The Silver Market Never Sleeps

The market remains open from 6 p.m. to 5:15 p.m. every day except Saturday. That means there is only 45 minutes a day when markets are officially closed.

However, given the immense number and volume of transactions being placed during opening hours, investors cannot afford to take their eyes off the live silver prices even one day a week.

Silver prices are volatile, changing every minute of the day. Stay as up-to-date as possible with live silver prices from SilverGoldBull.ca. Our online resource is the most accurate metric of live silver prices available. Simply hover over any point in time to see historical silver prices, or grab the sliders and make a particular selection to see more specific information about silver prices from that period of time.

Does Mintage Affect Price Of Silver Coinage

Mintage has a direct impact on the price of silver coins. Both private and sovereign mints produce silver coinage on a regular basis, and the volume of production is a major determinant of value. For example, sovereign mintage coins are more expensive because there are fewer of them. As such, they come with a higher premium fee. Because of their unique commemorative qualities, mint coinage represents a long-term investment with great sentimental allure and financial value.

Changing Silver Prices And Gold Prices

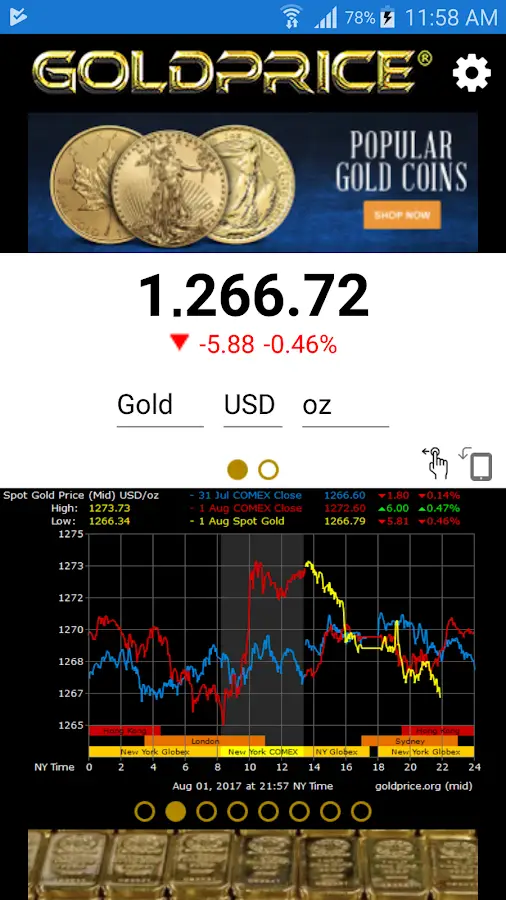

Study the changing price of gold with our interactive gold price charts. Use our helpful gold price chart data to gain insights into the future price of gold. Simply make a selection with the sliders and observe the price of gold over any period of time. Observe gold prices on any particular day by hovering over any point in the gold prices chart. Gold prices are volatile, and change every minute of every day. Stay up to date on the current price of gold and use our information to your advantage of the best gold prices when it comes to your investments.

You May Like: What Comes With Resident Evil 7 Gold Edition

What Were Gold And Silver Prices In 1986

After peaking in January 1980, gold and silver prices moved sharply lower over the following two years before basing out in the mid 1980s. By 1986, gold had found a floor around $300/oz.

A rally ensued through 1987, but it proved to be fleeting. Gold prices fell back into a long, protracted trading range. The market finally bottomed out from 1999-2001 before embarking on a multi-year secular upleg.

Difference Between Silver Bar Price & Silver Coin Price Premiums

The silver bar price takes into account the silver spot price, as well as attached fees for the fabrication, distribution, and dealing of the bars themselves. These three fees are variable the location of silver fabrication, the volume of silver bars being purchased & the silver premium asked for by the dealer.

As silver coins are not produced in the same way, they are not subject to the same premiums. In addition to their manufacturing and dealer fees, silver coins must be measured in terms of their numismatic value, scarcity & relative demand for similar coins. Numismatic value refers to the rarity of the coin, as the higher numismatic value a coin has, the higher its price raises. Rarity and scarcity are the major price differences in premiums between the silver bar price and the silver coin price.

