Why You Should Be Using Gold To Buy Your Groceries

Rick Ackerman, of Ricks Picks newsletter, ran an essay by his correspondent and occasional guest essayist Erich Simon.

He starts out provocatively enough with, The dollar is down about 98% since it became global tender. Immediately, I can feel the beginnings of another Wild Mogambo Outrage stirring within me, building into a raging anger at the Federal Reserve for creating so much money, and thus so much inflation, that the currency of my country has been so ruined that it contains a lousy 2 cents 2 cents! of buying-power left of that original 1913 dollar, which had 100 cents of buying power.

Of course, it wont take me more than a couple of expletives deleted before I REALLY get into a snit about the current incarnation of the foul Federal Reserve and its insane degrees of money creation, and about Ben Bernanke, the despicable liar and laughable incompetent who is now the satanic chairman of the Fed.

My growing violent outburst was, surprisingly, soon replaced with outright fear, as what I thought was an insightful essay turned into a pop quiz! Yikes!

Back in 1971, he starts off by way of introduction, the price of an ounce of gold was $35 in line with its 1945 conscription. Right after Nixon closed the gold window, the price popped to $42.

Then he continues with the question of the dreaded pop quiz, All things being equal , at what price must gold be valued to compensate for a 98% loss from call it inflation, debt or whatever you like?

Question : When Should You Buy Gold

As with all investments, the general rule of buy low, sell high applies to gold, whether in coin, bullion or stock form. To know the right time to buy, research the type of gold you want to buy and keep your eye on the market.

Since gold tends to perform well when the economy is in a recession, most people buy gold as a type of financial insurance policy to hedge their bets against the value of the dollar in the market. As a hard asset, gold holds its value even during times of inflation. For instance, the early 1970s would have been a great year to buy gold its value increased from $35 per ounce in 1971 to $180 per ounce in 1974.

There are two main reasons people buy physical gold: as insurance and as an investment. People who are concerned about the recent economic crisis tend to view their ownership of precious metals as an insurance policy: As long as you have physical gold or silver to sell or trade, you will never be broke, even if the economy collapses. It is relatively easy to buy a gold bar, and once you purchase it, you dont need to do anything but store it.

Why Trade With Gold Bullion Australia

Gold Bullion Australia has been trading precious metals since 1980.

We are an Australian owned and operated company with strong values, high integrity and a mission to help you to invest in precious metals, without stress. Our team is experienced and renowned for being friendly and helpful.

The GBA showroom on the Gold Coast is a secure, custom-built facility where safety and discretion are assured. Plus our fully custodial vault is one of the very few of its kind in Australia.

When you’re ready to sell your metals, we’ll buy your gold and silver back from you. We’re often asked what happens if the price gets really high. Over the many years we’ve been trading, we’ve seen a consistent demand for gold and silver. Our buy-back and selling prices are always based on the current spot price.

SMSFs can invest – Many of our clients invest in precious metals through their superannuation fund portfolio and the number of people adopting this proactive approach to wealth management is growing fast.

Precious metals stored with GBA are covered by insurance for its full replacement value. Regular audits are conducted at the facility, to confirm compliance, accuracy and transparency.

You May Like: St Louis Permanent Gold Teeth

Local Coin Shops And Pawnshops

LCS and Pawnshops have a huge varying degree of trustworthiness and fairness in terms of what products they sell and what type of premium they charge. This would take some scouting, learning, and talking to folks and getting an estimate of what they are charging. In my personal experience with local places in my area, these businesses are largely overpriced. Though, there is a difference between being overpriced and nefariously price-gouging customers.Keep in mind that owning an inventory of Precious Metals as a small business is extremely costly, subject to market loss, needs to be insured, has extremely small margins to work with, on top of security and building leases. So again, there is a difference between fair pricing and nefarious pricing but dont forget to consider these things before you give them a 1-star review online! Some folks enjoy the experience of going in, browsing, picking out what they want, and supporting small business and if that comes with 50 cents or a dollar premium over spot, that is OK!

Learn How To Diversify Your Portfolio

Inside the Buyer’s Guide you’ll find practical information on what are the best gold and silver assets to buy, which coins and bars are the best to own, and why you might want to consider the advantages of professional storage.

