Is The Price Of Gold Different In Other Countries

The current price of gold is the same, all things considered, in other countries. The US gold price is converted to the currency in that country based on the current exchange rate. In other words, no matter where in the world you purchase gold, the actual value of that gold in US dollars is the same. The below chart shows the annual gold price performance versus various fiat currencies.

Gold The Preferred Inflation Hedge

Fears of rising inflation had also seen markets tout Bitcoin as a potential inflation hedge, ie, returns on the currency would be consistently above annual inflation rates.

But with the token trading down for the year, such a notion seems rendered moot. Gold on the other hand, is trading close to the level of annual inflation in the U.S.- which had surged by 7.5% in January. The reading had rattled crypto markets earlier in February, while supporting gold.

Bitcoins recent sensitivity to inflation also makes it averse to rising interest rates. A bulk of the tokens decline this year has been driven by hawkish signals from the Federal Reserve, which has planned a rate hike in March.

Traders have been quick to pick up this trend. Prominent gold bull Peter Schiff has repeatedly downplayed the Bitcoin-gold relation on .

Supply Of Available Gold

The total weight of all the gold mined throughout human history is estimated at almost 198,000,000 kilograms. This means, if we were to gather all the gold mined, it would fit into a single cube thatâs about 21 metres in length and depth!

Each year, we add approximately 2,500,000 to 3,000,000 kilograms from gold mining to the overall stock of gold above the ground. This amount is usually not enough to meet global demands. Unexpectedly low supplies such as miners finding less gold than expected, can push up gold prices further.

At present, it is estimated that there is only about 20 per cent of gold left to be mined, albeit this figure is not set in âstoneâ. With new technologies, miners may be able to extract gold at sites which were originally overlooked because they were not economical to access.

Don’t Miss: Kay Jewelers $19.99

Whats The Bottom Line

According to Nickys forecast, it looks like all four precious metals could have a good chance to shine in 2022.

Most likely, gold might well profit and get a boost as a safe-haven asset by ever-growing inflation fears, investor risk sentiment as well as geopolitical risks. The silver price, on its part, might benefit from the ongoing transition to cleaner energy, with silver being a vital element in green energy technologies.

Platinum and palladium, as rare metals used by carmakers to reduce harmful vehicle emissions, are likely to profit from recovering car demand and stricter emission regulations, among other factors.

In any case, considering the last two years weve had, itll be interesting to see how 2022 unfolds. But in the meantime, with a still-unclear global economic situation and persisting inflation fears, investors could probably think of protecting their wealth with a safe-haven asset.

What Is The Outlook For Gold And Silver

While silver has rallied in recent days, following gold higher, to trade at US$15.70 per ounce, it is still well under US$17 an ounce and down by 8% over the last year. According to some analysts, silver will remain stagnant over the course of 2019 with higher gold the only tailwind that will push the white metal higher.

You May Like: Osrs Banned For Buying Gold

What Drives Gold Prices

Whether gold will continue going up depends on various factors. Decisions of central banks on interest rates and inflation affect the price of the metal, since lower interest rates and higher inflation both make it more expensive. The same goes for exchange rates, in the sense that a weak US dollar will cause gold to rise. Then, there is supply and demand of the metal itself gold mining is becoming more difficult over time, which is one reason for long-term increasing prices.

All these will have a bearing on investors deciding to buy or sell gold futures or the exchange-traded funds that trade in the commodity indices which include the precious metal. Also important is the level of uncertainty about the future of the economy, since gold is considered a safe haven in troubled times.

Gold has enthralled humanity since ancient times. Still it glitters from central bank vaults to jewellery bazaars the world over. The Conversation brings you five essential briefings by academic experts on the worlds favourite precious metal. For more articles written by experts, join the hundreds of thousands who

But as to how each factor exactly influences gold, the academic literature shows very mixed results for some of them. For instance, since the so-called commodity boom in 2005, there has been a heated debate about whether gold prices are driven more by economic fundamentals or by the behaviour of speculators and ETFs.

What Is The Future Of Silver

Silvers Future is the home time period of Silver the Hedgehog, occurring roughly 200 years after the Prime Zone s present. The nature of this future timeline often changes due to Silvers time traveling altering the past, but it is always in differing states of turmoil due to various unrelated events that occur in the past,

Also Check: How Much Is 18 Carat Gold

Gold Price Per Gram Today

Actual Gold Price equal to 57.53 Dollars per 1 gram. Today’s range: 57.50-57.61. Previous day close: 57.51. Change for today +0.02, +0.03%.

| 57.53 |

| 28.7% |

Gold Price forecast for .In the beginning price at 57.28 Dollars. High price 61.22, low 55.39. The average for the month 58.05. The Gold Price forecast at the end of the month 58.30, change for December 1.8%.

