More Benefits Every Day

| Apply for The American Express® Gold Credit Card and enjoy 15,000 Royal Club Miles*. |

| With Membership Rewards®, get 1 point for every US$ 1 spent. Points never expire and can be redeemed for 100s of items such as flights, hotel stays, electronics and luxury accessories. |

| Your purchases are covered by Retail Protection Insurance and Online Fraud Protection Guarantee. You will also receive generous travel insurance. |

| Enjoy exclusive offers as well as dining and shopping privileges. |

| Enjoy global airport lounge access with Priority Pass. |

| Up to 5 complimentary Supplementary Cards are available for immediate family members above the age of 15. |

| Manage your account easily via the Amex MENA app or Online Services. |

To be eligible for The American Express® Gold Credit Card, you need to have a monthly income of at least JOD 1,700.

Why You May Be Rejected When Applying For This Card

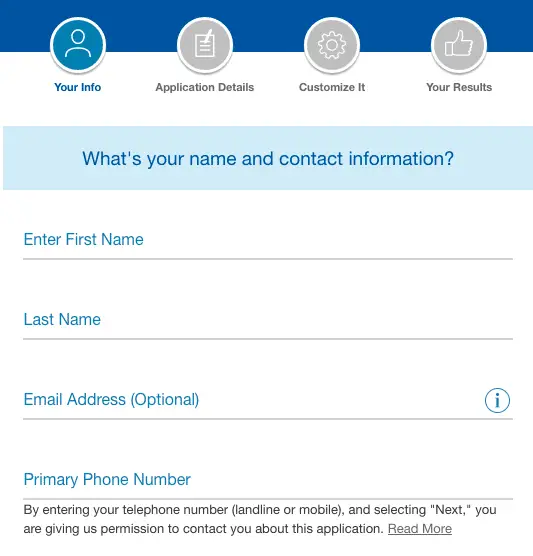

While credit card issuers heavily rely on credit scores to evaluate applicants, they also consider other factors, such as your annual income, how long you’ve had credit history and how many credit cards you currently have. For example, if you have a good credit score but have only had a credit history for a few months, the issuer may end up rejecting you because you don’t have a long enough credit history to indicate your creditworthiness.

American Express also has set limits when it comes to how many of its consumer and business cards you’re allowed to have. Individuals are limited to just five total consumer credit cards, so it’s possible you could be automatically rejected if you already have five American Express credit cards.

If, for whatever reason, you are rejected for the Amex Gold Card, card issuers and banks are required by federal law to let applicants know exactly why within 60 days. It might also be worth appealing the decision by calling American Express directly pointing out your loyalty to the credit card issuer or your history of making on-time payments on your lines of credit may help your chances.

The American Express Platinum Card

The Platinum Amex card offers members five points for every dollar spent on flights booked directly through airlines or through the American Express travel site, five points for prepaid hotels booked through amextravel.com, and one point for every dollar spent on other purchases.

The Platinum welcome bonus as of February 2021 gives cardholders 75,000 points when they spend $5,000 or more in the first six months of account membership. This is the equivalent of $855 for flights booked through the Amex travel website. However, if you decide to add up to three additional cards on your Platinum account, expect to pay an extra annual fee of $175. Each card after that will be billed a $175 annual fee, as well.

The Platinum card is great for people who love to travel. There are obviously many more perks that come with the Platinum card than with the Gold, especially when you consider the higher annual fee. Rewards can be used for merchandise, gift cards, dining, shopping, entertainment, or for use at the Amex travel website. Points can also be transferred to other frequent flyer programs.

The Platinum card offers Uber ride credits in the United States, giving cardholders a maximum of $15 in credits each month. The card also comes with an annual $200 incidental airline fee credit on the eligible airline of your choice, giving passengers complimentary checked baggage and an in-flight meal with qualifying airlines.

Read Also: Kitco Spot Gold And Silver Price

Scotia Credit Card Protection 11

This optional insurance coverage can provide you and your family financial protection by paying off your outstanding account balance or helping to cover your monthly credit card payments as a result of certain unexpected life events, such as Death, Critical Illness, Hospitalization, Disability, Job Loss or Strike or Lockout.

There are two different coverage bundles to choose from:

Basic Protection

American Express Gold: Airport Lounge Access

The American Express Gold Card does not currently offer airport lounge access of any kind. For that, youll want to look at The Platinum Card® from American Express . It gives cardholders access to Amexs Global Lounge Collection, which includes Priority Pass membership, Plaza Premium lounges, lounges in the Centurion, Delta, Lufthansa networks and more.