With this guide, you’ll understand:

- Why gold is a prudent investment strategy. When stocks, bonds and other markets go down, gold goes up

- How to diversify your 401k and IRA portfolio with real gold and silver

- Why silver carries many of the advantages of gold but is currently undervalued

You May Like: 1/10 Troy Oz To Grams

Difference #: Silver Is More Affordable

This seems like an obvious statement, but the reason its important is because silver has many similarities with gold

If you buy physical silvernot ETFs, certificates or futures contracts, which are paper investmentsyou can capture the same benefits that gold offers. Advantages that virtually no other asset provides.

Like gold, physical silver

- Is a hard asset. Of all the investments you own, how many can you hold in your hand? In a world of paper profits, digital trading, and currency creation, physical silver is a tangible asset that cant be hacked .

- Is money, just like gold. It cant be created out of thin air like paper currency or digital entries. Look through monetary history and youll find that silver has been used in coinage more often than gold.

- Has no counterparty risk. If you hold physical silver, you dont need another party to make good on a contract or promise.

- Has never been defaulted on. If you own physical silver, you have no default risk. Not so for almost any other investment you make.

- Can be as private and confidential. You must report any gain on your income tax return, but if youd like some privacy or confidentiality with a portion of your investments, physical silver can provide it.

Silvers advantage over gold is that you can capture all these same benefits but at a much lower cost. Your financial insurance just got more affordable. Its why silver is called the poor mans gold.

Theres another advantage to silvers lower price: Selling

Can I Buy Silver From The Us Mint

YES! Silver is available in many forms from the United States Mint, including numismatic silver coins and bullion coins.

The United States Mint catalog is filled with a variety of silver options, including:

- silver versions of circulating coins

- silver commemorative coins

- proof and other numismatic finish American Silver Eagles.

If youre looking to buy a bullion version of, say, a 2021 American Silver Eagle straight from the mint, that is where youll need to turn to an authorized purchaser. APs are the only direct recipients of bullion American Silver Eagles from the United States Mint. Thats because the US Mint does not sell bullion American Silver Eagles directly to the public.

You can view our category page listing Silver Eagles in stock by following the link.

Trustworthy coin dealers will have many more silver bullion products available for sale than the mint, in most cases.

