Gold Futures Contracts On Mcx

MCX is Indias leading commodities exchange and a leading exchange to trade in gold. Contracts traded here offer great liquidity and offer investors the option of contracts in four different sizes as outlined below with their other key features:

Gold

- Ticker GOLD

- Trades during 6 months of the year i.e. February, April, June, August, October, December

- 1 contract = 1 kg of gold

- Initial margin: 4%

- Daily price limit: 3%

- Upper limit on positions: Up to 2.5 MT for individual clients higher of 12.5 MT or 15% of open position on market for all clients together through a member

- Quality: 995 purity, 999 purity

Gold Mini:

- Trades in all 12 months i.e. January to December

- 1 contract = 100 grams of gold

- Initial margin: 4%

- Limits on positions: Up to 2.5 MT for individual clients higher of 12.5 MT or 15% of open position on market for all clients together through a member

- Quality: 995 purity, 999 purity

Gold Guinea:

- Trades in all 12 months i.e. January to December

- 1 contract = 8 grams of gold

- Limits on positions: Up to 2 MT or up to 250,000 contracts at one time

Gold Petal:

- Trades in months as specified by the exchange

- 1 contract = 1 gram of gold

- Limits on positions: Up to 2,000,000 contracts at one time

Trend Of Gold Rate In India For February 2021

| Parameters | |

| Rs.5,232 per gram on 1 February | |

| Lowest Rate in February | Rs.4,927 per gram on 20 February |

| Overall Performance | Incline |

- Gold rate in India opened the month of February at Rs.5,232 per gram and showed a declining trend during the first week. The price of the metal was at its highest on the day and declined to Rs.5,228 per gram on 2 February.

- The price of the metal on 3 February was Rs.5,159 per gram and dipped to Rs.5,115 per gram with the rise in the dollar value in the international market.

- With a rising risk appetite and shift to the equities market, the gold rate declined to its lowest on 5 February at Rs.5,010 per gram and recovered marginally to Rs.5,115 per gram, closing at Rs.5,041 per gram on 7 February.

- Gold prices in India opened the second week of the month at Rs.5,042 per gram on 8 February and declined marginally to Rs.5,039 per gram on 9 February due to fluctuations in the international prices.

- On 10 February, the yellow metals prices increased to Rs.5,106 per gram and further to Rs.5,171 per gram on fresh hopes of a stimulus package from the United States as well as in India.

- The value of gold dipped eased on 12 February at Rs.5,095 per gram and further to Rs.5,061 per gram and closed the week at Rs.5,062 per gram on 14 February.

Its Hard To Get A Response From Acres Support Team

Part of the issue appears to be that Acre Golds customer service reps are hard to reach. For the sake of this Acre Gold review, I decided to experiment and contacted Acre Gold at the listed email address with a fake query.

Although I got a response to my email inquiry, it was not as informative as I expected. The most frustrating thing was that the support team didnt tell me their price per bullion because, as they were so kind to explain, the market value of gold is constantly fluctuating.

Also Check: How Much Is 1 Kilo Of Gold Bar

Gold Prices Skid Third Day In A Row

The gold prices in India dipped again for the third day in a row. On the MCX, the gold futures had dropped by 0.1% to Rs.43,314 per 10 grams. The price of this precious metal has been very volatile in India post reaching a height of Rs.45,000 per 10 grams. When it comes to the overseas market, the price of gold had increased after WHO had declared the coronavirus to be a pandemic. The price of spot gold had risen by 0.6% to $1,645 per ounce.

The announcement by WHO had also pulled the U.S. Dow Jones industries into a bear market and the index had dipped to 1,500 points.

Silver had witnessed a much bigger fall in its prices as the metal had dipped by 1.3% to Rs.45,225 per kg. In the global market, the white metal had gained by 0.6% to $16.85 per ounce.

12 March 2020

Details Of Gold Price In India For November 2020

- In the country, the gold rate in India in November opened the month at Rs.5,194 per gram on 1 November and showed an inclining trend for the first week due to the uncertainty around the U.S. elections.

- On 3 November, the price of the metal had increased to Rs.5,268 per gram and further increased to Rs.5,416 per gram on 5 November as Europes lockdown continued due to the rise in COVID-19 cases.

- The price of the metal on 7 November was Rs.5,461 per gram and increased to hit its weekly high at the end of the week at Rs.5,504 per gram on 8 October.

