Where To Buy Bitcoin Gold: How To Buy Btg Right Now

With Robinhood, you cannot purchase gold directly. But you can buy the SPDR Gold Trust ETF, which is highly liquid and is backed by nearly 41 million ounces of gold . Momentum Stock Can you day trade bitcoin on robinhood That record doesnt even scratch the surface of gold-backed tokens that exist right now, as there are a ton extra tasks that have followed the same path. or financial institution how to buy bitcoin bitcoin core transfer You can actively trade with a cash account, but you have to wait 3 days for each trade to settle, which effectively makes it so you can only day trade 2-3 times/week. Lastly, Robinhood doesnt allow short selling Robinhood vs. Webull: Which is The Best Free Online Brokerage? Webull and Robinhood are both free online brokerages that investors can use, but which one is more suitable for your needs?. What Is Webull? Webull is an online brokerage that lets its customers trade stocks, ETFs and options.. It is also in the process of rolling out cryptocurrency trading so you can buy and sell Bitcoin, Bitcoin.

Read Also: How Much Is 18k Gold Per Gram

How To Downgrade From Instant To Cash Account Robinhood

The selection of a type of account depends on the requirements of the account holder or the trader. If you are a trader who uses Robinhood for day trading or swing trading, you might want to switch the cash account to an instant account and vice versa.

To convert your instant Robinhood account to a cash account on Robinhood, you will need a few days for the funds to be available for investing again.

Turning your instant account into a cash account is easy. First of all, you need to go to the account settings on your Robinhood app. Once you open this menu, go to the instant settlement option.

Here you can disable the instant settlement by scrolling to the bottom of this page. A single click can allow you to change your account to a cash account.

You will receive confirmation about this and also, information about how many days it will take for the funds to be available with you for further investing.

How To Buy Gold

Are you ready to buy gold now? Some people prefer to invest heavily in gold to profit in their distant future, while others want to buy into gold as a short-term investment and then sell off quickly.

Stalking pawn shops and estate sales is a superb way to find physical gold. Gold coins and gold jewelry often turn up at such places, and you can snag them for pennies on the dollar. Dont forget to store your stash of gold in a safe place, though.

You can also shop for gold, virtually, without ever leaving your home . If you already have a hefty investment portfolio, you may now want to consider diversifying and adding gold investments.

Also Check: How Much Does One Brick Of Gold Cost

How To Buy Gold Etfs And Mutual Funds

Gold exchange-traded funds are commodity funds. Gold ETFs were first launched in Australia in 2003, followed by the first U.S.-based ETF in 2004. These funds trade like stocks and represent assets backed by gold, although those who invest do not own any physical gold. Instead, they are investing in small quantities of gold-related assets, creating more diversity in their portfolios.

Investors who do not have a substantial nest egg often choose a gold ETF, since it is a smaller investment than gold bullion or gold coins. Buying gold as an ETF also helps you avoid needing to store the physical commodity.

To buy a gold ETF, simply type in the ticker symbol of the one you want and buy it like a normal stock. For instance, if youre using and want to buy SPDR Gold Shares , just search for GLD youll be brought to the SPDR Gold Shares information page.

Advertiser Disclosure This advertisement contains information and materials provided by Robinhood Financial LLC and its affiliates and MoneyUnder30, a third party not affiliated with Robinhood. All investments involve risk and the past performance of a security, or financial product does not guarantee future results or returns. Securities offered through Robinhood Financial LLC and Robinhood Securities LLC, which are members of FINRA and SIPC. MoneyUnder30 is not a member of FINRA or SIPC.

The Robinhood Instant Account Is What You Receive By Default

The Robinhood Instant account, introduced in 2016, is free, meaning you pay no monthly fees. There’s also no minimum account balance required. When you sign up for a Robinhood account on the app or website, youll start with the Robinhood Instant account by default. The Robinhood Instant account offers instant trade settlements, allowing you to access proceeds from a stock sale immediately. Previously, Robinhood investors needed to wait three days to obtain funds from a stock trade. Additionally, the account offers instant bank deposits, but with deposit limits.

Also Check: How Much Is A 400 Oz Bar Of Gold Worth

How To Buy Gold In 2021

For thousands of years humans have coveted gold and todays investors are no exception. Whether you plan to buy the metal in the form of coins, bars or gold-backed securities, there are plenty of reasons to add it to your portfolio.

