Understanding The Dow To Gold Ratio

The Dow to gold ratio is a measure of the stock market in comparison to gold. The Dow gold ratio been observed to move downwards in the wake of panic associated with inflation and deflation. During the Great Depression, the Dow to gold ratio stood at 1:1. In January 1980, both the Dow Jones Industrials and gold prices sported a handle at 850, thus reaching 1:1 ratio.

As an example, a 20,000 Dow and $20,000 gold price may seem impossible to achieve today but when panic spreads in the market, price extremes on either side could be reached, sometimes even simultaneously.

Features Of The Veracash Listing

The price of gold on VeraCash® is updated every 15 minutes, Monday through Friday . Along with the international gold price, the VeraCash® quotation can fluctuate upward or downward depending on changes in the calculation parameters mentioned above.

The “GoldSpot” spot quote results from the aggregation of different data*:

The “GoldPremium” quotation adds a premium onto the spot price that is calculated according to the volume of the exchanges on all the group’s platforms, including AuCOFFRE.com, VeraCash® and VeraOne as well as the manufacturing costs of the Vera Valor currency.

The gold products that constitute the store of value deposited in the VeraCash® account are physical, 100% allocated and regularly audited and monitored.

The gold bars and gold coins stored in our safes at Geneva Freeports are products recognised by local and international markets, especially due to their universal format. These are “Good Delivery” gold products, following a universally recognized quality standard certified by the foundry assayer’s stamp placed on each product by partner foundries, systematically members of the LBMA.

*Source : Xignite.com

What Are Safe Haven Assets

Gold is a great way of storing wealth and has been used for this purpose since the ancient Egyptians. Despite having a history of being highly volatile, gold has traditionally performed well above expectations during tumultuous periods such as economic weakness, political disruptions, and financial turbulence.

In order to stabilize the economy, central banks create dovish monetary policies and introduce fiscal initiatives to influence the countrys currency and stimulate more demand for gold. It is commonly observed by investors to buy gold when they tend to lose confidence in their currency.

Recommended Reading: How Much Is 22 Karat Gold Worth

Make Informed Decisions About Your Future

Gold Rate uses professional grade data sourced directly from gold dealers, exchanges or brokers with direct exchange relationships. All data sources are vetted by our team of economists, data scientists and finance experts so that you have knowledge you need when taking the future into your own hands.

What Makes Gold Valuable

At just under $2,000 an ounce in 2021, gold by weight is one of the most expensive items money can buy. The most expensive caviar, Beluga caviar, typically sells for about $200 to $300 per ounce. A brand-new Rolls Royce, which starts at over $450,000, if valued based on its weight, would sell for about $5 per ounce. Why do investors value gold so highly? The reason is demand.

The US Dollar can be viewed as just a piece of paper or digits on a computer screen. Similarly, gold can be viewed as just a shiny piece of metal. The US Dollar has value because people around the world want it. Without this global demand, the US Dollar would have no value. Similarly, countries and societies around the world want gold as well. This demand is what drives the price of gold.

The demand for gold began at the dawn of civilization. Since gold must be extracted from the earth and cannot be manufactured at will, people used precious metals to store their wealth due to their limited supply. This practice has continued throughout history and still to today. With gold being traded on the global market with no single country controlling it, gold’s purchasing power has remained stable in the face of inflation.

Recommended Reading: Michael Kors Black Bag With Gold Chain

Gold Futures Vs Spot Gold

There is a difference between the price of gold futures and spot gold. Gold futures represent the due amount to be paid on a date of delivery in the future. The prices for gold futures are higher than spot gold, as is commonly observed in the market. This difference depends on several factors such as the market demand for immediate physical gold, interest rates, and how many days remain before the delivery contract date arrives. The Forward Rate is when the difference between the two is expressed in terms of annual percentage rates.

Spot Gold is normally exchanged by independent dealers while gold futures depend on centralized exchanges which are accessible by investors for almost 24 hours a day. The price for spot gold is completely left to the market and unregulated. In the case of gold futures, the prices are regulated by the Commodity of Futures Trading Commission and the National Futures Association .

