What Happens To Gold If We Enter A Recession Or Depression

By Jeff Clark, Casey Research

Mayan prophecies aside, many of the senior Casey Research staff believe that economic, monetary, and fiscal pressures could come to a head this year. The massive buildup of global debt, continued reckless deficit spending, and the lack of sound political leadership to reverse either trend point to a potentially ugly tipping point. What happens to our investments if we enter another recession or gulp a depression?

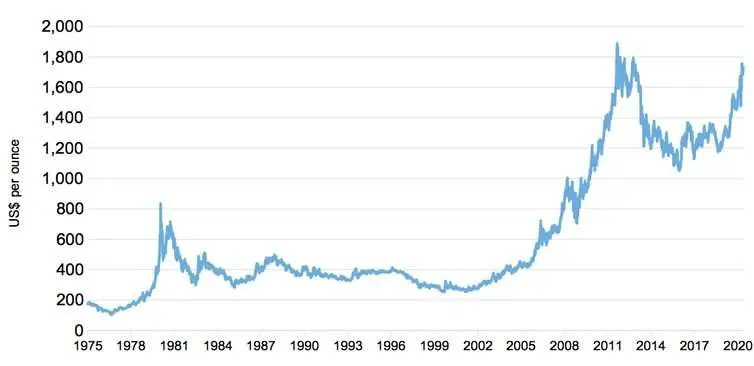

Heres an updated snapshot of the gold price during each recession since 1955.

Clearly, one should not assume that gold will perform poorly during a recession. Even in the crash of 2008, gold still ended the year with a 5% gain. And with the amount of currency dilution weve undergone since that time, it seems more likely gold will rise in any economic contraction than fall. Indeed, if the response of government to a recession is more money printing, precious metals will be a critical asset to have in your possession.

Even if the gold price ends up flat or down this year,the CPI wont. Golds enduring purchasing power is why we hold the metal.

How about gold stocks?

Dont lose patience with, or confidence in, your gold holdings. What happens to the price over any short period of time is only one chapter in the book of this bull market, and we think youll be happy by the time that last chapter is written.

Is The Gold Rate In The Us Different From The Gold Rate In Other Countries

Yes, the price of gold, specifically the spot gold price, will be different from one market to another, but only marginally so. Youll actually pay the same regardless of your market. While there is a 24-hour gold market, its closer to Forex than the stock market in terms of performance. However, with that being said, there is usually a very close correlation between the gold rate for one market and the gold rate for another.

This all said, since the year 2000 gold has performed better vs some fiat currencies like the Argentine peso vs other stronger less rapidly debasing fiat currencies like Swiss francs or New Zealand dollars for instance. See various annual price performances of Gold vs Fiat Currencies below.

GOLD vs FIAT CURRENCY KEY

Is There A Gold Benchmark

Because there is no official closing or opening price for gold or silver, market participants rely on benchmark prices, set during different times of the day by different organizations. These benchmarks are also referred to as fixings.

The London Bullion Market Association is the leading organization that is responsible for maintaining benchmarks for all precious metals. The LBMA Gold Price, the LBMA Silver Price, and the LBMA PGM Price are the widely accepted benchmarks in the precious metals space. Kitco.com also provides a variety of benchmark prices for gold and silver.

The benchmark price is determined twice daily in an electronic auction between participating banks with the LBMA, which is administered by ICE Benchmark Administration.

Also Check: Free Eagles For War Thunder

Do Gold Prices Always Go Up During A Recession

November 25, 2020 by Daniels Trading|Futures 101

According to Forbes contributor David Rodeck, a recession is a significant decline in economic activity that lasts for months or even years. Formally, a recession is defined as being two or more quarters during which economic activity contracts. Symptoms of a recession include rising unemployment, falling personal incomes, and lagging industrial output. Although recessions are an unavoidable part of the economic cycle, they can bring intense pain to people and financial markets.