- In India, gold opened the second week of November at Rs.5,505 per gram. When compared to the closing price of the previous week, the price of the yellow metal was up by Re.1.

- The price of gold increased in the country the next day and was retailed at the highest recorded price for the month till date. A gram of the 24-karat gold was retailed for Rs.5,525 on the mentioned date.

- Gold rate in India closed the week at Rs.5,428 per gram. The overall performance of gold witnessed an inclining trend.

Read Also: Are Gold’s Gym Treadmills Any Good

Gold Trading As A Commodity In India

Gold is traded through spot contracts or derivative contracts i.e. investors can trade in gold without possessing gold in its physical form.

- Gold spot contracts are whereby gold is bought and immediately delivered .

- Gold futures contracts are whereby gold is bought and sold at a later date as per the contract. Unlike most other commodities, gold futures are traded at spot prices and not at prices influenced by demand and supply.

Gold is traded as a commodity on three major commodity exchanges in India:

Gold Lacklustre As A Strong Dollar Weighs Heavy

Gold showed a lacklustre performance in the domestic market in the early trade on January 18, due to the rise in the US dollar.

On the Multi-Commodity Exchange , February gold contracts dropped by 0.07% percent at Rs.48,668 for 10 grams.

Gold prices slipped to Rs.48,702 per 10 gram in the previous trading session on January 15, as investors increased their short position. Gold ended with a loss of Rs.116 or 0.24% for the week.

18 January 2021

Don’t Miss: How To Apply For Gold Card

Acre Gold Reviews & Comments

Many reviews mention that Acre Golds sales policy is not exactly transparent, and its BBB rating is far from perfect. There have also been many complaints of Acres support policy, particularly on sites such as www.no-scam.com.

A comment from a particularly disgruntled client reads that this whole Acre Gold thing is a scam. Albeit you pay your subscription every month, this online gold retailer does not provide any data-backed info as to how much cash you have sent them so far and what amounts of gold the money can buy. Other reviews advise dealing with Acre Gold at your discretion and with due diligence.

How Big Is A Grain Of Gold

DescriptionA picture showing one grain of pure gold and size comparisons with a 5 British pence, 20 euro cent, 10 yen and 25 U.S. cent coins. Also shown is a tape measure with Metric units on the bottom showing the diameter of the grain gold piece. The measured diameter is 3.18 mm or 1/8 inch.-

Also Check: How To Roll 401k Into Gold

Mexican Peso Gold Coins Presentation

The Mexican Peso gold coins were minted in different denominations from 2 to 50 Peso, including the 2.5 Mexican Peso gold coins which make the subject of our article. They were minted starting with 1918 and ending their issuing in 1948. The 2.5 Peso Mexican coin displayed on our website is dating from 1945, a data engraved on the reverse.

These small gold coins have an overall weight of 2.0833 grams out of which the pure gold weight is 1.87 grams. This feature belonging to the 2.5 Mexican Peso gold coins makes them to be used in the jewelry industry, having a diameter of only 16 mm.

The 2.5 Mexican Peso gold coins are also of an interest to collectors since they can also be regarded as commemorative coins since they were struck after the death of Miguel Hidalgo which succumbed in 1811. He was a priest that started a movement that transformed into the Mexican War of Independence which led to the liberation from the Spanish occupation.

What Is A Gram Of Gold Worth In Australia

Gold Spot PriceGold Price Today Change—Gold price per gram 73.47 +0.57Gold price per kilo 73,467.99+568.64Gold price in pennyweight 114.26 +0.88Gold price in tola 856.92 +6.63

DescriptionGold Value 1 grain gold bar $3.722.5 grain gold bar $9.315 grain gold bar $18.62

Subsequently, What is grain gold?

The small golden disk close to the 5 cm marker is a piece of pure gold weighing one troy grain. A grain is a unit of measurement of mass, and in the troy weight, avoirdupois, and Apothecaries system, equal to exactly 64.79891 milligrams.

Also, How much is 1g of 24k gold worth?

The current 24k gold price per gram is $57.38.

How much is 1 gram of gold worth in the UK?

