How Pure Is Raw Gold

Raw goldis 100% pure gold in its natural state, and always contains some kind of impurities.

When these impurities consist of other metals, the gold is considered to be an alloy. The most common metal to be found with gold is silver, but gold can also be found with copper, iron, and lead impurities as well.

Raw gold is commonly found as 18 karat gold, it can be as low as 14 karats in purity.

Best Comprehensive Offering: Apmex

APMEX

With more than 10,000 products to offer, APMEX makes our list as the online gold dealer with the best comprehensive offering.

-

Shipping can be slow

-

Prices tend to be higher than top peers

APMEX has built itself into a global precious metals powerhouse since its founding in 2000. It’s not surprising then that it has the largest selection of precious metals products, making it our choice as the online gold dealer with the best comprehensive offering.

In addition to a wide range of gold and silver bullion and coin products, APMEX also has an extensive selection of platinum, palladium, and copper products. Its coin selection is a virtual United Nations, representing coins from the U.S., Canada, Australia, South Africa, Mexico, and beyond. APMEX is also one of the best sources for collectors, offering a wide variety of coins and old banknotes.

While APMEX doesn’t have the lowest prices around, it’s significant sales volume allows it to be competitive. Using the Gold Eagle coin as a barometer for pricing competitiveness, APMEX is offering the 1 oz. coin for $2,053. That’s just 5% above the spot price of gold at $1,944, which is reasonably competitive. APMEX also offers bulk discounts on bullion and coins on purchases up to 19, 20 to 99, and 100 or more.

If you want your gold stored, APMEX will ship it to Citadel Gloval Depository Services, one of the world’s largest private storage facilities, for an annual fee.

Where To Sell Gold Jewelry Online

Our No. 1 top recommendation for selling gold is to CashforGoldUSA. Online gold buyers tend to pay out more because of steeper competition on the Internet, and lower overhead, since they don’t have to pay a premium for retail rent. Get a free FedEx mailer sent to your home in 24 hours, and get a 10% bonus if you send in your jewelry within 7 days with CashforGoldUSA > >

Don’t Miss: How Much Is 10k Gold Worth

What Is Gold Filled

Gold-filled jewelry is constructed in two or three layers: The core metal is brass, and a gold alloy is then bonded to one or both surfaces of the brass core with heat and pressure. Gold-filled jewelry contains a much thicker layer of gold than plated or vermeil items and will hold up better with wear comparatively.

Advantages To Buying Gold Bars

One downside of buying gold coins is that they often come with a relatively high premium over the spot gold price. Gold bars, on the other hand, are often minted with simple designs and sold at a price very close to spot. If youre wondering what types of gold bullion products have the lowest premium or dollar amount over the spot price of gold, the answer is probably gold bars. This means that investors who want to maximize the amount of gold for their money should generally consider investing in gold bars instead of coins.

The main advantages of buying gold bars:

- Low premium. Because the cost to produce and design gold bars is considerably lower than coins, most gold exchanges are able to bring you gold bars at a price commiserate with the current spot gold price. This means that the best value when investing in gold typically comes from gold bar purchases.

- Weight variety.Gold bars come in a variety of different sizes. Years ago, gold bars were only sold in large, industrial sizes to institutional investors. Today, retail investors can purchase gold bars in hundred ounce, ten ounce, one ounce, and even 1/10 ounce denominations! This provides investors with greater liquidity and control over their investments.

Don’t Miss: What Is Goodrx Gold Card

So How Do You Find A Reputable Dealer

Good question. There are thousands of dealers in the country, but there is no federal regulation and little state regulation. The U.S. Mint has a list of national dealers and dealers by state that it checks but doesnt vouch for. White says that the Mint checks those dealers against the Better Business Bureau list for complaints, as well as online to see whether there is any negative information about the firm and to get a feel for how the company conducts and promotes itself.

However, given that the Mints authorized purchasers are obviously trusted by the Mint, you may want to buy directly from one of them. We checked with each of them, and here are their rates, terms and conditions.

