Estimates Are Currently 190000 Tons Of Gold Exist Above Ground

Government central banks own only about 1/5th of the above-ground gold bullion supply. Another 1/5th is spread out amongst private investors in various coin and smaller gold bar size formats.

The vast majority, or around half of all physical gold above ground gets held in gold jewelry form, most of which resides in the eastern world .

Total notional gold derivative contract trading volumes around the world every year dwarf the entire physical supply of gold in the world. In other words, ‘bets on the fiat spot price actions of gold,’ are many multiples more than the actual value of physical gold owned by human beings.

This is only one primary reason why when you buy physical gold bullion in any format you will have to typically pay some price premium above the fluctuating gold spot price.

^ If this illustration does not make sense to you, perhaps learn more about how the gold market works ^

Gold Prices Decrease After Increasing By Rs700 In The Previous Session

Due to the improvement in riskier assets, the prices of gold fell sharply in India on 5 June 2020. The reopening of economies was the reason for the improvement in riskier products.

Gold futures prices on MCX decreased by 0.7% and are at Rs.46,369 for 10 grams. In the early trade, the equities market was firm. Procedures have been set by the health ministry for offices, hotels, restaurants, and shopping malls so that the spread of COVID-19 can be contained. Economies will further reopen from 8 June 2020. In the international markets, the prices of gold increased because of a weaker dollar. Spot gold prices increased by 0.2% and are at $1,714.78 for an ounce. Traders will be closely watching the US payroll data which will be announced later on 5 June 2020. A larger stimulus package has been approved by the European Central Bank. Gold prices hit record highs and crossed Rs.48,000 for 10 grams earlier in May. The tensions between China and the US ensured that the prices of gold remained high. Gold prices in India are inclusive of 3% GST and 12.5% import duty.

5 June 2020

How Much Is A Gold Bar Worth In 2021

When trying to determine the price of a gold bar, most people simply look at the gold price charts and make an estimation based on the gold bars weight.

This is a very inaccurate approach to determining how much a gold bar is worth since many factors come into play. The weight of the bar is important but it is not the only factor that determines the bars overall price as well see below.

To know the actual worth of a gold bar, you need to also factor in the manufacturing, handling, storage and insurance costs as these will be passed on to the investor as premiums.

This means that before undertaking any gold investment adventure, you need to conduct a thorough research and get all the facts right to avoid making grave investment decisions.

One advantage of gold bars is that they are manufactured by licensed, reputable entities hence chances of running into risk are minimal.

Attention: Is Your Business or Personal Assets Protected from This 2021 US Dollar Financial Falling Value Crisis? Request Your FREE 2021 Investors kit to learn more .Minimum Investment: $25,000 .

Read Also: How Many Grams Is 1 10 Oz Of Gold

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Buying Gold In Tonnage Is Not Easy

To acquire tonnes of physical gold bullion requires relations with the most significant physical gold bullion trading desks in the world . The BIS has advertised it’s gold and FX intervention desk services to its central bank and commercial bank members over the years. They are often involved with gold swaps in the hundreds of tonnes per their annual report documentation.

To buy gold bullion by the ton also requires available gold bullion sellers at current gold spot price points where often today both government central banks and the eastern world are gobbling up all-new line physical gold bullion supplies.

Often if someone is trying to sell metric tonnes of gold in an email or online, it is a tip-off that a greed-driven gold scam attempt is in the works.

Here is a brief comedic example of a such a commonly occurring would be gold scam phenomenon.

If someone even mentions the word ton, tonne, or metric tonne. It is a 99.9% tip-off of a scam artist.

Also Check: 1/10 Troy Oz To Grams

How Is The Live Spot Gold Price Calculated

Every precious metals market has a corresponding benchmark price that is set on a daily basis. These benchmarks are used mostly for commercial contracts and producer agreements. These benchmarks are calculated partly from trading activity in the spot market.

The spot price is determined from trading activity on Over-The-Counter decentralized markets. An OTC is not a formal exchange and prices are negotiated directly between participants with most of the transaction taking place electronically. Although these arent regulated, financial institutions play an important role, acting as market makers, providing a bid and ask price in the spot market.

What’s The Price Of Gold

You may also manipulate the graph by choosing a specific range of time located at the top of the graph. You can switch to silver prices by clicking the button at the top left.

This chart updates every 10 seconds . You may always refer to this page to find the current price of gold at any given time.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Gold Trading As A Commodity In India

Gold is traded through spot contracts or derivative contracts i.e. investors can trade in gold without possessing gold in its physical form.

- Gold spot contracts are whereby gold is bought and immediately delivered .

- Gold futures contracts are whereby gold is bought and sold at a later date as per the contract. Unlike most other commodities, gold futures are traded at spot prices and not at prices influenced by demand and supply.

