Gold As An Investment

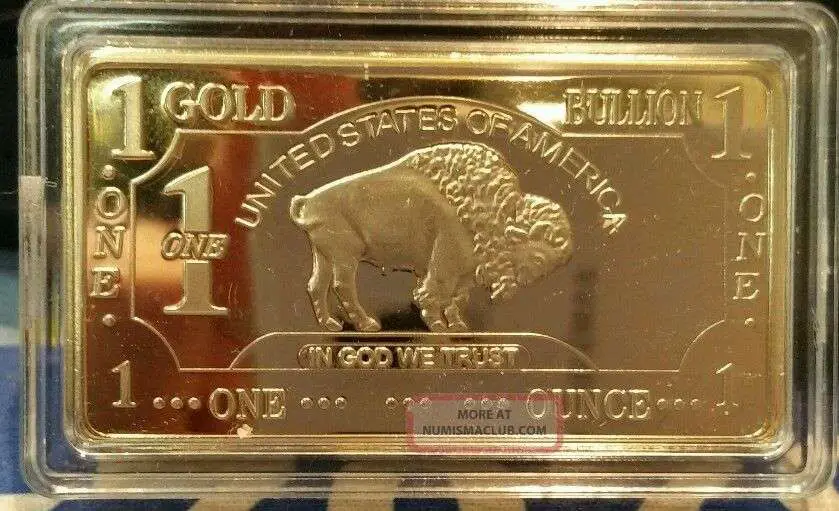

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

How Do Central Banks Influence The Price Of Gold

A central bank is a national bank that implements monetary policies and issues currency for its respective country. It also provides financial and banking services for its countrys government and commercial banking system. This means a central bank can affect the amount of money supply in its country to help stimulate the economy if needed. The Federal Reserve is the United States central bank while Europe has the European Central Bank . Other central banks include the Bank of Japan, the Bank of England, Peoples Bank of China, Deutsche Bundesbank in Germany, to name a few. Central banks are also responsible for managing its countrys reserves, including its foreign-exchange reserves, which consists of foreign banknotes, foreign bank deposits, foreign treasury bills, short and long-term foreign government securities, gold reserves, special drawing rights and International Monetary Fund reserve positions.

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

You May Like: Gold Earring Rdr2 Location

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

Why Do Investors Care About The Gold Price

As with any other type of investment, those looking to buy gold want to get the best deal possible, which means buying gold at the lowest price possible. By watching gold prices, investors can look for trends in the gold market and also look for areas of support to buy at or areas of resistance to sell at. Because gold pretty much trades around the clock, the gold price is always updating and can even be viewed in real time.

Also Check: Where Can I Melt My Gold Jewelry

How Much Does A Gold Bar Weigh

These heavy gold bricks are comprised of 400 troy ounces of pure 24k gold . A troy ounce is the industry standard for weighing and pricing precious metals, based on the ancient unit of weight developed by the Romans.

A troy ounce is 1.09714 standard ounces.

That means, 400 troy oz gold bars weigh around 27 pounds or 12.4 kilograms each about the same weight as a dumbbell.

How Often Do Gold Spot Prices Change

Spot prices for gold are constantly changing, as can be seen on any gold price chart. The price floats freely on the market and responds to real-time trading behavior.

U.S. markets close at 5:15 pm in New York, but gold continues to trade âovernightâ in Asian and Australian markets. Today’s gold price is rarely the same as yesterday or tomorrow. Therefore the spot price can change at virtually any time.

Historical charts before about 1950 don’t reflect this. Reliable data about the historical gold price is harder to find. Gold prices today are more dynamic and well-documented.

Recommended Reading: Can I Buy Gold On Robinhood

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

If The Gold Spot Price Increases Just Before I Make My Online Purchase Am I Going To Be Charged A Higher Amount

Yes. The spot price of gold fluctuates on a constant basis. Thus the prices for individual items are updated every minute. The price you will pay is locked in before checkout.

In the case of a bank wire purchase, the spot price will be locked in for 24 hours or until the next business day. For more information on bankwire pricing, see our policy on bankwires.

You May Like: 10k Gold Band Value

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

What Is A Troy Ounce

First-time precious metals buyers are often confused by the difference between a troy ounce and a regular ounce, especially when their 100 oz silver bar actually weighs 6.85 lbs on the scale instead of 6.25 lbs. Did they receive more silver than they paid for? The answer lies in an antiquated system of measurement still used today for precious metals known as troy weights.

But first: what exactly is a regular ounce? We remember from grade-school that an ounce is 1/16 of a pound, and when we visit the grocery store and ask for half-a-pound of cheese, we expect to receive eight ounces in return. This extremely common unit of measure is known as an avoirdupois ounce, and it is used for measurements not involving gold, silver, platinum, or gunpowder.

The troy ounce was retained from the Roman system for these four commodities in order to preserve the standards previously set across time, as the two-system standard would have created problems for the monetary system of the day.

