What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

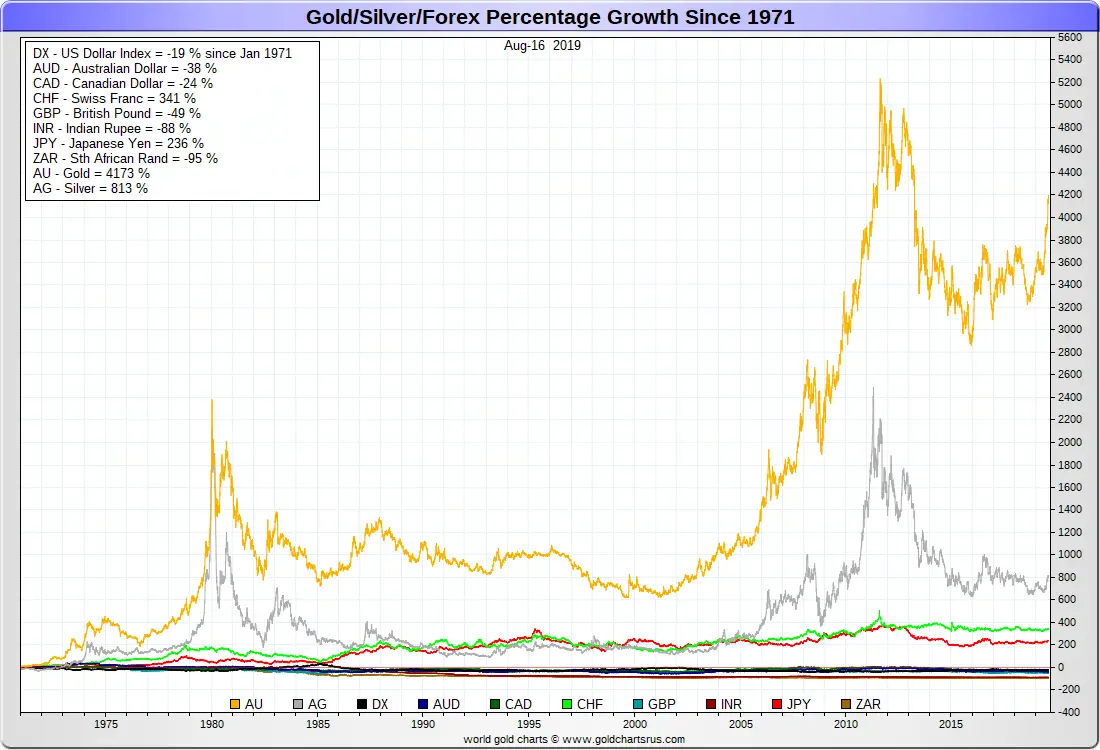

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Calculation : Gold Buyers

This calculation determines how the price compares relative to the value of gold metal from calculation 1.

This calculation is useful for people buying gold. In general, how far the price deviates from the gold metal value determines if it is cheap or expensive.

| Price |

|---|

| Step 1: Calculate gold metal value |

|---|

| Gold metal value = Price ÷ Value of gold metal × 100= 0 ÷ 0 × 100= 0 % |

Recommended Reading: How To Get Free Golden Eagles In War Thunder Ps4

How Is The Current Price Of Gold Per Ounce Determined

There are many factors that contribute to the current price of gold. Chief among these factors is the strength of the US dollar. Traditionally gold has an inverse relationship to the value of the dollar. In other words, when the value the US dollar is strong, gold prices go down. Related, the strength of major economies also has an inverse relationship to the price of gold – at least when an economy has a significant downturn. All of this is due to the safe haven status gold has traditionally had in the investment world. Gold prices are historically far more stable over the course of time than economies and other classes of investments.Supply and demand, of course, also play a key role in the price of gold per gram or ounce. There is only so much gold to be mined and gold mining is not cheap. When gold demand outstrips gold supply, the price of gold goes up. The chief areas of gold demand are in gold jewelry. In 2017, 46% of demand for gold was for jewelry. There is also the use of gold in industry for such things as electronics and medical devices.

What Is Gold Spot Price

The spot price of gold is the most common standard used to gauge the going rate for a troy ounce of gold. The price is driven by speculation in the markets, currency values, current events, and many other factors. Gold spot price is used as the basis for most bullion dealers to determine the exact price to charge for a specific coin or bar. These prices are calculated in troy ounces and change every couple of seconds during market hours.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

Does The Monetary Denomination Of A Gold Coin Affect Its Overall Value

Not particularly. Having a legal tender status, in and of itself, can help increase the total value of a coin. But the actual face value or denomination has little to no bearing on that value. It doesn’t mean the coin contains an amount of gold worth the face value. It’s actually much higher.

