Silver And Gold Price Differentials Explained

The differences between silver prices and gold prices are correlated with a host of factors. Gold prices are far more expensive than silver – nearly seventy times more expensive! People have less interest in silver because it has less historical value, but that is only part of it. Gold is significantly harder to mine & purify, and thus more costs are associated with its production. Even though silver might be just as rare as gold, it will probably never come to be as lucrative. Gold prices have been influenced by a much stronger historical demand over the past 6,000 years when gold was used for embellishment, decoration, money, and much more.

Should Investors Buy 1 Oz Gold Bars

1 oz gold bars typically command premiums of between 2.5% and 3.75% with GoldCore who offer some of the most competitive premiums in the gold market. They are great for accumulating gold at attractive premiums that are considerably cheaper than gold coins. As long as you buy from a reputable dealer, tamper-proof and sealed bars you should be fine.

Who Makes Gold Bullion And Coins

Gold bullion is produced by mints located worldwide, by either a sovereign mint or privately owned. Gold bullion produced by these mints typically come in coins, bars and rounds with a wide selection of sizes available to fit any type of investment. For collectors and investors, it is important to know the difference between sovereign mints and private mints.

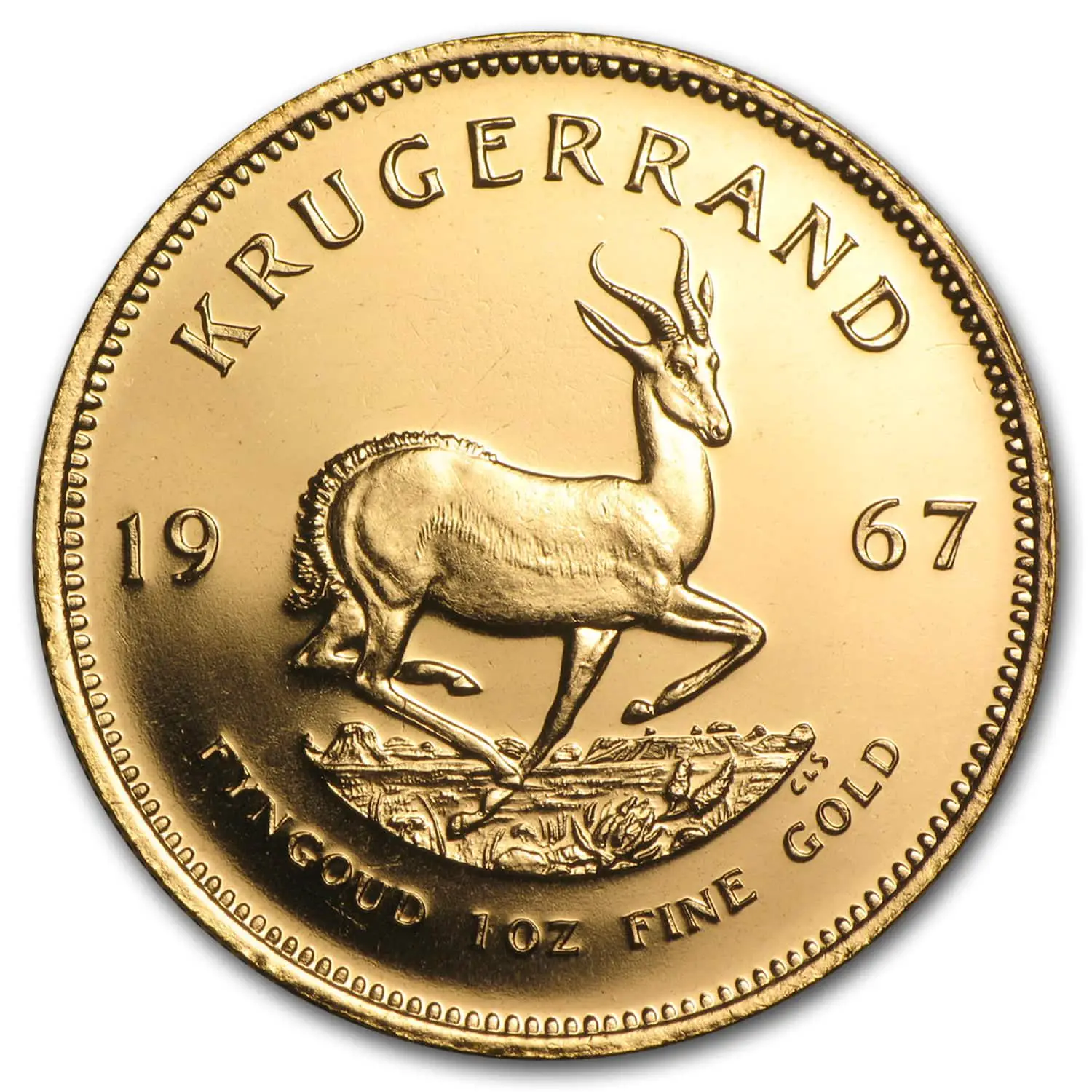

Sovereign mints, also known as government mints or national mints, manufacture bullion that is produced for legal tender in that country. Typically, there is a face value associated with the bullion and an official legal tender status. Widely collected bullion such as the American Eagles and Canadian Maple Leaf series are produced by these sovereign mints. Examples of these well-known sovereign mints include the United States Mint, Royal Canadian Mint, The Perth Mint, the Austrian Mint and more.

Private mints, like the name suggests, are privately owned and do not produce bullion for legal tender. Private mints make their own designs and branding, purity and metal content of their choosing. There are no legal requirements or restrictions placed on private mints to produce any specific amount of Precious Metals. While private mints do not produce legal tender bullion, they create countless popular and unique products each year that are great additions to many collections. Examples of these private mints include Engelhard, PAMP Suisse, Johnson Matthey and more.

You May Like: How To Buy Gold Or Silver

What Is The Ounce Of Gold Price

The gold spot price is typically reflecting a troy ounce of gold.

The spot price is the value of one troy ounce of gold on the over the counter market. However, understand that gold is not always sold by the ounce, although that is one of the most common methods. Gold can also be sold by the gram and by the kilo . So, by knowing the gold price per ounce, you know the baseline of what youll typically pay for one troy ounce of .999 fine gold from a bullion dealer .

Why Buy Gold Bars

