The Revamped American Express Gold Rewards Card Details Are Revealed

Back in May we had a post in our series on Canadian cards due for an overhaul that covered the American Express Gold Rewards card. At that time we had no knowledge of the changes that would happen to the Cobalt Card only a few short months later and heralded the fact the Gold Rewards Card was still one of the best in Canada. We actually put our opinion out there that the card was only due for a tweaking not an overhaul. However with the changes to the American Express Cobalt Card it pretty much made the Gold Rewards Card in its present form obsolete. There was speculation, even on our part based on emails we had received that the Gold Rewards card was going to be discontinued but that was quickly corrected that the card was only being paused for a revamp.

Best Metal Credit Cards Of 2022

There is something sleek and stylish about carrying a metal credit card. While that feature in and of itself shouldn’t influence you to choose a particular card, there are several metal cards on the market that also happen to be terrific for earning rewards, travel benefits and other perks.

Mastercard Titanium Card: Heaviest Credit Card

Type of metal used and weight of the card

The Mastercard Titanium Card is one of three cards offered through the Luxury Card program. The Titanium Card weighs 22 grams and is made out of brushed stainless steel on the front and carbon on the back.

Rewards and benefits

This card does not offer an introductory bonus and provides a standard one point for every dollar spent on purchases. The difference with this card is in the redemption rate. Airfare can be redeemed at a rate of 2%, while cash back can be redeemed at 1%.

Other benefits include:

- 24/7 access to Luxury Card Concierge

- No foreign transaction fees

- Test drive a Porsche of your choosing with a 90-minute driving experience

- Enroll and take five eligible rides a month with Lyft and get a $10 credit

- Free two-day shipping and free returns on eligible purchases when you sign up for a complimentary ShopRunner membership

- Global acceptance

Editors thoughts

The Mastercard Titanium Card has an annual fee of $195. If youre interested in owning a luxury card at a reasonable annual cost, this could be the option for you.

To learn more about this card and its other benefits, .

You May Like: Spectrum Gold Package Cost

How Does The Amex Gold Card Compare To Other Rewards Cards

While the Amex Gold card offers one of the best rewards rates on both restaurant and U.S. supermarket purchases, its high annual fee can limit its earnings. Plus, while it comes with a few valuable credits, its dining credit has a limited scope, potentially decreasing the overall value you can get from the cards extras.

To get a sense of where the Amex Gold stands in todays marketplace, our team of researched hundreds of credit cards to rank the Amex Gold based on factors like its rewards rate, welcome bonus, annual fee and more. The card fared quite well, especially in its rewards rate, welcome bonus and annual bonus . It does charge a higher annual fee than the average rewards card, however.

Though the Amex Gold can easily pay for itself if you take advantage of its benefits, if you arent sure how many of the cards perks youll use and worry about a high annual fee coming back to bite you, there are a few other rewards cards that offer great rewards rates and charge a lower annual fee. Plus, since the cards rewards are best used for travel, it may not be the best fit if youre looking for maximum flexibility.

Consider these alternatives:

What Is A Metal Card

Metal credit cards are credit cards that are literally made from metal and usually offer accelerated rewards on travel and experiences, as well as access to prestigious banking benefits. While our neighbours to the south have metal credit cards that come with no annual fees, there are currently only a few offered in Canada, and most of them come with pretty unattainable eligibility requirements for the average person with the exception of one: The Platinum Card from American Express.

You May Like: Price Of 18k Gold Today

Amazon Prime Rewards Visa Signature Card

The * is geared towards frequent Amazon shoppers, rather than people who want to travel using credit card points. Theres no annual fee, but you can only get the card if you are an Amazon Prime member. Youll also earn a $150 Amazon gift card upon approval, which offsets the price of your $119 in your first year.

The card earns 5% cash back at Amazon.com and Whole Foods, plus 2% cash back at restaurants, gas stations and drugstores, and 1% cash back on everything else.

American Express Gold Card Uk The Sign

The American Express Preferred Rewards Gold card offers 10,000 bonus Membership Rewards points when you spend £3,000 in your first 3 months .

Membership Rewards points can be directly converted to Avios and with a number of other partners. If converted to Avios this would be enough for a return flight to Athens. Use our Avios points calculator to see where your points could take you.

Even better, you can get a higher bonus of 12,000 points if you use this specific link for the Amex Gold card , helping you to fly even further. For those who have read my post about the value of American Express Membership Rewards points if converted to Avios, youll know that I value the points at roughly £0.01 per point. As such by using this link youre making in the region of £20, with the total benefit somewhere in the region of £120. Worth considering! Just look out for the additional 2,000 points as shown below in red when you use the referral link.