A troy ounce is 1/12 of a troy pound . The troy ounce is heavier than the avoirdupois ounce . A grain is 64.79891 milligrams therefore one troy ounce is 31.1034768 grams . This measures out to be about 10 percent more than the avoirdupois ounce, which is 28.349523125 g.

1 troy ounce = 1.09714286 ounces

Troy ounce to metric metric measurements

As mentioned above, one troy ounce is equal to 31.1034768 grams. Therefore, one kilogram is equal to 32.1507 troy ounces.

Recommended Reading: How To Get Free Golden Eagles In War Thunder

Industrial Commercial And Consumer Demand

The traditional use of silver in photographic development has been dropping since 2000 due to the decline of film photography. However, silver is also used in electrical appliances , , RoHS compliant solder, clothing and medical uses . Other new applications for silver include RFID tags, wood preservatives, water purification and food hygiene. The Silver Institute have seen a noticeable increase in silver-based biocide products coming onto the market, as they explain:

Currently weâre seeing a surge of applications for silver-based biocides in all areas: industrial, commercial and consumer. New products are being introduced almost daily. Established companies are incorporating silver based products in current lines – clothing, refrigerators, mobile phones, computers, washing machines, vacuum cleaners, keyboards, countertops, furniture handles and more. The newest trend is the use of nano-silver particles to deliver silver ions.

â

Data from 2010 reveals that a majority of silver is being used for industry , jewelry , and investments .

The expansion of the middle classes in emerging economies aspiring to Western lifestyles and products may also contribute to a long-term rise in industrial and jewelry usage.

What Can Cause The Spot Gold Price To Change

Any change or disruption to either the supply or demand for gold will move the spot price.

If a large gold deposit is discovered, the increased supply will cause the spot price to fall. The reverse is true if the gold supply decreases.

An increase in gold demand will also drive the spot price higher. Perhaps the demand is due to accelerating inflation or extreme economic uncertainty.

Supply and demand are affected on a daily basis, meaning the gold spot price is constantly in flux.

Also Check: Does Kay Jewelers Sell Fake Diamonds

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

Read Also: How To Get Free Gold Bars In Candy Crush

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

Is The Spot Price Universal

Yes. You may see some minor variance in the daily gold price from region to region. These differences are invariably due to local issues. Otherwise the spot price at a given moment applies everywhere in the world.

Realtime spot prices in Zurich, London, New York, and Shanghai are key reference points. It is usually measured in USD but may be expressed in the local currency, as well. The gold gram price may be quoted in addition to the price per troy oz.

Also Check: 1/10 Oz To Grams Gold

How Much Is 1 Pound Of Gold Worth

troy

| 1 Troy Pound of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

You May Like: Where To Sell Gold Rdr2

Other Applications Of This Gold Calculator Are

With the above mentioned units calculating service it provides, this gold converter proved to be useful also as a teaching tool: 1. in practicing troy ounces and grams exchange. 2. for conversion factors training exercises with converting mass/weights units vs. liquid/fluid volume units measures. 3. work with gold’s density values including other physical properties this metal has.

International unit symbols for these two gold measurements are:

Abbreviation or prefix , unit symbol, for ounce is: oz tAbbreviation or prefix brevis – short unit symbol for gram is: g

What Other Types Of Gold Bullion Products Should I Consider Buying

We make a market in a range of the most popular bullion bar and coin products. You can buy Gold Krugerrands, buy Gold Eagles, buy Gold Maples, buy Gold Philharmonics or indeed buy Gold Britannias. If you wish to own a smaller coin and the divisibility benefits of smaller gold coins you can buy Gold Sovereigns.

High net worth investors frequently opt to buy Gold bars and Gold bars . Larger gold bars are normally stored in our Secure Storage vaults internationally.

You May Like: Hidradenitis Suppurativa Dial Soap

Value Of Gold Per Ounce: Things To Remember

Do remember that the value of gold per ounce is always a function of supply, demand and many other factors. Just because the price of gold is high right now does not mean it will still be high about a year from now.

Ten years from now, however, this will likely be a different story. Gold is a long-term investment, and if you are not familiar with the ins and outs of purchasing this type of asset for the long haul, its important to consult people who have the knowledge base to help you.

Certain events can also change the current price of gold, so make sure that you keep yourself tuned in to the latest fluctuations to determine the best time to buy.

Kilo Gold Bullion Barsdesign And Specifications

Historically, gold bullion has been referred to as real, honest money and a potential safe haven investment during periods of uncertainty. With a keen understanding of investor demand, Monex proudly offers the 32.15 troy ounce gold kilobar.Each certified one kilo gold bar is stamped with the manufacturers hallmark, weight, and purity of bullion content. The .9999 fine one kilo gold bar is available to investors who wish to make a larger investment in one of the most popular forms of currency in the world.

With billions of dollars in transaction volume, a sizable buy-and-sell market and consistently competitive prices, Monex remains a preferred source for buying gold bars. Monex account representatives are available between 5:30 a.m. and 4:30 p.m. Pacific time each Monday through Friday and on many weekends.

You May Like: Gold Earing Rdr2