How To Calculate Your Personal Zakat

This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow’s Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.wikiHow marks an article as reader-approved once it receives enough positive feedback. This article received 40 testimonials and 100% of readers who voted found it helpful, earning it our reader-approved status. This article has been viewed 544,404 times.Learn more…

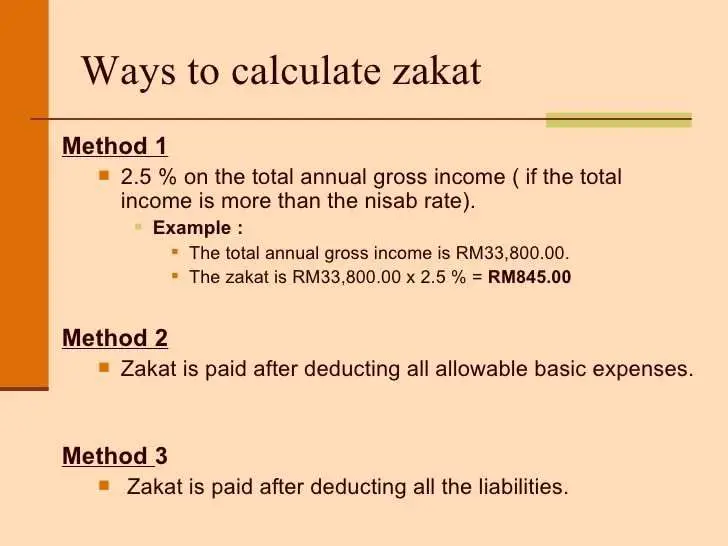

Zakat is one of the pillars of the Islamic faith. Zakat literally means “alms”, and there are different kind of Alm’s, e.g. Zakat ul-Fitr or Zakat ul-Maal . The implied Zakat that makes up the pillar of islam is Zakat ul-Maal, which mandates muslim to donate 2.5% of their personal wealth to those in need, annually.Muslims believe that Zakat purifies the spirit and brings them closer to God, and that not paying it makes your wealth “dirty” .Learn how to calculate your personal zakat so you can fulfill your spiritual duties.XResearch source

How To Calculate Zakat On Gold:

When your personal wealth is more than the Nisab amount, you are obliged to give Zakat. Nisab is the cut-off amount. So when your wealth is below the Nisab, you dont need to give Zakat. You use either the current market price of gold or silver to calculate Nisab. As the prices of gold and silver fluctuate it is always wise to check the current market rates.

Is Zakat Due On Cryptocurrency

The term crypto is broad and includes a whole range of crypto-assets.

It is useful to understand that any crypto-asset, whether it be a currency or a platform token, if purchased with the intent of capital gain and to resell in the short-term, then these will be 100% Zakatable no matter the nature of the asset.

The ruling of Zakat then differs if the intention is not to resell and to hold for an indefinite amount of time. Whether a hold strategy results in Zakat depends on the underlying asset itself.

So the crucial principle is are you a crypto trader or are you a long-term passive crypto investor? If you are a trader you definitely need to pay zakat on all your holdings, and if you are a passive investor, you may need to. Lets dive in.

Recommended Reading: How Many Grams Is 1 10 Oz Of Gold

Can The Question Of Zakat On Womens Jewelry Be Summarized

no zakat on jewelry in two cases:

-

Womens jewelry for personal use whether of gold or silver, or other precious metals, gems, and stones that do not exceed customary amounts or commonly accepted measures of dimension and value.

-

A plain silver ring for men, or a silver-handled sword, or one with a silver-ornamented hilt, provided it is of real use and not a decorative piece.

-

pay zakat on jewelry in three cases:

-

On gold and silver jewelry kept as a store of value for the purpose of investment or increasing its worth, when it equals or exceeds the market value of 85 gm of pure gold in its appraised value . This is added to ones other gold and silver holdings to determine nisab and due Zakat.

-

On all jewelry or ornamentation in unlawful forms and used as decorations, utensils, or art or prohibited jewelry worn by men.

-

On all jewelry considered, in the common sense, extravagant, either in dimension, value, or amount, whether one wears it or not.

Is Zakat Due On Gold

Yes with some exclusions. The key reason is that there are explicit ahadith and verses requiring zakat to be paid on gold. Heres one:

In the case of gold, you have nothing to pay until you own 20 dinars. If you have 20 dinars and you have had it for a year, the duty is to pay half a dinar. .

The underlying philosophy of zakat is that you pay it on liquid cash-like assets, and not on investments, business assets, machinery and the like. Gold is usually seen as a liquid investment. But there are exceptions more on that later.