Don’t Miss: Kay Jewelers Certificate Code

Selecting Your Gold/silver Bullion Coins & Bars

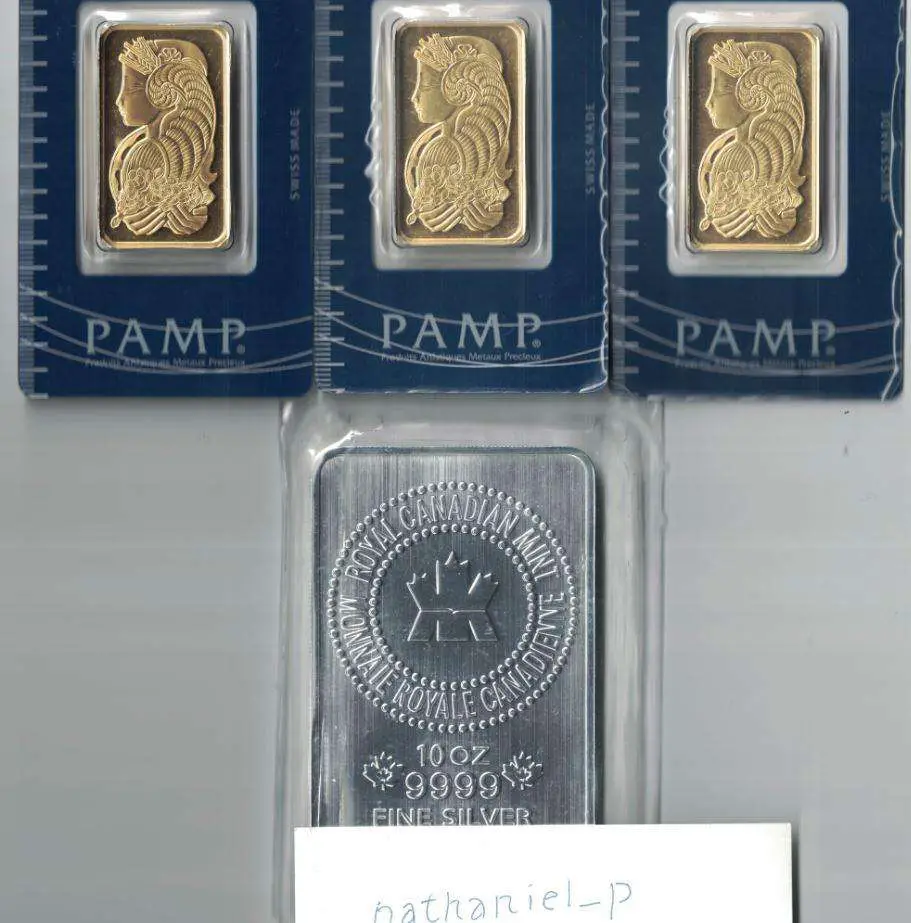

Once youve settled on the right dealer, your next step will be deciding the type of precious metals merchandise you would like to purchase. Precious metals come in a variety of shapes, sizes and styles, so customers should try to familiarize themselves with their different options. Customers should also be sure to understand the premium policies and investment benefits of these options as well.

When buying precious metals, customers should first decide which forms of precious metals they intend to purchase. Some common forms of bullion include coins, rounds and bars. Coins are the most recognized of the bullion forms because of their use as currency. Their stunning designs make them ideal for customers who want to display their investments. However, due to mintage restricting by the government, coins are often produced in limited quantities, making them quite valuable as both collectibles and investment pieces. Their rarity is also the reason they carry higher premium rates than other precious metals bullion.

With their flat, disc-like shape, rounds are often confused with coins however, unlike coins, rounds do not have a circulating face value. Their value is based solely on precious metal content. While the premium rate for a round is lower than that of a coin, it is important to note that their premium rates increase and decrease inversely with the size of the round. In other words, the smaller the coin, the higher the premium over spot.

Why Buying Silver Below Spot Price Is Unlikely

Many folks are hoping to find a secret source, a back alley for buying bullion at prices below spot. The reality is that unless you’ve an active coin dealer or bullion broker, you can’t expect to find silver below spot price in a retail setting.

Silver Coins

Dealers are wholesale-oriented buyers. They can legitimately obtain silver for prices just below spot. The reason isn’t too complicated: When you’re in business you’ve got to pay overhead and make a little profit, too. If you track silver prices, you’ll see that they change by the minute. Therefore margins are extremely thin between the wholesale and retail levels.

That doesn’t mean customers can’t find silver at ridiculously good prices buying silver online or at a local coin shop. One example is by buying heavily worn or damaged coins.

Many brick-and-mortar and online dealers who sell rare coins are also in the business of selling silver. They may be looking to clear out large inventories of damaged silver coins to make room for their medium-priced and big-ticket coins.

But if you’re particularly concerned about getting the most silver for your money, you may not want to be buying cull silver coins. These could be missing a substantial amount of silver due to excessive wear or damage.

In summary, this ages-old retail adage applies to buying silver: you get what you pay for! You really do.

Don’t Miss: Does Kay Jewelers Sell Real Gold

Do Your Due Diligence To Ensure Youre Buying Real Gold And Silver Products

Unfortunately, counterfeit gold and silver products are fairly common. Especially if collectors and investors do not opt to buy from a reputable source. One of the most important factors of buying your precious metals is ensuring theyre authentic. Otherwise, you risk spending a lot of money on fake, worthless items.

Aside from trying the tests mentioned above, one of the best ways to ensure youre buying only authentic gold and silver is buying from a great source.

Silver Gold Bull is the leader in their industry. Theyre a trusted silver and gold dealer that offers competitive, up-to-minute pricing on their items. They also guarantee that your precious metals are always fully insured.

-

Please, no payments to this address

2780 So. Jones Blvd.

St Century Silver & Gold Bullion Buying

Since about the year 2000, there has been a steady increase in gold and silver prices as well as in the investing publics buying of gold and silver bullion bars and coins. During and after the financial crisis of 2008, the trend of online silver and gold bullion buying and selling has increased substantially around the world.

Long-term silver and gold bullion owners often believe that bullion coins and bars offer:

- Investment portfolio diversification.

- Defense against inflation and deflation.

- Bank failure and frozen account protections.

- Private assets in a world increasingly digital and trackable.

- Unhackable tangible stores of value.

