Find The Right Medicare Advantage Plan

Its important to do your research before selecting a health plan for yourself. Here are some questions to consider asking:

-

What are the plans costs? Do you understand what the plans premium, deductibles, copays and/or coinsurance will be? Can you afford them?

-

Is your doctor in-network? If you have a preferred medical provider or providers, make sure they participate in the plans network.

-

Are your prescriptions covered? If youre on medication, its crucial to understand how the plan covers it. What tier are your prescription drugs in, and are there any coverage rules that apply to them?

-

Is there dental coverage? Does the plan offer routine coverage for vision, dental and hearing needs?

-

Are there extras? Does the plan offer any extra benefits, such as fitness memberships, transportation benefits or meal delivery?

If you have additional questions about Medicare, visit Medicare.gov or call 800-MEDICARE .

ARTICLE SOURCES

What Are Medicare Advantage Plans From Humana

If youre looking for an alternative way to get your Original Medicare benefits, you might want to consider the Medicare Advantage program. Under this program, private, Medicare-approved insurance companies provide your Part A and Part B benefits . Humana may offer Medicare Advantage plans in your area. Here are a few types of Medicare Advantage plans Humana offers :

Humana also offers optional plans with additional benefits, such as routine vision and dental care, which you can add onto certain Humana Medicare Advantage plans. You must continue to pay your Medicare Part B premium when you enroll in a Medicare Advantage plan, plus any additional premium required by Humana.

Humana Premier Rx Plan

Like the Walmart Value Rx Plan, the Humana Premier Rx plan also uses Walmart as its preferred cost-sharing partner. This means that living close to a Walmart location is key to saving the most on your prescriptions.

While this plan has a higher premium than the Walmart Value Rx Plan , the Humana Premier Rx Plan includes additional benefits:

- $0 deductible on tier 1 and 2 medications

- $0 copay on 90-day supplies of tier 1 and 2 medications from Humanas mail-delivery pharmacy service

- preferred cost-sharing at Humana Pharmacy, Walmart, Walmart Neighborhood Markets, Sams Club, Publix, Kroger, Harris Teeter, HEB, and Costco pharmacies

- $445 annual deductible on tiers 3 through 5 medications nationwide and $305 in Puerto Rico

- more than 3,700 medications on the plans list of covered drugs

You May Like: Gold Package Spectrum

Curious About Our Hmo Plan Coverage

If the security of a broad range of benefits is your highest priority, all of our HMO plans offer all the benefits of Original Medicareand then some. Plans may include:

- Coverage for prescription drugs – most of Humanas HMO plans include coverage for prescription drugs

- Broad network of providers its easy to see if your doctor is covered, and our provider networks continue to grow as more and more Medicare Advantage members choose HMO plans

- Dental benefits – unlike Original Medicare, most of our Medicare Advantage HMO plans include coverage for routine dental care such as cleanings, exams, and X-rays

- Vision benefits – many of our plans also include coverage for eye exams, lenses and frames

- Hearing benefits – many plans include coverage for hearing aid devices, audiologist visits and ongoing fittings and exams

Pros And Cons Of Medicare Coverage From Humana

As with most plans, there are both pros and cons to opting for Humana.

As far as cons go, while the insurance company itself is available all over the country, certain plans may not be.

For example, SNPs are available in just 20 states and there are additional limitations on the type of condition covered like the state of Georgia, which technically has SNPs, but only for diabetes.

For the pros, one major advantage for Humana is its status as a national company with availability across the U.S. This can offer more security than you might get from a more regional option and ensures that some form of coverage is likely available where you live.

Another pro is that, with some exceptions, Humanas customer satisfaction tends to be high. In July 2021, a J.D. Power pharmacy study ranked Humana first in customer satisfaction for mail order.

Also Check: Banned For Buying Gold Wow 2021

How Does The Humana Pffs Plan Work

In lieu of the managed care structure of some other types of Medicare Advantage plans, a Humana PFFS plan reimburses doctors and other health care providers for each specific service rendered.

The result is an experience where beneficiaries can receive treatment on a service-by-service basis, which can help offer greater transparency into costs and can help reduce surprise bills.