Gold Price forecast for .In the beginning price at 58.30 Dollars. High price 61.89, low 55.99. The average for the month 58.78. The Gold Price forecast at the end of the month 58.94, change for January 1.1%.

Gold Price forecast for .In the beginning price at 58.94 Dollars. High price 61.45, low 55.59. The average for the month 58.63. The Gold Price forecast at the end of the month 58.52, change for February -0.7%.

Gold Price forecast for .In the beginning price at 58.52 Dollars. High price 62.72, low 56.74. The average for the month 59.43. The Gold Price forecast at the end of the month 59.73, change for March 2.1%.

Gold Price forecast for .In the beginning price at 59.73 Dollars. High price 60.81, low 55.01. The average for the month 58.37. The Gold Price forecast at the end of the month 57.91, change for April -3.0%.

Gold Price forecast for May 2022.In the beginning price at 57.91 Dollars. High price 60.83, low 55.03. The average for the month 57.93. The Gold Price forecast at the end of the month 57.93, change for May 0.0%.

Yellow Metal Faces Challenge In Land Of Golden Sparrow

Gold neither pays interest nor pays dividend so till the time corporate profitability is expanding and bonds pay positive real rates, you dont need gold, says Ritesh Jain, a Canada-based global macro investor.

Year to date, the Nifty index has given over 28 per cent returns while gold returns are in negative, though in the Indian currency, gold has given positive returns every year since 2000 except for calendar years 2015 and 2013 .

Don’t Miss: Charter Tv Select Price

Is Bitcoin Or Gold A Better Buy For These Uncertain Times

Investors are seeking haven assets as Russias invasion of Ukraine roils markets.

Bitcoin is down 2.0% over the past 24 hours, currently trading for US$37,813 .

Gold has gone the other way.

Bullion prices have climbed another 1.2% since this time yesterday, to US$1,911 per troy ounce.

Thats up from US$1,801 per ounce on 1 February, for a monthly gain of 6%.

Bitcoin, on the other hand, has slid from US$38,144 on 1 February, down 1% for the month.

Gold Price Predictions For Next 5 Years

When looking at the potential price of gold over the next five years, there are a lot of factors that could propel it higher. Thats one advantage gold ownership offers: it isnt about one factor or another, its about any factor that increases fear or uncertainty on the part of investors. And there are a lot of risks surrounding us at this point that could cause any type of crisis.

But probably the biggest catalyst right now is monetary dilution. When a currency is debased, it makes real assets like gold more valuable, since they cant be created with a few computer key strokes.

And the U.S. now has both monetary stimulus and fiscal stimulus. Monetary stimulus usually goes first to the banking system and ends up inflating asset prices. But fiscal stimulus are funds injected directly into the economy and immediately spent. Its like me giving you $100 and you deposit it in a savings account vs. spending it that day on groceries.

You probably dont need me to say it, but the U.S. doesnt have trillions of extra cash to spend on fiscal stimulus packages. It already cant balance a budget. Some claim theyll collect on the backend as jobs are created and the economic grows, tax revenue will increase. But the debts and deficits are so high now theyre mathematically unpayable. And history clearly shows they will lead to inflation .

Where will the funds come from for these stimulus programs? They have to be , which will add to the already bloated deficit.

You May Like: Weight Of Brick Of Gold

Whats The Forecast For The Price Of Gold

The Gold Price forecast at the end of the month 1793, change for September -1.1%. Gold Price forecast for October 2021. In the beginning price at 1793 Dollars. High price 1885, low 1705. The average for the month 1795. The Gold Price forecast at the end of the month 1795, change for October 0.1%. Gold Price forecast for November 2021.

Does Gold Go Up Or Down When Dollar Goes Up

As a rule, when the value of the dollar increases relative to other currencies around the world, the price of gold tends to fall in U.S. dollar terms. It is because gold becomes more expensive in other currencies. As the price of any commodity moves higher, there tend to be fewer buyers, in other words, demand recedes.

Read Also: Golden State Grant Program For Ssi Recipients

Precious Metals Price Forecast For 2022

With inflation worries growing stronger over the past months, precious metals, especially gold, have been reflecting investors’ sentiment about inflation quite well.

As investors initially supported the Feds transitory inflation mantra, the gold price ended up staying rather flat over the last few months.

But as fears grew stronger, and with inflation hitting a new 30-year high in October, gold, silver, and platinum prices soared, responding to surging consumer prices and deteriorating investor sentiment.

To see if this upward trend is likely to continue in 2022, read Nickys price estimates for each precious metal below.

Our Gold Price Prediction For 2022

Based on the long term charts which show golds dominant patterns we expect this new bull market to continue for several years.