Typically, the specific issuing country will have more effect on the total value of the coin. Investors prefer coins minted by major economic powers, such as the U.S., China, Great Britain, or Canada.

You May Like: How Much 10k Gold Worth

Here Are Four Reasons To Invest In Gold Today

1. Gold Holds Unique Value Gold is physical money. It isnt like the US dollar which is issued and backed by the US government, making it vulnerable to market fluctuations. Gold has immediate purchasing power as currency and that makes it uniquely valuable. Owning gold bullion is considered to be a means of protection when the US dollar is failing or world markets become volatile and uncertain. Traditionally, the value of gold goes up when the dollar is down.

2. Gold is Historically Stable Physical gold holds the same value and standard weight all over the world, creating a viable option to easily buy, sell or trade. While you can shop for gold in many currencies and weights, the gold industry recognizes a standard for that weight. This standardization around the world makes buying gold bullion and other precious metals, a trustworthy process.

3. Gold Supply is Limited There is a limited supply of gold on the earth and gold is also not renewable. Gold cant be printed like money and that means once all of the gold has been mined and sold, there wont be more. Gold mining can be a costly activity so if mining companies decide that it isnt financially feasible to mine, the supply will lag behind demand. All of this rarity, including low discovery of new gold, makes gold even more valuable, especially as a long-term investment.

The Cost Of Making Chains Vs Earrings

A popular style of gold chain will be more reasonably priced than say a pair of earring as an earring takes more time and steps to make. Also a company might make 100 pair of earrings in one year, while they make 1,000 pieces of a frequently ordered chain style.

They can make that chain style again and again for years, but the styles of earrings change regularly, and the cost of designing and testing each earring style would increase the overall cost of the earrings as well.

You May Like: Is Gold Peak Tea Healthy

You May Like: Buy Gold From Dubai Online

Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

Also Check: How To Get Free Gold Bars In Candy Crush

Gold Bullion Barsdesign And Specifications

For centuries, buying physical gold has been recognized as one of the best ways to store wealth and preserve purchasing power. In addition to these well-established attributes, modern day investors continue to buy gold bullion bars for their portfolio diversification properties.Monex offers gold bars in three convenient forms. The 10 ounce gold bullion bar of at least .995 fine purity is the standard industry unit. Also available is the 32.15 troy ounce gold kilobar, a one kilogram bar of at least .999 fine gold purity. Both of these gold bars are hallmarked by a leading refiner to certify weight and purity and are available for personal delivery or storage.

For those who desire the finest investment-grade gold bullion bars available, we offer the exclusive Monex-certified 10 ounce gold bullion ingot. Composed of pure .9999 fine gold, this magnificent bar is one of the purest available to investors today. Each bars weight and purity is certified and guaranteed by Monex and is further hallmarked by Heraeus, a world-leading refiner, and the reputable Austrian Mint. Please note: Although this is our main gold bar offering, Monex may also offer larger gold bar sizes, including 400 ounce gold bars, by request.Gold bullion bars are real, tangible assets, and throughout history, have been an ideal store of value. They are extremely liquid investments, easily stored and transported, and can be a uniquely private way to preserve one’s wealth.

Does Gold Fluctuate Too Much To Make It Worth The Time Of An Ordinary Investor

While youll find major players investing in gold constantly, from big banks and governments to investors like George Soros, it is not too volatile for the ordinary investor to use. By knowing the spot price of gold and historic gold prices, you can track the movement of the metal and make smart investing decisions. Many ordinary investors choose to put a percentage of their wealth into gold simply to protect it from paper dollar devaluation.

Gold is a store of value investment. This means that while the gold price might change daily, or even hourly, the value of the gold does not. It protects the money you put into it. This is more important during challenging economic times than it is during the course of normal events.

Also Check: How Many Grams Is 1 10 Oz Of Gold

What Are The Essential Terms To Understand The Gold Trade

Bid Price: Current market spot price at which one can sell gold.Ask Price: It is the current spot gold price of 24k gold at which investors can buy it.Spot Price: it is calculated using the recent average of bid price and asks price.Gold Price Fixing: It is carried out by the London Gold Market Fixing Ltd. It is also a benchmark for pricing the gold and its products.

