debt relation, it does not matter if money is backed by anything to maintain value.

Heres Why The Us No Longer Follows A Gold Standard

Every few years, the idea of the gold standard becomes a hot topic. And why not? Gold is shiny and valuable, and people like it.

A gold standard means the value of a countrys currency is linked to a specified amount of gold. Under the gold standard, governments needed to be ready and willing to buy and sell gold to anyone at the set price.

You May Like: How Much Is 10k Gold Worth

When Was The Gold Standard Introduced

The gold standard was first introduced in Germany in 1871, and by 1900 most developed nations, including the US, were using it.

The system remained popular for decades, with governments worldwide working together to make it successful, but when World War I broke out it became difficult to maintain. Changing political alliances, higher debt and other factors led to a widespread lack of confidence in the gold standard.

What Would It Take To Return To The Gold Standard

Trumps four years as president passed without a return to the gold standard, and the consensus seems to be that its highly unlikely this event will come to pass. For the most part, even the most ardent supporters of the gold standard recognize that going back to it could create trouble.

As the Motley Fools Williams explains, by and large economists agree that moving to a lower-key version of the gold standard in 1933 was a big reason why the US emerged from the Great Depression, and a return would be a mistake.

But if a future president did decide to go through with it, what would it take? According to Kimberly Amadeo at the Balance, due to trade, money supply and the global economy, the rest of the world would need to go back to the gold standard as well. Why? Because otherwise the countries that use the US dollar could stand with their hands out asking for their dollars to be exchanged for gold including debtors like China and Japan, to which the US owes a large chunk of its multitrillion-dollar national debt.

That wouldnt be too big of an issue if it werent for the fact that the US doesnt have enough gold in its reserves to pay it all back. So for a US president to unilaterally return the country to the gold standard, the country would have to exponentially replenish its gold reserves in advance.

Also Check: How To Get Free Golden Eagles In War Thunder

Fifty Years Ago President Nixon Turned The Dollar Into A Fiat Currency Overturning The Basic Monetary Arrangements Of The Postwar Era

Fifty years ago next month, at a secret weekend meeting at Camp David, President Richard Nixon and his top economic advisors decided to take the U.S. off the gold standard. The dramatic move, announced by the president upon his return to the White House on August 15, 1971, suspended the most fundamental rules of the international monetary system, affecting the prices of all products, commodities and services in world commerce. No policy choice since World War II has done more to shape global exchange, with repercussions still visible in todays economic and geopolitical rivalries.

Nixons decision overturned arrangements created by the U.S. and its wartime allies in 1944 at Bretton Woods, New Hampshire, where Washington had agreed to exchange dollars for gold at a rate of $35 per ounce. Making the dollar convertible into gold, and pegging every other currency to dollars at a fixed rate, was meant to inject stability into international commerce. The hope was to avoid the sort of competitive currency depreciations and rampant tariff increases that had worsened the Great Depression in the 1930s and helped to precipitate a world war.

The U.S. had the gold reserves and the credibility to underpin the worlds currencies.

President Nixon meets with Treasury Secretary John B. Connally at the White House in July 1971.

Was the U.S. right to go off the gold standard? Join the conversation below.

More in Ideas

So Why Does The Government Still Borrow Why Does The Government Still Tax

If the government can print dollars at will, then those holding dollars are at the mercy of that will. But since the government can legally, and does legally, create dollars out of thin air as it sees fit, then why does it need to ever borrow money? More importantly, since the government can and does create dollars out of thin air as it sees fit, why does it still need to tax your income to raise revenue?

To put it another way, if the federal government authorized you to print legal tender dollars on your printer at home, would you ever need to borrow or ask anybody for money again? Wouldnt you just print up what you needed instead of indebting yourself or taking money from others? Do you see the scam theyre running on you? Do you dare ask why?

The Political News Report was created in the interests of informing the public and your help is needed to spread the word. Please share this article and website on social media, and also like and subscribe so other people can find this content.

You May Like: Gold Rx Card

Gold Standard System Versus Fiat System

As its name suggests, the term gold standard refers to a monetary system in which the value of currency is based on gold. A fiat system, by contrast, is a monetary system in which the value of currency is not based on any physical commodity but is instead allowed to fluctuate dynamically against other currencies on the foreign-exchange markets. The term “fiat” is derived from the Latin “fieri,” meaning an arbitrary act or decree. In keeping with this etymology, the value of fiat currencies is ultimately based on the fact that they are defined as legal tender by way of government decree.

In the decades prior to the First World War, international trade was conducted on the basis of what has come to be known as the classical gold standard. In this system, trade between nations was settled using physical gold. Nations with trade surpluses accumulated gold as payment for their exports. Conversely, nations with trade deficits saw their gold reserves decline, as gold flowed out of those nations as payment for their imports.

History Of Fiat Money In The Us

The U.S. dollar is considered to be both fiat money and legal tender, accepted for private and public debts. Legal tender is basically any currency that a government declares to be legal. Many governments issue a fiat currency, then make it legal tender by setting it as the standard for debt repayment.

Earlier in U.S. history, the country’s currency was backed by gold . The federal government stopped allowing citizens to exchange currency for government gold with the passage of the Emergency Banking Act of 1933. The gold standard, which backed U.S. currency with federal gold, ended completely in 1971 when the U.S. also stopped issuing gold to foreign governments in exchange for U.S. currency.

Since that time, U.S. dollars are known to be backed by the “full faith and credit” of the U.S. government, “legal tender for all debts, public and private” but not “redeemable in lawful money at the United States Treasury or at any Federal Reserve Bank,” as printing on U.S. dollar bills used to claim. In this sense, U.S. dollars are now “legal tender,” rather than “lawful money,” which can be exchanged for gold, silver, or any other commodity.

