Last Year Alone Your Zakat Enabled Us To Save Lives

Your Zakat has funded some of our crucial work with people and communities living in disaster and war zones: drought and famine-struck countries across East Africa communities affected by conflict in Yemen and families in war-torn Syria struggling to survive one day to the next.

Your Zakat has supported communities to build sustainable livelihoods in the face of climate change and to build better lives for vulnerable orphans and families across the globe.

Alhamdulillah, your Zakat has the power to transform peoples lives. Help make this happen. Give your Zakat for the love of Allah.

Which Nisab Should You Choosegold Or Silver

Now the question iswhich Nisab should you choose? While the silver Nisab is considered Afzal or more rewarding, both for the giver and the recipient, as more Zakat is given due to the lower threshold, there is a way to determine which Nisab to use.

Generally, if you only have assets and savings in gold, that is the Nisab you should use. However, if you have savings and assets in silver or mixed assets, including cash, gold, silver, and other tradable commodities, it is ideal to use the silver Nisab.

Please note that different religious sects may differ in their opinions with regards to which Nisab you should follow, and if you are in doubt, it is best to ask an Aalim-e-Deen for advice.

Gold Prices Increase Rs300 Per Tola

F.P. Report

ISLAMABAD: The price of 24 karat per tola gold witnessed an increase of Rs300 and was sold at Rs123,300 in the local market on Monday against its sale at Rs123,000 the previous day, Karachi Sarafa and Jewellers Group reported.The price of 10 gram 24 karat gold also increased by Rs257 to Rs105,710 against its sale at Rs105,453 whereas that of and 10 gram 22 karat surge to Rs96,900 from Rs96,665.The price of per tola and ten gram silver remained constant at Rs1440 and Rs1234.56 respectively.The price of gold in international market decreased by $1 to $1817 from its sale at US $ 1718, the Jewellers Group reported.

Recommended Reading: Kay Jewelers 19.99 Sale

Also Check: 400 Ounces Of Gold Worth

How Much Do You Pay In Zakat On Gold

The Prophet, on him be peace, set both the rates and timelines of Zakat on all Zakatable, that is Zakat-eligible, types of wealth for Muslims. He established a 2.5% Zakat rate on gold, silver and all measures of currency, which means on all money. Muslim scholars have unanimous agreement on this.

The Prophet, on him be peace, said:

On silver, 2.5% is due.

Again, this applies to all currency and money.

About Tcfs Zakat Collection

Is TCFs Zakat collection process Shariah compliant?

TCFs Zakat collection process is certified to be Shariah compliant. Our Zakat collection and disbursement procedures and structures have been reviewed thoroughly by our Shariah Advisor, who has issued a certificate confirming that we are Shariah Compliant. We aim to provide Muslims over the world a simple, transparent, and ethical way to invest in educating the less privileged children of Pakistan. You can view a copy of the Zakat compliance certificate.

What is the model of Zakat collection followed by TCF?

TCF follows the wakala model of Zakat. As per this model, Muslim parents of deserving students, upon their childrens admission in TCF Schools, nominate TCF as a wakil and authorise the organisation to receive Zakat on their behalf. This Zakat money is then spent on providing education to children during the year. We ensure that any parents consenting for the utilisation of Zakat for their children fulfil Islamic requirements and qualify as recipients of Zakat.

How does TCF ensure proper utilisation of Zakat Funds?

All proceeds collected by TCF as Zakat are maintained in separate bank accounts at Islamic Banks in Pakistan. The funds are then utilised through the course of the year to educate deserving children. We have well defined SOPs governing our Zakat utilisation. These SOPs have clearly been delineated by our Shariah team.

Our Shariah Advisor:

Our Shariah Team:

Mufti Muhammad Ibrahim Essa

Also Check: Buy Gold In Dubai

How Is Zakat To Be Distributed

Now that you know how you can calculate your Zakat, lets discuss the distribution process:

The calculated amount of Zakat can be paid immediately in one single transaction, or you can choose to pay it in instalments throughout the year until the next lunar year begins. However, Zakat can only be given to people who fall in one of the eight categories mentioned in the Quran.

Is Golds Zakat Value Today The Same As In The Prophets Time On Him Be Peace

Yes. Many scholars, Muslims and others, have clearly established a precise measure between gold at the time of the Prophet, on him be peace, and current weights used for Zakat today.

Briefly, the Companion Umar ibn Al-Khattab, Allahs mercy upon him, standardized the legal weight of the dirham. Then Abdul-Malik minted all Umayyad-era coins at the same weight, 10 silver dirhams equaling that specific measure, known as a mithqal. These still exist today.