The Capital One Venture X Rewards Credit Card is a more affordable option at $395 per year. The card comes with an annual $300 travel credit to offset the fee. Cardholders also get Priority Pass membership, Plaza Premium lounges and unlimited access to the Capital One lounge network. The network currently consists of just one lounge at Dallas Fort-Worth Airport , but two more loungesone in Denver and one at Washington Dulles are set to open later this year.

Read Also: What Is The Highest Gold Price Ever

American Express Gold: Redeeming Points

The American Express® Gold Card earns Membership Rewards, which is one of the most valuable reward currencies. Membership Rewards can be used for virtually anything, but the best value is to transfer them to one of their 20 travel partners.

Here are just a few examples of sweet spots you can book with Membership Rewards:

- Flying Blue: 35,000 miles one-way for a round-trip economy class ticket from the West Coast to Hawaii

- Delta SkyMiles Deals: Starting at 10,000 miles round-trip for select domestic awards

- Virgin Atlantic Flying Club: From 10,000 miles one-way to London in economy class

- FlyingBlue Promo Rewards: Discounts of 25-50% on select routes

- Singapore Krisflyer: 57,500 miles one-way to the Middle East in business class

- ANA MileageClub: 88,000 miles round-trip to Europe in business class

Is The American Express Gold Card Worth It

At first, you may be turned away at the annual fee for an everyday card, this may not seem affordable. But take a closer look, and youll truly see how valuable this is. Take advantage of the up to $240 in annual statement credits and the 4x earnings rate, and youve got a fantastic card for most individuals and families.

Read Also: American Express Gold Card Vs Chase Sapphire Preferred

Exclusive Access To Special Offers And Events

Amex Offers®

Make every day more rewarding with Amex Offers.® With offers for shopping, dining, travel, and more, theres something for everyone. Adding offers to your card is quick, easy, and best of all, incredibly rewarding.14

Amex Front Of the Line®

Cardmembers can purchase Front Of The Line® presale tickets to some of the most in-demand concerts, theatre productions, restaurants, and special events before the general public.

Cardmembers can also purchase Front Of The Line® Reserved tickets from a block of seats reserved exclusively for American Express during the public on-sale period for many major events.9

American Express Invites®

Enjoy a variety of special offers and events created just for you. From advance screenings of blockbuster movies, to weekend getaway packages and special online and in-store shopping deals, its never been easier to have an experience youll never forget.9

Complimentary concierge services

Whether you need help booking your restaurant reservations or scoring tickets for a show, our concierge service is happy to assist you 24/7.5

Airport lounge access

Be confident that youll have a place to relax or catch up on business. Enjoy a preferred discount on the Priority Pass membership and access over 1200VIP lounges around the world as a Scotiabank Gold American Express® Cardholder.6

Save time at the checkout

Get a supplementary Card

Upgrade Amex Gold To Amex Platinum

While the Amex Gold card is great, you can upgrade this card to the another Amex Platinum after 1 year of card membership. Then you can open another Amex Gold . Now you’ll have 2x Amex Platinums and 1x Amex Gold.

I recently upgraded my Amex Gold card to another Amex Platinum card. I then opened another Amex Gold card account to continue to have access to the 4x points on restaurants and US supermarkets.

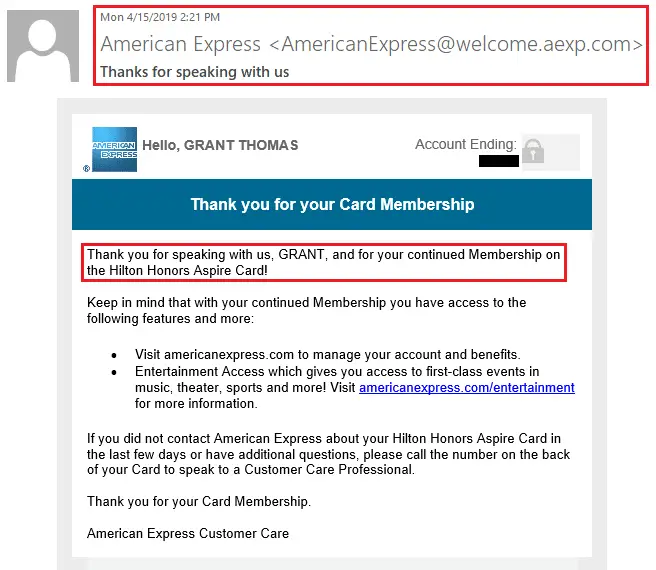

Please note, you are not eligible for the welcome offer on this card if you have ever received a welcome offer before on an Amex Gold card or an Amex Premier Rewards Gold card.