Gold is considered a safe haven asset because when prices for other investments, like stocks or real estate, drop sharply, gold doesnt lose its value it may even gain value as scared investors rush to buy it.

Whats more, some experts also see gold as the ultimate way to protect your savings against rising prices since its held value for hundreds of years.

But when does it really make sense to invest in gold? And whats the best method? Heres everything you need to know about how to buy gold in 2021.

How Can I Avoid A Margin Call

Make sure you regularly check the buying power screen or the margin investing section of the Robinhood account settings page.

Look out for updates from Robinhood when youre getting close to a margin maintenance call. Youll typically receive an inbox message when youre close to receiving a margin maintenance call, and an email once youve received one.

There are two ways for you to resolve a margin call:

If you think you may be approaching a margin call, it might be a wise idea to cut it off before it happens.

Also Check: 400 Oz Of Gold Worth

What Is The Downside To Robinhood

Robinhood lacks advanced features including trading tools, and although it’s worth noting that the broker continues to refine and improve its offering, it still lags other brokers in categories such as platforms and tools, mobile, education, research, and offering of investments.

Also, because there are many users on Robinhood who follow the crowd, there can be periods when the platform may be down because many people are trying to do the same thing at once, such as buying a particular security.

Who Is Robinhood Gold For

Robinhood Gold is appealing to investors who want more access to advanced investing methods. These investors make small investments, so paying commission fees is out of the question. Commission fees can add up and hurt small investors portfolios, but Robinhood Gold charges a flat monthly rate, eliminating that concern.

Its appealing to people who make a large number of stock or ETF trades since they wont have to pay commissions on every trade. In addition, mobile users typically like Robinhood Gold since they can use the app easily on the go.

Read Also: Warthunder Golden Eagles Hack

Other Robinhood Details You Should Know

High-yield savings

Robinhood also offers a cash management account that currently pays 0.30%. The account comes with a debit card and free ATM withdrawals from more than 75,000 ATMs, and offers up to $1.25 million of FDIC insurance thanks to Robinhood’s agreements with several banks.

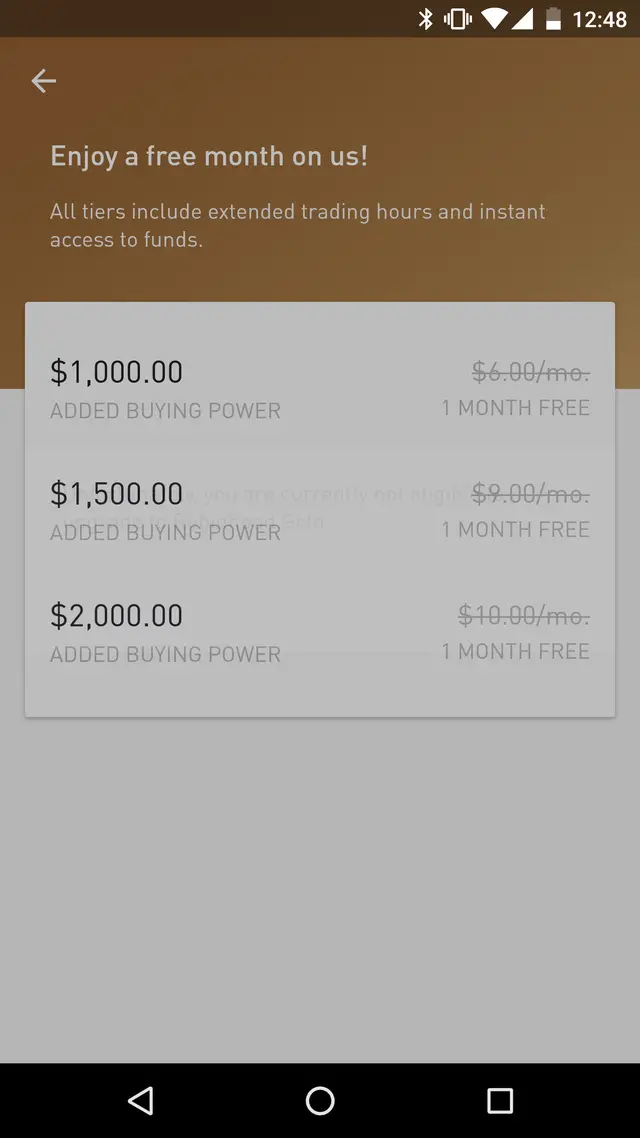

Robinhood Gold

Robinhood Gold offers investors the ability to trade on margin. The opt-in service carries a flat monthly fee of $5.