Gold has always been a protection of wealth and a hedge against inflation. Gold bars are an affordable and convenient option for investors with lower premiums over gold spot price. Additionally, buyers have a broad array of sizes and design options. Most gold bars are 99.99% pure gold and come with an assay card.

Don’t Miss: How Much Can I Sell My Gold For

Gold Investment Storage Options

Storing gold in a depository facility is the only real way to hold your precious metal in a fully insured fashion. Bank safe deposit boxes holding gold are explicitly uninsured, and your home insurance policy is unlikely to cover your gold in case of theft. We always recommend storing your gold investments in a third party storage facility with no ties to the banking system. Our fully allocated, fully segregated gold storage program keeps your gold holdings separate from other client’s gold holdings, and they are audited and insured for their full value. Finally, your gold can be delivered to you quickly if you so desire, or you can access instant liquidity by selling your gold to us.

What Is The Biggest Platinum Exchange

Physically backed-exchange traded funds have revolutionized the investment landscape in the last 15 years and platinum is no exception. These products provided easy access to difficult markets for investors. Among PGM markets, Aberdeen Standard Investment runs the biggest platinum-backed ETF in the world with assets under management valued at $765.2 million.

Recommended Reading: Which Gold Bullion Is Best To Buy

Make Use Of Our Spot Gold Price Calculator

At our site SilverGoldBull.ca, we list the price of gold in grams, ounces, and kilos. Our live spot gold prices graph provides our calculator with the most up-to-date numbers so that you can invest with the ideal gold prices at the most opportune times. Stay up to date on the price of gold with our SilverGoldBull.ca gold prices charts.

How Does The Gold Bar Price Vary From The Ounce Of Gold Price

Gold is available in many different forms, including modern gold coins, gold bars and older collectible gold coins.

The gold bar price will vary depending on the amount of gold in the bar. If the bar contains one ounce of gold, the price will typically be slightly less per ounce than the gold price for government guaranteed and minted gold bullion coins or other similar gold bullion collectible items. However, if the gold bar contains more or less gold, the price will vary mostly depending on overall weight. For instance, a one gram gold bar will not cost the same as an ounce gold bullion bar or a one kilo gold bar.

Make sure to know the exact amount of gold bullion contained in any gold bar or gold coin before purchasing or selling to ensure that you are indeed getting a fair price.

Don’t Miss: Rose Gold And Burgundy Wedding

Whats The Difference Between Gold Futures And Bullion

Gold futures contracts are really nothing more than promissory notes. They promise that the individual or organization in question will buy or sell a specified amount of gold at a specific time in the future . These contracts may be for a few months down the road, or they may be for years ahead. There are several challenges here.