MTB : 212-981-4510. MTB sells primarily to wholesalers, but individuals can buy from the company, too. It charges 4.5% over the spot price. Theres no minimum purchase, but there is a minimum commission of $25. No discount for bulk purchases.

CNT : 508-697-9600. Minimum purchase of $1,000. The company does a background check you must provide several pieces of information, including your drivers license number. Traders work off a current spot-price screen, which changes throughout the day. No discount for bulk purchases and no standard commission given.

Dillon Gage: 800-375-4653. Minimum order of $5,000. The dealer ships everywhere in the U.S. for a flat $25 fee the markup is 7%.

How To Sell Gold

Depending on where you sell gold, the process varies. Here are posts with more detailing on various options you could consider:

If you want to get the most cash for gold, heres the gist of how to sell gold online:

CashforGoldUSA pays a 10% bonus if you send your item in within 7 days of the request, and sends payment within 24 hours.

You May Like: Does Kay Jewelers Sell Real Gold

How Much Is 14k White Gold Worth

14k white gold contains 58.3% gold. Because gold is a soft metal, and 14k gold has less gold in it, youll typically find that 14k white gold will be sturdier than 18k white gold.

To find out how much your 14k white gold is worth, you will need to:

- Look up the current spot price of gold.

- Weight your 14k white gold and multiply that number by 0.583 to determine how much pure gold is in the item.

- Multiply the number above with the current spot price of gold to determine how much it is worth.

How To Choose A Reputable Gold Dealer

Unquestionably, a company’s reputation is the number one criteria by which to evaluate and compare gold dealers. The single best measure of a company’s reputation is its transaction history, which can be assessed by customer reviews. Companies with a large number of reviews are typically more established or have built up their trust and reputation through a greater number of transactions.

Additionally, you should look for the following when evaluating a dealer’s reputation:

Also Check: How Many Grams Is 1 10 Oz Of Gold

How To Sell Gold Bullion Online

Gold bullion, by definition, is pure gold for the purpose of investment. Bullion can be in bars or coins, or occasionally other forms like an ingot. Gold coin bullion can be sold the same as other scrap gold, including on reputable online sites.

A bar is better sold to a mint or local dealer.

A bar of gold bullion can be sold locally to a mint or local buyer.

If you have gold coin bullion, CashforGoldUSA.com is an excellent choice for selling all gold online. Their online gold calculator on their homepage accurately helps you estimate how much you will get for your coin, and easy steps for sending in your item, securely, for quick payment of cash.

How Often Does The Spot Gold Price Change

If youve done any research on the spot gold price you might be wondering how often the spot price of gold changes? The answer is very often. Gold is shifting in price constantly, with most exchanges updating their spot gold prices multiple times throughout each day. Always check here before buying any new gold item for the latest updates on the spot price of gold today. Big world events and political decisions almost always have some sort of an impact on the spot gold price, so its important to be aware of whats going on in the bullion market in order to make an informed purchasing decision.

Don’t Miss: Does Kay Jewelers Sell Real Gold

Kitco’s Price Of Gold

Kitco is a leading gold and precious metals buyer and seller, as well as creator of precious metals commodities news. The Kitco Gold Index is a popular measure of real-time gold pricing today. Unlike the stock market, which is a dynamic marketplace, daily gold prices are set by independently owned markets. Kitco is one of these markets.

What Is Silver Bullion

Silver bullion is silver that has been cast or poured into bars, coins, rounds or ingots. Silver bullion can be used for industrial or medical applications or you can buy silver bullion as an investment. Many investors prefer to buy silver bullion in rounds, which are the same shape as a coin but do not carry any face value as legal currency.

Recommended Reading: Does Kay Jewelers Sell Fake Gold

Nymex Spot Gold Price

The New York Mercantile Exchange is another popular exchange where gold is traded. Since 1872, the exchange has been one of the most popular places to trade commodities in the United States. NYMEX had an initial IPO as a publicly-traded company in 2006, but they merged to become a part of the large Chicago Mercantile Exchange two years later in 2008.

Where Is Raw Gold Found

Gold can be found all over the world. China, Australia, Russia, the United States, Canada, and South Africa are commonly mentioned as top gold-producing countries.