As a member of a Humana PFFS plan, you may choose a primary care physician if you wish. But unlike some other types of Medicare Advantage plans, you are not required to select a PCP.

With a Humana PFFS plan, you do not need to obtain a referral in order to visit with a specialist.

Finding The Humana Medicare Plan For You

To find the Humana Medicare Plans available in your area, you can do an online search on their website.

Simply enter your zip code and youll be presented with a list of options in your geographical area. Deductibles, copays, maximum out of pocket costs, and monthly premiums are provided for each.

Humanas website also lets you compare the three plans youre most interested in purchasing in an easy-to-read chart.

If you prefer to talk to someone instead or if you have questions on one of the plans, you can contact Humana by phone at 560-3122 . Sales agents are available between 5 a.m. and 8 p.m., seven days a week.

MORE ADVICE

Don’t Miss: What Is The Price Of 18k Gold Per Gram

Curious About Our Ppo Plan Coverage

If the security of a broad range of benefits is your highest priority, all of our PPO plans offer all the benefits of Original Medicareand then some. Plans may include:

- Coverage for prescription drugs – most of Humanas PPO plans include coverage for prescription drugs

- Broad network of providers – with a PPO, you have the flexibility to visit providers outside of your network, but visiting an out-of-network provider will usually cost you more

- Dental benefits – unlike Original Medicare, many of our plans include coverage for routine dental care such as cleanings, exams, and X-rays

- Vision benefits – many of our plans also include coverage for eye exams, lenses and frames

- Hearing benefits – many plans include coverage for hearing aid devices, audiologist visits and ongoing fittings and exams

- PPO plans do not require referrals for any services

Available Humana Medicare Advantage Plans

Humana offers several kinds of Medicare Advantage plans, and they vary in terms of structure, costs and benefits available. Many plans offer dental and vision benefits, worldwide emergency care, and fitness benefits through SilverSneakers.

In general, Humana offers Medicare Advantage Prescription Drug plans, or MAPDs, as well as stand-alone prescription drug plans and Medicare Advantage Plans without drug coverage. Its also worth noting that Humana Honor, the companys Medicare Advantage plan thats aimed toward U.S. military veterans, has been expanded into 47 states in its third year of operation.

Other plan offerings include the following types:

A health maintenance organization generally requires that you use a specific network of doctors and hospitals. You may need a referral from your primary doctor in order to see a specialist, and out-of-network benefits are usually very limited.

Preferred provider organization plans provide the most freedom, allowing you to see any provider that accepts the insurance. You may not need to choose a primary doctor, and you dont need referrals to see specialists. You can seek out-of-network care, although it may cost more than seeing an in-network doctor.

Humanas private fee-for-service plans allow you to see any Medicare-approved provider who accepts your Humana plan. You wont have to pick a primary doctor, and you wont need a referral to see a specialist.

You May Like: War Thunder Free Eagles App

Prescription Drug Plan Considerations

If you have multiple medications due to your health condition, Humanas Medication Therapy Management Program may become an option. This program entitles you to a one-on-one review with a pharmacist or other healthcare provider to ensure that youre getting the most from all of your prescription medications.

This review involves the pharmacist going over your scripts and making sure the medications are working as intended, are as affordable as they can be based on your specific prescription drug plan, and are safe for you to take. Theyre also there to answer any questions you may have.To qualify for the Medication Therapy Management Program, participants must meet all three of these requirements:

- Have at least three of the following conditions: chronic heart failure, osteoporosis, diabetes, abnormal cholesterol, and/or chronic obstructive pulmonary disease

- Take eight or more chronic maintenance drugs

- Have medication costs likely to exceed $4,044 in 2019

Humana warns that prescription drug coverage obtained under Medicare Part D has what is known as a donut hole. This refers to the gap that exists after drug coverage limits have been reached but before catastrophic coverage kicks in. During this gap, participants are often forced to pay more for their regular prescription medications.

MORE ADVICE

MORE ADVICE Discover more tips for comfortably aging in place

Pros And Cons Of Humana Medicare Advantage Plans

| What we like about Humana Medicare Advantage Plans: | The drawbacks of Humana Medicare Advantage Plans: |

|---|---|

|

|

Recommended Reading: How To Watch Gold Rush Without Cable

Humana Launching 72 New Medicare Plans For 2022

Humana is launching 72 new Medicare Advantage plans for 2022 across hundreds of additional counties, the insurer announced Friday.