One tried-and-true hedge against the negative impacts of such downturns is the acquisition of gold. As a general rule, gold prices appreciate during challenging financial times. But is this always the case? In this blog post, well examine two recent examples of how bullion reacts during severe recessions.

How Much Is An Ounce Of Gold Worth

Assuming investment grade gold of .999 purity, an ounce of gold is worth the spot price, plus or minus any premiums, based on market conditions. For example, if a person has a rare, sought after one ounce gold coin produced by a sovereign mint, that coin is generally worth more than a generic one ounce gold round produced by a private mint. That is to say, gold price per ounce depends on exactly what gold is being appraised or evaluated.

You May Like: 18kt Gold Per Gram

How Does The Gold Bar Price Vary From The Ounce Of Gold Price

Gold is available in many different forms, including modern gold coins, gold bars and older collectible gold coins.

The gold bar price will vary depending on the amount of gold in the bar. If the bar contains one ounce of gold, the price will typically be slightly less per ounce than the gold price for government guaranteed and minted gold bullion coins or other similar gold bullion collectible items. However, if the gold bar contains more or less gold, the price will vary mostly depending on overall weight. For instance, a one gram gold bar will not cost the same as an ounce gold bullion bar or a one kilo gold bar.

Make sure to know the exact amount of gold bullion contained in any gold bar or gold coin before purchasing or selling to ensure that you are indeed getting a fair price.

Silver Price Predictions Projections & 5

Jeff Clark, Senior Analyst, GoldSilver.com

What will the silver price do in 2021? And where is it headed over the next 5 years?

Ive compiled silver price predictions from a number of precious metals analysts and consultancies. I also make my own prediction, based on the key factors that in my experience are most likely to influence the silver price both this year and the next five years.

This will be fun, so lets jump in!

Recommended Reading: How Much Is 14k Italian Gold Worth

Do Current Gold Prices Vary By Country

The price for an ounce or gram of gold remains mostly the same regardless of which country you are in. The price is determined by converting the current spot gold price for an ounce or gram of gold into the country”s currency. For example, the current spot gold price for 1 gram of gold would be converted into Indian Rupees according to the current exchange rate.

Gold Holds Tight Range As Higher Yields Counter Omicron Fears

22 Dec, 2021, 07.45 AM

Gold traded within a tight range on Wednesday as higher U.S. Treasury yields and improved risk appetite countered concerns about the rapidly spreading Omicron coronavirus variant. Spot gold was little changed at $1,789.12 per ounce by 0126 GMT. U.S. gold futures also remained unchanged, at $1,789.50.

Read Also: Free Golden Eagles App

Are Gold Futures The Same As Buying Physical Gold

While gold future prices will be similar to the bullion price, it is important to understand that gold futures contracts are not the same as owning the physical precious metal bullion. While you can technically buy a gold futures contract rather than an actual physical ounce of gold, youll ultimately pay more for your purchase in the end. The number of good delivery bullion products available in this manner is very limited, and youll not only pay the gold bullion price, but also a host of additional fees and charges before you can take delivery of a minimum of 100 oz gold per contract.

Is The Price Of Gold Different In Other Countries

The current price of gold is the same, all things considered, in other countries. The US gold price is converted to the currency in that country based on the current exchange rate. In other words, no matter where in the world you purchase gold, the actual value of that gold in US dollars is the same. The below chart shows the annual gold price performance versus various fiat currencies.

Read Also: State Of California Golden State Grant Ssp

Silver Price Fundamental Analysis Silver Basis

In silver, the pattern is similar with a key difference.

There is less pronounced movement within a range, though its there. And of course the magnitude is bigger as a percentage. The low in the range is about 1.2 grams to 1.44 grams, or 20%. Compare to 1mg in gold, which is 6%.

The take-away is that there really is not much of a fundamental change in the market through this. There just is not the shortage, much less panic, that some gold analysts proclaim. Nor the massive dumping of mass quantities of futures .