New investors should be aware that margin trading is risky. Youre trading on money borrowed from the broker, which means you can lose more than you invest.

Reliability and trustworthiness

Robinhood has been the subject of serious complaints and lawsuits over the years, which potential users shouldnt ignore:

» Learn more about alternatives to Robinhood

Best Gold Stocks To Buy In 2022

Many Wall Street professionals would urge you to keep at least a small portion of your portfolio invested in gold. Although historically the stock market has yielded impressive returns in the long run, when the market is down, safe havens like gold help to offset the declines.

Moreover, gold makes a great hedge against inflation, helping to offset the loss of buying power when prices are on the rise.

Then again, most investors have neither the amount of money needed nor the desire to invest in a pile of physical gold and store it in a safe. Thats where gold stocks come in.

Also Check: Free Eagles For War Thunder

How To Buy Gold Jewelry As An Investment

Buy gold jewelry as an investment only after doing your research into the industry. If you go to a jeweler and buy a necklace, bracelet, or ring, you will almost certainly be overpaying for the actual value of the gold. Since retail jewelers add a considerable markup for gold jewelry, it could take decades before gold prices catch up.

Instead, look for gold jewelry from private sellers, preferably not at auction. The gold jewelry at auctions is usually pre-appraised and priced at or above the gold value. You should have better luck with small private sellers or lucky finds at garage sales or junk markets.

Gold jewelrys value depends upon the purity of the gold. Pieces that are marked 99.99% pure, 24-karat, or 24K should be high purity with worth equal to that of raw gold bullion. The lower the karat number, the less pure the gold.

Investing in gold by buying gold jewelry can be labor-intensive. You may be able to find some valuable pieces if the owner doesnt know their true worth or thinks they are costume jewelry.

Can I Trade Immediately After I Open My Robinhood Account

Robinhood says it notifies you in less than one hour if your application is approved, at which time you can initiate a bank transfer. Because Robinhood uses instant verification with several major banks, transfers of up to $1,000 are instantly available for investing. The same goes for proceeds of up to $1,000 from selling stocks. Deposits of more than $1,000 take about four or five days to process.

Also Check: Osrs Banned For Buying Gold

Can I Buy Penny Stocks On Robinhood

You can buy penny stocks on Robinhood, but the selection is limited. This is because most penny stocks are not listed on the major exchanges like Nasdaq or the New York Stock Exchange and are, instead, listed on the Over-the-Counter Markets. Robinhood users can only trade exchange-listed stocks, making the apps selection limited to penny stocks listed on the major exchanges.

Additionally, its difficult to search for penny stocks. Users can search for broad categories, like ETFs or stocks across certain sectors, but penny stocks are not a searchable category on the app.

Exchange-listed penny stocks are typically viewed as the safer alternative to OTC stocks because to be listed on an exchange, stocks must meet that exchanges listing requirements and pay entry and annual listing fees. Requirements vary by exchange but typically include minimum stockholder equity amounts, minimum share prices and minimum shareholder counts.

Robinhood doesnt offer access to over-the-counter penny stocks.

Why Should You Invest In Gold

Gold can feel like a volatile investment, but dont let that discourage you. Historically, gold consistently goes up in valueand when other investments fall, gold can see gains. Your gold investment can carry you through periods when your traditional stocks may be faltering.

Gold investments let you choose how hands-on you want to be and then adjust your risk level accordingly. If you like physical assets, you can buy gold bullion or gold jewelry outright. If you prefer diversifying your portfolio, look into gold funds, or acquire shares of mining companies.

Also Check: Does Kay Jewelers Sell Moissanite

What Is The History Of The Gold Standard

Precious metals and jewels have held value throughout centuries. However, modern gold standards began to become normalized when countries first moved to bimetallic standards for ease of international trade. Then, price competition between metals and mistakes in valuation began to cause countries to move to gold alone. England adopted a gold standard in 1819. The U.S. followed in 1900 with the passage of the Gold Standard Act following the gold/silver ratio troubles of the late 1700s/early 1800s. Other major countries also moved to a formal gold standard in the late 1800s. The years 1880 to 1914 are often called the classical gold standard because of the number of countries moving to the standard.

