Is The Spot Price Universal

Yes. You may see some minor variance in the daily gold price from region to region. These differences are invariably due to local issues. Otherwise the spot price at a given moment applies everywhere in the world.

Realtime spot prices in Zurich, London, New York, and Shanghai are key reference points. It is usually measured in USD but may be expressed in the local currency, as well. The gold gram price may be quoted in addition to the price per troy oz.

What Is The Price Of Gold Today

Todays spot price of Gold, like all days, is constantly changing according to supply and demand, market conditions, geopolitical forces and many other variables. However, todays price of Gold could also refer to the total percent change of the spot price, as calculated relative to the price at the start of that trading day.

Sign Up For Our Silvergoldbullca Gold Price Alert Service

Looking to sign up for our gold spot price alerts service? SilverGoldBull.ca offers an intuitive tool to help notify you when your ideal gold price or silver price is current in the market. Sign up for our gold price alerts to never miss your ideal spot gold price target again! Take advantage of our useful gold prices notifications and secure a better ROI on your gold bullion investments by purchasing your gold at the best possible prices.

Don’t Miss: Heaviest Credit Cards 2020

Industrial And Commercial Purposes

Another factor affecting the price of gold is that approximately two thirds of the world’s annual production of gold is used in jewelry. As one of the largest consumer markets for gold jewelry, India and China alone have an effect on its price. When the demand for jewelry increases and the supply is limited, the price of gold automatically rises. As soon as the demand for gold decreases, its price also depreciates. Another factor determining its price is that gold has excellent thermal and electrical conductive properties which result in it being used for numerous industrial purposes. Additionally, because of its resistance to corrosion and bacterial colonization, gold is prized in the medical field. In other words, the more uses there are for gold, the higher its price will rise.

The most common way that people invest in gold is by acquiring physical gold which is available in the form of gold coins and gold bars. Lear Capital can help you find out more about current market gold prices, the best time for you to buy and sell gold, and answer any other questions you may have about the price of any particular precious metal.

The Risk Of Gold Etfs

Gold ETFs also prevent investors from taking on too much risk. An ETF stock functions much like a regular investment if the price of gold increases, your stock becomes more valuable. If the price of gold decreases, gold ETF holders simply lose the monetary difference between the initial buying price and the current value of the stock. Given the historical price trends associated with gold, its also highly unlikely that any gold ETF truly goes belly-up and results in tremendous losses for gold ETF investors.

Also Check: Price Of 18k Gold Today

What Is The Spot Price Of Gold

The spot price of gold is the standard used to determine the current price that one troy ounce of gold can be bought or sold. The spot price is based on the unfabricated form of gold or silver before being sold to a dealer to be struck as a coin or poured into a bar. Dealers use the gold spot price as a basis to determine what to charge for a coin or bar.

Is The Gold Rate In The Us Different From The Gold Rate In Other Countries

Yes, the price of gold, specifically the spot gold price, will be different from one market to another, but only marginally so. Youll actually pay the same regardless of your market. While there is a 24-hour gold market, its closer to Forex than the stock market in terms of performance. However, with that being said, there is usually a very close correlation between the gold rate for one market and the gold rate for another.

This all said, since the year 2000 gold has performed better vs some fiat currencies like the Argentine peso vs other stronger less rapidly debasing fiat currencies like Swiss francs or New Zealand dollars for instance. See various annual price performances of Gold vs Fiat Currencies below.

GOLD vs FIAT CURRENCY KEY

Read Also: Is The Delta Platinum Card Metal

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

Factors That Can Influence The Price Of Gold

A number of different factors can influence the price of gold. Speculation on the stock market, the discovery of new gold mining spots, current events and conflicts, and more. The price of gold really can change at a moments notice. A smart investor should always have the most up-to-date data on the price of gold as it climbs up and down. Were here to keep you covered with the newest information available on the spot gold price charts.

Don’t Miss: Buy Wow Gold Safe

Numismatic Value And Gold Price Premiums

Numismatic value refers to certain beneficial features of a gold coin that increase its price. These include rarity, scarcity, artistic merit, age, condition, and so forth. Its up to you as an investor to decide if numismatic value is something to focus on or not. While the upfront prices are higher for gold with numismatic value, due to its rarity investors can be sure numismatic gold coins will bring a strong return on investment, yielding a high sale price no matter how volatile the market is.

To estimate numismatic value, take the total gold price of a numismatic 1oz coin and subtract the live gold spot price, fabrication costs, distribution fees and dealer mark-up. What remains is the current approximate numismatic value of the gold coin. While these numbers are sometimes hard to predict, doing the math before buying or selling your gold bullion will give you a more accurate estimate of what prices you will pay for your gold, and of what your ROI will look like.

Many collectors of numismatic gold bullion coins prefer to diversify their coin holdings with minted gold coins from around the world. The most reputable numismatic gold coins many collectors prefer consist of: Canadian gold coins, American gold eagles, Australian gold coins, Chinese gold pandas, British gold coins& African gold coins.

