Ct / K Gold Price Per Gram :

9K gold contains the least amount of gold compared to other forms. It has only 37.50% pure gold and 62.50% other metals. The other metals could be silver, zinc, or platinum, etc.

375 hallmarked gold is comparatively harder, but that does not mean that it is more durable. Its harder material makes it less durable, so you need to keep that in mind before buying it.

What Is A Gold Share Or Gold Trust

Some Gold investors would prefer not to house or ship their Precious Metals, so they invest in what is known as a Gold Share with an ETF. These shares are unallocated and work directly with a Gold Fund company who then backs up the Gold shares or stocks, and thus takes care of shipping and storage. With that, the Gold buyer does not have to worry about holding the tangible asset. However, Gold investors who prefer to hold and see their investments do not care for this option.

Buying Gold For Investment

Although no investment is completely devoid of risks, gold is one of the few assets that come with no strings attached. It is a great way to diversify your portfolio because prices have historically grown with the passage of time. Many people see gold as a stable form of investment because prices continue to lurch ahead even though bonds, stocks, and the US currency come crashing down.

Read Also: Kay Jewelers Buy Gold

Whats The Price Of Gold Per Ounce

The price of Gold can fluctuate based on market conditions, supply and demand, geopolitical events and more. When someone refers to the price of Gold per ounce, they are referring to the spot price. The spot price of Gold is always higher than the bid price and always lower than the ask price . The difference between the spot price and the ask price is known as the premium of Gold per ounce.

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

Read Also: Free Golden Eagles App

What Influences The Price Of Gold

Gold is traded on the global marketplace, and its price is determined by a huge variety of social, economic, and political factors. Its price fluctuates every minute of every day, sometimes wildly. Of course, this isn’t random, and there are predictable trends that cause the price of gold to rise and fall.

Why Does The Price Of Gold Rise

Gold is seen as a safe bet by investors: unlike other investments, it doesn’t run the risk of completely losing its value if the global financial market collapses.

Because of this, demand increases for gold in uncertain times. As a result, the global price of gold rises. For example, the price of gold reached an all-time high during the 2008 global financial crisis, when investors were looking for a safe investment in an extremely precarious period.

If you want to get the best price for your scrap gold, keep an eye on the global news. You’ll get the best deal during times of international financial uncertainty.

Also Check: How Much Is 10k Gold Worth

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

How The Price For Live Spot Gold Is Calculated

Gold has a benchmark price that is set every day. The most common entities that make use of these benchmarks include producer agreements and commercial contracts. The benchmarks are based on the spot markets trading activity on decentralized OTC or over-the-counter markets.

OTC means that the prices are not set by formal exchanges and are negotiated privately by participants over the phone or electronically. While prices for spot gold are not regulated, financial institutions still play a valuable role by serving as market makers, providing an ask price and bids for the spot market.

Don’t Miss: Value 10k Gold

What Is Your Gold Really Worth

Postal gold companies and high street gold buyers are in the business to make a profit, that’s fair enough. Unfortunately, some companies have taken this to the extreme and are blatantly ripping-off their customers.

Many unsuspecting members of the public are getting paid as little as 20% of the real value for their gold.

This page is here to help you make an informed decision as to whether you’re getting a fair deal.

The calculator in the right-hand column of this page will help you work out the real value of your gold. Pricing is based on the current ‘spot price’, which fluctuates during normal trading hours.

You’ll need to know two pieces of information to work out the value of your gold:

- The purity / Carat of your gold

- Its weight

If you live in the UK, the Hallmarking Act 1973 stipulates that any item of gold weighing over 1g must be hallmarked. This is your guarantee that the item contains the amount of gold stated. If you need need help identifying a hallmark, check our our gold hallmark guide.

Unfortunately, gold purchased in the USA is subject to lower quality control. The minimum recognized purity for an item to be called ‘gold’ in the States is 10k. However, under-karating occurs and is impossible for the average consumer to spot.

If possible, weigh your gold on a set of jewellers digital scales. You need to know the weight, in grams, preferably to one-tenth of a gram. Be wary of digital kitchen scales as many units only weigh in increments of 5 grams.

Gold Seen As The Best Performing Class With Returns Of Around 30%

Even though the markets are recovering quickly, the interest rates on FDs are low and the equities markets continue to be poor. This year, the best performing asset has been gold, seeing a 30% return. The different ways by which an individual can invest in gold are gold ETFs, SGBs that are issued by the RBI, and digital gold that is being offered by mining firms. Even though SGBs do not come with the backing of physical gold, the market value of gold is provided at maturity after 8 years. Rs.50 is also provided as a discount if the SGB is purchased online.

27 October 2020

Read Also: Who Makes Gold Peak Tea

Is Gold Always Traded 24/7 If Not Is There A Set Open And Close

Trading for gold takes place Sunday through Friday, 23 hours a day. It is common for OTC markets to overlap. No market actively trades between 5 PM and 6 PM ET. Because of the presence of OTC markets, there are no closing or opening prices for spot gold.