For instance, the price of gold youll pay will be significantly higher than buying just a single ounce , and the chance for the price of gold to change between the time you buy your futures contract and when you actually take delivery is high. While there is potential for the price to go up, meaning youve saved money, theres an equally good chance that the price might go down, meaning youve paid too much.

Why Is Platinum Mostly Quoted In Us Dollars

While you can buy platinum in any currency in the world, it is important to realize that ultimately everything is based on the value of the U.S. dollar. Because of the importance of the U.S. economy in the world, the U.S. dollar is considered a reserve currency, meaning that it is held in significant quantities by other governments and major institutions. Reserve currencies are used to settle international transactions. Since the start of the 20th century, the U.S. dollar has been the dominant reserve currency around the world.

Also Check: What Is 14 Karat Gold

Is There A Gold Spot Price Calculator

On our SilverGoldBull.ca website we display the price of gold in a number of different measurements gold prices per gram, gold prices per ounce, and even gold prices per kilo. Our calculator uses the most up-to-date live gold price data to ensure you are able to make the wisest decisions possible. When purchasing your gold bullion investments, make sure you take advantage of the most ideal gold prices, thereby securing a maximum ROI in the long term.

How Do I Compare The Current Price For Gold

Gold is sold in many different forms, and when comparing or tracking the live gold price, you must ensure that youre comparing apples to apples. For instance, you might find gold offered in both ounces and in grams.

Obviously, the price for each would be different because the weights are not the same. The volume of gold in each option differs. So, comparing the gold price for a troy ounce to the gold price per gram would not do you much good.

Instead, make sure youre tracking and comparing troy ounces to troy ounces . You also need to remember that even with freshly minted sovereign gold coins like the Australian Kangaroo Gold coin, the price will be higher than the spot price of gold. Again, this is due to the seigniorage and slight premium of the coin on top of the cost of the gold contained within it.

Don’t Miss: Where To Buy Gold Chain Necklace

What Is The Price Of Gold Today

The price of gold today is the gold spot price. The spot price is the price in the gold futures markets, and that price can vary depending on which market a person is quoting or watching, such as New York or London. The spot price is the gold price one sees on financial news networks tickers and trackers, but the spot price is not the only price a person must pay when actually buying gold. There is also a premium price for whichever type of gold is being purchased, which is added to the spot price.

The Value Of A Gold Investment

Trading in gold should be seen as a long-term investment. Gold tends to hold its value well over the long term, but it is always susceptible to market forces. Historically, the price of gold has been shown to increase as the US dollar decreases, a comparative phenomenon known as the Gold Index. Additionally, gold prices have done well in even the most inflationary of periods. Investing in gold is an excellent way to keep a diversified portfolio for every investor.

Read Also: How Much Gold Is In The Federal Reserve

Spot Gold Price Or Gold’s Current Value

The spot gold price refers to the current, real-time price of raw gold per one troy ounce before any gold dealer premiums and/or taxes. This gold spot price metric is based on global values and is the same no matter where one is located in the world as translated into local currencys prices.

The spot gold price today abides by a global standard to avoid gold arbitrage. Arbitrage refers to the practice of buying a commodity in one market and selling it for a higher value in another market. This practice would undermine the structural integrity of global gold markets and make speculative investing impossible. Monitor the live spot gold price today on our website to gain the best insight into future gold market trends.

Relationship Between Gold Coin Value And Gold Spot Price

Like all forms of gold, the price of gold coins will fluctuate depending on the gold spot price. When investing in gold coinage, be aware of the other factors that influence the gold price. The mintage, scarcity, numismatic value and condition of the gold coin itself are four secondary influencers that affect the gold price of any gold bullion product on the market.

Recommended Reading: Gold And Silver Drawer Pulls

Buying Gold Coins And Bars

Gold continues to be a store of value and wealth and a key element for many looking for long term financial security. Gold investments are typically divided between coins and bars.

Gold coins are issued by sovereign governments and often include both modern and historic or antique bullion coins. Coins come in a variety of standard sizes and are measured using troy ounces and in fractions of an ounce.

Gold bars are most often from private mints. For many investors, 1 oz gold bars are a popular choice due to the wide availability and low premiums.

Fractional gold bars are the most popular and offer versatility and flexibility. Premiums for fractional gold bars are relatively higher. The smallest of sizes will have the highest premiums.

