What Can Cause The Spot Gold Price To Change

Any change or disruption to either the supply or demand for gold will move the spot price.

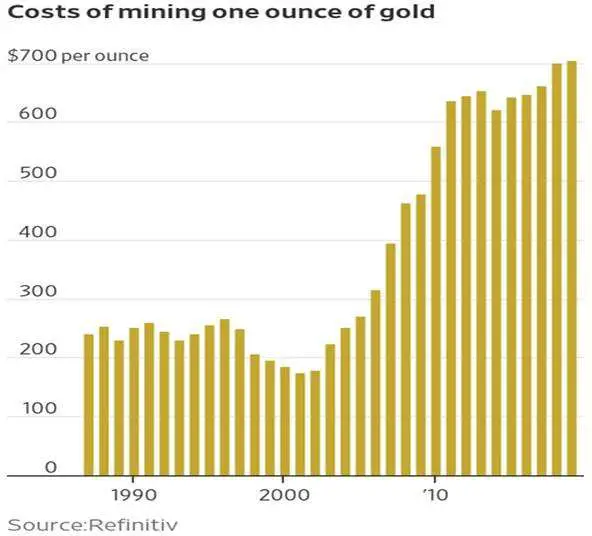

If a large gold deposit is discovered, the increased supply will cause the spot price to fall. The reverse is true if the gold supply decreases.

An increase in gold demand will also drive the spot price higher. Perhaps the demand is due to accelerating inflation or extreme economic uncertainty.

Supply and demand are affected on a daily basis, meaning the gold spot price is constantly in flux.

My 2021 Gold Price Prediction

My forecast for the gold price in 2021 is based on the current environment of negative real yields, a weak dollar, rising inflation expectations, and ongoing monetary and fiscal stimulus. We also have to consider the Feds diminishing ability to respond effectively to crisistheir toolbox is indeed getting low.

As a result, I expect the gold price to be higher in 2021. Here are my predictions.

The most important message from this analysis is that even if Im wrong, it has rarely been more important to own gold. That means any dips in price should be bought, especially for those that dont hold a meaningful amount.

- Remember, though, gold is less about the price, and more about its value, meaning what it will buy you.

There are many factors that could impact the gold price, of course, in both the short and long term. To learn more about investing in gold and silver and what might be ahead, especially for fiat currencies, download Mike Maloney’s best-selling book for free, Guide to Investing in Gold & Silver.

What Are The Essential Terms To Understand The Gold Trade

Bid Price: Current market spot price at which one can sell gold.Ask Price: It is the current spot gold price of 24k gold at which investors can buy it.Spot Price: it is calculated using the recent average of bid price and asks price.Gold Price Fixing: It is carried out by the London Gold Market Fixing Ltd. It is also a benchmark for pricing the gold and its products.

Also Check: How Many Grams In 1 10 Oz Gold

Gold As An Investment

Gold is available for investment in the form of bullion and paper certificates. Physical gold bullion is produced by many private and government mints both in the USA and worldwide. This option is most commonly found in bar, coin, and round form, with a vast amount of sizes available for each.

Gold bars can range anywhere in size from one gram up to 400 ounces, while most coins are found in one ounce and fractional sizes. Like other precious metals, physical gold is regarded by some as a good way to protect themselves against the ongoing devaluation of fiat currencies and from volatile stock markets.

Buying gold certificates is another way to invest in the metal. A gold certificate is basically a piece of paper stating that you own a specified amount of gold stored at an off-site location. This is different from owning bullion unencumbered and outright because you are never actually taking physical ownership of the gold. While some investors enjoy the ease of buying paper gold, some prefer to see and hold their precious metals first-hand.

What Makes Us The Best Scrap Gold Buyer

As a company serving in this business for many years, we completely understand how much you value your investments of Gold jewellery, coins, and bars. We also appreciate you for entrusting us with your precious items.