This includes 42 new Medicare Advantage Prescription Drug plans, three MA-only plans, and 27 special needs plans, Humana said. The company will expand its HMO Medicare plans into 115 new counties and PPO Medicare plans into 162 new counties.

Humana also intends to bring its dual special needs plans to 268 new counties. The overall expansion will allow it to reach 4 million additional Medicare eligibles.

After considering the needs of our members and how we could offer them more for 2022, we designed our Medicare plans to address peoples whole-life needswith a particular focus on their most important health care needs and delivering the human care our members expect from Humana, said Alan Wheatley, president of Humana’s Retail Segment, in a statement.

RELATED: Here’s what major national payers are offering in Medicare Advantage for 2022

Our 2022 product continuum evolves our Medicare capabilities to meet the personalized needs of individuals across the country as we address health equity in the diverse populations we serve,” Wheatley said.

Medicare open enrollment begins on Oct. 15, and insurers are now outlining their offerings for the coming plan year.

Read more on

What Are Humana Medicare Advantage Plan Options

Humana offers nearly a dozen plans, including HMOs, PPOs, PFFS plans, and SNPs. Some plans dont have monthly premiums and have relatively affordable out-of-pocket costs, with visits to primary care doctors ranging from $0 to $15 and visits to specialists from $20 to $45. In addition to covering medical and hospital care, all plans include memberships for SilverSneakers, and many have an allowance for over-the-counter medications. Plans vary depending on your location. Check available options in your area.

These are among the most popular Humana Medicare Advantage Plans:

Humana Medicare Advantage Plans

*Based on pricing in Chicago, IL in 2022

Recommended Reading: Golden Eagle Generator

Humana Medicare Advantage Plan Options

Humanas Medicare Advantage Plans vary among states and counties within those states. The provider supports four plan types: HMOs, PPOs, PFFS plans, and SNPs, but these are subject to area availability. You may only qualify for a Special Needs Plan if your diagnosis matches the list of required conditions.

Humana has robust telemedicine services and the company has waived out-of-pocket costs for all visits to its in-network provider, MDLIVE. This applies to online and phone consults for physical and behavioral health matters.

HMOs are typically the most affordable option, but many limit your ability to select the doctors and health care providers of your choice. With Humana HMO, SNP, and PFFS plans, primary care visits are often free or very low-cost, while PPOs tend to have higher copays on doctor visits and lower copays for emergencies. Take a look at some of the most popular options available for each of these types of plans.

| Plan name |

|---|

*Based on pricing in Orlando, FL

Humanas Medicare Supplement Insurance Plans

Even if you have Medicare parts A and B, there are still some healthcare-related costs that arent covered including copayments, coinsurance, and deductibles. To help offset some of these expenses, you may choose to purchase a Medicare Supplement Insurance Plan, also known as Medigap.You must:

- Be 65 years of age or if youre under 65, have a qualifying disability or end-stage renal disease

- Be enrolled in Medicare parts A and B

- Live in the state covered by the supplemental policy

There are a number of Medicare Supplement Insurance Plans offered by Humana and they range from Plan A to Plan N, each providing benefits for various copayments and coinsurances.

For instance, Medicare Supplement Insurance Plan A provides benefits related to Medicare Part A coinsurance and coverage, Medicare Part B coinsurance and copayments, blood, and hospice care coinsurance and copayment.

Medicare Supplement Insurance Plan G provides these same benefits plus benefits related to skilled nursing facility coinsurance, Medicare Part A deductibles, Medicare Part B excess charges, and foreign travel emergencies.

Generally speaking, Medicare Supplement Insurance Plans do not cover costs related to vision, dental, or hearing aids. They also dont typically provide benefits related to long-term care, private-duty nursing, or prescription drug coverage.

Don’t Miss: How Many Grams In One Ounce Of Gold

What Is Humana Gold

Humana GoldHumana

. Simply so, what is Humana Gold Choice?