You May Like: How Many Grams In 1 Oz Of Gold

Is All Womens Gold Jewelry Zakat

No. Jewelry hoarded for wealth accumulation, in excessive amounts or in extravagance, must have Zakat paid on it at 2.5% annually. Many Hanafi scholars consider gold and silver Zakatable regardless of its form. Jewelrys Zakat-exempt status for women and its use for personal adornment, however, many scholars deem as the stronger position.

Zakat Calculator: Simplifying Your Zakat Calculation

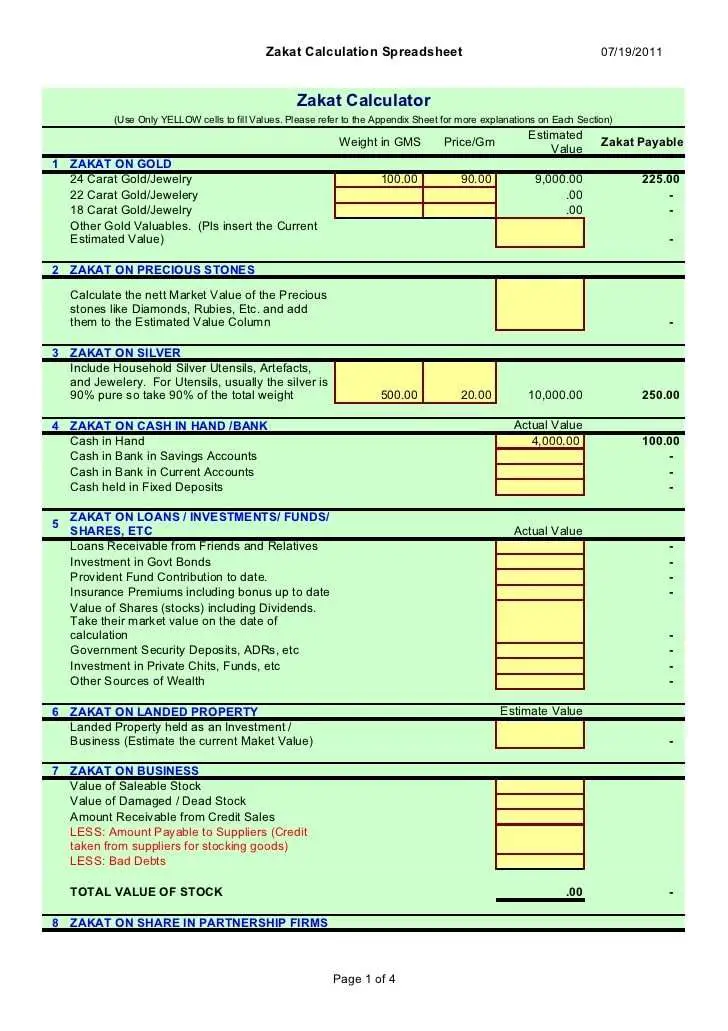

Calculating your Zakat isnt as difficult as you may think. We find that breaking your assets down into different categories makes the Zakat calculation process really simple.

We have broken down the calculation process into Zakatable assets and Deductible liabilities so you can calculate the Zakat you owe easily.

The amount of Zakat you need to pay will be determined once you have calculated the value of your net assets. You then need to see whether your net assets are equal to, or exceed, the Nisab threshold.

Recommended Reading: How Much Is 14k Italian Gold Worth

Which Nisab Should You Choosegold Or Silver

Now the question iswhich Nisab should you choose? While the silver Nisab is considered Afzal or more rewarding, both for the giver and the recipient, as more Zakat is given due to the lower threshold, there is a way to determine which Nisab to use.

Generally, if you only have assets and savings in gold, that is the Nisab you should use. However, if you have savings and assets in silver or mixed assets, including cash, gold, silver, and other tradable commodities, it is ideal to use the silver Nisab.

Please note that different religious sects may differ in their opinions with regards to which Nisab you should follow, and if you are in doubt, it is best to ask an Aalim-e-Deen for advice.

Question: I Have Questions Relating To Zakat: 1 Is It Necessary To Pay Off Zakat As Soon As It Is Counted Or It May Be Paid Off Round The Year 2 If I Have Got Cash Or Stock Which Is Not One Year Old Do I Need To Count Zakat On That Amount 3 Is It Necessary To Inform The Reciever The Amount Is From Zakat 4is It Ok If I Calculate Zakat On Stock According To Purchase Rate As The Selling Rate Is Not Certain And Moreover What I Earn From The Stock Will Naturally Reflect In My Cash Next Year

Bismillah hir-Rahman nir-Rahim !

Calculate Zakah at the completion of one year, then pay Zakah in lump sum or bit by bit around the year, but delaying it unnecessarily is not right lest you should miss the same.

If you already owe nisab, so you have to pay the Zakah of amount gained during the year with the nisab.

It is not necessary to inform, rather you can give him in the name of gift.

Give Zakah as per the market value of the stock at the time of completion of the year.

