Gold Heads For Best Week In 3 Months As Inflation Worries Mount

“Yields are backing off just a touch, so I think gold is just catching its breath right now to figure out what its next move is,” said Philip Streible, chief market strategist at Blue Line Futures in Chicago. Benchmark 10-year U.S. Treasury yields US10YT=RR eased after topping 2% for the first time in nearly three years in the previous session. St. Louis Fed Bank President James Bullard said on Thursday he wants a full percentage point of rate hikes over the next three policy meetings.

Is It Worth It To Buy Gold Bullion And Bullion Etfs

Buying gold bullion in Canada may be a good decision, but you have to provide a secure place. There are many downsides to owning physical gold, the foremost being you may lose it somehow.

As far as gold bullion ETFs this is a much easier way to hold physical gold you do not have but are entitled to

Gold Bullion ETFs are a great way to invest directly in the price of gold as a commodity without dealing with any other market risks associated with holding equities of companies.

There are situations in which both are worth it, but more so investing in ETFs.

Index Sector Weightings As Of 02/28/22

-

Sector

Important Disclosure

VanEck only serves professional clients in countries where the funds are registered or where funds can be sold in accordance with local private placement rules.*The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author, but not necessarily those of VanEck.

1 30-Day SEC Yield is a standard yield calculation developed by the Securities and Exchange Commission that allows for fairer comparisons among funds. It is based on the most recent 30-day period. This yield figure reflects the interest earned during the period after deducting the fund’s expenses for the period. It does not reflect the yield an investor would have received if they had held the fund over the last twelve months assuming the most recent NAV. Distributions may vary from time to time. In the absence of temporary expense waivers or reimbursements, the 30-Day SEC Yield for VanEck Gold Miners ETF on 03/25/2022.

7 Morningstar.

Also Check: How To Get Golden Eagles War Thunder

What Is The Price Of Gold

When someone refers to the price of Gold, they are usually referring to the spot price of Gold. Gold is considered a commodity and is typically valued by raw weight . Unlike other retail products where the final price of a product is largely defined by branding and marketing, the market price of 1 oz of Gold is determined by many factors including supply and demand, political and economic events, market conditions and currency depreciation. The price of Gold changes constantly and is updated by the minute on APMEX.com.

Gold Production In The Universe

Gold is thought to have been produced in supernova nucleosynthesis, and from the collision of neutron stars, and to have been present in the dust from which the Solar System formed.

Traditionally, gold in the universe is thought to have formed by the r-process in supernova nucleosynthesis, but more recently it has been suggested that gold and other elements heavier than iron may also be produced in quantity by the r-process in the collision of neutron stars. In both cases, satellite spectrometers at first only indirectly detected the resulting gold. However, in August 2017, the spectroscopic signatures of heavy elements, including gold, were observed by electromagnetic observatories in the GW170817 neutron star merger event, after gravitational wave detectors confirmed the event as a neutron star merger. Current astrophysical models suggest that this single neutron star merger event generated between 3 and 13 Earth masses of gold. This amount, along with estimations of the rate of occurrence of these neutron star merger events, suggests that such mergers may produce enough gold to account for most of the abundance of this element in the universe.