The Humana Gold Choice Medicare Advantage plan is a private fee-for-service plan. A Medicare Advantage Private Fee-for-Service plan works differently than a Medicare supplement plan. The network providers have already agreed to see members of our plan.

Also, is Medicare and Humana the same thing? No Medicare and Humana are not the same. Humana is one of the largest private insurance companies that provides, along with other products, Medicare Advantage plans and Medicare Part D prescription drug plans. To learn more about Humana, you can visit their website at www.Humana.com.

Thereof, what is the difference between Humana and Humana Gold?

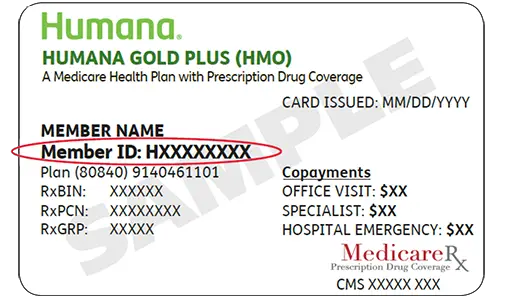

Most Medicare Advantage Humana Gold Plus HMO Plans offer prescription drug coverage. With Gold Plus HMO Plans your out-of-pocket costs are reduced and more predictable than with the majority of other plans. You may enroll in Gold Plus HMO plan only during specific times of the year.

Is Humana Medicare good?

Once you’ve enrolled in Medicare, you can sign up for a Medicare Advantage plan offered by a private insurer. One insurance company garnering positive reviews is Humana. Humana offers a wide range of Medicare Advantage plans, some with $0 monthly premiums, so they’re worth considering.

Humana Choice Plan Benefits

If you decide on a Humana Medicare plan, youll want to weigh the benefits as they relate to your specific situation. Some benefits of Humana Choice include:

- A strong PPO Network in most service areas.

- Good value for your premium.

- Reasonable hospital costs compared to many other Advantage plans.

- Affordable co-pays for outpatient services, like doctors visits.

- Part D drug plan is included.

- Extra benefits, including vision, dental and hearing.

- Value added services, including discounts on alternative medicine.

All Humana Medicare plans have there strong and their weak points, just like any insurance product. The key is to find what best suits your needs and budget. The Humana Choice Medicare Advantage plan goes along way toward meeting that goal.

Read Also: How To Get Free Golden Eagles

What Is A Humana Hmo

HMO stands for Health Maintenance Organization.

Members of a Humana HMO plan choose a primary care physician from within the Humana network of providers. This general doctor serves as a gatekeeper for your care and coordinates services with providers from within the plans network whenever further tests or treatment are needed.

HMO plans are a form of managed care that take a more team approach to each member and emphasize preventive care. You will generally need a referral from your primary care physician in order to make appointments with specialists and other doctors.

How We Reviewed Medicare Providers

Even Medicare health plans with a national presence can vary locally in their cost, quality, and customer satisfaction. To evaluate Medicare plans, we looked at health insurance industry ratings from the primary accrediting agency for health plans, NCQA, and the Medicare Star Ratings from CMS, the regulatory agency that oversees Medicare. We included the National Association of Insurance Commissioners complaint index and AM Bests financial stability ratings. We also considered information from the companies on their programs and strategies.

Also Check: 18 Gold Price

Frequently Asked Questions About Medicare Plans

Your out-of-pocket costs for prescription drug deductibles, copays and coinsurance vary from plan to plan. Be sure to check each plan’s Drug List to see what drugs are covered.

Medicare Supplement insurance, often called Medigap coverage, helps pay some of the healthcare costs that Original Medicare doesn’t cover. That may include:

You’ll pay a monthly premium for a Medicare Supplement plan in addition to your Part B premiums. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

With Original Medicare, a primary care doctor is not required. You can visit any doctor who accepts Medicare.With a Medicare Advantage plan, your choice of doctor depends on whether you select a health maintenance organization or preferred provider organization plan.With an HMO plan, you can choose your primary care physician from any doctor in the plan’s network. If you opt for a PPO plan, generally, choosing a primary care physician is optional. With both types of plans, you’ll usually save money by visiting a network provider.It’s important to note that Medicare Advantage plans must offer emergency coverage outside of the plan’s service area, anywhere in the U.S.