Within the United States, gold has been found across the country. While California is famous for the Gold Rush of 1848, today Nevada and Alaska account for much of the gold produced in the United States.

Raw gold is commonly found in placer deposits along riverbeds and streams. Gold can also be found encased in hard rock, and is often found in Quartz veins.

Also Check: How To Get Free Gold Bars In Candy Crush

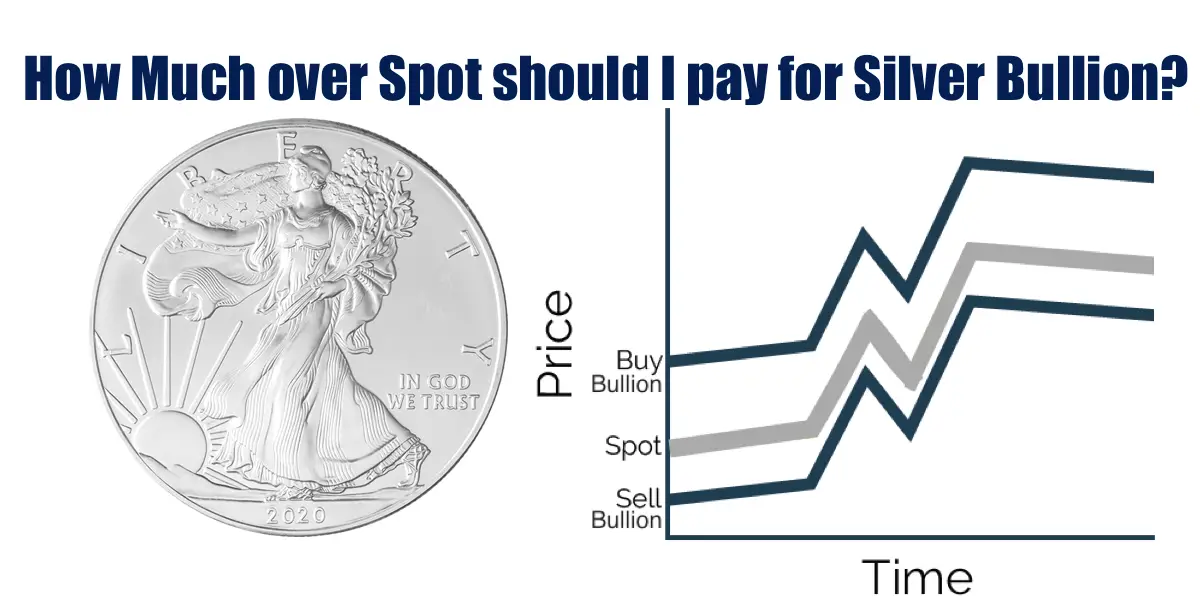

So Whats A Fair Price For Silver And Where Should You Buy It

What is a reasonable premium over spot for silver? The answers to these questions depend on what youre buying. Silver bars carry the lowest premium, followed by silver rounds. Silver coins generally have the highest premiums. Quantity also counts. Usually, you see lower premiums on bulk orders. Bulk usually meaning something north of 10 ounces , and typically closer to 100 ounces and up.

A fair premium for silver bars is typically 5% to 8%, while silver coins usually trade for 12% to 20% premiums above spot. Silver rounds register in between those premium points. Prices can be higher or lower depending on the mint that produced the round and its popularity in the marketplace.

Of course, you get what you pay for, too. Ordinarily, the more popular bars, rounds, and coinsthe ones for which you may pay a slightly higher premiumare also more widely recognized and in demand. In other words, theyre generally more liquid and more likely to help fetch you a higher price when the time comes that you wish to sell your silver bullion.

silver bullion

Finding a place that will sell you quality silver bars, rounds, and coins at a fair price isnt hard if you know what to look for. Turn to a bullion dealer who receives high marks by the Better Business Bureau. Also, look for one that is a member of the Industry Council for Tangible Assetsa leading organization for the worlds premier bullion dealers.