How Much Is An Ounce Of Gold

An ounce of gold is the worldwide standard weight thats used when discussing the gold market, and also when referring to a one ounce gold coin specifically. Because gold is more dense than silver, a one ounce American Gold Eagle is smaller in size than a one ounce American Silver Eagle. Because of this difference in density between the two metals, some people say that a one ounce gold coin feels heavier than a one ounce silver coin, even though they both weigh one ounce.

Read Also: Can You Get Banned For Buying Wow Gold

Gold Coins Vs Gold Bars: How To Know Which To Invest In

Deciding on the type of gold you invest in depends on your current investment portfolio, and the amount of risk you are willing to accept. Investing in gold bars represents a relatively low-risk option with incremental long-term rewards. The gold price premiums are low and the option to sell is always available if the market continues to rise. If you want to diversify your portfolio with an investment like mutual funds or bonds, investing in gold bars is your best option.

Gold coins represent higher premium costs and a bit more risk, as the price of gold coinage tends to fluctuate more than gold bars. The upside to gold coins is that you can read the market effectively and sell them at a five or ten-year high in price. Additionally, gold coins have an added benefit as they allow selling in smaller batches. This makes it easy to sell smaller portions of your gold bullion as opposed to selling a single 1kg gold bar all at once.

Can I Buy Gold At The Gold Spot Price

Under normal circumstances, typically it is not possible to buy gold for spot gold price, unless an aggressive bullion dealer is running an absurd promotion. Most gold products are sold at some sort of premium over spot. If you want to buy gold at a price as close to spot as possible, consider purchasing either a gold ETF or gold bullion bars. Gold coins and rounds often come with large premiums over the spot gold price.

Don’t Miss: Kay Jewelers Purity Rings

How Is The Spot Price Of Precious Metals Determined

The spot price is based on trading activity in the futures markets. Precious metals trade just like stocks and other securities do. Spot price reflects the current trading price.

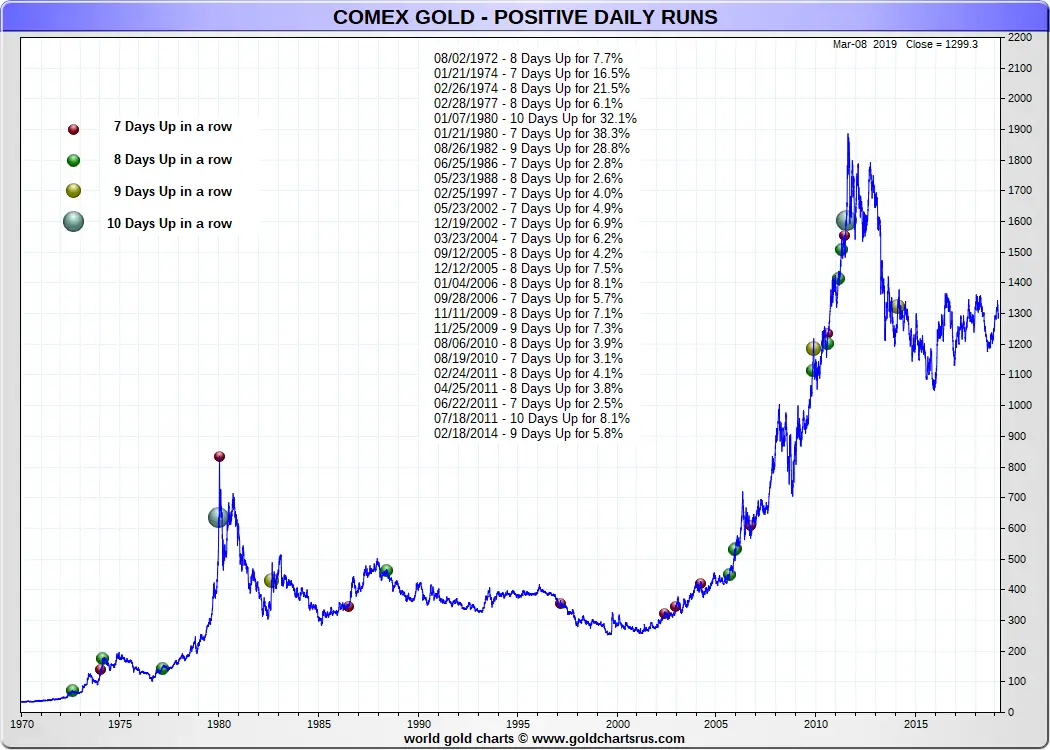

In the US, the COMEX is the primary exchange that sets the price, which fluctuates throughout the trading day. This is the price that filters down to the retail level and is quoted to you when you go to buy from a dealer, depending on what buyers and sellers are doing.

COMEX transactions involve the buying and selling of futures contracts. In the case of gold, each of them represents 100 ounces of the metal. For silver, contracts are for 5,000 ounces . It is possible for individuals to buy physical gold or silver on the Comex, but the size of the contracts puts them out of the reach of all but the most affluent buyers. In addition, taking delivery of metal from the Comex is a complicated procedure. Thus nearly all of the trading on the exchange results from major financial institutions making speculative moves or hedges, using large contracts as the vehicle.