InvestingHavens research team strongly believes that golds dominant trend is a bullish trend after completing an 8-year rounding formation which started after hitting all-time highs in 2011. The first time former all-time highs were hit was in 2020. Consequently we expect a second attempt for gold to move above former ATH in 2022.

Bull markets accelerate slowly over time, only to accelerate as they mature. With that in mind we predicted several spikes prior to 2022 but the real breakout above golds former highs at $2,000 should be there no later than 2022. In fact, we expected this breakout to occur in 2021 but we were probably just a little too early with this gold prediction.

We expect an acceleration of the gold price bull run in 2022.

Recommended Reading: Heaviest Metal Credit Card

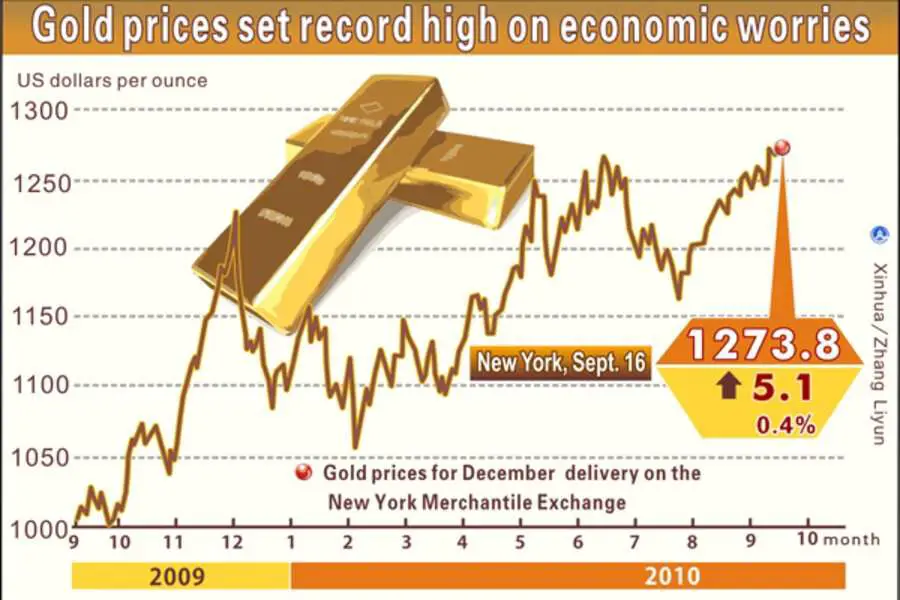

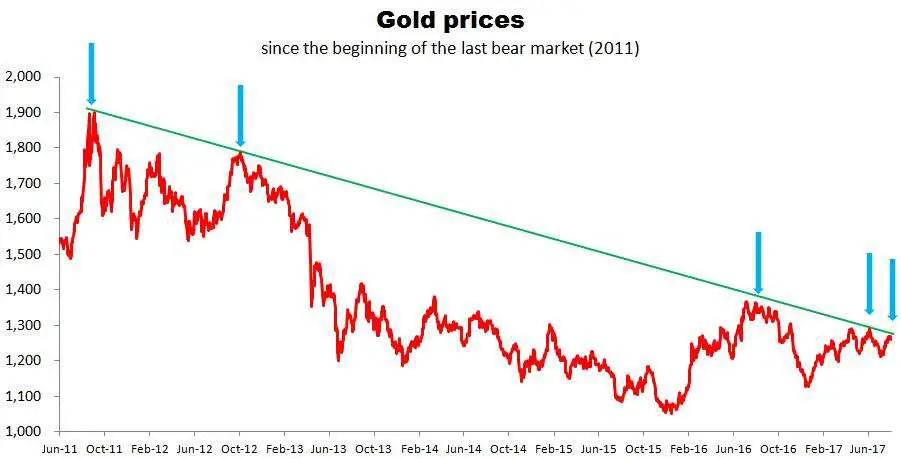

Gold Prices Between 2011

These high prices were as a result of debt issues with the U.S. and Europe, which turned investors to buying gold.

However, fast forward two years later, golds most profound price fall happened between October of 2012 and July of 2013. The metal lost around a third of its initial value.

Experts attributed this sudden fall into the strengthening of the U.S. dollar in those two years.

Money works inverse to commodities. When the dollar strengthens against major currencies, the prices of commodities such as gold, drop.

This is because many foreign buyers purchase gold using dollars. So, when the dollar is weak, they have more buying power. Hence the demand for gold increases.

The price continued to fall to a low of $ 1060 per ounce in January 2016 before making a rebound in 2018.

The U.S. major market indexes almost experienced a bear market on December 24, 2018. By April of 2018, the price was around $ 1657 per ounce. In 2018, the dollar’s currency also strengthened against its peers and rose from 120 to 128. On the other hand, dollar-denominated assets were more attractive to investors, so they shifted their money to the U.S.

