What Could Be Improved

Consumer perceptions and recent trading restrictions

Robinhood has been under intense public scrutiny as a result of the early 2021 GameStop trading frenzy that sent shares of the stock skyrocketing. Robinhood restricted trading in some shares through and had some PR missteps along the way, including some temporary outages more recently. While this is concerning and is reflected in our rating, we recognize that most impacts were to traders moving in and out of speculative investments. Long-term buy-and-hold investors don’t necessarily have to worry about similar risks, and those are the types of investors we’re considering when determining our opinion of a stock broker.

Access to mutual funds and fixed income investments

Robinhood’s platform currently doesn’t support mutual fund and fixed income investing, which is a rarity among major brokers. You can certainly invest in bonds through exchange-traded funds through Robinhood’s platform, but you can’t buy individual bonds.

Tools and research

Robinhood’s platform was designed to be a simple, no-frills investment experience. However, if you want access to educational tools, stock research, or an advanced trading platform, you may want to look elsewhere.

IRA accounts

Robinhood only offers standard brokerage accounts. You cannot invest through an IRA through Robinhood, nor can you open a custodial account, trust, or Coverdell, just to name a few.

Cryptocurrency withdrawal and deposits

Limited number of cryptocurrencies

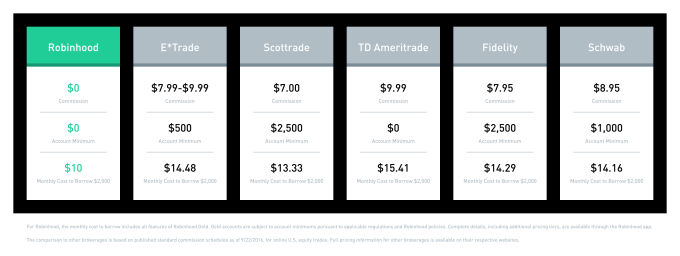

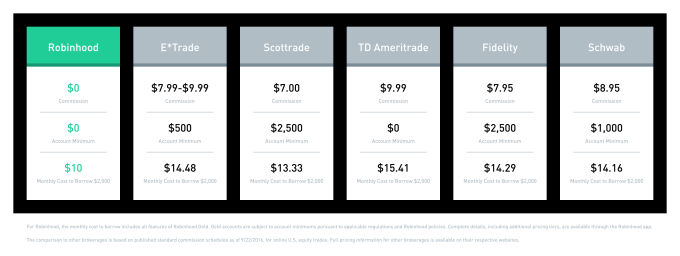

Robinhood Commissions And Fees

Robinhood was the first major brokerage platform to eliminate commissions on stock and options trading, helping to revolutionize the industry. Today, commission-free trading of stocks and exchange-traded funds has become the standard.

Customers must pay at least $5 per month for Robinhood Gold to get access to a margin account, including $1,000 in margin credit, and research materials. Robinhood Gold also provides customers with quicker access to funds and the ability to make larger deposits.

For any margin above $1,000, there is a very competitive 2.5% annual interest rate, which is calculated daily and charged to the customers account at the end of each monthly billing cycle.

Robinhood receives payment for order flow, or directing orders to third-party market makers in exchange for a fee. These third parties may or may not be able to provide faster trades or better prices. But because Robinhood gets paid whether or not they improve order speed and price for its clients, some industry experts are critical of this practice.

Who Robinhood Is For

With more than 13 million users with an average age of 31, it is clear that Robinhood has positioned itself to be ideal for younger investors who want to get skin in the gameeven if that means in small quantities through fractional shares. Robinhoods overall simplicity makes the app and website straightforward and easy to navigate. If youre interested in trying cryptocurrency investing, Robinhood can help. You will be able to use their platform to trade Bitcoin, Ethereum, and more. Robinhood has also expanded their options trading platform, making the broker a potential choice for options traders, although there are concerns about the quality of trade executions.

-

Lack of transparency around payment for order flow

Also Check: How Many Grams In 1 Oz Of Gold

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

What Are The Differences Between Leverage And Margin

Investors need a margin account to invest using margin. Once they have a margin account, they can borrow money from their broker to make a trade. For example, an investor who wants to buy $10,000 worth of shares in company ABC may only have to provide $5,000 of her own money. The broker lends the other $5,000. In this scenario, the investor’s initial margin requirement is 50%. They had to provide at least 50% of the cost of an investment.

When borrowing money to invest, the investor is said to be buying on margin. As long as the investors position remains open, they have to pay any costs associated with the margin, such as interest. FINRA regulations also require that investors maintain at least 25% equity in a margin account in most circumstances. Some brokers have higher requirements, and requirements may vary by security. If an investors equity falls below that amount, theyll have to deposit more cash or securities, or allow the broker to sell your investments for a loss.

You May Like: Buy Oz Of Gold

How To Use Level 2 Quotes

Traders primarily use level 2 quotes to identify very short-term supply and demand. Practitioners claim that shifts in supply and demand show up on level 2 and time & sales before you see it on a chart.

