How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

Will Gold Price Go Down In 2022

After falling below $1200 per ounce in 2018, gold rebounded sharply over the next 12 months, and a significant bullish trend began. Its yield increased by almost 20%, whereas its quotes went up to $1,556 per ounce.

Long-Term Gold Analysis for 2021/2022.

| Month |

|---|

- Diwali/Dhanteras 13 and 14 November 2021.

- Balipratipada-15 November 2021.

Value Of Gold Per Ounce

Are you wondering, “what’s the price of gold”? The live chart above shows the current spot value of gold per ounce in US dollars. You can change the currency by using the menu at the top of the chart.

As with the other charts located on this site, just hover your mouse over the graph to see the particular price at a given time.

Recommended Reading: How Much Is 10k Gold Worth A Gram

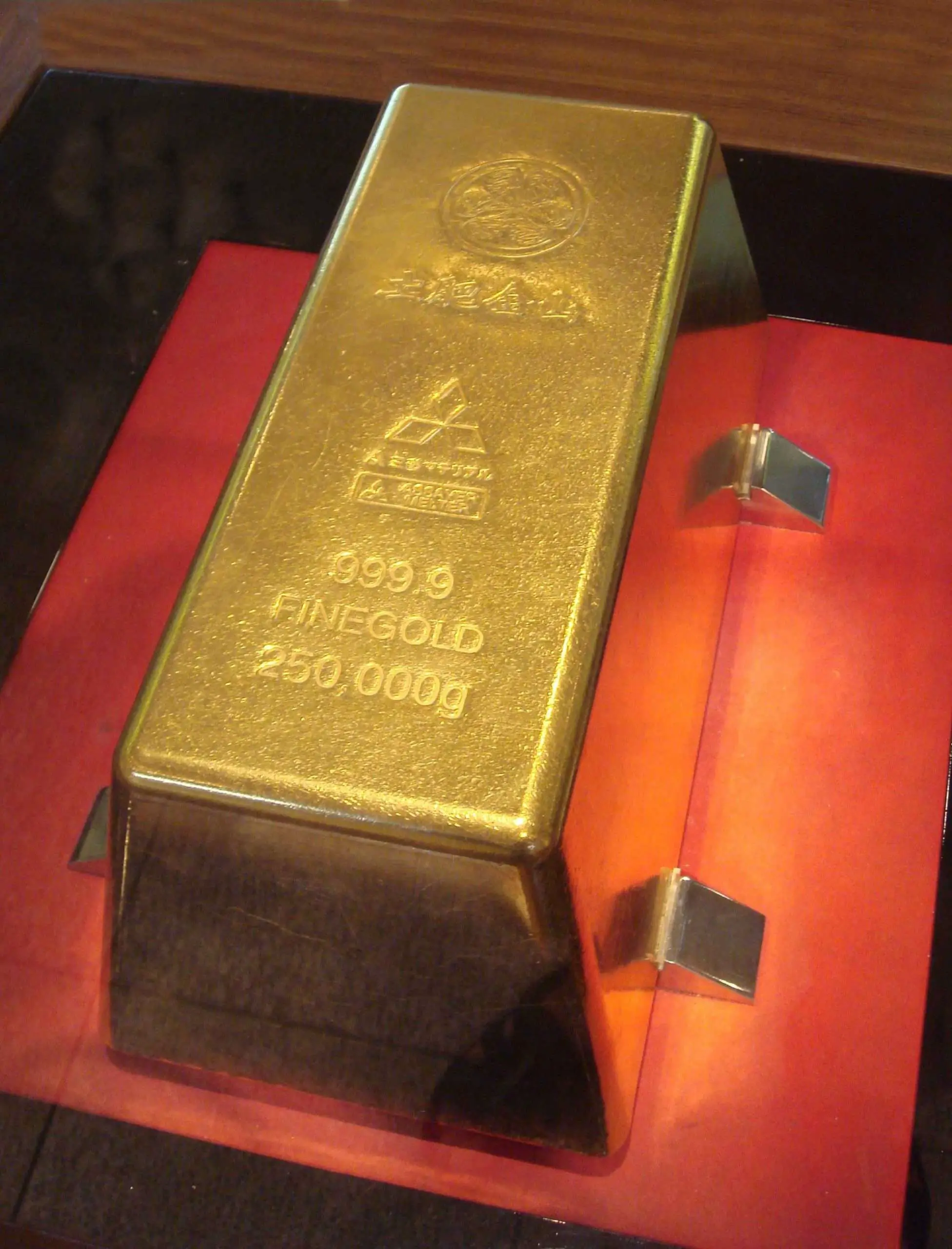

What Does A Gold Bar Contain

Gold bars can vary in size and weight. Under the United States Mint regulations, bars weigh from 350 to 430 troy ounces. The length of the bar changes from 210-290mm, the height from 25-45mm, and the width from 55-85mm. Each bar has its serial number, year of manufacture, and other details.

Different sized bars have different prices. An average gold bar weighs 400 oz, which is also known as the standard weight for gold bars. Other commonly traded gold bar weights are 1kg, 10 oz, 5 oz, and 1 oz.

Run-of-the-mill investors arent purchasing a full standard-sized gold bar for their investment portfolio. Instead, they consider smaller sizes.

What Is The Ounce Of Gold Price

The gold spot price is typically reflecting a troy ounce of gold.

The spot price is the value of one troy ounce of gold on the over the counter market. However, understand that gold is not always sold by the ounce, although that is one of the most common methods. Gold can also be sold by the gram and by the kilo . So, by knowing the gold price per ounce, you know the baseline of what youll typically pay for one troy ounce of .999 fine gold from a bullion dealer .

Also Check: Grams Per Ounce Of Gold

How Much Is 100 Ounces Of Gold Worth

troy

| 100 Troy Ounces of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Whats The Difference Between Gold Futures And Bullion