Read Also: Xbox Gold Worth It

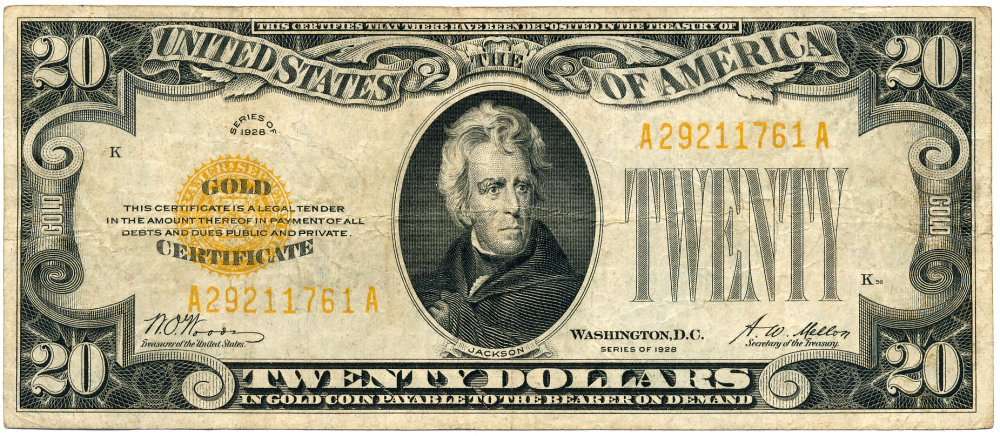

Fdr Takes United States Off Gold Standard

On June 5, 1933, the United States went off the gold standard, a monetary system in which currency is backed by gold, when Congress enacted a joint resolution nullifying the right of creditors to demand payment in gold. The United States had been on a gold standard since 1879, except for an embargo on gold exports during World War I, but bank failures during the Great Depression of the 1930s frightened the public into hoarding gold, making the policy untenable.

Soon after taking office in March 1933, President Roosevelt declared a nationwide bank moratorium in order to prevent a run on the banks by consumers lacking confidence in the economy. He also forbade banks to pay out gold or to export it. According to Keynesian economic theory, one of the best ways to fight off an economic downturn is to inflate the money supply. And increasing the amount of gold held by the Federal Reserve would in turn increase its power to inflate the money supply. Facing similar pressures, Britain had dropped the gold standard in 1931, and Roosevelt had taken note.

READ MORE: How Did the Gold Standard Contribute to the Great Depression?

The government held the $35 per ounce price until August 15, 1971, when President Richard Nixon announced that the United States would no longer convert dollars to gold at a fixed value, thus completely abandoning the gold standard. In 1974, President Gerald Ford signed legislation that permitted Americans again to own gold bullion.

What Are Bullion Exchanges

Bullion exchanges mean that a government will buy bullion from producers in exchange for fiat currency. A bullion exchange might mean that the price of gold in a country depends on government regulators and not a free market. It might also mean that most local producers rely on the government to maintain their livelihoods.

For example, in the Philippines, it is illegal to buy and sell gold unless youre an authorized dealer from the central bank. Filipinos need to look for gold items in pawnshops and jewelry stores that they can melt into coins and bars to keep for a rainy day, but even then, its a pointless exercise. Filipinos cant sell gold, and no one would appraise their product unless they surrender it to the Bangko Sentral ng Pilipinas.

Recommended Reading: Free Golden Eagles

The Gold Standard: A History

“We have gold because we cannot trust governments,” President Herbert Hoover famously said in 1933 in his statement to Franklin D. Roosevelt. This statement foresaw one of the most draconian events in U.S. financial history: the Emergency Banking Act, which forced all Americans to convert their gold coins, bullion, and certificates into U.S. dollars. While the legislation successfully stopped the outflow of gold during the Great Depression, it did not change the conviction of gold bugs, people who are forever confident in gold’s stability as a source of wealth.

Gold has a history like that of no other asset class in that it has a unique influence on its own supply and demand. Gold bugs still cling to a past when gold was king, but gold’s past also includes a fall that must be understood to properly assess its future.

Stability In Good Times

A gold standard is an exchange rate system in which each countrys currency is valued as worth a fixed amount of gold.

During the late 19th and early 20th centuries, one ounce of gold cost $20.67 in the United States and 4.24 in the U.K.. This meant that someone could convert one British pound to $4.86 and vice versa.

Countries on the gold standard which included all major industrial countries during the systems heyday from 1871 to 1914 had a fixed price for an ounce of gold and thus a fixed exchange rate with others who used the system. They kept the same gold peg throughout the period.

The gold standard stabilized currency values and, in so doing, promoted trade and investment, fostering whats been called the first age of globalization. The system collapsed in 1914 at the outbreak of World War I, when most countries suspended its use. Afterward, some countries such as the U.K. and U.S. continued to rely on gold as a centerpiece of their monetary policies, but lingering geopolitical tensions and the high costs of the war made it much less stable, showing its severe flaws in times of crisis.

You May Like: Why Are Golden Goose Sneakers So Expensive

Trump And The Gold Standard

Former US President Donald Trump was keen on returning to the gold standard, but could the US really bring it back? We look at whether its possible.

The gold standard hasnt been used in the US since the 1970s, but when Donald Trump was president there was some speculation that he could bring it back.

Rumors that the gold standard could be reinstated during Trumps presidency centered largely on positive comments he made about the idea. The former president suggested that it would be wonderful to bring back the gold standard, and a number of his advisors were of the same mind Judy Shelton, John Allison and others also expressed support for the concept.

With Trump now out of office, is the US likely to return to the gold standard? And what would it mean if that happened? Read on to learn what the gold standard is, why it ended, what Trump said about bringing it back and of course what could happen if it ever came into play again.