When investing in precious metals the most important factor is to buy with the lowest premiums. The lowest gold premiums can often be on gold bars and vintage gold coins.

Vintage gold coins offer tremendous intrinsic value as well as historic consideration. Popular historic gold coins for investors and stackers include Pre-1933 American Gold Coins such as the $20 Double Eagle and $10 Gold Eagle. Fractional gold coins like the 20 Francs and British Sovereign are affordable, easy to stack and at times have the lowest premiums of other fractional gold.

View Gold Prices Per Oz At The No1 Gold Price Site

Conversion : 1 troy ounce = 31.1034768 grams

To learn about our gold price data

On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can, however, be quoted in any currency by the ounce, gram or kilo. The price of gold is constantly on the move and can be affected by many different factors.

Don’t Miss: 14kt Gold Cuban Link Chain

How Do Current Gold And Silver Prices Relate To One Another

While silver prices are far lower than gold prices, it can sometimes appreciate substantially. Savvy investors should compare the current gold and silver prices to determine the gold silver ratio at the moment. Depending on the results of that investigation, they may purchase gold bullion, silver bullion, or both.

Common 1 Oz Gold Bars Mints

Since 1 oz gold bars are some of the top choices for gold investors, theres no wonder various mints around the world manufacture them. One ounce gold bars come with a broad array of design options and styles to accommodate the needs of any gold investor. Lets take a look at the most common mints that manufacture gold bars in this very sought-after weight:

Recommended Reading: Should I Sell My Gold Now

Why Wont My Dollars Hold Their Value

Scenario: the market has crashed, investors are selling stocks in an irreversible panic frenzy. In the months ahead, economic uncertainty conditions the populace to save their money as much as possible and not to spend. Like an economic time-bomb, these dollars sit quietly, waiting to have purpose. When this frugality mindset breaks and confidence is restored in the market, a large-scale sudden wave of spending can cause a rapid influx of dollars to over-flood the economy.

When there are more dollars to spend on goods than there are goods to sell, increased levels of inflation or even the rare economic killer known as hyper-inflation have historically occurred soon after. When this phenomena begins, inflation spirals out of control and collapses the economy into a devastating state, similar to the hyper-inflation of German currency leading up to WWII.

Dollars simply do not store value through turbulent economic periods, they can actually become quite useless – the germans used to burn them for warmth because it was more expensive to buy firewood with their currency!

Without a safe place to store the value locked inside our hard-earned currency, most of us stand to suffer a preventable loss – unless of course the value within our currency is translated into the form of gold bullion.

Is The Gold Spot Price The Cost Ill Pay To Buy An Ounce Of Gold

No, you will not pay the gold spot price. The spot price does not apply to physical bullion investors, and does not include any dealer premiums or other charges. When you buy bullion from a dealer, youll pay a markup, which can vary from one dealer to another. Dealers buy at or slightly over the spot price from mints, and then add on premium to ensure they are able to make a profit and maintain their business. However, the spot price of gold is important to know because it allows you to determine whether or not youre paying a fair price with the dealer you ultimately choose. The amount between what the gold dealer paid, and what youre paying is the dealers gross profit margin which is intended to help them cover their costs of doing business.

Don’t Miss: Black And Gold Nikes Mens

How The Gold Price Per Ounce Is Determined

In ancient times, the price of gold was even more steep because gold was one of the most coveted and valuable of commodities. Today, the gold price per ounce is still extremely high, and determined by many more factors.

Pure gold is very expensive to mine and refine. Mining industries on average must move 9.4 tons of earth in order to procure the weight of approximately one golf ball sized sphere of pure gold. The difficulties dont end there however gold is frequently alloyed in with other raw metals and requires an expensive gold purification process to fully separate..

The jewelry industry also has a major impact on the price per ounce of gold. This should come as no surprise, given that gold is the most sought-after jewelry commodity for weddings, fashions and exquisite gifts. Approximately 46% of gold demand in Q1 2017 came from the jewelry market. If the demand for gold jewelry goes up from one year to the next, the supply of gold will have to rise to meet this demand.

In the tech industry, gold holds unique properties as a corrosion-resistant electrical conductor. Including gold inside many modern electronic devices has become a staple for manufacturers globally. This industrial demand for gold adds to the scarcity, playing a role in determining the gold price. As time moves forward, more and more gold will be consumed by this industry.