More articles about buying precious metals:

Where To Sell Silver

The GoldSilver Team

If youre selling silver bullion, you want to get the best price available. Perhaps youve been investing in precious metals for many years and now you think its time to offload some of your collection. Or maybe youve inherited some precious metals from a family member or are cleaning out your jewelry drawer. Whatever your case may be, weve put together this guide to help make sure your transaction is as smooth as possible.

We look at all the most important things you should consider before you sell your silver, including:

- Getting a fair price

- Selling different forms of bullion

- Where to sell your precious metals

- Selling silver bullion to or from a pawn shop

- Online sales and storage

Whenever you decide the time is right for selling silver, the three primary factors to consider are price, convenience and safety. Lets look at the topics above while considering how these factors come into play, beginning with the biggest question of all:

Also Check: Where To Sell Valuables Rdr2 Online

What Are Some Of The Factors That Drive Spot Gold Prices

Gold is not only bought as an investment, but it is also bought for use in other areas such as industry and jewelry making. The potential influences on the spot price are extensive, but the following list names some of the major ones:

- Investment demand

- Interest rates and/or monetary policy

- Risk aversion or appetite

- Geopolitics

- Equity markets

Gold can potentially see stronger investment demand during periods of economic or geopolitical stress. For example, spot gold may potentially move higher during times of war or geopolitical unrest. From an economic standpoint, gold may potentially see increased buying from a stock market collapse or bear market. Interest rates and monetary policy can also have a significant effect on the spot gold price. Gold may potentially benefit during periods of ultra-low interest rates, as low rates make the opportunity cost of holding gold less. On the other hand, gold may potentially come under pressure as interest rates rise, due to the fact that gold does not offer any dividend or interest for holding it. Currency markets are another major driver of the spot gold price. Although gold is traded all over the globe, it is often denominated in dollars. As the dollar rises, it makes gold relatively more expensive for foreign buyers and may potentially cause declines in the spot price. On the other hand, a weaker dollar may potentially make gold relatively less expensive for foreign investors, and can potentially cause spot gold prices to rise.

Saving Silver In The Storage

After figuring out how much over spot should I pay for silver, you should know that silver bars are easier to store compared to coins. Bars take less space in the storage. Meanwhile, to get 500-oz silver coins, can you imagine how many coins you should own? Still, this is not the main concern of investing in silver. Picking silver for investment is always a good idea.

You May Like: Where To Sell Valuables Rdr2

How To Start Buying Gold Bullion

You can invest in gold in several different ways. Buying gold bars minimizes the cost over the spot gold price of a given gold piece. Some consumers prefer to buy gold coins, rounds, or novelty items instead, which all come with their own advantages and disadvantages. Some investors even choose to buy jewelry in order to put their money on gold. We dont recommend this strategy gold jewelry is easy to find, but comes with high markups and a low resale value.

Can I Buy Gold Below Spot Price

Typically the only individuals who buy physical gold bullion below spot price are gold scrap refineries, we buy gold stores, and gold bullion dealers who may bid or offer a price slightly lower than the fluctuating gold spot price. Often for gold bullion bars, the bid price given to purchase gold bars from customers is at or just below the gold spot price. Conversely, popular modern gold bullion coins typically yield bid prices at or even slightly above the gold spot price).

Currently, for new .999 fine physical gold bullion products, one should never accept a bid or offer price below 98% of the fluctuating gold spot price.

If an individual tries to buy gold below the spot price, the chances are high that you will run into counterfeit gold bars or coin conmen or con women on websites like Craigslist or unproven gold bullion sellers on eBay.

Be very careful as gold looking Chinese counterfeit products are a real issue in our industry and are used daily to try and take advantage of unknowing or ‘lowest price at all cost’ would be gold bullion buyers.

More often than not, these counterfeit gold frauds go undetected for years or even go unreported due to the embarrassment it may cause the person who fell for the scam.

For every I tried to buy gold below spot price victim and gold fraud story covered on the news or in the media. We could probably multiply that figure by 10X or more in the amounts of times this similar story has gone unreported.

You May Like: How To Get Golden Eagles In War Thunder Free