How Much Is A Ton Of Silver Worth

If you pay attention to transparent physical silver bullion investment inventory data or the hundreds of millions of ounces of Indian silver bullion imports each year.

Chances are high then that you have heard and or seen the term silver ton or silver tonne used.

When referring to precious physical metals, a ton refers to a metric tonne.

For .999 fine physical silver bullion or any other precious metal for that matter, a metric tonne is exactly 32,150.7 troy ounces of silver or other precious metals.

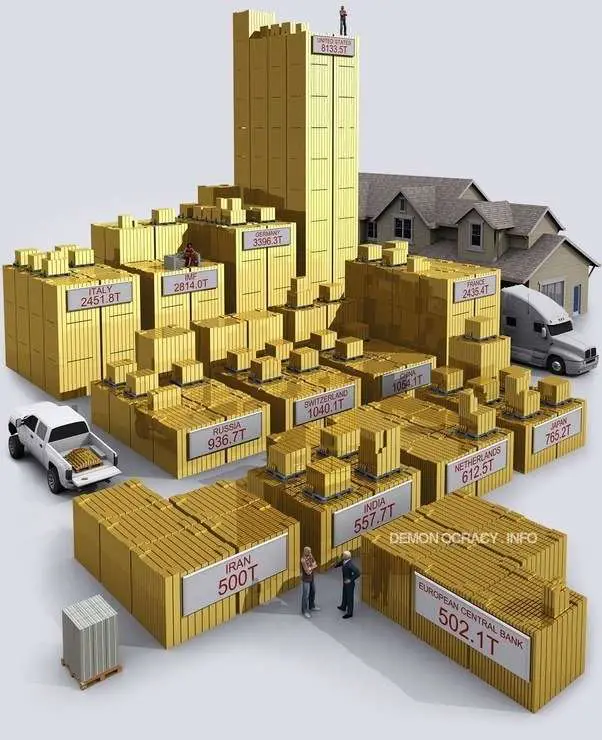

How Much Gold Really Is 165000 Metric Tons And 2500 Metric Tons

An Olympic swimming pool is 50 by 25 by 2 meters. It therefore contains 2,500 cubic meters of water. Each cubic meter of water is one metric ton. Gold is 19.3 times as dense as water. Therefore an Olympic swimming pool would contain 48,250 metric tons of gold. It follows that 3.42 Olympic-sized swimming pools could contain all the gold thats ever been mined. Another way to imagine this is to think of all the gold in the world ever mined as a single cube. That would be a cube with each side just over 20 meters, or 67 feet, in length. Given that about 2,500 metric tons of gold is mined each year, this annual production of gold would fit in a cube whose sides were 5 meters, or 16.6 feet, in length. All the production of gold in the world for a given year would thus fit in a 20 by 30 foot room with an 8 foot ceiling.

How Much Is A Ton Of Gold Worth

If you pay attention to physical gold flows and increased government gold bullion buying figures, you will often hear and or see the term gold ton or gold tonne used.