Recommended Reading: Eiffel Tower Ring Kay Jewelers

I Got A Free $4000 Flight With My Amex Gold Card Does It Live Up To The Hype

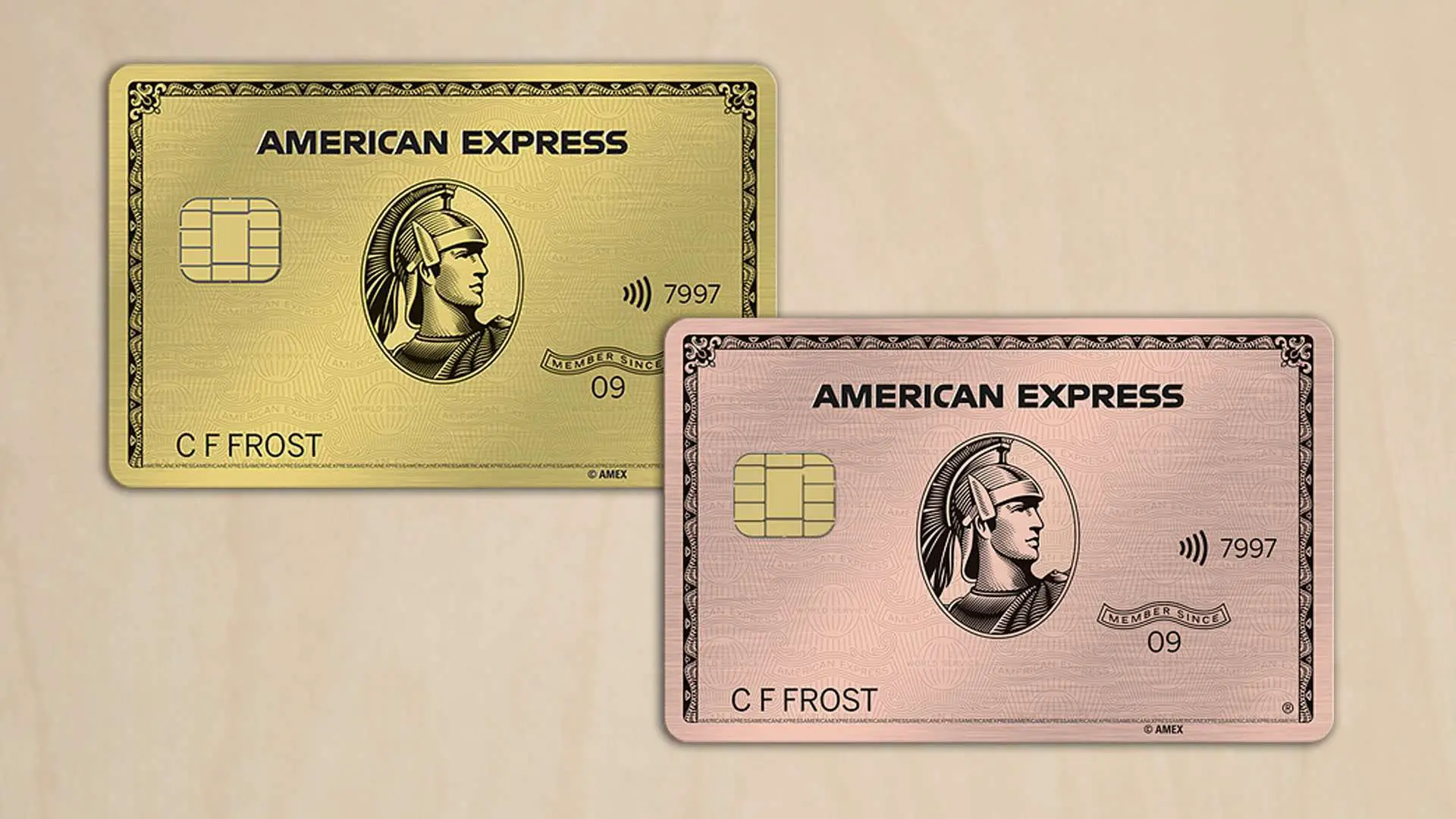

The term Gold Card is so widely used in the credit card industry that its lost nearly all of its meaning. But American Express is trying to bring the gold standard back with their refreshed and reintroduced Gold Card. Not only is a limited-edition metal card in an attractive rose gold color being offered by American Express, but this Gold Card really is providing customers with top-notch value.

If youre interested in this golden opportunity to earn more rewards and perks, take a look at why I think this American Express card is worth considering. And then lets see how it stands up against its competition in the crowded field of premium rewards cards.