Said the celebrated Muslim historian Ibn Khaldun:

It is unanimously agreed upon since the early ages of Islam, the era of the Companions and the Successors, that the weight of a silver dirham is equal to seven-tenths the weight of a gold dinar .

Related Detailed Answers

Read Also: How Much Does A Brick Of Gold Cost

Zakat Is Not Just A Duty On Those With Wealth Given For The Love Of Allah But A Right That Gold Rate For Zakat:

Zakat on pure gold and gold jewellery. She could have alternatively, weighed it at home and gone on the internet to get a quote for the day rate per gram. Now we will tell you with an example that how you can calculate their gold and silver for zakat according nisab. Last year alone, your zakat enabled us to save lives. 2020 1 . I have 10 tolas gold and i dont know how to calculate the amount of zakat i have to pay. Calculating zakat isnt as difficult as you think. Calculate your zakat with our easy to use zakat calculator. if you need to pay your zakat for previous years, you would use the values for those years. How to calculate zakat on gold. Zakat should be calculated at 2.5% of the market value as on the date of valuation . If i have to pay the zakat of last year is it going to be according to the price of gold in that respective year? Working out how to calculate your zakat on gold is an important part of figuring out how much zakat you need to pay.

I have 10 tolas gold and i dont know how to calculate the amount of zakat i have to pay. You can use our zakat calculator for gold, silver, cash and other assets to determine your overall wealth, and subsequently work out how much zakat you need to pay. Calculate your zakat with our easy to use zakat calculator. Your zakat should amount to 2.5% of your annual total wealth accumulated over the year. Last year alone, your zakat enabled us to save lives.

What Zakatable Assets Are In Gold

Gold and silver are zakatable in full. This is whether they are in the form of jewellery, coins, etc.

Calculating it is simple. You take the value of your gold or silver and pay zakat on 2.5% of the value.

1 gram of gold is approx. £40. 2.5% of this = £1. Therefore, you need to pay £1 per gram.

However, this excludes jewellery in day-to-day use e.g., your wedding ring or necklace. The reasoning is that this is part of your everyday dress rather than a pure investment.

Please note though, that the Hanafi school typically even requires you to pay zakat on jewellery you wear day-to-day. For what its worth, our personal view is the majority of other schools here that zakat on such jewellery is not required.

Recommended Reading: Heaviest Credit Cards 2020

How Do I Calculate Zakat On Jewellery

* This blog post was updated on 28th March 2022

Over the past few weeks we have been receiving a considerable amount of enquiries about Zakat on Jewellery and specifically how it is calculated. So we have decided to write a blog post about it to help inform those who are unsure. If you would like further information, please do not hesitate to call us on +44 208 767 7627

What is Zakat?

In Islam offering Zakat is one of the five pillars of Islam. It is a charitable contribution that every adult, mentally stable and financially able Muslim has to offer in order to support those less fortunate.

Zakat is obligatory when a certain amount of money, called the nisab is reached or exceeded. Zakat is not obligatory if the amount owned is less than this nisab. The nisab threshold for gold is 87.48g and the nisab threshold for silver is 21 ounces or their cash equivalent.

Zakat is based on giving 2.5% of total savings within a lunar year. These savings include cash in hand, income earned on investments, funds currently in bank accounts and precious metal objects There is no Zakat due on platinum or palladium or other precious metals apart from gold and silver. Diamonds and gemstones are also exempt from Zakat.

Zakat on Jewellery

Calculating Zakat on your jewellery is often seen as being complicated and can leave people confused. This is mainly due to a lack of concise and clear information on the subject.

The calculation for Zakat on Gold & Silver is as follows:

Why Must You Pay Zakat On Gold

Zakat comes due on all the growing and producing wealth of every Muslim who solely owns it once it reaches its set threshold and date of maturation. Growth and production potential define gold as the very standard of Zakatable assets.

In fact, Muslim scholars have literally made gold the standard weight measure for the nisab threshold on currency because it has proven the most constant, stable unit of fungible wealth-forms, like precious metals, coinage, currency, or money.

The importance of gold in the economic life of the community means hoarding it can quickly turn into a mechanism for permanently enriching the few and impoverishing the many if its holders do not put it into circulation.

Obligatory Zakat deliberately creates an incentive to invest gold and its analogous wealth-forms in society, which then inures the people, through both its circulation and its distribution.

For this reason, the Prophet, on him be peace, exhorted Muslims to invest the wealth of the orphans in their care. He did not want annual Zakat payments to consume their wealth before they grew old enough to take control of their own fortunes and put them to use.