We work hard to give you excellent service and the best prices based on the gold price today. In every customer we receive, our friendly professionals do their best to provide an accurate value for your scrap gold jewellery. We guarantee an efficient and smooth process when selling your scrap gold. We will transfer funds directly into your account on the same day or pay instant cash.

You May Like: How Much Is 10k Gold Worth

What Is The Gold Silver Ratio

The gold-silver ratio is the ratio between the price of a troy ounce of gold and a troy ounce of silver. You might think of it as the number of ounces of silver it takes to buy one ounce of gold.

The ratio stayed between 15:1 and 16:1 for much of American history. However, in 1971 the âNixon Shockâ closed the gold window forever, and the ratio of the gold and silver price today is more than 70:1.

What Is The Gold Bullion Bar

It is a bar or ingot of gold of various sizes bullion word originates from Louis XIII, Claude de Bullion, a French Minister of Finance. Its worth relying on its purity /immaculateness and mass. Pure bullion gold is called parted bullion that is officially 99.5% pure, while impure, sullied gold is called unparted bullion , one example is 22k gold widely using in jewelry. Gold rocks are initially found, mined, and afterward, gold is extracted utilizing great warmth and distinctive chemicals, then changed over into billions.

Also Check: How Many Grams Is 1 10 Oz Of Gold

Are The Gold Prices Per Ounce The Same Around The Globe

One troy ounce of gold is the same around the world and for larger transaction are usually priced in U.S. dollars as that is the most active market however, the value of an ounce of gold can be higher or lower based on the value of a nations currency. Traditionally, currencies that are stronger than the U.S. dollar have a lower value gold, price where currencies that are lower than the U.S. dollar have a higher prices. While gold is mostly quoted in ounces per U.S. dollar, OTC markets in other countries also offer other weight options.

The Kitco Gold Index is an exclusive feature that calculates the relative worth of one ounce of gold by removing the impact of the value of the U.S. dollar index. The Kitco Gold Index is the price of gold measured not in terms of U.S. Dollars, but rather in terms of the same weighted basket of currencies that determine the US Dollar Index®.

What Are Bid And Ask Prices

The ask price is the lowest price at which a dealer is willing to sell a troy ounce of gold. The bid price is the lowest price that a dealer is offering to pay for a troy ounce of gold.

This why the current price is important to know if you are buying gold bullion or you want to sell gold to a dealer.

The difference between bid and ask prices is called the dealer spread.

You May Like: Rdr2 Gold Earrings

Is Gold Traded 24 Hours A Day

Yes. Gold trades on exchanges located around the world. Even when one exchange is closed for the night, there is another somewhere else that is active.

Electronic trading of gold goes on continuously. This is reflected in the Globex gold price overseen by the CME Group. Globex prices are updated moment to moment based on futures trading.

24-hour gold trading means that gold product prices always fluctuate.

What Is The World Gold Council

Founded in 1987, the World Gold Council is the market development organization for the gold industry responsible for stimulating demand, developing innovative uses for gold and taking new products to the market. Based in the U.K., the WGCs members include major gold mining companies. There are currently 17 members including Agnico Eagle, Barrick Gold, Goldcorp, China Gold, Kinross, Franco Nevada, Silver Wheaton, Yamana Gold and more.

Recommended Reading: Where To Sell Gold Rdr2

What Is A Carat Of Gold

Gold jewellery comes in a variety of purity levels carat of gold. For example, 24k gold is the purest form of gold, while 22k gold is composed of small impurities that make gold ideal for jewellery such as:

- Rings

- Earrings

- Bracelets

22k jewellery is made of standard quality gold, but some of them contain a low carat or level of purity, such as 18-carat, 15-carat, 21-carat, etc. To calculate the value of these types of gold when selling scrap gold, you need a scrap gold price calculator.

The 24-carat gold level is 99% pure and the 22-carat gold is ideal for jewellery. Its formula for calculating the percentage of gold to other metals in the alloy looks like this:

What Influences The Price Of Gold

Gold is traded on the global marketplace, and its price is determined by a huge variety of social, economic, and political factors. Its price fluctuates every minute of every day, sometimes wildly. Of course, this isn’t random, and there are predictable trends that cause the price of gold to rise and fall.