Recommended Reading: How Heavy Is A Brick Of Gold

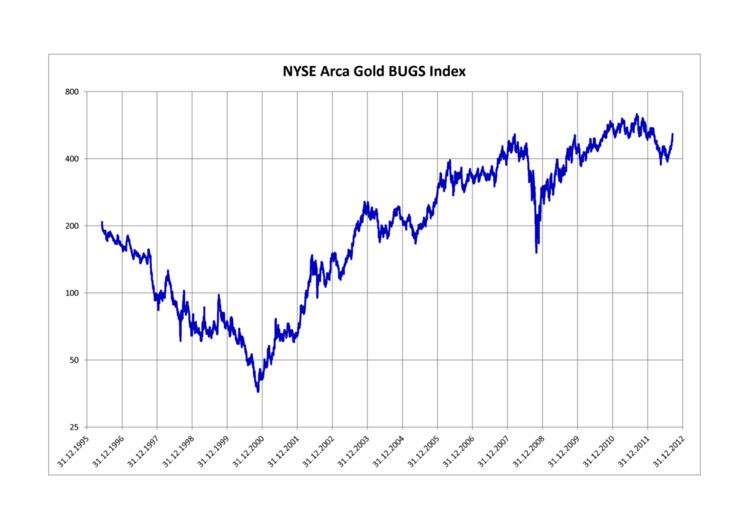

Understanding The Nyse Arca Gold Bugs Index

Gold mining companies make considerable investments in land rights, mining equipment, and workers in order to mine and process gold. Since their expenses stay pretty much the same regardless of the price of gold, these companies can become extremely profitable when gold prices increase, especially if the increase is sudden.

On the other hand, they risk becoming unprofitable if the price of gold sinks below the level that can sustain their operating expenses. For this reason, most gold-mining companies hedge their risks through methods such as selling gold futures contracts. By doing so, they can lock in a profitable sale price for the gold they mine.

While this protects them against the risk of falling prices, it can also prevent them from enjoying the outsized profits that result when the price of gold jumps unexpectedly.

Table : Gold In Usd Has Been The Best Stagflation Performer Since 1973

Annualised average adjusted return 2 since Q1 1973 *

*As of Q2 2021. Please refer in the appendix of ‘Stagflation rears its ugly head‘ for a detailed descriptions of the methodology.Source: Bloomberg, World Gold Council.

Golds strong performance year-to-date might be following its historical track record in reflationary environments, lagging commodities initially but eventually catching up. The Ukraine crisis has undoubtedly focused more attention on golds hedging credentials. Whatever the motivation for the current widespread interest in gold, it is doing exactly what an effective diversifier and portfolio hedge should: providing protection when other assets are faltering.

What may also be benefiting gold here is the lacklustre performance of bonds. Consistent with reflationary periods, bonds have struggled since the start of the year. A broad index of US government bonds has fallen 6% so far and even the Russian invasion of Ukraine failed to muster more than a brief uptick before the downdraft resumed.3 If growth slows significantly and stagflation materialises, history suggests bonds should rally .

There are strong tailwinds for gold at the moment: equity weakness, geopolitical risk, soaring inflation. Weakness in bonds is adding further support, and we are still in a reflationary environment. Should this morph into something more stagflationary the risk of which is rising then history suggests it could be even better for gold.

Footnotes

You May Like: Tinder Gold Free Trial

So What Is The Best Gold Etf In Canada Moving Forward In 2020

| 112 | Variety of covered calls |

The Horizons Gold Yield ETF employs a covered call strategy to provide investors with exposure to gold hedged to the CAD and tax-efficient distributions.

As of writing, Horizons currently yields an attractive 6.68%, has $59.06 million in assets and has a net asset value of $5.21 per share.

Unfortunately, this ETFs MER fee of 0.60%, which is equal to $6 for every $1,000 invested, is quite expensive.

Of all those on this list, HGY is the one that tracks the price of gold the closest if you include the distribution. If you strip out the yield, it has actually underperformed.

The fund is a unique product in that it holds gold ETFs as opposed to the physical metal or companies in the industry.

SPDR Gold Shares is the primary holding, making up over 96% of assets.

This fund is not for everyone. If all you are looking to do is increase your exposure to gold, then the other options on this list may be better options. This is especially true because of the high MER fees.

On the other hand, it is a unique product in that it allows you to increase exposure to goal and generate income.

Although similar to the HEP fund, it is less risky and volatile. HGY invests in funds that hold physical gold as opposed to companies that produce physical gold.

As weve seen, the ETFs whose primary holdings are gold producers tend to be more volatile. These ETFs tend to outperform in a gold bull market and can significantly underperform when gold struggles.

Hgy 5 Year Performance Vs The Tsx

Disclaimer: The writer of this article or employees of Stocktrades Ltd may have positions in securities listed in this article. Stocktrades Ltd may also be compensated via affiliate links in this post.

Mathieu Litalien

About the author

Mathieu is an individual investor and has been investing part-time for the better part of the past 20 years. He is primarily interested in fundamental analysis, focusing on the long-term and his portfolio is composed primarily of dividend-paying equities. Mathieu has a moderate risk profile and also looks for growth and value. His passion for finance and the markets have led him to his MBA and writing for Seeking Alpha and Stocktrades. Mathieu also focuses primarily on stock research and content production for Stocktrades.ca Premium and the Stocktrades blog.