Gold Price Factors Faq

The price of gold seems to move around quite a bit. What are some things that cause changes in the gold price?

Gold is a commodity that can have very rapid price changes during periods of high volatility and can also have very little price movement during quiet periods of low volatility. There are many different things that can potentially affect the price of gold. These issues include but are not limited to: supply and demand, currency fluctuations, inflation risks, geopolitical risks, and asset allocations.

Gold is viewed by some as a safe-haven asset for it is one of the only assets with virtually no counter-party risks . This is why golds value may potentially rise during times of economic instability or geopolitical uncertainty.

Isnt the price of gold too volatile for most investors?

Gold can, just like any other commodity, become volatile with rapid price changes and swings. The gold market can also, however, go through extended periods of quiet trading and price activity. Today many financial experts see gold as being in a long-term uptrend and that may potentially be one reason why investors are buying gold.

Why does gold trade essentially 24 hours per day?How often do gold prices change?

Read Also: How Many Grams Per Ounce Of Gold

Four Facts Making Gold Prices Go Up And Down

Dollar For Dollar

An oft-told saying remarks that wherever the dollar goes, so goes gold prices. The two offer an inverse relationship: when demand for dollars slips, investors and banks around the world turn to gold, thereby increasing the value of everyone’s favourite metal .When the dollar appreciates in value, investors tend to shift their money from gold into the currency. The fall in demand for gold causes its value to depreciate. When the dollar appreciates in value, investors tend to transfer their money from gold into the currency. The fall in demand for gold causes its value to depreciate. Its relationship to the dollar correlates to how many see gold buying: it’s a defensive measure and a guard against inflation and currency devaluation.

Interested in Interest RatesAnother factor in gold’s rise or fall is interest rates. As the Telegraph writes: “Although gold has no yield, it tends to offer investors a better place to park their money when returns from bonds and cash savings are poor – as they are when rates are low.” The Telegraph goes on to quote Matthew Michael, a commodities expert at asset manager Schroders. “Gold behaves differently after a hiking cycle,” he says. “A quick look back in history shows gold has performed well when rate hikes happened in the case of the Fed.”

What Is The Ounce Of Gold Price

The gold spot price is typically reflecting a troy ounce of gold.

The spot price is the value of one troy ounce of gold on the over the counter market. However, understand that gold is not always sold by the ounce, although that is one of the most common methods. Gold can also be sold by the gram and by the kilo . So, by knowing the gold price per ounce, you know the baseline of what youll typically pay for one troy ounce of .999 fine gold from a bullion dealer .

Read Also: Does Kay Jewelers Sell Moissanite

Gold In The Age Of High

The best thing you can do is know how to have a balanced portfolio.Ray Dalio, Bridgewater Associates

In an article headlined Robots conquered stock markets/Now theyre coming for bonds and currencies, Bloomberg finance reporter Lananh Nguyen tells us: In the most liquid equity markets, more than 90 percent of trades are executed electronically, according to estimates from Greenwich Associates. That compares with 79 percent in global foreign exchange, 44 percent in U.S. Treasuries and 26 percent in U.S. corporate bonds, with the most room for growth in the latter two markets, according to McPartland at Greenwich. Just this year, Morgan Stanley and Goldman Sachs requested counterparties forgive rogue, machine-driven trades that caused a $41 billion flash crash in a matter of seconds. Though concentrated in a single stock, such anomalous events serve as a cautionary tale on how a full-out, machine-driven panic might evolve on a larger scale.