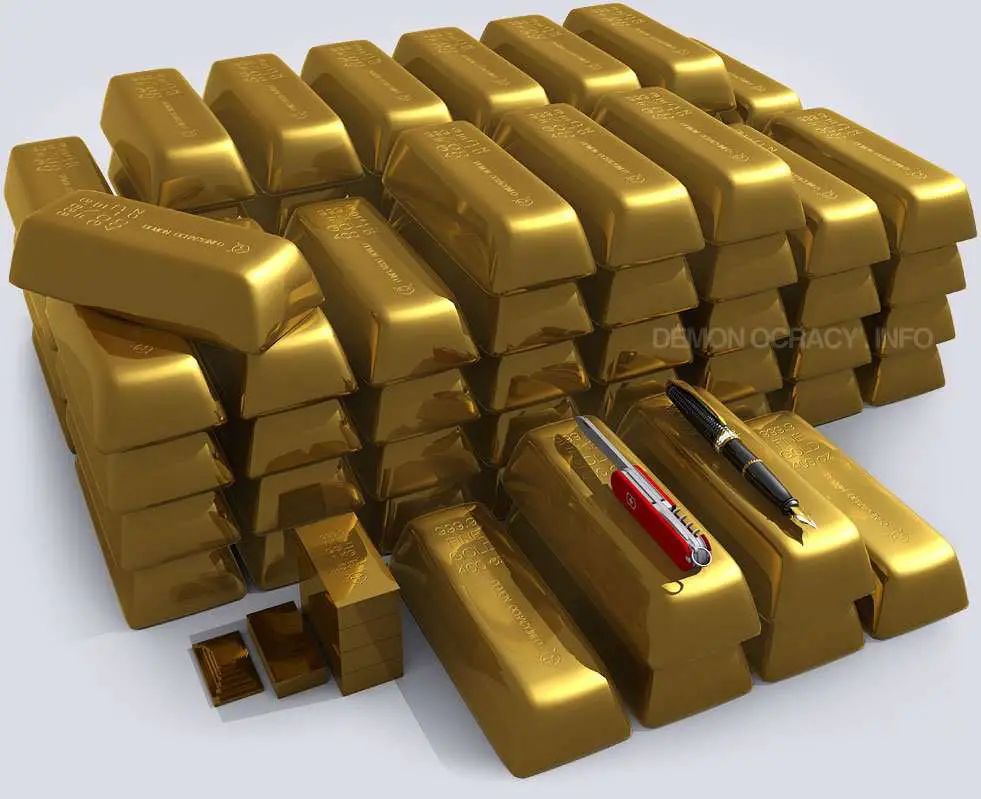

When referring to precious physical metals, a ton refers to a metric tonne. For .999 fine physical gold bullion or any other precious metal, a metric tonne is exactly 32,150.7 troy ounces of gold or other precious metal.

You May Like: How Much Does A Gold Bar Weigh In Lbs

Uk Firms Are Esg Leaders

UK companies have historically been early adopters of environmental, social, and governance practices. In fact, 45% of FTSE 100 companies have begun integrating ESG metrics into their executive compensation schemes.

UK firms are also leaders in gender diversity, consistently tracking ahead of other developed markets.

| Year |

|---|

| 2.0% |

This outperformance even lasted through the COVID-19 pandemic, when dividend rates around the world were rebased .

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Jewelry demand

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

You May Like: War Thunder Golden Eagles Code

How Tons Of Gold Flow Through The Gold Bullion Market

Since beginning in 1987, the London Gold Bullion Association has taken the position as the world’s dominant physical gold bullion settlement organization.

This situation or trend will likely remain so until the eastern world wrestles away gold price discovery power.

The ongoing disconnect from representative gold derivative traders and physical gold flows is a real phenomenon. Many of the individuals involved in day-to-day trading representing massive gold tonnage have often never even touched a Good Delivery 400 oz Gold Bar throughout their entire working career.

As well, since the LBMA established its dominance in the physical gold ton game, the daily west vs. east compounding daily gold price discovery leaves doubt. Much of what is perceived as gold price discovery has likely meant a more sophisticated western gold fiat price containment over the last three decades or longer. Similar to the attempt made to contain the gold price after World War 2 through the late 1960s with the country conspiring price rigging London Gold Pool.

What Is Gold Jewelry

Jewelry made of gold can be combined with other precious elements and gems to enhance its appearance and value. The value of jewelry depends on gold purity and mass, worth of gem used, and artistic work used to build it. Jewelry is used to be worn, and as an investment, e.g., 22k gold is the famous and 91% pure gold.

You May Like: Kay Jewelers 19.99 Ring 2016

Sign Up For The Copper Digest

The first thing investors must under-stand is that high-grade mineralization is relative to the depth of the intersection and relative to the size of the intersection. Todays mining technology allows mining on a vast scale, with large open pits and huge 200-tonne mining trucks capable of processing large volumes of ore at a low cost. This is possible, provided the zone is near surface and the ore zone is large enough to be mined in bulk. Open pits are generally less than 300 metres deep and are several hundred metres in diameter. Two questions to ask are:

Is the zone less than 300 metres deep?

Is the drill intercept over 100 metres thick?

If both of these questions can be answered yes, then the threshold for what constitutes high-grade will be dramatically lower. As a rule of thumb, open pit mining can process ore for $10 per tonne and, where the ore grade is more than double that at $20 per tonne, results would be economic. Consider that 1% of a metric tonne is 22 pounds. Then, for a commodity worth about $1 per pound such as zinc, 1% zinc worth $22 per tonne becomes interesting. Grades triple that, worth $66 per tonne when less than 300 metres deep and more than 100 metres thick, would be considered high-grade.