You May Like: Where To Sell Gold And Silver

The Troy Ounce Vs The Avoirdupois Standard Ounce

Gold prices are always measured in troy ounces. A single troy ounce is one-tenth heavier than the traditional avoirdupois ounce and has been set internationally as the standard upon which gold prices are measured. Some investment websites will measure gold by the gram or in kilos, as well as ounces. As global markets trade gold & other precious metals in troy ounces, it is advisable to always calculate your gold bullion investments in troy ounces.

When assessing multiple pounds of gold, keep in mind that one pound of gold works out to be 12 troy ounces. If you prefer measuring gold in grams, consider that a single troy ounce of gold works out to be 31.1035 grams.

Different Premiums For Different Gold Bullion Products

There are two major forms of gold available for trade on the market. The first type of gold bullion are gold bars. The gold bar price is the combination of the gold spot price for the amount of troy ounces contained therein along with any additional costs of gold fabrication, distribution, and a dealer fee. This math will give you the actual price of your gold bar investment.

The second type of gold is gold coinage. To calculate the gold price of coins, we must take into account factors like mintage, the total number of similar minted gold coins on the market and the quality of the coins in question. The price of gold coins is harder to estimate because it considers more intangibles. As a result, the overall premium cost for gold coins is higher than that of gold bars.

Recommended Reading: What’s The Best Karat Gold

What Happens To Precious Metal Prices In A Recession

Some metals tend to correlate strongly with the business cycle and may therefore perform poorly during a recession. Gold and silver are more counter-cyclical and can benefit from a bad economy accompanied by safe-haven flight out of the stock market.

The premier safe-haven hard asset is gold. Prices for the money metal have gained during five of the past seven recessions that have occurred since 1970. In 2008, gold was one of the only alternative investment assets to show a gain for the year.

Silver is less reliable during economic downturns. It performed fantastically during the stagflationary 1970s. But in general silver tends to fare poorly when a bad economy causes demand from industrial users to weaken.

Rising investment demand can make up some of that decline. Silver is historically and foundationally a form of money. During a financial panic or currency crisis, the masses may rediscover its monetary utility. That makes silver more promising to hold during hard times than a straight-up industrial metal.

Why Are Gold And Silver Prices Being Suppressed

Gold and silver are the ultimate forms of money. When they are rising rapidly in value versus fiat currencies and paper assets, governments, central banks, and investment banks on Wall Street get nervous. A sharp rise in precious metals prices suggests not all is well in the financial world.

The bullion banks can try to combat rising demand for physical metal by flooding futures markets with paper sell orders. It might work in the short-term, but it will ultimately fail if the paper market loses credibility.

Spot prices could diverge from real-world pricing in the markets for physical precious metals. For example, during periods of extreme stress in markets it may be impossible to obtain physical metal anywhere near the quoted spot price. Premiums on retail bullion products may surge as a consequence. When the physical market diverges from the paper market, wholesale over the counter prices may be more realistic than spot prices.

You May Like: How To Get Unlimited Xbox Live Gold

Current Silver And Gold Prices

Track the ever-changing prices of gold and silver on our interactive gold price charts and maps. Monitor the live gold price conveniently and effectively with our live gold prices graphs. Simply grab the left and right sliders to make a time-based gold price selection, and allow the data to provide insights into past gold prices, current gold prices and the future of the gold price.

Are My Silver Investments Taxed

Since the CRA classifies precious metals as investments, profit made on your metals will be subject to taxation when you sell them in the future. A T5008 tax form will be completed for you and a copy is submitted to the CRA, as well as provided to you during tax season. A T5008 form calculates the gain/loss on the investment, and you are taxed accordingly based on standard capital gains tax rules. Our purchasing team can help you calculate this amount and answer your questions

Don’t Miss: Green To Gold Deadline 2022

Whats The Difference Between An Ounce And A Troy Ounce

The troy ounce is the standard unit of measurement used for precious metals like gold and silver. A troy ounce, when converted into grams, is equal to 31.103 grams, which is heavier than the traditional ounce, equal to 28.349 grams.