Current Price £41.12

Grain 21K $3.2963 USD

Don’t Miss: What Is The Current Market Value Of Gold Per Ounce

Gold Rates Increase To One

Gold and silver rates had increased in the Indian markets and tracked firm global prices. On the MCX, the gold futures for February had increased by 1.4% and reached a one-month high and reached Rs.51,009 per 10 gram and the silver futures had increased by 5.4% and reached Rs.71549 per kg.

In the international markets, the gold rates had increased after top U.S. lawmakers agreed on a $900 billion COVID-19 economic relief package. The spot gold had risen by 1.1% and reached $1,900.57 per ounce. The silver rates had increased by 4.5% and reached $26.93 per ounce.

21 December 2020

Trend Of Gold Rate In India For July 2021

| Parameters | |

| Rs.5,171 per gram on 17 and 18 July | |

| Lowest Rate in July | Rs.4,792 per gram on 1 July |

| Overall Performance | Incline |

- Gold price in India opened the first week of July at Rs.4,792 per gram. When compared to the previous weeks closing price, the price was up by Rs.21 per gram in the country.

- Over the week, the price of the precious metal increased gradually in the country. The lowest and highest price of the yellow metal for the month was recorded on 1st and 4th July. On the mentioned dates, a gram of 24-karat gold cost Rs.4,792 and Rs.5,046 respectively.

- The overall performance of gold in the country witnessed an inclining trend over the opening week of the month.

- Gold price in India opened the second week of July at Rs.5,048 per gram. The price of the yellow metal was down by Rs.41 per gram in the country when the rate was compared to previous weeks closing price.

- The price of the precious metal dropped in the country over the next two days. The decline in the price saw gold record its lowest price for the month till date on 11th July with a gram costing Rs.4,782.

- Gold rate continued to see slight fluctuations over the remainder of the week and closed at Rs.4,792 per gram. The overall performance of the yellow metal in India witnessed a declining trend.

Read Also: Is Gold Standard Whey Protein Good

Gold Prices Reduced For The Fourth Time Over The Last Five Days On 7 July 2020

Due to muted prices in the international markets, the prices of gold reduced in India on 7 July 2020 . Gold futures prices for the month of August on MCX reduced by 0.03% and are at Rs.48,210 for 10 grams.

This is the fourth time over the last five days that the prices of gold have fallen. However, the fall in rates has not been huge because of the rise in the number of coronavirus cases. In the last session, the prices of the yellow metal had increased by 0.34%. Last week, gold rates hit record highs and were at Rs.48,982 for 10 grams. In the international markets, the prices of spot gold increased and were at $1,784.99 for an ounce. Last week, the prices of spot gold hit an eight-year high and were at $1,788.96 for an ounce. According to John Hopkins University, over 1.15 crore people have been infected by the coronavirus. In times of financial and political uncertainties, investors move towards the yellow metal. According to a note provided by Kotak Securities, the increase in the number of coronavirus cases has led to expectations that more stimulus measures would be introduced by central banks and governments. There has been support for gold due to this. A weak US dollar also ensured that the prices of gold were cheaper for other currency holders.

7 July 2020

Gold Prices Plummet By 75% From Record Highs On A Stronger Dollar Value

Gold prices on 13 August dropped due to profit booking amongst investors as the U.S. dollar value increased against other currencies in the market. The development of a vaccine for COVID-19 from Russia also increased the risk appetite amongst investors. Gold prices fell by 3.4% in the previous session below the $1,900 per ounce levels.

On the Multi Commodity Exchange, gold futures for October decreased by Rs.265 with a percentage decline of 0.51% to Rs.51,980 per 10 grams. Silver futures for September dropped marginally by 0.33% to Rs.66,354 per kg.

Gold prices had hit its all-time high in the previous week at Rs.56,191 per 10 grams and silver prices hit an all-time high at Rs.77,949 per kg. The yellow metal dipped by more than Rs.4,000 per 10 grams and silver recorded a drop of more than Rs.10,000 at Rs.11,4115 per kg compared to its highest price.

13 August 2020

You May Like: Where Can I Buy Throat Gold For Dogs

Demand For Gold In India

Indias primary demand for gold is for use as jewelry. Investments are the next greatest demand driver. Unlike China, the next highest consumer of gold in the world, whose primary demand for gold is for industrial purposes, Indias industrial usage of gold is minimal.

Domestic production of gold in India is limited and, given its strong demand, India relies heavily on gold imports every year. Currently, the Kolar mines in Karnataka are the only operational mines in India, grossly unable to meet domestic demand.