Gold futures contracts are really nothing more than promissory notes. They promise that the individual or organization in question will buy or sell a specified amount of gold at a specific time in the future . These contracts may be for a few months down the road, or they may be for years ahead. There are several challenges here.

For instance, the price of gold youll pay will be significantly higher than buying just a single ounce , and the chance for the price of gold to change between the time you buy your futures contract and when you actually take delivery is high. While there is potential for the price to go up, meaning youve saved money, theres an equally good chance that the price might go down, meaning youve paid too much.

Also Check: How Much Is 14k Italy Gold Worth Per Gram

How Much Is A Nugget Of Gold Worth

Alan, reDollar expert answered

We have to differ between natural gold nuggets and artificial, human created, gold nuggets to talk about how much they are worth. While bigger natural gold nuggets are reflecting a value higher than the gold price, humanly created gold nuggets are always only worth the current gold price. Small natural gold nuggets, mined from Alaska to Australia, are also only worth the gold price because they are not either really rare or exceptional.

Natural Gold Nuggets

Most natural gold nuggets appear either as a pure nugget or in combination with a host rock like quartz. North American mined natural nuggets usually contain approx. 95% pure gold while Australian mined nuggets can contain up to 99% pure gold. A natural 1 gram gold nugget containing 95% pure gold is worth $48.63, today.

Please also check our value-examples further down this page to get an idea how much bigger-sized gold nuggets are worth.

Artificial Gold Nuggets

What Is A Troy Ounce Of Gold

A troy ounce of Gold is equal to 31.10 grams. Its a unit of measure first used in the Middle Ages, originating in Troyes, France. You may notice that this is slightly heavier than the 28.35 grams weve come to expect from the standard ounce . Troy weight units are primarily used in the Precious Metals industry.

Read Also: Kay Jewelers 19.99

What’s The Price Of Gold

You may also manipulate the graph by choosing a specific range of time located at the top of the graph. You can switch to silver prices by clicking the button at the top left.

This chart updates every 10 seconds . You may always refer to this page to find the current price of gold at any given time.