Because I had previously opened an Amex Gold card account and received a welcome offer, I will not be eligible for future welcome offers on new accounts.

After another year I will upgrade my new Gold card to another Amex Platinum card and the open another Amex Gold card. This process should be able to continue until I leave active duty or I hit the Amex charge card limit. Maybe I’ll even get more than 11 Platinum cards!

Bottom line, the Amex Gold card is perfect for traveling military servicemembers and spouses who eat out at restaurants either at home or on the road or grocery shop. The Gold Card should be your go to card for all food purchases, whether it’s making food at home or letting someone else do the cooking and clean up!

Apply for the military annual fee waived Amex Gold Card today!

Don’t Miss: What Flavor Is Gold Berry Body Armor

Who Is The American Express Platinum Card Aimed At

The card’s marketing pushes status. A solid credit score and income is necessary to qualify for the American Express Platinum card. Annual membership soared $145 to $695 for 2021. Cardholders get a variety of travel perks including access to airport lounges as well as benefits from Uber, airport security app CLEAR, hotels, car rental companies, and concierge services.

Another Issuer Might Be More Forgiving

Banks, credit unions and other financial institutions are typically the entities that issue credit cards, and each will have its own standards and application processes. According to Experian, however, American Express stands out by issuing most of its own credit cards directly. Applicants, therefore, are mainly held to American Express famously rigid standards mostly. In a few rare cases, applicants with shaky credit might be able to land an American Express card through a third-party issuer.

The American Express Credit Card, for example, is designed for applicants with average to excellent credit, according to the banks site. It has a high APR, it doesnt allow balance transfers and it doesnt deliver the top-shelf perks that made American Express famous forget about lounge access and concierge service but it does offer unlimited 1% cash back and fraud protection. Terms Apply.

You wont get the full American Express experience, but if you want to add the American Express name to your wallet, a card like this could be a good place to start.

You May Like: What Does One Ounce Of Gold Look Like

The American Express Gold Card

The Gold card comes with an annual fee of $250, and there is no annual fee for adding any additional cards to a Gold account. One of the biggest perks for any cardholder is the membership rewards program, which allows consumers to earn points as they use their credit cards.

The Gold card is geared toward people who are big shoppers, eat out a lot, and do a lot of everyday spending. American Express Gold cardholders can earn four points for every dollar spent at U.S. restaurants and U.S. supermarkets , three points for every dollar spent booking flights with airline companies or through the American Express travel website, and one point for every dollar spent on any other purchase.

As of February 2021, first-time cardholders are also eligible for 60,000 points after you use your card to make $4,000 in purchases for the first six months of account membership.

Unlike traditional credit cards, American Express cards do not have a regular APR or charge interest, as all balances must be paid in full each month. However, the Gold card does offer cardmembers the flexibility to pay for purchases of $100 or more over time at a set interest rate.

*Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by AMEX Assurance Company.

Our Featured Card For Luxury Travel: Platinum Card From American Express

If youâre looking for a more luxurious travel experience, complete with airport lounge access, shorter airport lines, and complimentary upgrades to nicer hotel rooms, the Platinum Card® from American Express may be a great option. It continually ranks among the best premium travel rewards cards from all credit card issuers. Keep in mind, however that unlike typical credit cards, this card allows you to carry a balance for certain charges but not all. The annual fee is certainly steep, but the cardâs various statement credits can help dampen the impact on your wallet.

Loading…

Pros:

Cons:

-

The $695 annual fee.

-

Other cards offer higher cash back or rewards points on everyday purchases.

-

It can sometimes be difficult to use the statement credits, and unused credits donât roll over to the next period.

Terms Apply.

You can read more about the card in our detailed review about the Amex Platinum card in our detailed review: Who should and who shouldn’t apply for the American Express Platinum card?

Also Check: Zales Men’s Gold Bracelets 14k

One Bonus Per Card Per Lifetime

American Express has the most conservative rules for earning welcome offers. Cardmembers can receive an offer on one single card only once per lifetime.