Allah knows Best

Darul Ifta,

Darul Uloom Deoband, India

Don’t Miss: Why Are Golden Goose Sneakers So Expensive

Do We Use The Same Gold Weight As The Prophet On Him Be Peace

Scholars, Muslims, and others have matched the exact equivalent of the gold dinar of the prophetic generation to our weights for Zakat on gold today through preserved samples of coinage called mithqal.

The second Rightly Guided Caliph and Companion Umar ibn Al-Khaâb himself standardized the legal weight of the dirham and the Caliph Abdul-Malik minted all coins of the realm on that legal weight. Many historians have established that 10 silver dirhams equaled a specific weight as measured against a mithqal.

It is unanimously agreed upon since the early ages of Islam, the era of the Companions and the Successors, that the weight of a silver dirham is equal to seven-tenths the weight of a gold dinar .

What Measure Determined The Value Of Gold At That Time

Weight determined the value of the silver dirham and gold dinar as currency in the time of the Prophet, on him be peace. He established the weights of Makkah as the Muslims standard measure for currency based on the weights of the dirham and dinar of the Makkans. This remains in force for calculating Zakats niâb on gold.

You May Like: Gold From Dubai Online

Last Year Alone Your Zakat Enabled Us To Save Lives

Your Zakat has funded some of our crucial work with people and communities living in disaster and war zones: drought and famine-struck countries across East Africa communities affected by conflict in Yemen and families in war-torn Syria struggling to survive one day to the next.

Your Zakat has supported communities to build sustainable livelihoods in the face of climate change and to build better lives for vulnerable orphans and families across the globe.

Alhamdulillah, your Zakat has the power to transform peoples lives. Help make this happen. Give your Zakat for the love of Allah .

Zakat: A Sacred Pillar

Zakat is not just a duty on those with wealth given for the love of Allah , but a right that the poor have over us.

Those with sufficient wealth are noted in the Holy Quran as for:

Those in whose wealth there is a recognised right for the needy and the poor .

Gold Rate for Zakat: £1.02 per gram or £11.57 per Bori/Tola

You May Like: How To Get Free Gold Bars In Candy Crush

Tell Your Friends And Make An Impact

How to calculate zakat on salary? Do you own zakat being a salary person? What is the percentage of zakat on a salaried person?

If you are a job holder, some of all of these questions might have surrounded you once or twice in your life. To make sure that you are paying off all the religious obligations on you, in a better way, you must get answers to all these questions.

Related Article: Must Read

Calculate Zakat On Gold

When you want to calculate Zakat on gold then the Nisab is the cash equivalent of 3 ounces/87.48 grams of gold

For example, if each ounce of gold is currently worth $43, the Nisab using the gold calculation is . If your personal wealth is above $129, you owe zakat.

People also face trouble when calculating Zakat on gold jewelry. This confusion mainly occurs due to a lack of clear information on the subject. At first, you need to know that zakat is only due on gold or silver jewelry. There is no Zakat due on platinum or palladium, Diamonds, and gemstones like pearls, sapphires, rubies, corals, etc.

If your gold jewelry is made up of a mixture of metals you are only required to pay Zakat on the gold. You can also give actual gold in Zakat. For example, if someone has gold jewelry that weighs 100 grams, they can give 2.5 grams of gold as Zakat on the jewelry.

If there are diamonds, gemstones, pearls, etc, set within your gold jewelry, take it to a professional jeweler when you need to find out the weight of the gold. A professional jeweler will have the knowledge and experience required to assess the weight of the gems and will be able to give you the best approximate weight of the stones. Now to calculate Zakat on your gold jewelry, you can use this simple method.

The total weight of jewelry the weight of other stones x the price of gold x 2.5%

Also Check: Does Game Pass Ultimate Include Gold

Property Tax And Nisab

The zakat that you pay on your property depends solely upon the nisab. This is not the case in property tax. It has an entirely different collection method and criteria. Get to know the difference between zakat on property and property tax.

Nisab of zakat is a minimum amount of money or wealth that is held for at least one year by the owner. The nisab by the gold standard is 3 ounces of gold or its cash equivalent. The nisab by the silver standard is 21 ounces of silver or its equivalent in cash or any other form of asset.

Note: Please keep in mind that the price of gold and silver change with time. Before making your zakat calculations, kindly refer to the latest gold and silver rate in your country. Read real estate vs gold where you should invest.

About Tcfs Zakat Collection

Is TCFs Zakat collection process Shariah compliant?

TCFs Zakat collection process is certified to be Shariah compliant. Our Zakat collection and disbursement procedures and structures have been reviewed thoroughly by our Shariah Advisor, who has issued a certificate confirming that we are Shariah Compliant. We aim to provide Muslims over the world a simple, transparent, and ethical way to invest in educating the less privileged children of Pakistan. You can view a copy of the Zakat compliance certificate.