How Much Is 7500 Ounces Of Gold Worth

troy

| 7,500 Troy Ounces of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

Read Also: How Much Is 18 Karat Gold Per Ounce

How Much Are These Gold Bars Worth

To calculate the price of a 400 oz brick of gold, multiply the current spot price of gold by 400. This is how the estimated price is calculated.

Savvy investors know that the more gold they purchase at once, the more they will save on initial costs. We only offer 400 oz gold bars that are stamped with hallmarks that are recognized worldwide to ensure their liquidity.

400 oz gold bars are the same gold bars that are held and traded by the worlds central banks. In fact, the United States holds 400 oz gold bars in the Fort Knox Gold Bullion Depository. These bars are a time-honored way to help guarantee that your investment is safe and easily transferable.

Own this impressive piece of gold today and store it in one of our secure global vaults to ensure its safety.

For more information on buying and owning gold and facts about how much gold is worth and how to value it, read our gold bar buying guide.

Is It Good Time To Buy Gold Now

Analysts remain bullish on gold prices and expect the price of the yellow metal to rise due to favourable macroeconomic conditions. It may be noted that the price of the precious yellow metal fell in India at the end of 2020 after rising to a record high last year during the peak of the Covid-19 pandemic.

Recommended Reading: 400 Oz Gold Bar Weight

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

Calculation : Gold Buyers

This calculation determines how the price compares relative to the value of gold metal from calculation 1.

This calculation is useful for people buying gold. In general, how far the price deviates from the gold metal value determines if it is cheap or expensive.

| Price |

|---|

| Step 1: Calculate gold metal value |

|---|

| Gold metal value = Price ÷ Value of gold metal × 100= 0 ÷ 0 × 100= 0 % |

Don’t Miss: Current Price Of 18k Gold Per Gram

How Does The Gold Bar Price Vary From The Ounce Of Gold Price

Gold is available in many different forms, including modern gold coins, gold bars and older collectible gold coins.

The gold bar price will vary depending on the amount of gold in the bar. If the bar contains one ounce of gold, the price will typically be slightly less per ounce than the gold price for government guaranteed and minted gold bullion coins or other similar gold bullion collectible items. However, if the gold bar contains more or less gold, the price will vary mostly depending on overall weight. For instance, a one gram gold bar will not cost the same as an ounce gold bullion bar or a one kilo gold bar.

Make sure to know the exact amount of gold bullion contained in any gold bar or gold coin before purchasing or selling to ensure that you are indeed getting a fair price.

Calculation : Gold Sellers

This calculation determines a price relative to the value of gold metal from calculation 1.

This calculation is useful for people selling gold. For people selling to a gold buyer for cash it helps you negotiate a fair price.For people onselling gold it helps determine listing prices.

In addition, this calculation can also be used by gold buyers to come up with offer prices.

| Gold metal value |

|---|

| Step 1: Calculate price relative to the value of gold metal |

|---|

| Price = Value of gold metal × Gold metal value ÷ 100= 0 × 0 ÷ 100= 0 |

You May Like: Gold Ounce Weight

What Factors Affect The Price Of Gold

Gold and silver are the most complicated assets to price. Currencies, stocks, and other commodities are primarily contingent on the essential data of the stock, the country involved, and the demand and supply of the various commodities.

However, this does not readily apply to gold essentially because gold is money and is subject to more nuanced influences, not least human psychology.

The following are the main factors that affect the price of gold…

How Does Inflation Affect the Price of Gold?

In the 1970s, US inflation, to be exact, became one of the main determinants of the fluctuations of gold prices. However, emerging markets have grown and now account for over half of the global GDP.

As a result, US inflation does not affect gold as much as it has in the past. The value of gold remains more stable in the long term more than ever. However, since currencies are still subject to high inflation rates, it may encourage investors to buy gold at times when the value of currencies decline.

How Do Global Crises Affect the Price of Gold?