Try It: Getting a Travel Rewards Credit Card Is the Best Money Move I Ever Made

What Do I Do With My American Express Points

Go Shopping: Shop with American Express merchant partners through the Membership Rewards portal. Note that the value of Membership Rewards points varies according to how you redeem them. Points can typically be redeemed for anywhere from 0.5 cent per point to 1 cent per point. Rewards arent all the Gold Card has to offer.

Recommended Reading: 18 Karat Gold Per Gram

Earn Rates And Redemption Remain Unchanged

The card’s earn rates remain the same:

- 2x the points on eligible travel purchases

- 2x the points on eligible gas, grocery and drugstore purchases

- 1 x the points on everything else

And as the card earns Membership Rewards points and there haven’t been any changes to the program since May the redemption side of things remains the same.

Amex Gold Rewards Card: Perks & Benefits

The Gold Rewards Card now offers a $100 annual travel credit, similar to the $200 annual travel credit on its premium counterpart, the Platinum Card.

The $100 annual travel credit can be redeemed towards any booking of $100 or more through the Amex Travel online portal, including flights, hotels, car rentals, and more.

Since the travel credit also applies to refundable bookings, its effectively as good as cash, and it reduces your net annual fee back down to $150.

In addition, the American Express Gold Rewards Card has added airport lounge access to its suite of travel perks.

Cardholders will receive four complimentary visits to Plaza Premium lounges in Canada every year, allowing you to make use of the Plaza Premium Lounges in Toronto, Vancouver, Winnipeg, and Edmonton as well as the Air France Business Lounge in Montreal, which is managed by Plaza Premium.

In addition, cardholders also receive complimentary membership with Priority Pass, although no free lounge visits are included instead, every admission to a Priority Pass lounge will be subject to the prevailing rate of US$32 per visit.

Finally, theres also a $50 statement credit on NEXUS purchases, valid once every four years when a NEXUS application or renewal fee is charged to the card.

In terms of everyday earning rates, the Gold Rewards Card offers the following:

- 2 MR points per dollar spent on travel, gas, groceries, and drugstores

- 1 MR point per dollar spent on all other purchases

You May Like: Free Eagles War Thunder

Does Amex Gold Have A Spending Limit

No, the Amex Gold doesnt have a preset spending limit. No Preset Spending Limit means your spending limit is flexible. Unlike a traditional card with a set limit, the amount you can spend adapts based on factors such as your purchase, payment, and credit history.

As a result, the Amex Gold Card doesnt have a credit utilization rate on credit reports like many rewards credit cards. But, cardholders will need to pay their balance in full each month to keep their account in good standing and potentially improve their credit score.

For more expensive months, cardholders may want to call American Express to pre-authorize large purchases that may trigger a card fraud alert.

Learn more: Johnny Jet Recommended Credit Cards

Gold Vs Platinum Amex Card: An Overview

Lets face it, theres a secret pleasure attached to American Express precious metal cards, whether Gold or Platinum. Whether it’s from decades of tv brand advertising or simply because you know your boss carries one, you have decided to join the club because membership has its privileges. You can imagine your restaurant server or local merchant taking notice when you hand over the iconic card brand with the metallic sheen. Perhaps the status buzz comes from the cards being charge rather than credit, which means the bill is paid off in full at the end of the month. The subtle message it conveys is: I can afford to spend freely on everything I want and need and not go into long-term debt to pay for it.

But when it comes time to choose a premium Amex card, how do the gold and platinum cards compare? The American Express Gold card carries a $250 annual fee while the Platinum card has an eye-popping $550 annual fee, as of June 2020.

Over 10 years of use, the Platinum will cost you an additional $5,500, and a side-by-side comparison confirms that the Platinum card is basically a Gold card with some attractive add-ons. As a result, it’s best to make your decision based on whether you will value and use the additional features year in and year out. If so, the Platinum card may well be worth the higher annual fee.

Read Also: Buy Wow Gold Safe

Mastercard Black Card: Heaviest Credit Card

Type of metal used and weight of the card

The Mastercard Black Card is one of three cards offered by Luxury Card. The Black Card weighs 22 grams and is designed with a black-PVD-coated stainless-steel front and carbon back.

Rewards and benefits

There is no introductory bonus and points are earned at a rate of one point per dollar spent with your card. However, points can add up with the redemption rate of 2% for airfare and 1.5% for cash back.

Other benefits include:

- 24/7 access to Luxury Card Concierge

- Up to $100 in annual air travel credit toward flight-related purchases

- A $100 statement credit for application costs related to Global Entry & TSA PreCheck

- VIP airport lounge access with Priority Pass Select

- No foreign transaction fees

Editors thoughts

The Mastercard Black card has an annual fee of $495. Youll have to spend a lot on this card to cover the yearly cost, but if luxury is what you are looking for, this card offers it.