A troy ounce is approximately 10% heavier than a regular ounce. An avoirdupois ounce, or traditional ounce, can be converted into a troy ounce by simply dividing it by 0.91. However, for every troy pound, there are only 12 troy ounces, making a troy pound lighter than a regular pound, which is 16 ounces. It can be confusing, but this is the standard for measuring precious metals like gold and silver.

Gold Coins Vs Gold Bars: How To Know Which To Invest In

![Live 24 hours gold chart [Kitco Inc.] Live 24 hours gold chart [Kitco Inc.]](https://www.goldtalkclub.com/wp-content/uploads/live-24-hours-gold-chart-kitco-inc-chart-gold-price-spots.gif)

Deciding on the type of gold you invest in depends on your current investment portfolio, and the amount of risk you are willing to accept. Investing in gold bars represents a relatively low-risk option with incremental long-term rewards. The gold price premiums are low and the option to sell is always available if the market continues to rise. If you want to diversify your portfolio with an investment like mutual funds or bonds, investing in gold bars is your best option.

Gold coins represent higher premium costs and a bit more risk, as the price of gold coinage tends to fluctuate more than gold bars. The upside to gold coins is that you can read the market effectively and sell them at a five or ten-year high in price. Additionally, gold coins have an added benefit as they allow selling in smaller batches. This makes it easy to sell smaller portions of your gold bullion as opposed to selling a single 1kg gold bar all at once.

Also Check: How To Invest In Gold In Usa

How Is The Live Price Of Silver Determined

The live price of silver changes by the second. The reason the live price of silver changes is based on several factors that can be fairly unpredictable. The Federal Reserve raising or lowering interest rates, job and wage reports, current events, or a failing U.S. dollar are all aspects that will send the price of silver up or down within minutes. With markets around the world trading silver 24 hours a day, the price is constantly in flux.

Gold And Silver Investment Is Happening Worldwide

From the pound and yen to the euro and the dollar, gold and silver are priced in thelocal currency of nations worldwide. Americans gauge price action in US dollars .But in a world where all currency is fiat, and inflation rates differ, metal prices mayperform quite differently depending on which nations money is used to valueit.

There are online calculators and websites devoted to quoting gold, silver, platinum andpalladium prices in the worlds major currencies. There are bullion dealerslocated everywhere buying and selling for whatever may serve as cash locally. Gold andsilver provide holders liquidity and a store of value regardless of where they are orwhere they are going.

You May Like: White Gold Diamond Huggie Earrings

Why Will Gold Protect Me In A Market Crash

Gold is the ultimate safe haven investment tool for the veteran investor.

Gold, silver and other precious metals and their cycles of fair valuation have a unique relationship with up and down trends in the stock markets. In a market crash scenario, as traditional stocks plummet in value faster than investors can sell, a gold bull market quietly begins to take shape. Gold prices historically rise after these major market crashes as more and more investors push their currency into precious metal assets, knowing the value of their dollars will be stored and grown. This gold bull run cycle typically lasts several years and has historically been responsible for unprecedented financial ROI for patient investors.

What Is The Silver Squeeze Movement

Since 2013, the silver price has traded in a range between the mid-teens on the low side to the low 20s on the high side. Unlike gold, which made an all time high in 2020, silver did not make an all time high. This has led many investors to claim that the silver price is being artificially suppressed by traders and large banks, who hold a short position of silver that they do not physically possess.

The goal of the silver squeeze movement is to purchase as much silver as possible. The thought of the movement is this will force the traders to cover their short positions of silver. With a large amount of short covering, the silver price will likely spike upwards.

You May Like: How Do I Reinstall Aol Gold

Precious Metals Bought And Sold By Weight

The standard unit for gold and silver in the US, Canada and the United Kingdom is the troy ounce.