What Is The Gold Price In The United Kingdom

In the United Kingdom, the price of gold is determined on the basis of LBMA Gold Price, a price administered by the ICE Benchmark Administration Ltd., an independent third party provider that provides the price platform, methodology as well as the overall administration and governance for the LBMA Gold Price. The price is set in US dollars. Sterling and euro prices are available but these are indicative prices for settlement purposes only. Gold prices are set twice a day, at 10:30 a.m. and 3:00 p.m. This Gold Price is established on the basis of electronic auctions conducted on the ICE Trading Platform auctions, the final prices of which are then published as the LBMA Gold Price.

You May Like: How Do You Make Money Investing In Gold

Understanding The Role Of Central Banks On The Price Of Gold

Central banks are national banks that issue currencies and govern monetary policies in regards to their country. They also provide banking and financial services to the local government and helps regulate the commercial banking system.

The central bank has a lot of influence when it comes to money matters in the country. It directly controls the supply of money in the country to help stimulate the economy as needed. Some examples of central banks include the Federal Reserve in the United States, the European Central Bank , the Bank of England, Deutsche Bundesbank in Germany, and Peoples Bank of China.

Central banks control the countrys reserves, including foreign exchange reserves which consist of foreign treasury bills, foreign banknotes, gold reserves, International Monetary Fund reserve positions, short and long term foreign government securities, and special drawing rights.

How To Price Gold In Us Dollars Per Gram

Gold is a precious metal with many attractive qualities, such as its resistance to corrosion and electric conductivity. In addition to using gold in electronic devices and to make jewelry, people invest in gold as a hedge against inflation. The troy ounce is a common unit of measurement for gold, but you can convert the price per troy ounce to price per gram to determine the market value of an amount of gold in grams. One troy ounce equals 31.1g

1.

Find the market price of gold in U.S. dollars per troy ounce on any financial or precious metals website that provides precious metals prices. For example, assume the price of gold is $1,400 per troy ounce.

2.

Divide the price per troy ounce by 31.1 to convert the price to U.S. dollars per gram. In the example above, divide $1,400 by 31.1 to get $45.02 per gram.

3.

Determine the amount in grams of gold that your business wants to buy or sell. For example, assume your business wants to sell 5g of gold.

4.

Multiply the number of grams you want to sell by the price per gram to calculate the total market value of the gold. In the above example, multiply 5g of gold by $45.02 per gram to get a market value of $225.10.

References

Also Check: How Much Is My Gold Necklace Worth

The Gold Futures Market

Gold futures are exchange-traded, standardized contracts in which the buyer takes delivery of a specified quantity of gold from the seller against a predetermined price in the future. Market makers and gold producers hedge their investments against the volatilities in the market by using gold futures, and as an easy way to make quick returns based off of movements made in the market.

A gold futures contract is a legal agreement for delivery of the precious metal at an agreed price in the future. These contracts are used by hedgers to minimize their price risk on the sale of physical gold or an expected purchase. Hedgers also provide opportunities to speculators to take part in the market.

Two positions can be taken: A short position is for making delivery obligations, while a long position is for accepting delivery of physical gold. Most gold futures contracts are agreed prior to fulfillment of the delivery date. For instance, this happens when investors switch position from long to short before the delivery notice.

Is Gold A Good Investment In 2022

Unfortunately, no one knows where the price of any asset will go in the short, medium and long term. It is possible that the gold price could increase. It is also possible that the gold price could decrease. However, this does not mean you should not buy gold.

Many seasoned investors believe in having an allocation to gold. In fact, using the last 50 years of data and looking at 10 year average returns, it is possible to have almost the return of a 100% stock portfolio with less volatility than a 100% bond portfolio by holding a mix of 80% in the S& P and 20% in gold.

Also Check: How To Get Gold In Clash Royale

Gold Has Numerous Applications

While gold has been the cornerstone of flourishing capitalistic markets, it has found numerous industrial uses such as the manufacture of electronic devices for GPD units, and personal use as jewelry. The latter is more popular in South Asian countries during the wedding season.

Gold has many desirable properties that are not easily found in other metals. It can conduct electricity but does not corrode. It is malleable and ductile, which means it can be sculpted and shaped.

Gold is utilized in the medical field and is best for crowns, bridges, fillings, and other orthodontic applications because of being chemically inert. Many patients are not allergic to the metal, making it ideal for treatments. Scientists use trace amounts of isotopes of gold in diagnosis and radiation treatments.

Due to its luster, gold is used in awards, statues, and crowds. Its exceptional beauty and rarity has turned gold into a status symbol. The metal is used in everything from Olympic medals to Academy Awards, and holds high esteem throughout the world.