For large scale transactions, most gold traders will utilize the benchmark price from specific periods during the trading day.

Factors That Influence The Gold Market

Gold is one of the most important commodity markets in the world, with only crude oil being more valuable. Despite this, the bullions price doesnt function on the basis of supply and demand. As is typical of most commodities, their prices are determined by expected demand and market supply.

Prices tend to rise when demand is high and inventories are low however in the case of gold, price are more heavily influenced by fluctuations in the currency and interest rates.

Some analysts like to think of gold as a currency instead of a commodity because of its intrinsic value. It is commonly believed that gold prices are driven by sentiment instead of traditional market factors. Gold has traditionally had an extremely inverse relationship with bond yields and the US dollar. Heres the rule of thumb: when the dollar and interest rates go down, gold rates soar.

Also Check: Dial Antibacterial Gold Body Wash

Places To Buy Gold In Chennai

There are many places in Chennai where a customer can buy gold. Customers can purchase gold from the trusted jewelry houses in Chennai.

Some of the favorite jewelry brands are present in Chennai.

A few of them are Vummidi Bangaru Srihari Sons, Mehta Jewellery, G R Thanga Maligai, Prince Jewellery, Nathella Sampathu Chetty Jewellery, Saravana Stores Thanga Nagai Maligai, Bapalal & Co. Jewelry, Lalitha Jewellery, NAC Jewellers, and so on.

Gold Futures Vs Spot Gold

There is a difference between the price of gold futures and spot gold. Gold futures represent the due amount to be paid on a date of delivery in the future. The prices for gold futures are higher than spot gold, as is commonly observed in the market. This difference depends on several factors such as the market demand for immediate physical gold, interest rates, and how many days remain before the delivery contract date arrives. The Forward Rate is when the difference between the two is expressed in terms of annual percentage rates.

Spot Gold is normally exchanged by independent dealers while gold futures depend on centralized exchanges which are accessible by investors for almost 24 hours a day. The price for spot gold is completely left to the market and unregulated. In the case of gold futures, the prices are regulated by the Commodity of Futures Trading Commission and the National Futures Association .

Also Check: Do Diamonds Look Better In White Or Yellow Gold

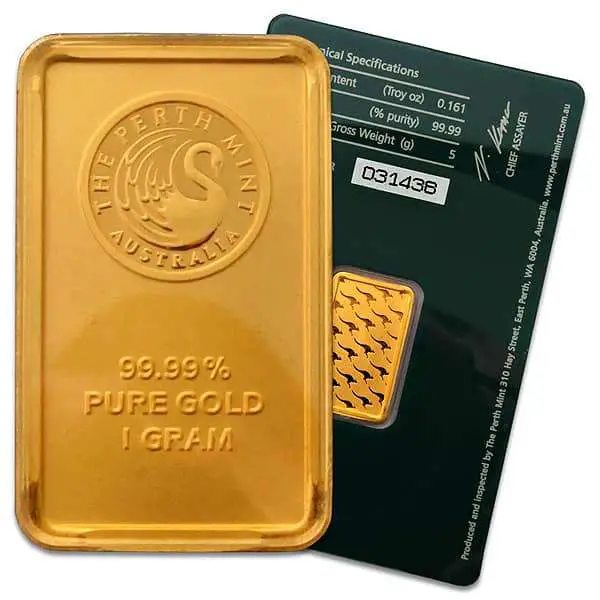

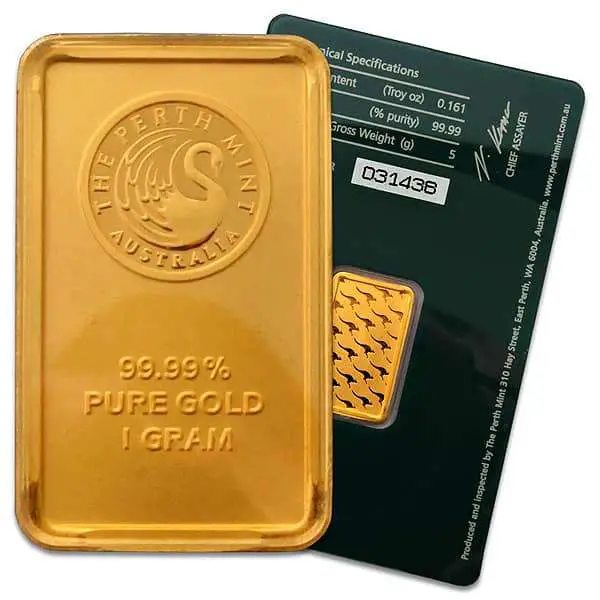

Gold Bar Price Basics

The base prices of all gold products are determined by the gold spot price. The gold spot price is a live price, meaning the price for gold is constantly changing . Since January 2018, the price for gold has not gone below $1,250 per ounce. In late 2019 to early 2020, the gold price has risen to levels as high as $1,650 per ounce.

