What Is The Difference Between An Ounce And A Troy Ounce When Looking At A Gold Chart

A troy ounce is used specifically in the weighing and pricing of precious metals and its use dates back to the Roman Empire when currencies were valued in weight. The process was carried over to the British Empire where one pound sterling was worth one troy pound of silver. The U.S. Mint adopted the troy ounce system in 1828.

A troy ounce is about slightly heavier than an imperial ounce by about 10%. An imperial ounce equals 28.35 grams, while a troy ounce is equal to 31.1 grams.

The Economy Of The Philippines

The economy of the Philippines is in transition, switching from a primarily agricultural economy to an economy focused on the manufacturing and services sector. The country is considered and emerging market economy and it could see significant expansion in the coming years.

The Philippines exports copper, petroleum, fruits, coconut oil and more. The country is heavily involved in shipbuilding as well, with major shipyards in Subic, Batangas, General Santos City and Cebu.

The Philippines has abundant mineral and geothermal resources. The nations mining and extraction sector is an important component of the countrys economy as well. The country has deposits of silver, coal, gypsum, sulfur and more. The deposits of nickel, chromite, gold and copper are considered to be some of the largest in the world.

Tourism also plays a vital role in the nations economy and employs a large number of citizens. It makes up a significant amount of the nations GDP. The nations major trading partners include Japan, the U.S., Germany, Thailand, Singapore, China and more.

Although the country has some of the largest gold deposits in the world, it is not one of the worlds largest gold producers. The nation has numerous issues to work through in order to tap the full potential of its gold mining resources. Some of these issues include various laws, land rights issues and environmental concerns.

Gold Futures And Paper Gold Faq

What is a gold futures contract?

A gold futures contract is a contract for the sale or purchase of gold at a certain price on a specific date in the future. For example, gold futures will trade for several months of the year going out many years. If one were to purchase a December 2014 gold futures contract, then he or she has purchased the right to take delivery of 100 troy ounces of gold in December 2014. The price of the futures contract can fluctuate, however, between now and then.

If I want to buy gold, couldnt I just buy a gold futures contract?

Technically, the answer is yes. One could purchase a gold futures contract and eventually take delivery on that contract. This is not common practice, however, due to the fact that there are only certain types of gold bullion products that are considered good delivery by the exchange and therefore ones choices are very limited. In addition, there are numerous fees and costs associated with taking delivery on a futures contract.

Isnt buying shares of a gold ETF the same thing as buying bullion?

Although one can buy gold ETFs, they are not the same as buying physical gold that you can hold in your hand. ETFs are paper assets, and although they may be backed by physical gold bullion, they trade based on different factors and are priced differently.

You May Like: How Much Is Gold Worth An Ounce Now

The London Bullion Market Association Gold Fix

What is the “gold fix” or “gold fixing”? The LBMA “gold fix” occurs twice a day and is a benchmark for the industry. How is the price of gold and silver determined? The price fix is set at 10:30 and 15:00 London time after auctions between some of the biggest traders in the gold industry. The fix allows for a more streamlined process of buying and selling and is used by gold mines, refineries and central banks. Most retailers and smaller businesses still operate on the live gold price and on this site the price you see for a gold coin or a gold bar at the live current gold rate.

What Is The Gold Spot Price

The spot price is considered to be the average price of wholesale gold as quoted by UK bullion dealers for immediate transactions. So, unlike a share price, which is created through an official trading platform like the London or New York Stock Exchange, the gold price is a combination of numerous bullion dealers in the UK and around the world. However, it is important to note that as the spot price chart shows an average of trading prices, it does NOT give an exact price, and should be used only as a guide to buying and selling.

You May Like: What To Do With Old Gold Jewelry

Do Current Gold Prices Vary By Country

The price for an ounce or gram of gold remains mostly the same regardless of which country you are in. The price is determined by converting the current spot gold price for an ounce or gram of gold into the countrys currency. For example, the current spot gold price for 1 gram of gold would be converted into Indian Rupees according to the current exchange rate.