Before electronic trading technology became ubiquitous, skillful analysis paid steep dividends.

You were able to spot out large orders with relative ease and ride the momentum they created. If the order didnt move the stock, you could always lean on the order to get out unscathed.

Things have changed, and everyday retail traders can cloak their orders on the level 2 effectively using tools offered by retail brokers like Interactive Brokers. As such, the effectiveness of these order flow strategies is debated among the trading community.

Thats not to say that there arent tons of traders who still see significant success trading order flow using level 2 quotes.

What You Need To Know About Gold Iras

A standard IRA allows you to invest in funds and other products with a wide range of eligibility requirements. With these types of IRAs, you will pay both a brokerage and a management fee, depending on which company you use. There are also some IRA companies that offer the option to invest in gold iras and there may be a discount or no service charge. When you buy a gold IRA, the company will typically provide a full disclosure of their brokerage and management fees and charges.

Investing in gold IRAs provides you with tax benefits over other forms of investing in a retirement plan. The most popular form of IRA investing is the Roth IRA, which allows you to invest in any form of income, without having to pay taxes on them. In order to contribute to a Roth IRA, you need to have an employer-sponsored retirement plan. The tax benefits that you receive from the investment will depend on the type of income that you have and the tax rate that you are paying.

Read Also: What Is 5 Grams Of Gold Worth

How Does Robinhood Make Money From Their Services

Robinhood does not charge any commission and other fees for their trading transactions, at least not directly. That’s right, it’s technically commission free.

While this is one of their most attractive features, there are invisible fees to generate revenue. You will notice this in their spread, which is the difference between the estimated buying price and the estimated selling price.

Robinhood has a wider spread compared to other crypto trading platforms. Gold account users are also charged a $5 monthly fee after their 30-day free trial.

What Does Robinhood Gold Cost

For $5 a month, you get all the Robinhood Gold premium features.

The platform will also include your first $1,000 of margin. Robinhood will charge you $5 every 30 days at the beginning of your billing cycle.

If you use more than $1,000 of margin, youll pay 2.5% yearly interest on the amount you use above $1,000. Robinhood will calculate your charge daily and debit your account at the end of each billing cycle.

In addition to the benefits listed above, Robinhood Gold is a , so there are additional risks and responsibilities you should be aware of. With margin investing, the returns on any stocks bought on margin have a magnified effect on your account value. Whether positive or negative.

Let us be clear, margin trading on Robinhood is completely optional. You do not need to use the margin features if you choose to purchase Robinhood Gold. You can simply say no to margin investing.

Recommended Reading: Where To Sell Gold Teeth Rdr2 Online

What Is Buying Power

Buying power on Robinhood refers to the amount of funds you have available in your account to purchase stocks or cryptocurrencies. You may have other funds already invested in stocks but these wont be available for investing in other assets unless you sell your shares and convert the funds back to brokerage cash.

Robinhood users can acquire more buying power with margin. This means you would be borrowing funds from Robinhood to add to your open trading positions. Investors need to have at least $2,000 in their accounts to be able to use this feature. In addition, users will need to sign up for a Robinhood Gold account to enable margin trading.

Broadly speaking, this option is not recommended for new investors, as margin trading comes with enhanced risk. Users can potentially lose more funds than they have deposited, which isnt generally the case with regular investing.

How Do We Review Brokers

NerdWallets comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists hands-on research, fuel our proprietary assessment process that scores each providers performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

For more details about the categories considered when rating brokers and our process, read our full methodology.

You May Like: What Are The Different Karats Of Gold

Interest On Your Cash

Whether you got spooked and pulled money out of the market, received dividends that havent been reinvested or just havent gotten around to investing money you transferred to a brokerage account, its possible you have significant cash sitting in the account. As of the end of 2020, there was over $1.5 trillion in brokerage sweep accounts, estimates Crane Data, a money market and mutual fund information company.

Robinhood has a cash management service where cash is swept into a network of banks and earns 0.30% annual percentage yield .

But Robinhood is making money off of that cash via fees from program banks, as well as from interchange fees when customers use the optional debit card that comes with the service, according to the companys site. You dont have to opt into the cash management service, but Robinhood also generates income off of your uninvested cash that doesnt go to those program banks by depositing it in interest-bearing bank accounts. Robinhood pockets the interest.

These are common practices of brokerages and banks. But its important to remember that the company is still making money off of your cash.

Who Should Choose Robinhood

Robinhood appears to offer new investors a platform specifically designed to lower the barriers to markets, courtesy of its bare-bones interface and industry-leading low basic trading fees.

But heres the problem with Robinhood: It makes trading so easy that it practically turns it into a game. This tends to drive active trading, or buying and selling stocks rapidly to turn a quick profit. Due to the amount of risk and huge potential of loss involved with active trading, most experts instead recommend almost all investors opt for passive investing, or buying and holding low-cost index funds long term to grow wealth.