Using the same dollar figures for mining, but considering other commodities, here are some high-grade intercepts for other commodities and a few recent examples.

UNDERGROUND MINING OR SMALL TONNAGE SCENARIOS

PLATINUM AND PALLADIUM:

How Much Is 1 Ton Of Gold Worth

troy

| 1 Ton of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

You May Like: How Much Is A Karat

How Much Gold Gets Mined Per Year Worldwide

The table below shows world gold production from 1900 thru 2011. Production in 1900 was around 400 metric tons per year and has consistently moved up over the years. It is currently around 2,500 metric tons per year. The all time high was reached in 2001, with 2,600 metric tons of gold production worldwide. The total gold mined from 1900 to the present is just under 141,000 metric tons. Given that humans have mined a total of 165,000 metric tons over the course of history, that leaves just 24,000 metric tons mined before the 20thcentury.

**Cumulative average thru November 22, 2011, .

SOURCE: This table thru 2009 appears here: .

How Much Is A Pound Of Gold Worth

Gold has been used for decades as an investment for a better future and increasing family finances. Therefore, many people invest in gold coins, jewelry, and gold bullion worldwide.

Even though various factors affect the gold price, including the world market conditions and the US dollar strength, this precious metal is still the most stable choice for investment. Its official price varies daily, so it is crucial to know how much is a pound of gold worth to be sure of the value of your investment.

You May Like: How Much Is A 400 Oz Bar Of Gold Worth

How Much Is 4 Tons Of Gold Worth

troy

| 4 Tons of Gold is Worth |

|---|

| U.S. dollars |

For long periods of time, yes, gold is an excellent store of value.

Until 1971, the U.S. was on the gold standard. This meant that the price of gold was fixed at $35 per troy ounce. Since that time however, the price of gold has increased by about 8% per year, more than twice the rate of inflation, and much more than bank interest rates.

This doesn’t mean that there haven’t been ups and downs. Between 19802000, the price of gold declined considerably.

However, with governments printing more and more money due to the coronavirus and pension crises, it seems likely that gold will continue to hold its value well.

What Does A Ton Of Gold Cost

One caveat to note when trying to gauge “What a tonne of gold is worth?”.

Even the last 1980 gold bullion bull market’s good delivery standard 400 oz Gold Bullion bar standard requires paying slight premiums over the spot price of gold.

Government central bank size 400 oz gold bullion bar ask prices, will typically have a slight basis point premium about the fluctuating gold spot price . This minute price premium is so large 400 oz gold bar refiners can maintain profitability.

The following video clip gives you an idea of the size of 1 ton of gold bullion. The Perth Mint recently showed off the world’s currently largest gold coin which weighs one tonne.

Don’t Miss: Runescapegoldmarket

What’s All This About Hundredweight

Oh yeah. Our first definition explained that both the old / American ton is 20 hundredweight, and the newer / British tonne is also 20 hundredweight. It’s just that the two systems define a hundredweight differently.

Simply put, there are 100 pounds to a hundredweight in the American system, while in the British system, there are 112 pounds to a hundredweight.

That means that the short ton is 2000lbs while the long ton is 2240lbs.

Use our handy weight conversion tool to easily and accurately convert between tons and other units of mass.

A Ton Of Gold Price In Perspective

Since 1986, the US Mint has been making the world’s most popular and often purchased modern-day gold bullion coin.

In the year 1999, the US Mint had its best gold coin sales year ever. The US Mint sold just over 63 metric tonnes of gold bullion coins in total in that record-breaking year of 1999. Annual US Mint bullion coin sales data is at the bottom of the backlinked coin mintage page.

Investors bought 22k American Gold Eagle Coins at a record clip in 1999 likely spurred by a combination of Y2K fears , the ongoing Asian financial crisis, and generationally low gold prices vs. other financial assets at the time .

Don’t Miss: Free Golden Eagles War Thunder

What Are The Factors That Affect The Gold Price

- 1. Demand and supply of Gold

- 2. Speculations

- Technology: 11%

- Unaccounted: 2%

They are available in markets. Bullion bars and coins are mostly used for investment of money, and jewelry is used to be worn, and it was used as an investment in the old-time, still, in some countries, it is used for investment.