What Are Benchmark Prices For Gold

There are no official opening and closing rates for silver or gold. As a result, traders are forced to peg their investment decisions on benchmark prices which are decided by different organizations during different times of the day. The technical lingo for benchmarks is also known as fixings.

The leading organization that maintains benchmarks for different precious metals is the London Bullion Market Association . It governs prices for gold and silver, both of which are well-respected benchmarks used by dealers in the precious metals marketplace.

The most typical way to determine benchmark prices is through electronic auctions between participating financial hubs such as banks.

Don’t Miss: Where Do You Buy Gold And Silver Coins

Who Makes Gold Bullion And Coins

Gold bullion is produced by mints located worldwide, by either a sovereign mint or privately owned. Gold bullion produced by these mints typically come in coins, bars and rounds with a wide selection of sizes available to fit any type of investment. For collectors and investors, it is important to know the difference between sovereign mints and private mints.

Sovereign mints, also known as government mints or national mints, manufacture bullion that is produced for legal tender in that country. Typically, there is a face value associated with the bullion and an official legal tender status. Widely collected bullion such as the American Eagles and Canadian Maple Leaf series are produced by these sovereign mints. Examples of these well-known sovereign mints include the United States Mint, Royal Canadian Mint, The Perth Mint, the Austrian Mint and more.

Private mints, like the name suggests, are privately owned and do not produce bullion for legal tender. Private mints make their own designs and branding, purity and metal content of their choosing. There are no legal requirements or restrictions placed on private mints to produce any specific amount of Precious Metals. While private mints do not produce legal tender bullion, they create countless popular and unique products each year that are great additions to many collections. Examples of these private mints include Engelhard, PAMP Suisse, Johnson Matthey and more.

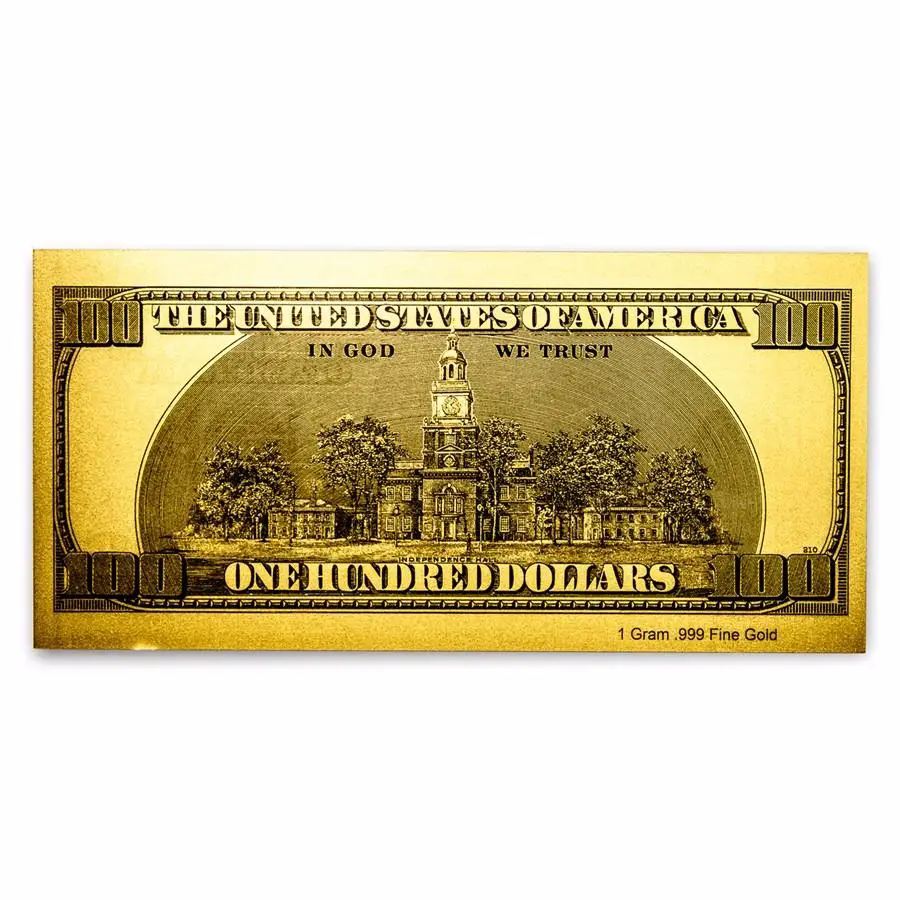

Is Buying A Single Gram Of Gold Worth It

Since gold is widely considered as a store of value and a monetary metal, any quantity of the yellow metal is worth it. A single gram of gold is a great way to diversify investment portfolios because of low barriers to entry. While small quantities of gold are affordable, there are other options of purchasing gold.