Don’t Miss: How To Get Free Golden Eagles In War Thunder

How Are Spot Prices For Gold Calculated

The total supply and demand for gold in the market ultimately determine the spot price.

Thus, movement of the spot price reflects a change in the available supply or current demand for gold. This includes factors such as:

- output from gold mines

- economic uncertainty

- other geopolitical events

Trading of gold futures has the most significant effect on today’s spot prices. The same is true for all commodities. So the silver price and platinum price behave in a similar manner.

General gold news can also influence investment demand for the precious metals. This includes gold, silver, platinum, and palladium.

For instance, prices today tend to shift dramatically if the Fed cuts rates. There may be a gold price rally if the International Monetary Fund adds to its gold reserves.

Learn more about gold futures contracts by following this link.

Is It Better To Buy Gold Online

Buying gold online has several advantages. It provides convenience because you can shop from home or your mobile device. In most cases, you can place orders at any hour. You can also view a gold sellerâs entire inventory with ease.

Online gold bullion dealers generally can offer their customers lower prices, as well. This is due to the lower overhead costs of running their business on the internet. Shopping for gold today is becoming much more convenient than ever before.

Also Check: Price Of Gold Teeth In New Orleans

Gold Price Per Gram Today

Actual Gold Price equal to 56.86 Dollars per 1 gram. Today’s range: 56.85-56.90. Previous day close: 57.19. Change for today -0.33, -0.58%.

| 56.86 |

| 26.5% |

Gold Price forecast for .In the beginning price at 58.29 Dollars. High price 58.96, low 53.25. The average for the month 56.64. The Gold Price forecast at the end of the month 56.05, change for September -3.8%.

Gold Price forecast for .In the beginning price at 56.05 Dollars. High price 58.07, low 52.54. The average for the month 55.49. The Gold Price forecast at the end of the month 55.30, change for October -1.3%.

Gold Price forecast for .In the beginning price at 55.30 Dollars. High price 58.09, low 52.55. The average for the month 55.32. The Gold Price forecast at the end of the month 55.32, change for November 0.0%.

Gold Price forecast for .In the beginning price at 55.32 Dollars. High price 59.28, low 53.64. The average for the month 56.18. The Gold Price forecast at the end of the month 56.46, change for December 2.1%.

Gold Price forecast for .In the beginning price at 56.46 Dollars. High price 56.46, low 50.31. The average for the month 54.05. The Gold Price forecast at the end of the month 52.96, change for January -6.2%.

Gold Price forecast for .In the beginning price at 52.96 Dollars. High price 59.05, low 52.96. The average for the month 55.30. The Gold Price forecast at the end of the month 56.24, change for February 6.2%.

Explanation With Lots Of Math

Snake Chain, Machine Made in Italy 14kt

What this means is that if the 20 gram chain is selling for $1,500.00 and $484.88 is the cost of the gold, the other $1015.12 includes the cost of the other metals, the labor, and the jewelers profit. What percentage is the cost of the other metals? The labor? And the markup from the jeweler? Unknown!

All I can tell you with certainty is that if pure gold is selling for $1300/oz. and the weight of the 14k chain is 20 grams, then the melt price of the gold is worth $484.88. There is no way to know what the jeweler paid for the chain from the manufacturer. Furthermore, we dont know what gold was going for at the time of purchase. The jeweler might have bought it when gold was at $1200.00 per ounce. Or $1800.00 per ounce!

Also Check: Is Kay Jewelers Real Gold

How To Buy Gold

First, decide what kind of Gold youre interested in buying. There are several types of Gold, ranging from scrap to bullion products. Second, determine the form in which youd like to buy. If youre buying Gold bullion, choose between Gold coins, bars and rounds .