Ready to include a safe haven in your portfolio plan?DISCOVER THE USAGOLD DIFFERENCE

USAGOLD note: Blain becomes introspective in the run-up to the holidays. Chasing value is his theme

Gold knocking once again on $1800s door, silver looking revitalizedHamilton: Delayed secular gold bull should be resuming

Chart of the Day

Gold and silver price performanceChart courtesy of TradingView.com

What Is Spot Gold

The spot gold price refers to the price of gold for immediate delivery. Transactions for bullion coins are almost always priced using the spot price as a basis. The spot gold market is trading very close to 24 hours a day as there is almost always a location somewhere in the world that is actively taking orders for gold transactions. New York, London, Sydney, Hong Kong, Tokyo, and Zurich are where most of the trading activity takes place. Whenever bullion dealers in any of these cities are active, we indicate this on our website with the message Spot Market is Open. For the high and low values, we are showing the lowest bid and the highest ask of the day.

You May Like: War Thunder Unlock All Planes Hack

Factors Most Likely To Influence Silver Prices

While there are a number of variables that can impact the silver price, lets look at those most likely to play out this year and beyond and determine if theyre likely to push the price higher or lower

Industrial Demand

Roughly half of all silver goes toward a variety of industrial applications . Demand from industrial users usually doesnt fluctuate all that much, but the next four years is likely to see a substantial increase due to Bidens green policies.

Thats because silver is a key component in many green technologies. Since it is most the most conductive of the metals, it is vital to making green technologies what they are. Check out just how much silver demand will grow under Biden in this article.

If industrial demand grows as I expect, the silver price is likely to increase…

RESULT: HIGHER SILVER PRICE

Investment Demand

The factor that has the biggest impact on the silver price at any time is not industrial demand or jewelry demand. It is investment demand. Heres the evidence

This chart, going back to 1960, demonstrates the link between investment demand and prices. The red shaded areas show that selling from investors led to lower or weak price, while the green shaded areas show that rising demand from investors led to rising prices.

The key to this chart is that when investment demand shifts from net selling to net buying, the price has risen . As such

- As investment demand goes, so goes the silver price.

So are investors buying or selling silver?

Whats The Difference Between Gold Futures And Bullion

Gold futures contracts are really nothing more than promissory notes. They promise that the individual or organization in question will buy or sell a specified amount of gold at a specific time in the future . These contracts may be for a few months down the road, or they may be for years ahead. There are several challenges here.

For instance, the price of gold youll pay will be significantly higher than buying just a single ounce , and the chance for the price of gold to change between the time you buy your futures contract and when you actually take delivery is high. While there is potential for the price to go up, meaning youve saved money, theres an equally good chance that the price might go down, meaning youve paid too much.

Don’t Miss: What’s The Difference Between 14k And 10k Gold

Three Leading Indicators For Our Gold Price Predictions

We apply a limited number of leading indicators for our gold price predictions:

All three combined help us forecast the future path of the price of gold. Moreover, it is by using these 3 indicators that we were able to accurately forecast annual gold price targets 6 to 9 months prior to the market hitting them.

How Much Is 1 Gram Of Gold Worth

One gram of gold is generally worth about 1/28th the price of one ounce of gold, as there are a 28.2395 grams in one ounce. Additionally, the worth of 1 gram must take into consideration any premiums. Since 1 gram gold coins, bars and rounds are more expensive to produce, they also generally command higher premiums, meaning the price one pays will be above and beyond the price for the mere weight of gold.

You May Like: Karats Of Gold Explained

Gold Price Prediction Trends & 5

Jeff Clark, Senior Analyst, GoldSilver.com

Most price forecasts arent worth more than an umbrella in a hurricane. There are so many factors, so many ever-changing variables, that even the experts usually miss the mark.

Further, some forecasters base their predictions on one issue. Interest rates will rise so gold will fall. Thats not even an accurate statement, let alone a sensible prediction .

But there is value in considering predictions. It can solidify why one has invested, offer factors that may have been overlooked, or even cause one to revise their expectations.

So while we take predictions with a grain of salt, lets look at what might be ahead for gold price in 2021 and the next 5 years. Well first summarize what many analysts are predicting, and then look at the factors that are likely to have the biggest impact on gold. Ill conclude with the probable prices I see based on those factors, as well as some long-term projections.

This will be fun, so lets jump in!