Top Stocks

Recommended Reading: How Many Pounds Is A Brick Of Gold

Top Canadian Gold Etfs For 2022 And Beyond

With the advent of Canadian exchange-traded funds , passive investing in Canada has become simple.

These days you don’t need to learn how to buy individual stocks. You can instead deploy a more passive approach with ETFs.

ETFs are also an excellent way to gain exposure to particular industries without having to pick individual stocks.

A piece of investment advice we often give is that every portfolio should have some sort of exposure to gold.

Gold has long been considered a defensive investment and helps insulate your portfolio against a variety of market conditions, potential bear markets, or market volatility.

There are some investors who buy bonds, or even Canadian bond ETFs for stability, which isn’t a bad decision either. But in an ultra low interest rate environment, bonds will no doubt struggle.

With that being said, stocks that rely on a commodity, like oil, gold or even other precious metals like cobalt, pose more risk. And our stock exchange here in Canada, the TSX, is loaded with these types of stocks.

Alternatives To Buying Gold Etfs

Instead of buying any of these ETFs, there are some other ways you can get exposure to gold.

- Pick your basket of gold companies from within the funds based on your personal preferences.

- Invest in single gold company stocks

- Invest in other sectors correlated to the price of gold

- Invest in mutual funds which hold Gold Companies

- Invest in a gold futures contract

- Another option is to hold bonds, but it doesnt have the same performance against inflation.

- Buy physical gold

- Stake a Mining Claim for yourself.

One easy way is to invest in Canadian mining companies Canada produces most of the worlds gold. The United States produces about 10% of the worlds gold supply. Some of the other largest producers include Australia, Russia, and China.

Many countries and companies are invested in gold in Canada Canadian Gold ETFs reflect that.

Read Also: Selling Rs3 Gold

What’s A Golf Index For

There are two reasons for a golf index. The main reason is to provide a way for golfers of different abilities to play and compete on a relatively even basis at any course. A secondary reason is to provide a rating system that indicates a golfer’s ability relative to other golfers.

| Another real benefit of the USGA’s golf index is that it is portable. Using your USGA Index, you can go to any course which has a course rating and a slope rating and calculate your handicap for that specific course and set of tees. Our Handicap System software calculates your USGA Index as well as course handicaps and keeps track of your scoring history. |

The 10 Best Gold Etfs For Canadians

Whoever has the gold makes the rules

Gold has always been seen as a precious asset. With its incredible store of value through inflation or other economic conditions, gold holds or increases in value in the long term. Please read our article to discover how to hold yourself a diversified basket of gold through Canadian Gold ETFs.

You May Like: 1 Oz Of 24 Karat Gold

Gold: Immediately To The Upside Comes $1950

Wednesdays decent uptick in gold prices was accompanied by increasing open interest and volume, allowing for extra gains in the very near term and with the next hurdle of note at the $%1950 mark per ounce troy.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

How To Buy Gold

First, decide what kind of Gold youre interested in buying. There are several types of Gold, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Gold bullion, choose between Gold coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Gold. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Gold in their own vaults or lockboxes at home, as well.