What is the model of Zakat collection followed by TCF?

TCF follows the wakala model of Zakat. As per this model, Muslim parents of deserving students, upon their childrens admission in TCF Schools, nominate TCF as a wakil and authorise the organisation to receive Zakat on their behalf. This Zakat money is then spent on providing education to children during the year. We ensure that any parents consenting for the utilisation of Zakat for their children fulfil Islamic requirements and qualify as recipients of Zakat.

How does TCF ensure proper utilisation of Zakat Funds?

All proceeds collected by TCF as Zakat are maintained in separate bank accounts at Islamic Banks in Pakistan. The funds are then utilised through the course of the year to educate deserving children. We have well defined SOPs governing our Zakat utilisation. These SOPs have clearly been delineated by our Shariah team.

Our Shariah Advisor:

Our Shariah Team:

Mufti Muhammad Ibrahim Essa

You May Like: Value Of 10k Gold

A Beginners Guide On How To Calculate Zakat

It is the month of Ramadan, and at this time many of us are wondering how to calculate Zakat. But lets take a step back and take the time to appreciate, what is Zakat? Why does it hold such importance in Islam?

At a time when many services and businesses are restricted, when borders are closed and many peoples livelihoods are uncertain, charities continue to provide aid and support. All over the world, humanitarian organizations are trying to make sure the most vulnerable people are not overlooked during this pandemic.

But they wouldnt be able to operate without the generosity of people who are willing to give at a time of crisis. As Muslims, giving charity is more than a means of earning Allahs pleasure, its also an obligation and a right we must fulfill, known as Zakat.

Those who put aside from their wealth a known right for the needy and the poor they are honoured in Gardens of Bliss.

Quran 70:24-35

To help you fulfill this important obligation, weve put together this beginners guide to Zakat. In the next sections, well cover everything you need to know to get started. The topics we cover will include:

- What is Zakat?

- What is Nisab? How do I know how much it is?

- How is Zakat used? Who receives your Zakat?

- How do I know if I need to pay Zakat?

- How do I actually calculate Zakat?

- Additional resources on Zakat.

Sample Calculation For Assets And Liabilities

Keeping the above criteria for assets and liabilities in mind, lets assume that you have PKR 300,000 in cash, PKR 350,000 in gold and silver jewellery and PKR 250,000 in foreign currency .

Thus, you have:

PKR 300,000 + PKR 350,000 + PKR 250,000 = PKR 900,000

Once, you have calculated your assets, you can tabulate the total worth of your liabilities. Assuming that you have to pay PKR 12,000 for pending utility bills and a rent of PKR 38,000 that is yet to be paid to your landlord, the total liabilities would be:

PKR 38,000 + PKR 12,000 = PKR 50,000

As a result, your Zakat net worth is:

PKR 900,000 PKR 50,000 = PKR 850,000

Comparing this net worth to both the gold and silver Nisab calculated above, we can come to the conclusion that you are eligible to pay Zakat on your assets. However, due to the presence of mixed assets, we will consider the silver Nisab, which makes you more than eligible to pay Zakat.

Don’t Miss: How Much Is 400 Ounces Of Gold Worth

Zakat On Gold Charity

Working out how to calculate your Zakat on gold is an important part of figuring out how much Zakat you need to pay.

For 12 Amazing Years at Penny Appeal, we have had a 100% Zakat policy that means that 100% of your Zakat payment will go to those in need, 100% of the time. That gives you 100% of the blessings!

Your Zakat on gold will make a real difference to people who need it most around our world.

When we think on the blessed payment of Zakat, we are reminded of the following Hadith:

Charity never decreases wealth.

And What Exactly Is Nisab

Nisab is the minimum amount of wealth that acts as a threshold to determine whether Zakat is obligatory on you. If what you own is more than Nisab, then it means you are eligible to pay Zakat that year. If it is less, then you dont need to pay Zakat.

In Islamic Law, the threshold of minimum wealth is determined by two set values, 3 ounces of gold or 21 ounces of silver. Since we no longer deal with gold and silver as our currency, we can calculate their cash value online.

Gold

The Nisab by the gold standard is 3 ounces of gold or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of gold.

Silver

The Nisab by the silver standard is 21 ounces of silver or its equivalent in cash. You can calculate this online, by multiplying the number of grams by the current market value of silver.

Wondering which Nisab threshold you should use, gold or silver? In the Hanafi school of thought, the silver standard is predominantly used to ascertain the Nisab threshold and eligibility to pay Zakat.

However, there are contemporary scholars within the Hanafi school who recommend using the gold standard, especially in todays age where the cost of living is high and the value of silver has significantly decreased. The other schools of thought use the value of gold. You can choose to use the silver standard if you would like to increase the amount of charity distributed.

You May Like: Buy Gold From Dubai Online