What Are The Largest Gold Producing Countries In The World

The following are four largest gold producing countries, and they are producing more than 40% gold out of 2990 MT . Some decades before, they were not appearing in the map of the largest gold producers, but recently they became the leader of the gold market. These countries significantly affect the price of gold. They had the largest gold reserves and underground unmined gold. Though, there are some countries of the world, which claims of owning huge gold reserves. But there is no authentic proof of that.

1. China:

As per a survey conducted in 2014, China produced 450 Metric tons of gold, which is 15% of the world . Of course, China had a vast territory, and it has more mines than any other country of the world, still a considerable amount of gold underground that is around 1,900 tons, and had about 1762 ton gold reserves, and ranked on the sixth number. Therefore, China influence the International gold market, and can drive gold price up or down. The demand for Gold in China is also increasing day by day, and a significant percentage of gold is using in jewelry.

2. Australia:

3. Russia:

It produced 247 metric tons of gold that are closer to Australia, and 3rd number in the list of largest gold producing countries. In January 2016, Russian gold reserves exceeded the 1414 tons limit and currently in the list of owning most gold reserves. Russia does not export a considerable amount of gold but imports to increase the reserves. Around 5,000 tons are underground and unmined.

Don’t Miss: Why Are Gold Prices Down

We Have A Problem: Biofuel Mandates Are Too Big

The 10% limit is an issue most didnt anticipate at the time the RFS came to be, and heres why things are going awry.

RFS mandates are out of touch with supply and demand dynamics. Biofuel and ethanol consumption in America is near all-time-highs with some 12 billion gallons consumed in 2020. At the same time, gasoline demand is some 30 billion gallons below the forecasts when the RFS passed.

Whats more, this is leading to unintended consequences and ineffective business practices:

- First, a surge in advanced biofuel imports is occurring. Given the RFS mandate requires more ethanol than the U.S. gas supply can absorb, refiners are forced to pay hefty fees for advanced biofuels from foreign markets. In 2020, the cumulative cost stood at a staggering $5.3 billion, nearly 15x the amounts imported in 2011.

- Second, these exorbitant import costs are being passed on to consumers in the form of higher fuel costs. For example, the RFS obligations have led to an average 20 cent per gallon increase in 2021.

- Third, fuel manufacturers are paying billions of dollars in compliance credits to satisfy the RFS obligations. In many cases, this expense is greater than total labor and wages expenses and threatens to make businesses in this space anti-competitive.

How Much Is 90 Tons Of Gold Worth

According to the show, it is stated that 90 tons of gold is worth approximately 3.9 bn, which roughly translates to $4.4bn or £3.3bn.

This extraordinary sum of money was also worked out by Money Heist fans on the shows subreddit, where it was calculated from the knowledge that 1 ton of gold is approximately worth $50 million.

Recommended Reading: How Many Grams In One Ounce Of Gold

One Tonne Of Gold Converted To Ounce Equals To 3215075 Oz T

How many troy ounces of gold are in 1 tonne ? The answer is: The change of 1 t ) unit of a gold amount equals = to 32,150.75 oz t ) as the equivalent measure for the same gold type.

In principle with any measuring task, switched on professional people always ensure, and their success depends on, they get the most precise conversion results everywhere and every-time. Not only whenever possible, it’s always so. Often having only a good idea might not be perfect nor good enough solutions. Subjects of high economic value such as stocks, foreign exchange market and various units in precious metals trading, money, financing , are way too important. Different matters seek an accurate financial advice first, with a plan. Especially precise prices-versus-sizes of gold can have a crucial/pivotal role in investments. If there is an exact known measure in t – Metric tonnes for gold amount, the rule is that the tonne number gets converted into oz t – troy ounces or any other unit of gold absolutely exactly. It’s like an insurance for a trader or investor who is buying. And a saving calculator for having a peace of mind by knowing more about the quantity of e.g. how much industrial commodities is being bought well before it is payed for. It is also a part of savings to my superannuation funds. “Super funds” as we call them in this country.

List with commonly used tonne versus troy ounces of gold numerical conversion combinations is below:

- Fraction:

Making The Grade: Understanding Exploration Results

Diamond drill core from the Freegold Ventures Shorty Creek Project in Alaska. Note the massive chalcopyrite mineralization. Photo courtesy Freegold Ventures Ltd

The most exciting news from a mining exploration stock is a high-grade drilling result. But what constitutes a good assay? It varies from situation to situation and commodity to commodity. Listed below is some rule of thumb information on interpreting drill results for investors.

Read Also: Buy Wow Gold Safe