Now, the price of gold bars is not exclusively determined by the spot price. In fact, it is exceedingly rare for a bullion dealer to have gold bars available at spot price. Every gold bar will have some sort of premium on top of the inherent value of the gold they contain. Depending on the dealer and the mint of the bars, these premiums can vary wildly. I will talk about the latter later in this post.

Check out our blog post on How to Buy Gold Bars

K Gold Price Per Gram

The current 10k gold price per gram is $23.34. This price is live and this page updates every 30 minutes with the most recent gold price. Bookmark this page and come back whenever you need to know the price of a g of 10 karat gold. Note 10k gold is 41.7% gold with the other 58.3% being some other metal usually copper or nickel.

Need to figure out the price of something besides 1g of 10k? If so use out Scrap Gold Calculator below, its totally free and displays the current gold prices.

Also Check: What Dentist Does Gold Teeth

Importing Gold Into Chennai

There are various aspects of importing gold into Chennai. Here are a few things that you need to keep in mind.

a) You can import a maximum of Rs 1 lakh of gold and that too you have stayed outside the country for more than 1 year.

b) The above is for women and men are allowed to import gold to the tune of Rs 50,000 only.

c) It is important to carry an export certificate, if you are carrying gold on your way out of the country, so you are not questioned on your way back into Chennai.

d) This is also a valuable document and forms an important basis of proof that you carried gold out of the country.

e) It is important to understand that you should have stayed outside the country for more than 1 year for the above norms to be applicable.

g) It is also important to remember that you cannot carry more than 1 kg gold and the limit is presently restricted to 1 KG.

What Are The Different Units Of Gold

The entire precious metals market in general quotes prices in troy ounces. Throughout history, countries have used different systems including the metric system to measure the weight of gold in grams, kilograms, and tonnes, and similar prefixes.

- 1 gram = 0.032 troy ounces

- 1 kilogram = 32.151 troy ounces

- 1 tonne = 32,151.7 troy ounces

- 1 tola = 0.375 troy ounces

Another popular unit for weight measurement is Tael and is commonly used in China. The tola is typically used to measure precious metals in South Asia.

Don’t Miss: Does Kay Jewelers Sell Real Gold

Where To Check Gold Rates In Chennai

There are a number of online portals where you can check for gold rates. We at www.goodreturns.in update our gold rates frequently everyday.

You can come back here to check gold rates across Chennai. We wish to emphasize that you must check the prices before buying. This is because there could be minor changes in gold prices amongst jewelery shops in Chennai.

One of the most important things that you should be careful about is the making charges of gold jewelry. Sometimes, the difference can be substantial, though gold rates in Chennai among different shops is unlikely to be very different from each other. What differs largely is the making charges.

We hope that discerning investors and buyers will check making charges before investing or buying gold jewelry.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

Don’t Miss: Dial Gold Body Wash Tattoo

Why Does The Price Of Gold Drop

The price of gold drops when investors are feeling more secure. During periods of stability, investors have a bigger appetite for high risk investments that have a small chance of a big return on investment. As a safe bet, gold doesn’t fit this profile, and therefore demand for it decreases. Prices follow, meaning you’ll get a less for your gold than in stable times.

Investing Options For Gold In Chennai

If you thought, that investing in gold coins, gold biscuits and gold jewelry was the only way to invest in gold in Chennai, you are making a big mistake. There are various options, including the recently launched sovereign gold bonds. However, we want to suggest that those who want to invest in gold in Chennai, must also look at gold etfs. These are the best form of investing in gold, because of a number of reasons. The first is that they cannot be stolen. It is pertinent to note that gold ETFs are traded electronically, so if you wish to buy them you can buy them electronically. Secondly, you need not worry about storage, and charges associated with them.

Do not forget to also invest in the sovereign gold bonds, as they offer you interest as well. Before investing in gold, also remember that there is a capital gains tax that is payable, when you sell the gold.

Don’t Miss: War Thunder Free Golden Eagles App

Gold Prices Near Rs52000 While Silver Reaches Rs64300

In the Indian commodity market, gold prices traded at Rs 52,000 while on the Multi Commodity Exchange, gold December futures traded at Rs.51,940, which was Rs.115 lower than the previous days price of Rs.52,055. December futures of silver traded at Rs.64,344 per kg with an intraday low of Rs 64,025 per kg. Spot gold fell to $1,939.10 per ounce, 0.5% lower, after increasing by 2.4% on 5 December 2020, heading towards a weekly gain of 3.2%. US gold futures decreased to $1,940.20 per ounce, a fall of 0.3%. Silver fell by 0.9% to settle at $25.10 an ounce.

9 November 2020