You May Like: Spectrum Tv Gold Price

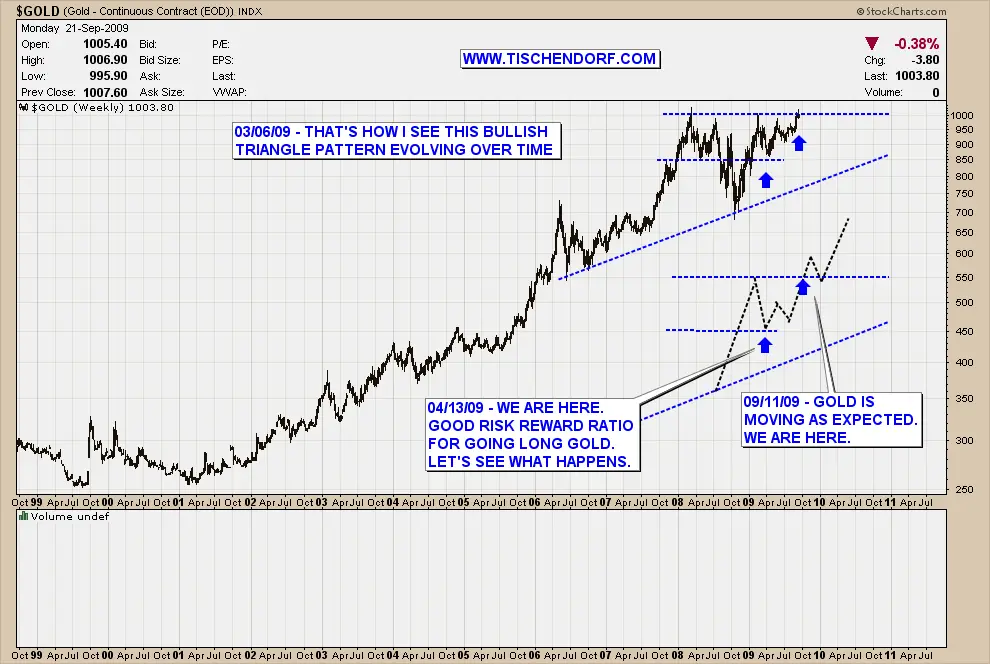

Gold Vs Barrons Gold Mining Index

Published by Dan Popescu| May 21, 2014

One cannot understand gold without understanding its supply side. Although gold production accounts only for 1.64% of existing above-ground gold, it still represents 64% of the gold market supply. Can we predict the price of gold by observing the gold mining index? As a reference for this article, I have chosen the Barrons Gold Mining Index , since it has been published since 1940 and thusly provides a long basis for analysis.

Firstly, one has to know that shares of a mining company are not the same thing as physical gold. The share prices are derived from the price of gold, but also from other factors. Those are companies managed by fallible people facing multiple corporate risks. Several things have to go right within those structures in order for individual shareholders to profit from the price of gold. Gold is liquid money without any counterparty risk, whereas mining companies shares are an investment. Gold protects capital whereas shares can increase it considerably, but with the risk of losing it. There is a 40% volatility in the gold mining shares, whereas the correlation between gold mining shares and physical gold is around 0.642.

Chart #1: BGMI Share Price vs Gold Spot Price BGMI Share Price in Ounces of Gold 1940-2014

Chart #2: BGMI Share Price vs Gold Spot Price BGMI Share Price in Ounces of Gold 1970-2014

Gold Index Etfs Growth

These are ETFs that focus on the growth of gold companies. Depending on their focus, they may provide a small yield but primarily focus on the growth and operations of gold companies and, in turn, the price of gold.

iShares S& P/TSX Global Gold Index ETF

Symbol: XGD

Seeks to provide long-term capital growth by replicating the performance of the S& P/TSX Global Gold Index, net of expenses.

We had to put the ETF first, the 2nd largest asset value ETF on our list but holding 60% of Canadian assets.

This fund has been around for 21 years and, as you can see below, has been a consistent performer providing both average annual growth and quarterly distributions.

Capitalization $1,239,267,923

AAGR : 5%

TOP 10 HOLDINGS

NEWMONT 20.39 BARRICK GOLD CORP 15.52 FRANCO NEVADA CORP 10.87 AGNICO EAGLE MINES LTD 8.85 WHEATON PRECIOUS METALS CORP 7.62 GOLD FIELDS ADR REPRESENTING LTD 4.81 ANGLOGOLD ASHANTI ADR REPTG LTD 3.75 ROYAL GOLD INC 3.07 KINROSS GOLD CORP 2.52 ENDEAVOUR MINING PLC 1.83

Harvest Global Gold Giants Index ETF

Symbol: HGGG

This ETF tracks an equally-weighted set of the top 20 gold companies by market cap globally. This is one of our top choices as it provides a great yield and AAGR with a low MER.

Here are some reasons this fund is quite successful

MER .40%

BMO Equal Weight Global Gold Index ETF

Symbol: ZGD

AAGR -0.5%

Don’t Miss: Brick Of Gold