Next, do your research and identify a reputable seller. For example, The United States Mint does not sell directly to the public but offers a list of Authorized Purchasers. APMEX has been on that shortlist since 2014 and is in such good company as Deutsche Bank, Scotia Bank and Fidelitrade, to name a few.

Finally, prepare for how you will securely protect and store your Gold. There are many factors and options for this. For a small fee, you can store it with a trusted third party such as Citadel . Of course, many choose to store their Gold in their own vaults or lockboxes at home, as well.

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

Also Check: 1/10 Troy Oz To Grams

Why Sell Scrap Gold

If at the moment money is more important to you than your jewellery, or if your jewellery is out of date, out of fashion and is in the jewellery box, you can sell scrap gold at the London Gold Centre.

Just post your items to the specified address on the companys website or bring gold jewellery to us in person. An expert from the London Gold Centre will quickly check and evaluate your gold products and provide a quote. At London Gold Centre you can sell scrap gold at the highest prices in London.

What Is Gold Worth

The worth of Gold is determined by the current spot price. This price is determined by many factors such as market conditions, supply and demand, and even news of political and social events. The value or worth of a Gold product is calculated relative to the weight of its pure metal content and is measured in troy ounces. However, collectible or rare Gold products may carry a much higher premium over and above the value found in its raw metal weight.

Additionally, other factors such as merchandising, packaging or certified grading from a trusted third-party may influence the final worth of the Gold product you are purchasing.

You May Like: How Many Grams Is 1 10 Oz Of Gold

What Is A Troy Ounce How Many Grams Are In A Troy Ounce

A troy ounce is a measurement commonly used to weigh the gold bullions that are traded on the global marketplace. There are 31.1035 grams in a troy ounce.

What if my jewellery doesn’t have a hallmark?

If you bought your jewellery overseas, it may have a completely different hallmark or it might not have one at all.

Also, only jewellery weighing more than one gram needs to be stamped with a hallmark under UK law. That means very small items like gold earring backs don’t feature one either.

If a piece of jewellery doesn’t have a hallmark, this doesn’t mean it isn’t valuable. Send us your gold through our cash for gold service and we’ll be able to test it for you and give you a fantastic price if it is the genuine article.

Gold Rate Forecast Conclusion

In trading terms, the forecast and prediction help investors to understand the movement of gold in the market.

It is very beneficial and tracks the operations, involvement, opening, and closing prices. It also counts profit, and losses on a daily, weekly, monthly, and yearly basis.

There has been an increase in the demand and sales of gold for the past decade. The analysis clarifies the current and future condition of gold in the market via forecasts and predictions.

Based on this, individual citizens, industrialists, and investors decide their next move.

However, the paper discusses all the possible outcomes of the analysis and briefly describes different situations.

These come as examples that contain essential information for proper understanding.

Also Check: Golds Gym 450 Treadmill Cost

Why Does The Price Of Gold Rise

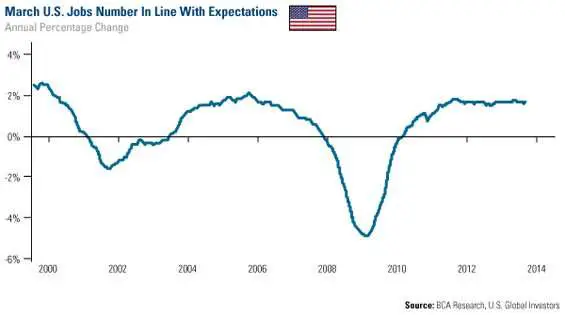

Gold is seen as a safe bet by investors: unlike other investments, it doesn’t run the risk of completely losing its value if the global financial market collapses.

Because of this, demand increases for gold in uncertain times. As a result, the global price of gold rises. For example, the price of gold reached an all-time high during the 2008 global financial crisis, when investors were looking for a safe investment in an extremely precarious period.

If you want to get the best price for your scrap gold, keep an eye on the global news. You’ll get the best deal during times of international financial uncertainty.