So, oddly, the price you will pay for physical gold at any given time is driven by a market where nearly 100% of the participants are simply trading paper and have no interest in purchasing physical gold. The spot price is quoted in US dollars.

Live Gold & Silver Prices

The prices above are pulled from the Globex, an Internet platform that is one of the worlds major precious metals exchanges. The Globex trades 24 hours a day, from Sunday evening 6:00 pm EST to Friday evening at 5:15 pm EST, with a 45-minute reset interval Mondays thru Thursdays from 5:15 pm EST to 6:00 pm EST.

The time of the Live Prices is noted just below the gold price. Click the refresh button in the URL to update prices, which can change by the second.

Prices for the gold and silver products that CMI buys and sells are calculated using Globex prices. For CMI prices of gold products see Gold Bullion Prices. For CMI prices of silver items, see Silver Bullion Prices.

A popular feature that CMI Gold & Silver Inc. offers is the emailing of Daily Prices shortly after the traditional closing times of the NYMEX . Subscribing to Daily Prices is a convenient way to keep track of precious metals prices and to their trend. But, there are still more benefits to receiving Daily Prices.

Along with the prices come notices of new posts to Bills Blog, where Bill Haynes, a forty-four year veteran of the precious metals markets, blogs about the markets, economic events and social developments that affect the metals markets. Further, there are links to reviews of books that should be of interest to precious metals investors. To start receiving Daily Prices via email, enter your email address in the sign-up box found at the top of this page.

Recommended Reading: Selling Rs3 Gold

Current Silver And Gold Prices

Track the ever-changing prices of gold and silver on our interactive gold price charts and maps. Monitor the live gold price conveniently and effectively with our live gold prices graphs. Simply grab the left and right sliders to make a time-based gold price selection, and allow the data to provide insights into past gold prices, current gold prices and the future of the gold price.

What Is The Difference Between An Ounce And A Troy Ounce When Looking At A Price Of Gold Chart

A standard ounce is equivalent to about 28.349 grams and is used as a measure for almost all common commodities. Gold, however, is always measured by the troy ounce, which weighs about 31.103 grams. This standard of measurement was adopted by the United States for standard coinage in 1828, but it was created in France during medieval times.

Don’t Miss: How To Earn Golden Eagles In War Thunder

Commonly Used Gold Gram Karats In Canada

Note: Do not be confused between the two terms of “Karat” and “Carat”. Carat is a unit of weight for diamonds where 1 carat= 0.2 grams. While a karat is a unit of purity of gold where gold 18 karat means gold which is 18/24 pure i.e. the absolutely pure gold should be karat 24.

The following are commonly used Gram karats in Canada as well as other countries:

How Do Current Gold And Silver Prices Relate To One Another

While silver prices are far lower than gold prices, it can sometimes appreciate substantially. Savvy investors should compare the current gold and silver prices to determine the gold silver ratio at the moment. Depending on the results of that investigation, they may purchase gold bullion, silver bullion, or both.

Read Also: Blue Cash Preferred Card Metal

The Troy Ounce Vs The Avoirdupois Standard Ounce

Gold prices are always measured in troy ounces. A single troy ounce is one-tenth heavier than the traditional avoirdupois ounce and has been set internationally as the standard upon which gold prices are measured. Some investment websites will measure gold by the gram or in kilos, as well as ounces. As global markets trade gold & other precious metals in troy ounces, it is advisable to always calculate your gold bullion investments in troy ounces.

When assessing multiple pounds of gold, keep in mind that one pound of gold works out to be 12 troy ounces. If you prefer measuring gold in grams, consider that a single troy ounce of gold works out to be 31.1035 grams.

Why Do I Care About The Gold Spot Price

Any buying and selling you want to do will be based upon the spot price of gold. Purchases arebased on the ask price, and sales are based on the bid price.

If youre a buyer, you naturally want a lower price. And when you someday sell, youll want thehighest spot price you can get.

Any transaction you make in the gold market will be based upon the spot price.

Don’t Miss: Kay Jewelers Ring For 19.99

Does The Value Of The Us Dollar Predict The Price Of Gold

As gold is traditionally quoted in US dollars, the price of gold is negatively correlated to the strength of the USD. The weaker the US dollar, the cheaper it is to purchase gold. Therefore, if economic factors predict a strengthening of the US dollar then this will tend to drop the price of gold, and vice-versa. According to the statistics , the long-term correlation between the U.S. dollar index and the gold prices is -0.6 so this link is quite strong.

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

You May Like: Free Eagles For War Thunder

Why Are Some Gold Coins Double Spot Gold Price

If youre wondering if the spot gold price is $1800, why do some gold bullion coins sell for double the price of gold? then this is your answer youre just paying a high premium for those gold coins. Although it is possible, youre not necessarily getting ripped off. Many times the intrinsic value, or rarity of the gold coin, will play a major roll in its over all value. Many other factors may increase the premium of a gold coin over the spot gold price. Three big reasons are the overall condition of the coin, how many coins are available and how many people interested in buying it. In short, Supply & Demand.