What Are Gold Futures Contracts

Futures contracts are agreements to buy or sell a commodity or asset at a future date. The amount being exchanged and the price are specified in the contract.

There are two main uses for gold futures contracts. They allow gold miners and dealers to hedge against falling prices. Futures also allow investors and large institutions to speculate on the gold price.

Read Also: How To Melt Gold Jewelry At Home

Does The Gold Market Operate 24 Hours Per Day Around The World

Yes, gold is bought and sold at all hours of the day and night, all around the world. You can get the current gold price per ounce at midnight or sunrise, lunchtime or any other time you need it.

Gold is traded 24 hours per day to ensure that all comers have access to this investment market, including banks, governments, other financial institutions, and investors just like you. The market is active around the clock to guarantee that you can always get an accurate gold price per ounce.

I’ve Heard That Gold Traded 24/7 Is That True Is There An Open And A Close

Gold, actually trades 23 hours a day Sunday through Friday. Most OTC markets overlap each other there is a one-hour period between 5 p.m. and 6 p.m. eastern time where no market is actively trading. However, despite this one hour close, because spot is traded on OTC markets, there are no official opening or closing prices.

For larger transactions, most precious metals traders will use a benchmark price that is taken at specific periods during the trading day.

Also Check: How Much Is 1/10 Oz Of Gold In Grams

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?

What Is The Minimum Amount Of Gold You Can Buy

Minimum gold purchases from an exchange vary depending on the company involved. Most reputable exchanges have minimum order amounts that can range from 10 to 20 ounces. These companies are generally very straightforward with their pricing, and they have a professional process to make purchasing coins very simple.

Don’t Miss: Horizon Gold Card Outlet

Get The Gold Price Today From Goldpricecom

Goldprice.com is your destination for industry insight and the best tools to discover live spot prices for gold, silver, platinum and palladium. Our gold price charts provide accurate price data and allow you to research currencies from 37 different countries with 8 options for weights of measurement. We offer analysis and expert opinions to help educate you on the gold price today and prepare you for future purchases and investments.

How Do You Find The Selling Price Of Old Gold

How To Calculate The Value of Old Gold Jewellery?

Recommended Reading: 1 10 Oz Gold Coin In Grams

What Are The Most Popular Gold Coins

Every major mint produces their own gold bullion coins and are extremely popular for investors who want to hold physical metal. While only government mints can produce gold coins with a monetary face value however, the face value is well below a coins intrinsic value. Along with government mints there are a variety of private mints that produce similar products referred to as gold rounds.

Of all government mints only the South Africans Krugerrand gold coin does not have a face value and its value is completely based on the global gold price.

Here are the top five gold coins currently available.

- South African Krugerrand

- British Britannia Coin

Are Gold Futures The Same As Buying Physical Gold

While gold future prices will be similar to the bullion price, it is important to understand that gold futures contracts are not the same as owning the physical precious metal bullion. While you can technically buy a gold futures contract rather than an actual physical ounce of gold, youll ultimately pay more for your purchase in the end. The number of good delivery bullion products available in this manner is very limited, and youll not only pay the gold bullion price, but also a host of additional fees and charges before you can take delivery of a minimum of 100 oz gold per contract.

Read Also: 10k Gold Ring Worth

Gold Vienna Philharmonicsdesign And Specifications

The Austrian Mint in Vienna has been producing innovative coinage and currency for over 800 years and the Vienna Philharmonic is no exception.First struck in 1989, the Vienna Philharmonic coin is the only European legal tender gold coin produced on a large scale and the only regularly issued bullion coin denominated in euros. The Vienna Philharmonic is pure gold, with a fineness of .9999 or 24 karats, and is the largest diameter one ounce pure gold coin in the world.

Each Vienna Philharmonic coin masterfully depicts the cultural pride of Austria, the Vienna Philharmonic Orchestra. The obverse side of the coin is stamped with the name of the orchestra in German, and features a montage of instruments, including a string bass, cellos, violins, a bassoon, harp and Viennese horn, representing Austria’s rich musical and cultural heritage.The reverse side of the coin features the image of the “Great Organ” found in Vienna’s Golden Hall where the Vienna Philharmonic Orchestra performs. The country of issue, the gold weight in ounces, legal tender value in euros and the coin’s purity are also stamped on the reverse side of the coin.With a very close working relationship with the Austrian Mint, Monex remains one of the leading dealers in Vienna Philharmonics.

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

Read Also: Does Game Pass Ultimate Include Gold