Considering all these unfavorable macroeconomic factors, the performance of gold this year was reasonable.

The price experienced minor changes up until February of 2020. Due to the fears of the growing pandemic and the effects on the economy, investors turned to gold as a safe haven.

What Makes Gold Prices To Fluctuate

Gold prices show the real state of a country’s economic health. When the prices for gold go up, it signals an unhealthy economy. This is because investors tend to buy more gold, to protect their wealth from an economic crisis or inflation. And as demand increases, so does the price. On the other hand, when the prices are low, the economy is in perfect health. This makes real estate, bonds, and stocks more profitable investments. Hence the demand for gold is low. The key takeaways are that gold prices reflect the thoughts and beliefs of commodity traders. For example, if the general perception of the economy is poor, they will buy more gold. If investors think that the economy is great, they buy less.

Recommended Reading: 18 K Gold Worth

Gold Price Change History

Gold has been used as the currency of choice throughout history, with the earliest known use being during 600 B.C. in Lydia .

Fast forward to 1848, gold was identified at Sutter’s Ranch, and this inspired the famous Gold Rush to California. A few years later in 1861, Salmon Chase, the U.S. Treasury Secretary at the time produced the original U.S. paper currency backed by gold.

And this was the start of the gold standard, which later came to an end in 1933.

Gold Price Forecast: 2021 2022 And Long Term To 2030

During the last year, the gold price increased from $1,479.13 to $1,858.42, marking a 25.6% growth year-over-year. In the first month of 2021, gold prices averaged $1,866.98/oz, 0.46 percent up from December. The World Bank predicts the price of gold to decrease to $1,740/oz in 2021 from an average of $1,775/oz in 2020. In the next 10 years, the gold price is expected to decrease to $1,400/oz by 2030.

In 2020, the high level of uncertainty observed in the global economy due to the outbreak of Coronavirus fueled demand for the yellow metal. In 2021, the gold price is predicted to gradually fall as uncertainty has decreased, but volatility is still high.

Investors’ expectations for an economic recovery due to vaccinations cautiously suggest a decline in gold prices, however, any event in 2021 that could increase volatility and uncertainty may put upward pressure on gold prices as low-to-negative interest rate conditions and loose monetary policies persist.

Don’t Miss: 18 Gold Price

Gold Up 7% Bitcoin Down 25% Is Bitcoin Losing Its Shine As Safe Haven Asset

Bitcoins latest tumble, as the Russia-Ukraine conflict intensified, saw it diverge further from gold this year, raising more questions over the tokens viability as a safe haven.

Bitcoin prices slumped nearly 11% from Wednesdays level, coming below a key $35,000 support level as Russias declaration of war against Ukraine rattled financial markets.

Safe haven: Gold or Bitcoin?

We found out today.

David Ingles

In contrast, gold jumped more than 2% as investors piled into the age-old safe haven.

The move highlights the growing rift between Bitcoin and the yellow metal this year. While gold prices have risen about 8%, the worlds largest cryptocurrency has shed nearly a third of its value, data from goldprice.org shows.

The decline has challenged earlier notions of Bitcoin being a viable gold alternative, considering its decentralized nature and general detachment from the broader financial space. These aspects of the currency were widely lauded during Bitcoins stellar rally last year, where it surged to nearly $70,000.

But while the rally was indeed steep, a large portion of it was backed by institutional interest in the token. The influx of big investment houses has seen Bitcoin behave more like conventional markets, specifically, stocks.

Losses in Bitcoin this year have mirrored those in the tech-heavy Nasdaq index, which is down about 22%.

A Report From The World Gold Council Also States That While Rate Hikes Can Create Headwinds For Gold History Shows Their Effect May Be Limited

Gold prices are expected to go up in the near future as it could benefit from the elevated risk environment, rising inflation, slower growth and low interest rates. Correction from short term hurdles could be used as a buying opportunity although over the course of next 12-15 months an extended rally could be seen over $2,000 with a potential to make new life time highs, says Navneet Damani, VP – Commodity & Currency Research, Motilal Oswal Financial Services. One ounce is equal to 28.34 grams.

Gold finished the year 2021 approximately 4 per cent lower, closing at $1,806/oz, as prices rallied towards the year-end on the back of the rapidly spreading Omicron variant. Currently gold is trading at Rs 48,535 in India. In USD the current gold prices are at $1840/oz.

A report from the World Gold Council also states that while rate hikes can create headwinds for gold, history shows their effect may be limited. At the same time, elevated inflation and market pullbacks will likely sustain demand for gold as a hedge and jewellery and central bank gold demand may provide additional longer-term support.

Recommended Reading: What Does Bacardi Gold Mix Well With