Also Check: How Much Does One Brick Of Gold Cost

What If Im Not Sure How To Calculate Part Of It

Of course, like taxes, everyones circumstances vary, and we understand that people want to be extra careful when determining how to calculate Zakat. This can be even more complicated when you take in differences of scholarly opinion.

Weve done our best to provide answers to frequently asked questions like when to pay or if you can pay in instalments, as well as give details that you may be looking for through our complete Zakat Guide Booklet.

During Ramadan, we also have a Zakat Hotline that is open every Thursday and Friday from 6:00 pm 8:00 pm .

Simply call us at 1-855-377-4673, and your queries will be answered by our resident scholar who is well-versed in the rules of Zakat and the major schools of Islamic law.

We hope this blog has given you the confidence and tools for how to calculate your Zakat! Whether its something youre doing for the first time, or something you do every year, we hope that we have helped you fulfill this beautiful opportunity with excellence.

Through this momentous act of worship, we pray that we can draw closer to Allahs pleasure and mercy and together bring healing to those most in need.

Whoever relieves the hardship of a believer in this world, Allah will relieve their hardship on the Day of Resurrection. Whoever helps ease a person in difficulty, Allah will make it easy for them in this world and in the Hereafter

Prophet Muhammad

How Much Gold Do You Have To Have To Pay Nisab

The nisab is the minimum amount of wealth a Muslim must possess before they become eligible to pay Zakat. This amount is often referred to as the nisab threshold. Gold and silver are the two values used to calculate the nisab threshold. The nisab is the value of 87.48 grams of gold or 612.36 grams of silver.

Read Also: 18 K Gold Worth

How To Calculate Your Personal Zakat

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHows Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 40 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 544,404 times.Learn more

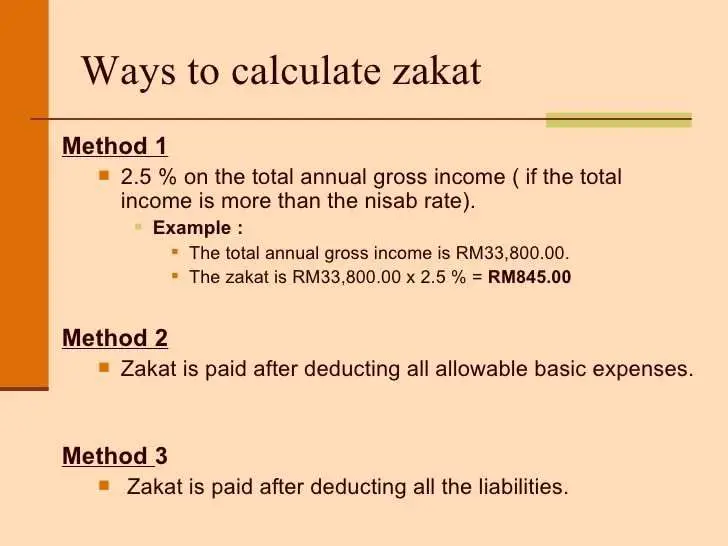

Zakat is one of the pillars of the Islamic faith. Zakat literally means alms, and there are different kind of Alms, e.g. Zakat ul-Fitr or Zakat ul-Maal . The implied Zakat that makes up the pillar of islam is Zakat ul-Maal, which mandates muslim to donate 2.5% of their personal wealth to those in need, annually.Muslims believe that Zakat purifies the spirit and brings them closer to God, and that not paying it makes your wealth dirty .Learn how to calculate your personal zakat so you can fulfill your spiritual duties.XResearch source

Zakat Calculation On Gold And Property And Eligibility

Zakat is one of the five pillars of Islam and Muslims are obligated to pay it every year. If you are a Muslim and possess a certain amount of wealth, it is essential for you to know how important paying Zakat is. The amount that you have to pay depends on your property, assets, wealth, and jewelry. If the fixed financial criteria or nisab is fulfilled, a specific sum of money is to be given to the less fortunate. The criterion is detailed in Islam and every Muslim is required to follow its rules. This article will elaborate on how to calculate Zakat on gold and property.