Gold is traded as a commodity on three major commodity exchanges in India:

Read Also: How To Get Free Gold Bars In Candy Crush

How Much Are Grillz

If you are wondering, How much are grillz? you are not alone. We receive this question pretty frequently from customers who are interested in gold teeth, or gold slugs or gold fronts, as they are commonly referred.

There are a number of grillz manufacturers who sell knock-off or pre-made grillz for under $50. These grillz are usually plastic or can sometimes be gold plated around stainless steel and are universally sized. This means that you will not have to worry about having a professional mold taken, because the pre-made grillz will be a one size fits all. These pre-made grillz are typically used for costume/halloween parties and are not too heavily sought after.

Custom Grillz pricing depends entirely on the number of teeth, gold purity, if you wish to have diamonds or other gemstones added, and other finishing options such as diamond cut and diamond dust, and deep cut.

Typically, high quality custom gold grillz start at around $200 – $250 per tooth when you order a single tooth. However, it is common to receive a better price per tooth when you order grillz with more teeth. Bottom 6 grillz in 10K solid gold costs $745 and if you want to upgrade to 14K gold, we charge $945.

If you are interested in adding diamonds to your smile, we can make that happen too. We have in-house wholesale diamond buyers who specialize in setting diamonds and other rare gemstones in grillz and other jewelry pieces.

A Bad Time To Invest In Gold

In order to ascertain the investment merits of gold, let’s check its performance against that of the S& P 500 for the past 5 years . Gold has underperformed by quite a bit compared to the S& P 500 over this period, with the S& P index generating nearly a 100% in total returns compared to gold, which returned just 42.5% over the same period.

That said, the period of time that we look at is incredibly important. Gold, for example, outperformed the S& P 500 over the 10-year period from November 2002 to October 2012, with a total price appreciation of 441.5%. The S& P 500, on the other hand, appreciated by 58% over the same period.

The point here is that gold is not always a good investment. The best time to invest in almost any asset is when there is negative sentiment and the asset is inexpensive, providing substantial upside potential when it returns to favor, as indicated above.

Read Also: Buy Gold From Dubai Online

Gold In The Modern Economy

Even though gold no longer backs the U.S. dollar , it still carries importance in today’s society. It is still important to the global economy. To validate this point, there is no need to look further than the balance sheets of central banks and other financial organizations, such as the International Monetary Fund. Presently, these organizations are responsible for holding almost one-fifth of the world’s supply of above-ground gold. In addition, several central banks have added to their present gold reserves, reflecting concerns about the long-term global economy.

What Is A Safe

Since ancient Egypt, gold has been thought of as a store of wealth. Historically, despite its volatility, gold traditionally performs well during periods of financial turbulence or economic weakness. To help stabilize an economy, a central bank will loosen its monetary policy or the government will introduce fiscal initiative, these measures can impact a nations currency and ultimately increase domestic gold demand. Investors buy gold when they lose confidence in their currency.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

Gold Prices Increase In India After Falling For Three Days In A Row

The prices of gold increased in India on 30 April 2020 after seeing a huge fall in the previous session. Gold futures prices for the month of June on MCX increased by 0.35% and are at Rs.45,700 for 10 grams.

In the previous session, the prices of gold fell by Rs.566. Gold prices have fallen over the last three sessions. Earlier in April, gold rates hit record highs and were above Rs.47,000 for 10 grams. However, the prices have remained volatile since then. In the international markets, gold prices decreased slightly due to an improvement in risk appetite. Spot gold prices decreased by 0.1% and are at $1,708.85 for an ounce. Gold prices have been supported due to an increase in the number of coronavirus cases across the world. According to Kotak Securities, even though the yellow metal may witness a choppy trade, there will be support for gold because of a weak US dollar and the introduction of several measures by the Central Banks to help the economy. Gold prices in the country are inclusive of 12.5% import duty and 3% GST. In the case of currency debasement and inflation, the yellow metal tends to benefit. The fear of a global recession has also seen the prices of gold increase.

30 April 2020

The Cost Of Making Chains Vs Earrings

A popular style of gold chain will be more reasonably priced than say a pair of earring as an earring takes more time and steps to make. Also a company might make 100 pair of earrings in one year, while they make 1,000 pieces of a frequently ordered chain style.

They can make that chain style again and again for years, but the styles of earrings change regularly, and the cost of designing and testing each earring style would increase the overall cost of the earrings as well.

Recommended Reading: How To Get Gold In Candy Crush

Pay For Gold Teeth With A Dental Loan

If you’re looking for help paying for gold teeth, have a look at our guide to dental loans and dental financing to find the best solution for you.

If you can’t get dental insurance to cover your gold teeth, and you can’t afford to pay for them on your own, a dental loan can give you the money you need to pay upfront for your treatment. You then pay back the entirety of the dental loan over installments.

You can use the SuperMoney loan search engine to search and compare dental loans.