To learn more about this card and its other benefits, .

American Express Gold Card Overview

The American Express Gold Card is one of the premier cards for dining rewards, and the best for dining in Amexs elite card portfolio.

Its high rewards rate, valuable benefits and up to $340 in total annual credits toward eligible dining, Uber and hotel purchases make the annual fee well worth it.

Compared to Amexs premier travel cardThe Platinum Card® from American Expressand similar top-tier rewards cards, the Amex Gold card is the best option for earning rewards outside airfare and hotel stays.

Read Also: How Much Is 14k Italian Gold Worth

The Rose Gold Design Is Here To Stay

While you shouldnt choose a card solely because of its design, a unique color is a nice perk. In fact, nearly three in five consumers would be interested in choosing their card design when picking a credit card, according to a recent Amex Trendex survey.

Card members desire for a unique card and the popularity of the rose gold design during limited-time releases in 2018 and 2019 furthered Amexs decision to permanently provide card members with the metallic hue.

In celebration of the Uber Cash and rose gold offers, Amex, Uber Eats and Fuku are releasing a limited-edition Rose Gold Meal during Valentines Day weekend. You can access this meal through Uber Eats at participating locations in New York and Los Angeles from February 13 to 14. Each order will feature a gold-dusted Knockout Sando, bubbly beverage, custom candle and dessert.

New Trip Cancellation Insurance

This is an insurance benefit I has asked Amex about back in 2010 when they launched the Gold Rewards Card as we were starting to see on more cards in Canada. At the time, it was an expensive benefit to add to a card that was first year free but we do finally see it being added to card now:

We know that travels might not always go as planned. Thats why the Card continues to come with the same travel-related insurance coverages Cardmembers already enjoy. Plus, effective September 21, 2021, Cardmembers can enjoy new Trip Cancellation Insurance. For more information about the Cards coverages, please visit www.amex.ca/myinsurance.

Read Also: Rs Gold Sell

When You Apply For A Gold Card From American Express Youll Also Get This Welcome Offer:

60,000 bonus Membership Rewards points after you spend $4,000 in 6 months

MilesTalk values American Express Membership Rewards points at 1.7 cents each, making this welcome bonus worth just over a thousand dollars .

Its also great that this current offer gives you 6 full months to meet the minimum spend requirements for the bonus offer as opposed to the more standard 3 month timeframe.

New Priority Pass Worldwide Airport Lounge Access + Four Complimentary Plaza Premium Visits Per Year

Yay! Lounge access! Now you may be saying well there isn’t much value in Priority Pass anymore since they lost all of their Plaza Premium lounges in Canada but Amex fixed that! Seeing that Amex has a separate relationship with Plaza Premium they will also offer four Plaza Premium visits per year. This is good for those cities with Plaza Premium Lounges while other cities like Calgary, Ottawa and Quebec City you can use the Priority Pass membership to access other lounges but will have to pay the US$32 entry fee.

American Express Gold Rewards Cardmembers can receive complimentary membership in Priority Pass. This allows them to relax before their flight in one of the 1,200 Priority Pass lounges around the world for a usage fee at the prevailing rate. On top of this, Cardmembers can enjoy four complimentary visits per year to Plaza Premium Lounges across Canada. After your four complimentary visits have been used for the year, Cardmembers may continue to visit the Plaza Premium Lounges for a usage fee at the prevailing rate.

Priority Pass Membership costs US$99 per year and this new benefit will waive that membership fee. So at the very least it is a US$79 value and then you have your four free lounge visits which are worth about US$32 each. Combined value is no less than US$207 or about C$260.

You May Like: Does Kay Jewelers Sell Moissanite

Gold Vs Platinum Amex Card: What’s The Difference

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

American Express Transfer Partners

| Radisson Rewards | 1:1 |

As you see, transferring points for travel is a great way to retain or grow your point value on your rewards. However, youll want to be aware of the point valuation of the partner youre looking to transfer your Amex points with to ensure youre getting an equal or higher rewards value than you would with the other redemption options. For example, transferring Amex points to partners like Hilton and Marriot increase the number of points youll have, but the cent value of those points remains for the most part consistent. Make sure to check the cent valuation of the travel partners points before transferring so you arent surprised.

In short, what makes Amex points so appealing is their versatility. From transferring points to airline and hotel partners to redeeming for purchases online, you get a ton of flexibility in how you can use your points. Your points also dont expire, and there is no limit to how much you can earn.

However, its important to understand how much value you are getting for your points in each situation because some redemptions are much more valuable than others. Looking a little more closely at redemption options, its clear that some are better than others:

Read Also: How Much Is 1 Block Of Gold Worth