Gold imports in India constitute the next largest chunk of total imports after crude oil. Of late, the government has increased its focus on curbing the negative impact of heavy gold imports viz. a widening trade deficit and rupee devaluation.

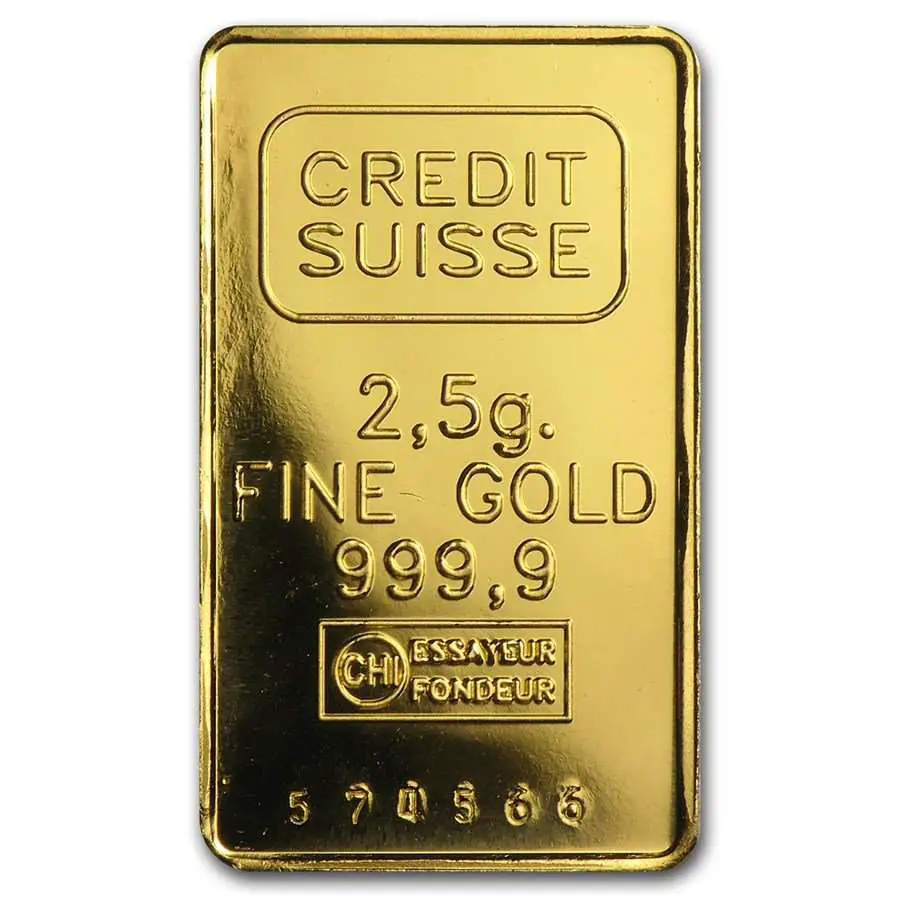

Acre Golds Bar Special Features

Each gold bullion comes in a premium, soft-touch box with a display drawer and bears an authenticity certifying assay card in tamper. The elaborate packaging both protects the gold plate and certifies its origin.

Each bullion is made of 2.5-gram or 5-gram of .9999 fine gold and is delivered in a sealed protective assay package that clearly indicates the weight and authentication of the bullion via an assayers stamp. Furthermore, each gold bullion is stamped with Acres logo along with its weight and purity. On the reverse side of the bullion, the client can again see Acres logo.

Don’t Miss: What Do Golden Eagles Eat

Factors Affecting Gold Price In India

Trading in gold is a preferred investment mode of investors who are financially savvy and have the required risk-appetite for this kind of market. It requires prudent monitoring of investments as gold prices are subject to change for many reasons. Maintaining or closing a position in this market depends on how well an investor can track, analyze and synthesize pricing information.

Some of the key factors that affect gold prices are outlined below:

$30 & $50 Monthly Packages

To first-time gold buyers and bargain-hardened pros, Acre Gold has something to offer. The company has launched a flexible layaway program allowing clients to pay a monthly fee of $30 or $50, accumulate gold, and get a 2.5-gram bar sent over to them when the money balance in their account reached the set cost threshold.

Recommended Reading: How Many Grams Make An Ounce Of Gold