World War I interrupted the way the gold standard worked in practice, as combating countries engaged in financial warfare as well as physical warfare. Afterward, from 1925 to 1931, the world saw the gold standard return as the Gold Exchange Standard . That agreement saw most countries agreeing to hold gold reserves, U.S. Dollars, or British Pounds as their monetary reserves. The U.S. and U.K. were to act as gates of sorts, holding only gold reserves in an attempt to restabilize world economies. However, France’s work to reestablish the Franc eventually undermined the arrangement.

Wheaton Precious Metals Corp

Number of Hedge Fund Holders: 24

Wheaton Precious Metals Corp. is a Canada-based firm that sells precious metals. The company has a solid dividend history stretching back close to one decade. In the past six years, these payouts have been growing consistently. On March 10, the firm declared a quarterly dividend of $0.15 per share, in line with previous. The forward yield was 1.22%. In early February, the company had entered into an agreement with Sabina Gold & Silver for a gold stream from the Goose Project in Nunavut.

On April 19, KeyBanc analyst Adam Josephson maintained an Overweight rating on Wheaton Precious Metals Corp. stock and raised the price target to $56 from $46, citing higher commodity prices as one of the reasons behind the target raise.

At the end of the fourth quarter of 2021, 24 hedge funds in the database of Insider Monkey held stakes worth $490 million in Wheaton Precious Metals Corp. , compared to 27 in the previous quarter worth $347 million.

In addition to Newmont Corporation , Barrick Gold Corporation , and Freeport-McMoRan Inc. , Wheaton Precious Metals Corp. is one of the stocks that elite investors are monitoring as interest rates rise.

Recommended Reading: 1 Brick Of Gold

Best Gold Stocks To Buy For Inflation

In this article, we discuss the 10 best gold stocks to buy for inflation. If you want to read about some more gold stocks, go directly to 5 Best Gold Stocks to Buy for Inflation.

Interest in gold has steadily increased in the past few months as inflation surges, interest rates rise, and some sections of the Treasury curve invert. All these factors tend to lead to outperformance for the gold sector, per historical data. In the first three months of 2022, after a below average performance in 2021, gold prices increased by a handsome 8%, the best quarterly performance for the precious metal since the second quarter of 2020. Inflows into gold ETFs also totaled $17 billion during the period, the highest since the third quarter of 2020.

The record rally in the prices of gold over the past three months, during which gold climbed above $2,000/oz, were primarily driven by rising inflation, increased geopolitical risk due to the Russian invasion of Ukraine, and a hawkish Federal Reserve. In this overall economic environment, in which oil prices have also reached record highs, investors have been flocking to safe havens like gold amid market volatility. The global economic recovery is being affected by these factors and this has led to fears around stagflation as well.

Our Methodology

So Youve Been Labeled A Pdt

Robinhood doesnt take kindly to folks trying to get around its rules. Anyone with a Robinhood Instant or Gold account with less than the required $25,000 that engages in PDT will face a substantial penalty.

Any investor who places four day trades within a window of five consecutive business days will have their account flagged as a pattern day trader. This designation lasts for 90 days. And this results in not being able to make any day trades for that period of time.

If, however, someone tries to buck the system and continues to day trade during that 90-day probation, they will face greater penalties. Anyone day trading on Robinhood with less than $25,000 in their account that has been marked with the scarlet PDT letters will have their account restricted even further.

Robinhood reserves the right to lock the account of PDT users for up to 90 days. This results in the user not being able to buy or sell any stocks or options for the full 90-day probation period.

You May Like: 19.99 Kay Jewelers

Read Also: Does Kay Jewelers Sell Fake Jewelry

Similarities Between Webull And Robinhood

Both Webull and Robinhood are committed to commission-free trades.

They both also offer investors the ability to trade in U.S. stocks, ETFs, and ATRs.

At this time, neither Webull nor Robinhood allows users to trade in mutual funds or bonds.

While this may turn some investors away, its important to remember that both platforms support phenomenal features that provide many research and trading options.

Both platforms also do not require account minimums to start investing and do not charge inactivity fees, or deposit/withdrawal fees for transfers from a bank account.

Robinhood Gold and Webull also offer margin trading.