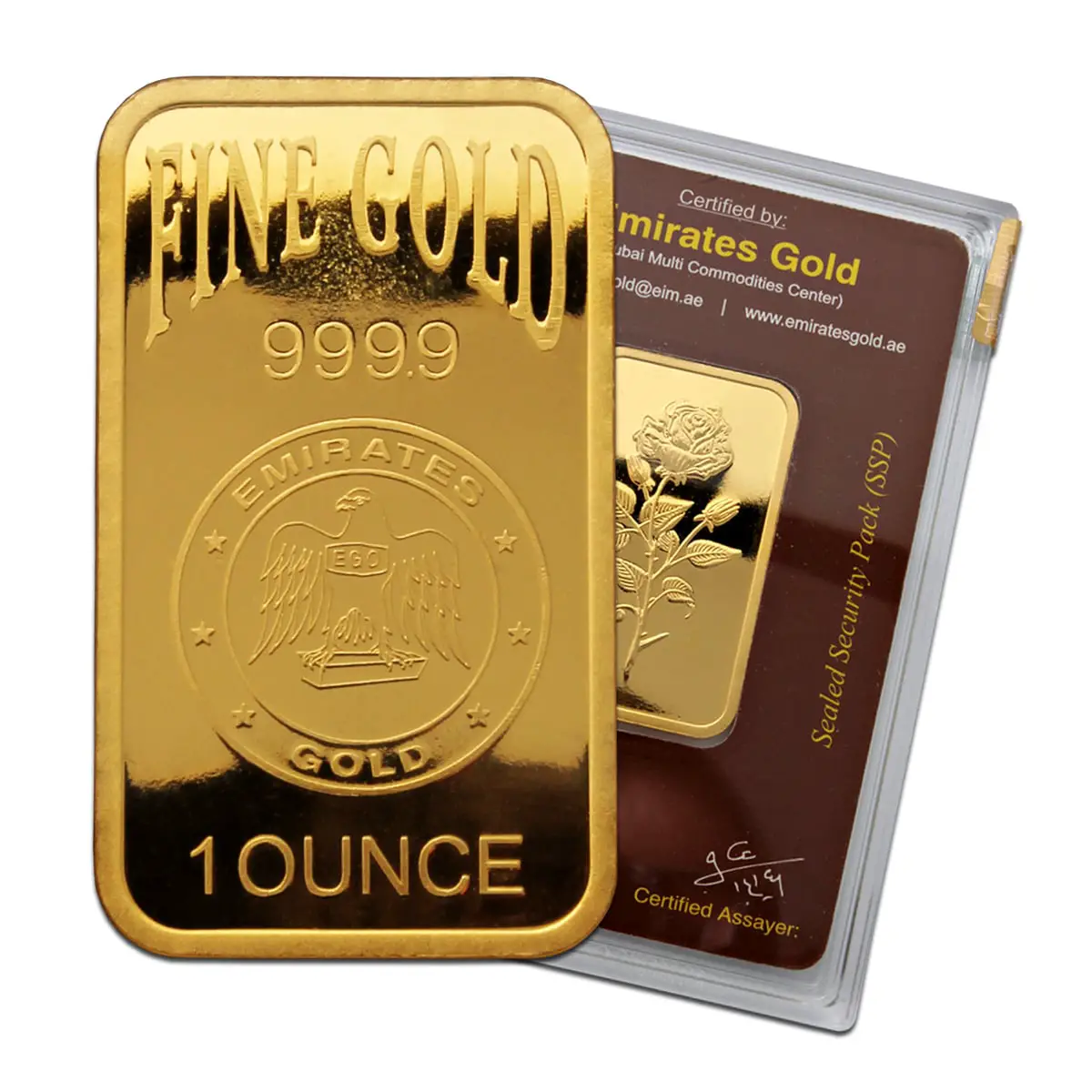

Where Is The Serial Number On A Metalor Gold Bar

Obverse: Displays the Metalor emblem along with the weight and purity. Youll read METALOR, 1 OUNCE, and 999.9 FINE GOLD. A unique serial number is displayed on the bottom Add the 1 oz Metalor Gold Bar to your collection or investment portfolio today. We will package and ship your order to you with the highest of care.

Recommended Reading: 1 Troy Ounce 24k Gold Price

You May Like: Who Passed Away On Gold Rush

How To Calculate The Price Of Gold Jewelry

The formula for calculation of gold jewelry price is Simple formula = Gold Rate + Making Cost + Tax Detailed formula =Gold price per gram of desired Karat X + Jewelry Making cost + Tax Let suppose you want to buy 22 Karat gold jewellery, then Gold price per Oz of 22k: 2000 USD Number of Oz: 2Gold price of 2 Oz = 2 * 2000 =4000 Jewelry Making cost: 2%, then = 40 Tax: 5%, then * 5/100 =202 =4000 + 40 + 202 =4242Note: we used Oz in our calculation, but you can also use other weight units like gram, tola, etc.