Recommended Reading: Kay 19.99 Ring

If You Need To Pay Your Zakat For Previous Years You Would Use The Values For Those Years

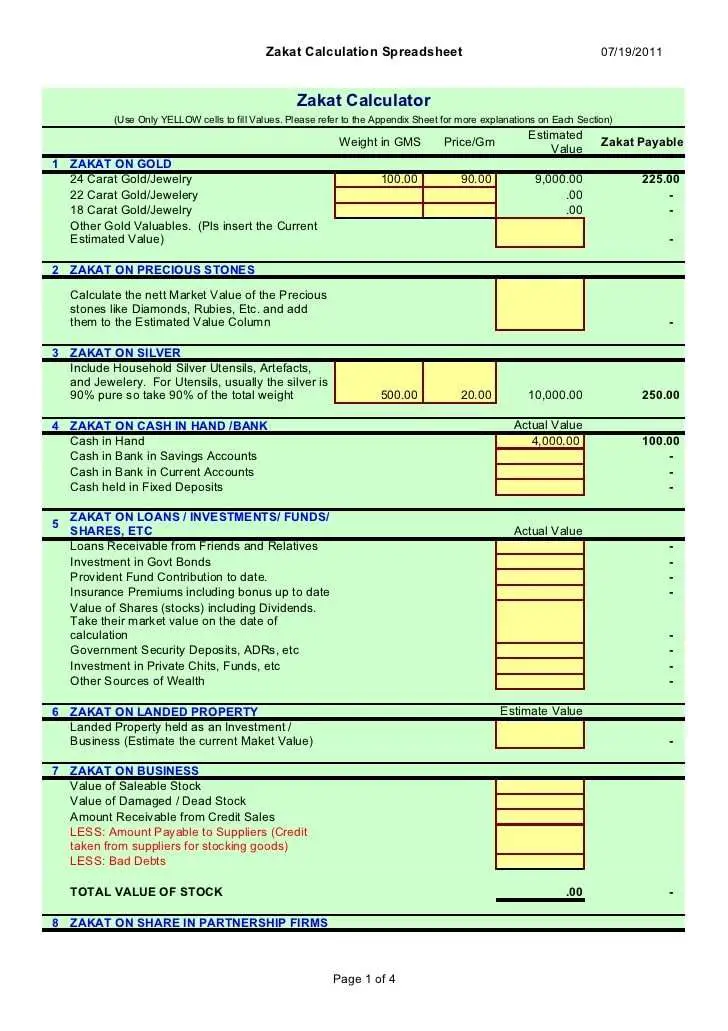

Enter the value of nisab in your local currency. Islamicfinder online zakat calculator 2021 provides you a step by step method to calculate zakat on your assets. How do i calculate zakat on jewellery? Find out the nisab and calculate zakat on cash, gold, silver, business, shares, rrsp/resp. Zakat is calculated as per the current rates of gold and silver in the country. $1.75 per gram or $19.85 per bori/tola. Our simple to use calculator will help take the stress out of working out your zakat amount. How to calculate zakat on gold. I have 10 tolas gold and i dont know how to calculate the amount of zakat i have to pay. According to sharia law, nisab is the minimum amount a person possesses for over a year in order to be obliged to pay zakah. Calculate the nisab cash values based on gold and silver. If you are married, you. Zakat is applicable on 7.5 tola gold.

Simple calculator for your personal and business zakat. If gold or silver takes the shape of a forbidden form or use item say 08 may 18 english goldrate goldratepakistan grp today 08 05 2018 gold rate in pakistan is rs 57350 per tola gol gold rate today gold rate silver rate. Calculating zakat on your jewellery is often seen as being complicated and can leave people confused. If your jewellery is made up of a mixture of metals you are only required to pay zakat if half or more of them are gold or. Your zakat has funded some of our crucial work with people and communities living in disaster and war zones:

Am I Eligible To Pay Zakat As Per The Nisab

You are Sahib-e-Nisab and eligible to pay Zakat if the total of your assets values more than 7.5 tola/3 ounces/87.48 grams of gold, or 52.5 tota/21 ounces/612.36 grams of silver for a full lunar year. Since gold and silver are not used as currency in todays world, it is important to convert the Nisab into your local currency based on the current rate of either gold or silver on the day of calculation.

READ MORE: Want To Make A Donation? Check Out These Welfare Trusts in Karachi

Please note that well be using Pakistani Rupees as the default currency in our examples, to show you how to calculate Zakat in Pakistan, but all the rates and currency values will differ based on when you are calculating your Zakat and in which country.

Recommended Reading: Where To Sell Valuables Rdr2

Recommended Reading: Kays Customer Appreciation

Assets To Be Included

The savings or assets that you must consider include:

- Cash, whether its at home or in the bank

- Foreign currency that you own

- Savings set aside for a specific purpose, such as Hajj, marriage, buying a car, etc.

- The value of all the gold and silver that you own in your local currency

- The market price value of any shares that you might own if you wish to sell them

- The dividend received from shares if you are not selling them in the near future

- Money that is owed to you and will be repaid in the near future

- Business owners should also include the balance sheet value of the stocks that they own

- Rental property owners should tabulate any saved rental income as well

- If a property is bought as an investment to be sold, then its market value is to be included

- Anticipated profit on the sale of an investment asset in the near future