The standard unit for gold and silver in the US, Canada and the United Kingdom is thetroy ounce. If the unit is not expressly stated as such when the price is quoted, it issafe nevertheless safe to assume. A troy ounce is slightly heavier than the avoirdupoisor standard ounce. There are 14.5833 troy ounces to the standard pound.

Most of the rest of the world uses metric units such as the gram and kilogram as thestandard unit.

While the spot or fix price used as the basis for valuing gold and silver bullionproducts does not vary based on quantity, the per ounce or per gram premium buyers andsellers receive for their coins, rounds and bars will vary. Like many products, largerquantities often mean lower prices. So making less frequent purchases in larger volumeis a good way to lower your overall price per ounce or per gram .

Buying a large bar instead of a number of small coins is another way to pay less premium.The cost per ounce to manufacture the bar is less than the cost to make multiplecoins that means savings. Just remember that saving money by buying bars todaywill likely come with a cost later when you are ready to sell. Bars cost less when youbuy and bring less when you sell. Larger bars also cannot bebroken down and sold in smaller lots, making them a bit less versatile than smallercoins or rounds.

Price Predictions For Gold And Silver

Gold and silver prices dont rise or fall for the same reasons that stock prices do. In general, gold is inversely correlated to the stock market. Precious metals are a historical safe haven, so if investors get skittish about stocks or fearful of what could happen in that market, they tend to buy gold, pushing its price higher. Conversely, if investors are confident that the stock market will rise, thats where theyll invest the gold price tends to fall.

Gold and silver performance depends on more than just the stock market, though. Since precious metals are, among other things, a store of value, their prices tend to rise when times are tough, whether those tough times be economic, monetary, financial, or geopolitical in nature. History also shows they perform well when inflation climbs.

In addition, gold and silver are money, and a hedge against financial catastrophe. If worse comes to worst if there is hyperinflation and a loss of confidence in fiat currencies precious metal coins will be one of the only methods of payment nearly universally recognized as having real and permanent value, and are likely to be accepted in exchange for goods and services.

You May Like: How Much Can I Sell My Gold For

Understanding The Cycles Of Economic Ups & Downs

Investors across the globe agree that all bubbles burst, which is a phrase used in economics to express all market up-trends will eventually become down-trends.

What is critical to understand about this recurring phenomena is that these up and down cycles are necessary balancers for the fair valuation of global markets.

When the stock market becomes too over-valued and warning signs of an impending crash start flashing, nervous investors looking to earn the maximum ROI from their stock portfolio begin pulling out their assets in vast numbers, sensing their patiently-earned gains may soon vanish. This panic-frenzy of sell-off behaviour across the market pushes towards an irreversible tipping point. At this time, much of the stock market becomes bearish and succumbs to buyer fears and economic turbulence.

What Is The Relationship Between Spot Price And Future Price

Futures exchanges are where the spot prices for the precious metals areset. For gold and silver investors, the spot price is the one most commonly used. It isthe price you see on CNBC, in the newspaper. Technically spot refers tothe price at which a futures contract for nearest active delivery month was mostrecently traded. It fluctuates up and down from second to second while the exchanges areopen and trading much like stock prices do. It is the price most commonly usedwhen pricing bullion. And it is the priceyou see at the top of this page.

The COMEX is the largest and most commonly referenced of the futures exchanges when itcomes to establishing prices for physical gold, silver, platinum and palladium. TheCommodity Exchange, or COMEX, merged with the New York Mercantile Exchange in the 1990s.But gold and silver futures are also traded on a number of exchanges all around theglobe. That means spot prices are updating nearly 24 hours per day except forweekends.

The futures markets specialize in commodities of all types, including gold and silver.Traders buy and sell contracts for a fixed quantity of a commodity, to be delivered atsome future date. The standard contract for silver is for 5000 troy ounces, while thegold contract is for 100 troy ounces.

These highly leveraged and volatile markets are generally not suitable for inexperiencedtraders or for anyone investing funds they cannot afford to lose. Fortunes can be madeor lost overnight.

Read Also: When Will Ssi Recipients Get Golden State Stimulus