Why Are Silver And Gold Prices So Different

The reason gold and silver prices vary widely boils down to one simple fact: rarity. The less supply there is of a metal, the higher the price. Therefore, gold prices tend to be much higher than silver prices because it is much harder to get. The reason supply is much larger for silver is because it is an easier metal to mine and it is often mined as a by-product to other metals mining. The average occurrence of gold in igneous rock is 0.004 parts per million. Silver shows up at a rate of 0.07 parts per million.

Also Check: White Gold Diamond Huggie Earrings

Is The Price Of Gold Too Volatile For The Average Investor

Gold is no more volatile than the stock market. Gold prices can have sudden ups and down just like other commodities but it is also known to go through long periods of time with relatively quiet price activity. Overall, gold is viewed by many financial experts as a long-term store of value which is why so many recommend having gold as part of your investment portfolio.

Detail Of Gold Calculator

Following is the description of our gold calculator. Each option is shown in the following image and described in detail.1. Select a unit type of gold from the dropdown list shown in the image above. You can choose different units from the list which are famous around the globe. They are Gram, Ounce, Tola, Kilo, Tael, Masha, Bhori or Vori, Grain, etc. There two types of tola they are slightly different in weight.2. Enter the number of units. You can enter a numerical value of your choice. For example, 1, 1.5., 2, 5, 10, 20, 50, 100 etc. This calculator is also supporting the floating-point values for example, 1.5, 2.5, 3.15, 4.1234, etc.3. Select Karat or Purity from the list, e.g., 24k, 23k, 22k, 20k, 18k, 14k, etc.4. Choose your desired currency from the dropdown list, as shown in the image. You can select any currency for example, Euro, US, Australian, or New Zealand Dollar, Pakistani, Indian, or Nepali Rupee, KSA or Saudi Rial, etc. It contains almost all currencies in the world. Moreover, currency rates are regularly updating with a one-hour interval while gold prices are updating with a one-minute interval.5. Spread: it is a difference between the buying price and selling price. By clicking on this link, you will be forwarded to another page having a spread option. Businesspeople like goldsmiths for buying or selling gold using this option.

Read Also: Gold Price Calculator 18k

Don’t Miss: Rose Gold Women Wedding Rings

K Gold Price Per Ounce In Us Dollar

| Ounce |

|---|

| 0.58238 Ounce |

Karat — a purity unit for gold

Karat is an ancient unit to indicate the purity of gold alloys. A unit karat contains 4.1667% gold, or equal to 1/24 part. Therefore, the value of Karat gold represents the different proportion of gold. 24K gold is referred to as pure gold that means 100% gold mixed 0% other metals.

The Color of Karat Gold

Generally speaking, karat gold is used to make gold jewelry. The karat gold has rich colors because of being mixed different metal, such as copper, silver or zinc. When karat gold shows red that mixes some copper in gold when it shows light red that mixes some copper and a little silver in gold. Thus, the color of karat gold is based on the mixed metals and their proportion.

What Other Types Of Gold Bullion Products Should I Consider Buying

We make a market in a range of the most popular bullion bar and coin products. You can buy Gold Krugerrands, buy Gold Eagles, buy Gold Maples, buy Gold Philharmonics or indeed buy Gold Britannias. If you wish to own a smaller coin and the divisibility benefits of smaller gold coins you can buy Gold Sovereigns.

High net worth investors frequently opt to buy Gold bars and Gold bars . Larger gold bars are normally stored in our Secure Storage vaults internationally.

Don’t Miss: Real Gold Chains For Men

Why Are Gold Prices Always Fluctuating

The price of gold is in a constant state of flux, and it can move due to numerous influences. Some of the biggest contributors to fluctuations in the gold price include:

- Central bank activity

- Investment demand

Currency markets can have a dramatic effect on the gold price. Because gold is typically denominated in U.S. Dollars, a weaker dollar can potentially make gold relatively less expensive for foreign buyers while a stronger dollar can potentially make gold relatively more expensive for foreign buyers. This relationship can often be seen in the gold price. On days when the dollar index is sharply lower, gold may be moving higher. On days when the dollar index is stronger, gold may be losing ground.

Interest rates are another major factor on gold prices. Because gold pays no dividends and does not pay interest, the gold price may potentially remain subdued during periods of high or rising interest rates. On the other hand, if rates are very low, gold may potentially benefit as it keeps the opportunity cost of holding gold to a minimum. Of course, gold could also move higher even with high interest rates, and it could move lower even during periods of ultra-low rates.