World events directly and indirectly affect golds market price. Some actions of the different countries all impact and add up to the price of the precious metal. For example, the value of gold rose sharply after the Russians moved into Ukraine in 2014. The increase was the result of the disruption of geopolitical stability in the region.

How Does US Dollar Value Affect the Price of Gold?

How Does Supply and Demand Affect the Price of Gold?

Will Gold Price Go Down In 2021

Gold is typically held in investor portfolios as a hedge against inflation. ANZs gold price prediction puts the precious metal at an average of $1,850 per ounce at the end of June, rising to $2,000 per ounce by the end of September, but then falling back to $1,900 by the end of 2021 and $1,800 by mid-2022.

Recommended Reading: How Many Grams In 1/10 Oz Of Gold

What Currency Are Gold Prices Per Ounce Offered In

The US dollar is the standard for international trade, and gold is always traded in US dollars. Even if youre buying in another nation, the dealer will likely have paid for the gold in a close equivalent amount of US dollars, and then simply translated the price to the currency of the nation in question. For instance, a dealer might offer an ounce of gold in British pound sterling, and you might pay for that gold in British pounds however, the dealer often originally paid for many of their gold bullion product inventory in US dollars. All gold transactions hinge on the value of the US dollar, no matter where the sale is taking place around the world.

Below is a large percentage change illustration of how various national currencies have lost value to gold bullion in this 21st Century Gold Rush thus far.

Gold Is A Safe Haven Investment

Protecting your money with gold is similar to owning a house. When you buy a house, it is more than just an investment. The house becomes your home. It has utility that extends beyond getting a return on your money. It provides shelter and stability. Unless you are a hedge fund or a billionaire, day trading gold is not advisable.

Think of gold as insurance for your retirement account. In fact, it is even possible to own physical gold directly within an IRA, to reap the rewards of both the hedge value and the tax benefits at the same time. Historically, gold has always defied inflation, posted profits, and most importantly- been in global demand. For certain, the same cannot be said for Enron or Blockbuster shareholders who purchased stocks, giving control to outside institutions. Ask yourself this: if you plan to retire in 15 years- will your money be there for you? As investors, we own gold for the future, not for tomorrow or next month.

You May Like: Can I Buy Gold On Robinhood

Global Value Of Gold Per Ounce

Gold: used as money for centuries

Gold has been considered as the most popular and the most valued precious metal globally. For centuries it was used as a monetary vehicle. It was also the determinant of wealth of a country.

It was once the standard of value for currencies all over the world. Now that this is no longer the case — most notably marked by President Nixon taking the USA off the gold standard in 1971 — investing in gold has become more important than ever.

The price of gold is usually stated in a currency value, usually in US dollars per troy ounce.

What Is Gold Bullion

Gold bullion refers to a Gold product that is valued by and sold mostly for its metal content and does not contain any numismatic or collectible value. Gold bullion often appears in the form of bars, rounds and Sovereign coins that carry a face value and are backed by a government. These products are most commonly categorized therefore as either .999 fine or .9999 fine Gold bullion, meaning the product is either 99.9% or 99.99% pure Gold.

Read Also: Gold Filled Jewelry Buyers

Pricing And Volume Discounts*

Save on your order when you purchase in larger quantities.

Quantities ofTD Customer PricingNon-TD Customer Pricing

1-49 C$35.38 / productC$36.44 / product

50-99 C$35.06 / productC$36.11 / product

100+ C$34.42 / productC$35.45 / product

* Pricing shown is based on TD Customer Pricing with payment from a TD bank account. Final pricing will be confirmed at checkout.

Why Does Gold History Price Matter

Paying attention to gold price history is crucial for a number of different reasons. Primarily, gold price history is important for determining the current trend. Too many new gold buyers rely on the gold spot price and immediate fluctuations to determine whether they should buy or sell. However, gold is best acquired and held in a longer term fashion, and gold price’s history helps you determine whether the overall trend is up, down or flat. Only by analyzing gold price history can you make an accurate determination of movement and then choose to take action or wait.

Don’t Miss: How To Buy Wow Gold Without Getting Banned