- Safety from fiat currency devaluations.

- Proven stores of value, easy to exchange.

Since 1977, Kitco has been buying and selling silver, gold, and other physical precious metal products. We are the worlds #1 gold news website and a trusted online silver and gold dealer.

Want more information on how to buy and sell gold? How to buy and sell silver? Please reach out to our first class Sales Associates by email or by phone, at , or using 1 877 775-4826 , 1 514 313-9999 .

Read Also: Gold Earing Rdr2

The World Leader In Investment Grade Bullion Coins

Congressionally authorized United States Mint Bullion Coins provide investors with a convenient and cost-effective way to add physical gold, silver, platinum, or palladium to their investment portfolios. The American Eagle Bullion Coin Program was launched in 1986 with the sale of American Eagle Gold and Silver Bullion Coins. Platinum was added to the American Eagle Bullion Coin family in 1997 and palladium in 2017. In 2008, the American Buffalo Bullion Coin Program was introduced. The America the Beautiful Five Ounce Silver Bullion Coin Program followed in 2010.

Best Places To Buy Gold And Silver Online

eBay and Craiglist are both great places to start. But unless youre sure that youre dealing with a reputable seller, you might want to look into other sites that specifically specialize in precious metals.

Weve compiled a list of 20 online sellers along with reviews of each one to help you find the best place to purchase gold and silver.

Also Check: How To Buy Wow Gold Without Getting Banned

Gold Investing : Investigate Before You Invest

If you want to invest in gold or silver, there is the need for you to do your homework by conducting an investigation first:

You need to seek for knowledge from a reputable dealer or financial advisor you can trust. Unfortunately, some promoters do not deliver what they promise and may push you into the wrong investment.

Do not be in a hurry to invest because any sales pitch urging you to buy quickly. This should be a signal to walk away and hold onto your money.

The Best Way To Buy Silver

During economic downturns or when a downturn is expected, many investors have taken comfort in owning precious metals. Designed to protect against inflation and ambiguity in the markets, the asset class contains much appeal. As such, gold, silver, and even platinum and palladium have now become portfolio staples. While there is much debate over whether or not investors should even own precious metals at all, there is a much bigger ongoing debate: Just how should they get that exposure?

The exchange traded fund boom has allowed investors to get access to metals via a variety of funds that either track futures contracts, like the Invesco DB Silver Fund or track physical bullion, like the SPDR Gold Shares Fund . Yet, there is a strong vocal camp that believes that owning the physical metal, in a safe or bank vault, is the only way to go. For those investors wanting to tap the silver market, choosing between the two methods isnt quite so simple.

Read Also: How To Get Free Gold Bars In Candy Crush

What Is A Reasonable Premium For Gold And Silver

There are a lot of variables that go into answering this but once you get familiar and browse the extraordinary variety of Gold and Silver products, you will start to get a good feel of what is a good or bad over spot premium. Though the variables I mentioned are vast lets go over a few important ones, some folks never really consider.Take two of the same metal type and weight coins minted by two different governments. The 1 oz Silver Maple Leaf by the Royal Canadian Mint vs. the 1 oz American Silver Eagle by the U.S. Mint. Both of these Silver coins are absolutely stunning and serve as the premier Silver bullion for both countries respectfully but there is one difference. The 1 oz Silver Maple Leaf can be purchased at about the current market spot + $2.00 to $3.00 whereas its American counterpart regularly trades at about $4.00 to $6.00 over market spot price. Why is this?Well, in this instance its because the Royal Canadian Mint controls the refining process and the U.S. Mint does not. The Royal Canadian Mint has its own refinery whereas the U.S. Mint actually contracts several private mints to refine the metal and create the blanks used in manufacturing.Other reasons could be efficiency, volume, supply, volatility in the market, among many other variables.

How To Buy Gold/silver Bullion Coins & Bars

When investing in gold and silver for the first time, it is very easy for customers to become overwhelmed by the many options offered to them. Whether faced with the decision of which products to order or how much to pay, the choices can seem endless. Fortunately, customers can rest assured knowing that there is no right or wrong way to purchase precious metals. While there are some general guidelines to keep in mind when doing your initial research, buying precious metals is mostly a matter of finding out which options best suit your needs.

Read Also: How Many Grams Is 1 10 Oz Of Gold