What Is Quantitative Easing

Quantitative easing is a monetary policy tool used by central bankers in response to the 2008 financial crisis. The tool was first used in Japan but became a widely used term punned QE after former Federal Reserve chair Ben Bernanke introduced the concept in the U.S. in response to the fall of major investment bank Lehman Brothers. Bernanke purchased bad debt off other major commercial banks in order to prevent them from defaulting, while simultaneously increasing the money supply. Since then, other central banks have implemented this tool including the European Central Bank and the Bank of Japan.

QE has risks including increasing inflation if too much money is created to purchase assets, or can fail if the money provided by central bankers to commercial banks doesnt trickle down to businesses or the average consumer.

Recommended Reading: What Does 14k Gold Mean

How Do Interest Rates Move The Price Of Gold

In simplest terms, interest rates represent the cost of borrowing money. The lower the interest rate, the cheaper it is to borrow money in that countrys currency. Rates have an impact on economic growth. Interest rates are a vital tool for central bankers in monetary policy decisions. A central bank can lower interest rates in order to stimulate the economy by allowing more people to borrow money and thus increase investment and consumption. Low interest rates weaken a nations currency and push down bond yields, both are positive factors for gold prices.

How Is The Current Price Of Gold Per Ounce Determined

There are many factors that contribute to the current price of gold. Chief among these factors is the strength of the US dollar. Traditionally gold has an inverse relationship to the value of the dollar. In other words, when the value the US dollar is strong, gold prices go down. Related, the strength of major economies also has an inverse relationship to the price of gold at least when an economy has a significant downturn. All of this is due to the safe haven status gold has traditionally had in the investment world. Gold prices are historically far more stable over the course of time than economies and other classes of investments.Supply and demand, of course, also play a key role in the price of gold per gram or ounce. There is only so much gold to be mined and gold mining is not cheap. When gold demand outstrips gold supply, the price of gold goes up. The chief areas of gold demand are in gold jewelry. In 2017, 46% of demand for gold was for jewelry. There is also the use of gold in industry for such things as electronics and medical devices.

Recommended Reading: How To Invest In Gold Futures

What Is Paper Gold

âPaper goldâ is the nickname for investment products that track the price of gold. This primarily means gold ETFs and futures.

The distinction between physical gold and paper gold is the latter is only âon paper.â By contrast, physical gold is a tangible asset.

Physical precious metals change hands in over-the-counter markets. The best example is the London Bullion Market, the UK gold hub.

The Cost Of Producing An Ounce Of Gold

Although gold has been used as jewelry and currency for thousands of years, it also has many other uses. For instance, many electronics and medical appliances use gold for its excellent and durable conductive properties. Investors and banks also hold onto gold as a loose form of commercial insurance against dramatic economic events. Individuals, businesses, and governments continue to clamor for more gold. Gold reserves are finite, and pulling new gold out of the ground can be very expensive. In fact, it is common to hear industry insiders cite $1,200 as the all-in cost for mining a single ounce of gold.

Also Check: 14k Solid Gold Italian Horn

Who Makes Gold Bullion And Coins

Gold bullion is produced by mints located worldwide, by either a sovereign mint or privately owned. Gold bullion produced by these mints typically come in coins, bars and rounds with a wide selection of sizes available to fit any type of investment. For collectors and investors, it is important to know the difference between sovereign mints and private mints.

Sovereign mints, also known as government mints or national mints, manufacture bullion that is produced for legal tender in that country. Typically, there is a face value associated with the bullion and an official legal tender status. Widely collected bullion such as the American Eagles and Canadian Maple Leaf series are produced by these sovereign mints. Examples of these well-known sovereign mints include the United States Mint, Royal Canadian Mint, The Perth Mint, the Austrian Mint and more.

Private mints, like the name suggests, are privately owned and do not produce bullion for legal tender. Private mints make their own designs and branding, purity and metal content of their choosing. There are no legal requirements or restrictions placed on private mints to produce any specific amount of Precious Metals. While private mints do not produce legal tender bullion, they create countless popular and unique products each year that are great additions to many collections. Examples of these private mints include Engelhard, PAMP Suisse, Johnson Matthey and more.

When Is The Gold Price The Strongest

It can be difficult to predict the next major rally in gold as it is strongly driven by sentiment. Gold does well in period of high uncertainty, a shifting inflationary environment and during periods of currency debasement however, historically, there have been high and low seasonal period in the gold market. Historically, September is golds strongest month. Many western jeweler start to build their gold inventories during this time to prepare for the holiday season. The next strongest month is January, which traditionally sees strong buying among Eastern nations ahead of the Lunar New Year. The worst month has historically been March, April and then June.

Don’t Miss: How Much Is 1 Troy Ounce Of Gold Worth