For example, lets say you earned a welcome offer by applying for the Delta SkyMiles® Gold American Express Card and meeting the spending requirements. Two months later, the public offer increases, but, unfortunately, you wouldnt be eligible for the welcome bonus on this card ever again. For this reason, its best to apply for Amex cards when the offers are at their highest.

However, the rule doesnt keep you from receiving a welcome offer on the Delta SkyMiles® Platinum American Express Card or the Delta SkyMiles® Reserve American Express Card, as theyre considered different card products. Keep this in mind when considering product-changing to another cardyou might be eligible for a new bonus by submitting a new application instead.

Anecdotal evidence suggests that the history of each card product goes back as far as seven years. Still, in the world of credit card rewards where things change all the time, seven years might as well be a lifetime.

Another important nuance to remember is that being an authorized user on another persons card doesnt prevent you from receiving your own welcome offer on the same card product.

65,000

Bonus Miles

after you spend $2,000 in purchases on your new Card in your first 6 months. Offer ends 11/9/22.

Annual Fee:$0 introductory annual fee for your first year, then $99.

American Express Gold Card Overview

The American Express Gold Card is one of the premier cards for dining rewards and the best for dining in Amexs elite card portfolio. When compared to Amexs premier travel card The Platinum Card® from American Express and similar top-tier rewards cards, the Amex Gold card is also the best option for earning rewards outside airfare and hotel stays.

While its annual fee may seem steep, its high rewards rate and valuable benefits, including up to $340 in total annual credits toward eligible dining, Uber, and hotel purchases make it well worth it.

You May Like: Where To Buy Golden Goose

How Much Are Membership Rewards Points Worth

If youâre looking for a rewards card, Amex cards offer either cash back rewards in the form of Reward Dollars or Membership Rewards® points . The cards generally have a base rate of 1% cash back or 1X Membership Rewards points on purchases, and bonus points or cash back on eligible purchases from certain merchants.

Many cards also have a welcome bonus offer for new cardholders, which can greatly increase the value of a card during the first year if you meet the minimum spending requirement within the required months of card membership. Consider the earned welcome offer, fees, and bonus earning rates as you compare the best Amex credit card offers and narrow in on which card will be the best fit.

Figuring out how the value of Amex points can be tricky, though. With cash back, itâs easy to calculate and understand the rewards youâll earn. But if you earn MR points, the value will depend on which Amex card you have and how you redeem your points.

For example, you could redeem Membership Rewards for statement credits and receive 0.6 cents per point, or for gift cards at a value of around 0.7 to one cent per point. Alternatively, you can transfer your MRs to one of the eligible hotel or airline loyalty programs, such as the Deltaâs SkyMiles® program, and book rewards hotel stays or flights. With the latter method, you may be able to receive a value of around two cents per point.

The Power Of Redemption

Luxury Cards redemption rewards every purchase with no limits, no blackout dates and no point expirations. Enjoy the choice between generous cash back or airline redemptions. More flexibility and more rewards mean your points take you further on your terms.Earn points every time you spend. Luxury Card enhances your purchasing power by providing you with one point for every one dollar you spend. Every purchase gets you closer to the rewards you want.

10

Recommended Reading: Which Is Better For Investment 22k Or 24k Gold

Can I Apply For Two American Express Cards At Once

You can apply for two American Express cards at the same time. Because of the Amex “1 in 5” it’s likely that your second application will get flagged for possible fraud. There’s still a chance of getting approved, though.

For rates and fees of Blue Cash Preferred® Card from American Express, please click here

For rates and fees of Blue Cash Everyday® Card from American Express, please click here

For rates and fees of Delta SkyMiles® Platinum American Express Card, please click here

For rates and fees of American Express® Gold Card, please click here

For rates and fees of Hilton Honors American Express Card, please click here

For rates and fees of Marriott Bonvoy Brilliant American Express® Card, please click here

The information related to American Express Platinum Card® for Schwab, The Platinum Card® from American Express exclusively for Morgan Stanley, The Business Platinum Card® from American Expressl, Ritz-Carlton Rewards Credit Card, J.P. Morgan Ritz-Carlton Rewards® Credit Card, Marriott Rewards® Premier Plus Credit Card, Marriott Bonvoy Premier Credit Card, Marriott Rewards® Premier Credit Card, Hilton Honors American Express Surpass® Card, Hilton Honors American Express Ascend Card and Marriott Bonvoy Business® American Express® Card has been independently collected by ValuePenguin and has not been reviewed or provided by the issuer of this card prior to publication.