Robinhood also lacks many of the educational resources offered by the best online brokerage platforms for beginners. Taken together, these aspects of Robinhood may give new investors the wrong idea about how trading and investing should work.

There have been tragic outcomes associated with Robinhoods approach. In June 2020, a 20-year-old college student named Alexander E. Kearns took his own life after seeing an unexpected negative balance of over $730,000 on his Robinhood app. It is thought that the negative balance was associated with a complicated options trading strategy deployed by Kearns that used and that it may have only been temporary losses on paper that would have rectified as soon as trades were settled, although this fact may have been unclear on the platform.

Recommended Reading: Tinder Gold Free Code

Robinhood Gold Review 202: Is Robinhood Gold Worth It

Robinhood is an investing platform that opens the doors to financial markets by offering commission-free trades on a sleek and clean mobile app.

There is no account minimum to get started and no fees to open an account, transfer funds, or maintain an account.

However, for just $5/month you can access a premium subscription called Robinhood Gold. But, is the $5 per month worth it?

Here’s what we think…

Will I Still Earn Interest On My Cash If I Have A Robinhood Gold Account

If youre a Gold subscriber and you dont borrow money by spending on margin, youll earn interest on your uninvested cash thats swept to our network of program banks. If you borrow money by spending on margin, you wont have any uninvested cash left in your account to sweep to banks, so you wont earn any interest. In that scenario, since youre borrowing money, youll pay interest on any money you borrow over $1,000.

You May Like: Does Kay Jewelers Sell Real Gold

Buying Your First Stocks: Do It The Smart Way

Once youve chosen one of our top-rated brokers, you need to make sure youre buying the right stocks. We think theres no better place to start than with Stock Advisor, the flagship stock-picking service of our company, The Motley Fool. Youll get two new stock picks every month, plus 10 starter stocks and best buys now. Over the past 17 years, Stock Advisors average stock pick has seen a 632% return more than 4x that of the S& P 500! . Learn more and get started today with a special new member discount.

How To Withdraw Money From Robinhood Online

The Robinhood app is designed to make your life easier whether youre depositing, trading, or withdrawing, but doing it on your computer can be just as straightforward. To withdraw money using the Robinhood website, just follow these steps:

Also Check: 18k Gold Cost

More Details About Robinhood’s Ratings

Account minimum: 5 out of 5 stars

Robinhood doesnt have an account minimum, which means investors can get started right away. Of course, in order to invest, youll need enough to purchase the investment you have your eye on.

Stock trading costs: 5 out of 5 stars

Robinhood provides 100% commission-free stock, options, ETF and cryptocurrency trades, making it attractive to investors who trade frequently. Still, these days many big-name brokers also offer free trades, so it makes sense to compare other features when picking a broker.

Options trades: 5 out of 5 stars

Robinhoods commitment to low-cost trading is especially apparent in its options trading offering Robinhood is among the handful of brokers that dont charge a per-contract fee.

Account fees: 3 out of 5 stars

One of the biggest fees Robinhood charges is the $75 outgoing ACAT transfer fee that cost is a bit on the high end, but it’s not an unusual fee among brokers.

Number of no-transaction-fee mutual funds: Not rated.

Robinhood does not offer any mutual funds.

Tradable securities: 1 out of 5 stars

The securities available to trade at Robinhood are limited. Mutual funds and bonds arent supported, which can help build a diversified, long-term portfolio. Robinhood does, however, offer access to more than 650 foreign companies via American Depository Receipts.

Crypto offering: 5 out of 5 stars

Trading platform: 3 out of 5 stars

Mobile app: 4 out of 5 stars

Research and data: 3 out of 5 stars

Can I Track My Gold Payments In The App

Yes, you can find all Robinhood Gold fees and interest payments in your account history. You can also find information about your next Gold billing cycle in your account overview . The Gold billing section includes:

- Next Gold Billing Date: This is the next date on which you will be charged for Robinhood Gold.

- Monthly Fee: The monthly fee paid for Robinhood Gold. This will be automatically deducted from your account on the next Gold billing date.

- : How much youve invested on margin. Interest is calculated daily based on your margin used over $1,000.

- Yearly Interest Rate: The yearly interest rate you pay for margin used over $1,000.

- Unpaid Interest: The margin interest accumulated for the current billing cycle. This amount will be automatically deducted from your account on the next Gold billing date.

You May Like: 400 Oz Gold Bar Size

A Great Alternative For Your Withdrawn Money

Whether youre withdrawing using iOS, Android or on desktop, Wise can be a great alternative to a bank account for managing the cash youve withdrawn from Robinhood.

Wise is one of the fastest and easiest ways to manage, send, and receive money in multiple different currencies. You can use it whether youre collecting money from trading applications like Robinhood, sending money to friends and family, or collecting invoice payments from international clients.

With Wise, there are no hidden fees, no extortionate mark-ups, and absolutely no-nonsense. When was the last time you were able to say that about your bank?