Some of these options include the APMEX-branded gold bars and Vacambi Mint gold bars. Gold can store value and adds one more layer of dimension to an investors portfolio.

Read Also: Gold Bar Stools Set Of 4

Is Gold Always Traded 24/7 If Not Is There A Set Open And Close

Trading for gold takes place Sunday through Friday, 23 hours a day. It is common for OTC markets to overlap. No market actively trades between 5 PM and 6 PM ET. Because of the presence of OTC markets, there are no closing or opening prices for spot gold.

For large scale transactions, most gold traders will utilize the benchmark price from specific periods during the trading day.

Why Do Central Banks Use Quantitative Easing

Quantitative Easing was first utilized by central banks in 2008 to address financial crisis. Japan is the first country to use this monetary policy tool. It saw widespread use after the former chair of the Federal Reserve, Ben Bernanke, introduced the concept in the US. Ben used Quantitative Easing to respond to the fall of Lehman Brothers, a major investment bank.

QE was used to purchase bad debt from major commercial banks in order to prevent Lehman Brother from defaulting, all the while increasing the supply of money. After the success of the move, other central banks have implanted QE, including the European Central Bank.

QE is not without its risks, one example is the rise in inflation if excessive money is created to purchase assets. It can fail if the money provided by the central bank fails to reach the average consumer or businesses alike.

Read Also: What Is Horizon Gold Card

How The Price For Live Spot Gold Is Calculated

Gold has a benchmark price that is set every day. The most common entities that make use of these benchmarks include producer agreements and commercial contracts. The benchmarks are based on the spot markets trading activity on decentralized OTC or over-the-counter markets.

OTC means that the prices are not set by formal exchanges and are negotiated privately by participants over the phone or electronically. While prices for spot gold are not regulated, financial institutions still play a valuable role by serving as market makers, providing an ask price and bids for the spot market.

Gold Price Per Ounce In Us Dollar

| Gram |

|---|

| 18.01638 Gram |

Gram – a mass unit

Gram is a metric system unit of mass, which also is a SI derived unit. It is defined as “the absolute weight of a volume of pure water equal to the cube of the hundredth part of a meter, and at the temperature of melting ice”. The unit symbol for gram is “g”.

1 gram = 0.03215 troy ounces

1 gram = 0.001 kilogram

Don’t Miss: Black And Gold Area Rug

Understanding The Difference Between One Ounce And One Troy Ounce

Troy ounce has been used historically by the Roman Empire to weigh and set prices for precious metals. Back then, all currencies were valued in terms of their equivalent weight in gold . This process was later borrowed by the British Empire which tied one pound sterling to one troy pound weight in silver.

The US also used the troy ounce system in 1828. A troy ounce is bulkier than one imperial pounce by about 10 percent. A troy ounce is equivalent to 31.1 grams in weight, while an imperial ounce is equal to 28.35 grams.

Names Of Popular Gold Coins

All major manufacturers of gold print their own bullion coins. This product is a less risky means of storing physical gold. Only governments have the authority of producing gold coins with monetary face values, and even then, the face value is less than the coins intrinsic value. Private companies produce their own mints, also known as gold rounds.

All governments in the world, except for South Africas Krugerrand gold coin, have face values which are based on the current global price of gold.

Here are the top five gold coins that a person can invest in:

Also Check: How To Wear Golden Goose Sneakers

How Is The Price Of Gold Moved By Interest Rates

Put simply, interest rates are the cost of borrowing money. Lower interest rates imply that it would be cheaper to use the countrys currency in order to borrow money. Interest rates tend to have a strong impact on economic growth. Central banks use it as an important tool to make decisions in regards to monetary policies.

It is common for central banks to decrease interest rates if they lead to better economic prospects. Lower interest rates result in increased consumption and investment by the local population. The disadvantage is the low interest rates decrease currency and bond yields, both of which positively influence gold prices.