Gold Prices Gain As Inflation Concerns Grow

- Spot gold rose 0.3% to $1,759.31 per ounce by 13:44 p.m. EDT.

- U.S. gold futures settled 0.2% higher at $1,759.3.

Gold prices rose on Tuesday, as rising inflation fears dulled risk appetite and boosted demand for the safe-haven metal, although an advancing U.S. dollar limited bullion’s gains.

Spot gold rose 0.3% to $1,759.31 per ounce by 13:44 p.m. EDT, while U.S. gold futures settled 0.2% higher at $1,759.3.

A global energy crunch has threatened economic outlook and fanned inflation fears, driving some investors toward safer assets.

“We see undertones of support coming from the general idea that inflationary pressures are going to be enough to hold gold up in the midst of an environment where we see the Federal Reserve slowly moving towards reducing asset purchases,” said David Meger, director of metals trading at High Ridge Futures.

But overall, the dollar is pulling at the heels of the gold market and limiting its upside, Meger said.

Gold is traditionally seen as an inflation hedge. However, reduced central bank stimulus and interest rate hikes tend to push government bond yields up, translating into a higher opportunity cost for holding gold that pays no interest.

“There’s more risk aversion in the market and gold is benefiting from that, coupled with concerns about inflation and cooling of the global economy,” Commerzbank analyst Daniel Briesemann said.

Focus is on minutes from the Fed’s Sept. 21-22 policy meeting and the consumer price index, both due on Wednesday.

Read Also: What Dentist Does Gold Teeth

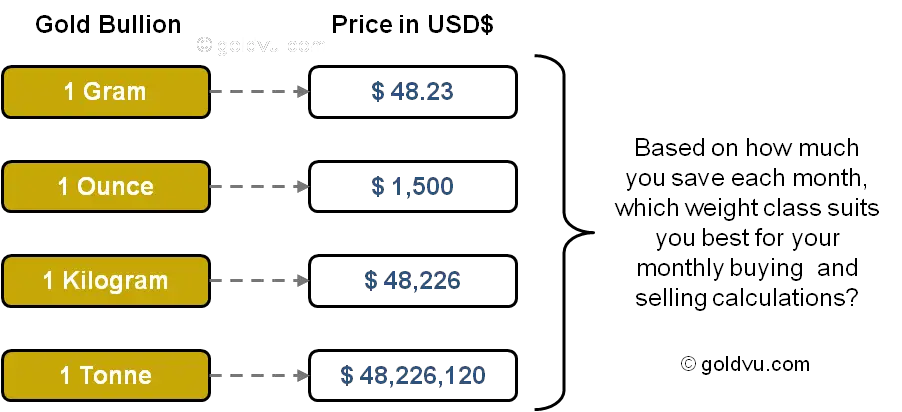

What Size Gold Bar Or Coin Should I Choose

Choosing a bullion size is totally personal and you should consider what size works best for your needs.Do you have the capacity to store several dozen 1 ounce gold coins? Do you prefer the look of gold coins over gold bars? Or does it make more sense to own a single 100 ounce gold bar? With so many weights of measurement to choose from, owning a variety or just a simple selection of bullion become options for the average consumer.

Latest Posts

What Is The Price Of The Gold And Silver Ratio

The gold-to-silver ratio shows you how many ounces of silver it would take to buy an ounce of gold. If the ratio is at 60 to 1, this means it would take 60 ounces of silver to buy one ounce of gold.

Investors use the ratio to determine whether one of the metals is under or overvalued and thus if it is a good time to buy or sell a particular metal.

When the ratio is high, it is widely thought that silver is the favored metal. When the ratio is low, the opposite is true and usually signals it is a good time to buy gold.

Don’t Miss: How Many Grams Is 1 10 Oz Of Gold

What Is Gold Price Per Gram

The gram is the entry level weight of a gold or silver bar. It is the smallest bar you can buy. Coins can also be bought in grams and are referred to as fractional because most coins are 1 troy ounce. The troy ounce is the standard unit of measurement for precious metals and one troy ounce is 31.1034807 grams. The standard ounce is 28.35 grams, a little bit less than the troy ounce. Even this slight difference demonstrates where grams can matter or might be worth noting. Buying in grams allows for versatility.

Gold Price In Canadian Dollar

The data is retrieved continuously 24 hours a day, 5 days a week from the main marketplaces .

The “spot” price is the reference price of one troy ounce, the official unit of measurement on the professional market for spot transactions. One troy ounce represents 31.1 grams.

With GoldBroker.com you buy and sell on the basis of the spot price in Euros, US Dollars, Swiss Francs or British Pounds.

The gold price in CAD is updated every minute. The data comes from the gold price in US Dollars converted at the exchange rate of the USD/CAD pair.

Read Also: Gold Peak Tea Commercial